How the ECB’s Mark-to-Market of its Gold Holdings to €1 Trillion and €3.1 Trillion in QT Affect its Balance Sheet

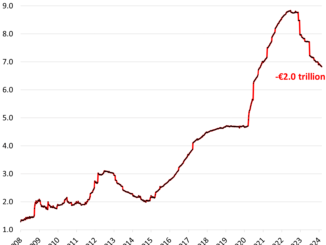

Under QT, the ECB shed €3.1 trillion in bonds and loans. Separately, it wrote up its gold assets by €409 billion, or by 68%, to reflect soaring gold prices. By Wolf Richter for WOLF STREET. The ECB values […]