Talk of a US ban on fuel exports sent European diesel prices soaring. Europe is desperate to find alternatives to its mainstay Russian ultra-low sulfur (ULSD) diesel imports ahead of next year’s sanctions, and traders had been banking on extra US supplies.

The US has almost doubled its ULSD sales to Europe already this year. Market participants had been expecting a major rerouting of sanctioned Russian fuel to South America to help free up even more US fuel to come to Europe next year, alongside rising East of Suez traffic.

But worried about low gasoline and diesel inventories in the US Northeast going into winter, US Energy Secretary Jennifer Granholm has written to US oil companies asking them to prioritize refilling domestic stocks over exports.

With market backwardation removing any commercial incentive to stockpile, Granholm has hinted that the US government could use executive authority to ban or limit exports if her request is ignored. The US has a history of such energy nationalism, having banned crude exports for years before its shale oil boom.

The growing sense of doom in Europe is palpable. “The market can’t cope with the sanctions, I don’t understand the politicians saying it can,” says a leading distillates trader in London. Russia still makes up almost half of Europe’s gasoil imports with even surging volumes from India, the United Arab Emirates, the US and even Singapore in recent months barely scratching the surface.

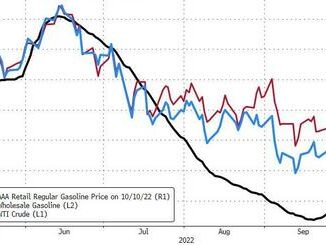

ULSD’s premium over Brent crude has doubled in Northwest Europe in the last two weeks. At $60 per barrel, it now stands 10 times higher than in August last year. Calls for Europe’s heavy industry to stockpile gasoil in case Russia shuts off the supply of natural gas this winter are “blind to the fact the logistics aren’t there,” says one trader.

Gasoil stocks in Amsterdam-Rotterdam-Antwerp are rising only because low river levels mean barges can’t move as much fuel inland. Last week’s 12% jump in stocks was one of the highest ever seen but tanks remain low by historic standards. At 1.7 million metric tons on Aug. 26, according to Insights Global, ARA gasoil tanks are still a third lower than the five year average.

Europe’s own refiners are doing everything they can to make ULSD but Europe’s ancient refinery kit is crumbling under the pressure while sky-high natural gas prices also curb their ability to strip out sulfur.

Russian Arctic Oil Will Struggle to Sell

The formal bans on Russian oil, including the looming EU embargo in December, has focused the market’s attention on Urals, Russia’s flagship export grade.

But Russian crude exports to Europe have also comprised lesser-known grades from the Arctic region, including Varandey, Novy Port, and Arctic Oil (Arco).

Varandey comprises a mix of crude exported through Lukoil’s proprietary pipelines and the Varandey terminal on the Pechora Sea, which opened in 2008.

Gazprom Neft’s oil fields in the Russian Arctic produce the other two heavier, sour grades: Arco from the Prirazlomnoye field and Novy Port from Novoportovskoye.

Both grades are exported from Gazprom Neft’s Arctic Gate terminal on the Yamal Peninsula, which was designed to handle 200,000 barrels per day of crude. This was still the case in the first quarter of 2022.

But shipping data compiled by Energy Intelligence show that combined Arco and Novy Port exports in the second quarter fell by 19%, from 202,000 b/d to 164,000 b/d. July exports stood at 146,000 b/d.

Likewise, Lukoil exported more than 130,000 b/d from its Varandey terminal, but this fell by about 9%, from 134,000 b/d to 122,000 b/d. July exports registered a far more dramatic drop to 35,000 b/d.

Russian Arctic oil is partly shipped by ice-class tankers, or sent by railway to the Kola Peninsula and re-exported to Europe from the port of Murmansk, close to the Norwegian and Finnish borders.

Both Lukoil and Gazprom Neft’s Arctic terminals were designed for exports to Europe and will be hit by the EU ban.

Former buyers of Varandey included refiners in France, the Netherlands and the UK. The volumes are now entirely kept in Lukoil’s own system and shipped to its ISAB refinery in Syracuse, Italy, Kpler analytics show.

| SPOT CRUDE OIL PRICES | |||

| $/bbl f.o.b. terminal or c.i.f. destination | Aug 30 ’22 | Aug 23 ’22 | Chg. |

| Dated Brent f.o.b. (38 API) | 99.34 | 99.49 | -0.15 |

| Russian Urals c.i.f. NWE (31 API)* | 76.45 | 75.18 | 1.27 |

| Russian Urals c.i.f. Med (31 API)† | 81.45 | 80.18 | 1.27 |

| Azeri Light (35 API) | 102.50 | 101.23 | 1.27 |

| CPC Blend c.i.f. Med (45 API)† | 97.95 | 96.68 | 1.27 |

| ESPO (35 API) | 98.25 | 93.91 | 4.34 |

| Dubai (30 API) | 102.80 | 93.95 | 8.85 |

| *Basis Rotterdam. †Basis Augusta. | |||

| PRODUCT PRICES | |||

| $/ton, c.i.f. basis | Aug 30 ’22 | Aug 23 ’22 | Chg. |

| ICE LSGO Futures (front month) | 1,122.00 | 1,119.00 | 3.00 |

| ICE LSGO Futures (second month) | 1,095.50 | 1,107.75 | -12.25 |

| 0.1% Gasoil NWE* | 1,135.75 | 1,125.00 | 10.75 |

| 0.1% Gasoil Med* | 1,135.75 | 1,117.00 | 18.75 |

| 10 ppm Diesel NWE* | 1,167.00 | 1,148.50 | 18.50 |

| 10 ppm Diesel Med* | 1,166.75 | 1,159.00 | 7.75 |

| HSFO NWE* | 464.00 | 485.75 | -21.75 |

| LSGO = low-sulfur gasoil. *Basis Rotterdam. Source: Energy Intelligence | |||