Morgan Stanley’s Adam Jonas was out yesterday lowering his price target on Tesla stock from $330 to $250, but maintaining his overweight rating on the name and arguing that the recent selloff in the name has created an “opportunity”. The note may have inadvertently acted as the final capitulation hurdle to get out of the way before the stock was able to break higher.

And break higher it has done today, rising 7% at the cash open, outperforming the broader market strength (and up 15% from yesterday’s early lows)…

Tesla has sold off an astounding 45% in December, and while some skeptics continue to believe that the name could have further to fall. Jonas argued the opposite in his note yesterday, attributing the sell off to EV supply outpacing EV demand for the first time since Covid and “technical factors”.

We noted yesterday that the Morgan Stanley note could very well mark capitulation in the name…

“We believe 2023 is shaping up to be a ‘reset’ year for the EV market where the last 2 years of demand exceeding supply will be substantially inverted to supply exceeding demand. Within this environment, we believe players that are self-funded (non-reliant on external capital funding) with demonstrated scale and cost leadership throughout the value chain (from manufacturing to up-stream material supply) can be relative winners,” Jonas wrote.

“We believe Tesla may bein position to extend its lead vs. the EV competition in FY23 (both legacy and start-up) even before consideration of IRA (Inflation Reduction Act) benefits where Tesla also stands out as the biggest potential winner,” he continued.

Jonas is convinced that among peers, Tesla is one of the best suited to handle the macro headwinds, writing: “On a relative basis, the reiteration of our OW rating must be seen vs. more challenged EV-related peers such as EW-rated Fisker (FSR), UW-rated Lucid (LCID),and UW-rated QuantumScape (QS). Between a worsening macro backdrop, record high unafforability,and increasing competition, there are hurdles to overcome. Yet we do believe that in the face of all these pressures, TSLA will widen its lead in the EV race, as it leverages its cost and scale advantages to further itself from the competition.”

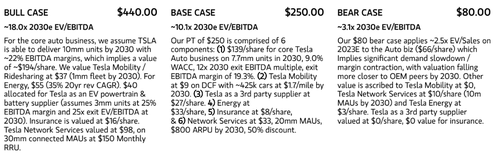

“While we adjust our forecast to reflect our views of lower ATPs and the risk of ADAS commoditization, we still see there being an attractive entry for investors as TSLA approaches our new $80 bear case,as well as a sub 10×2025 EBITDA multiple,” he says.

But Jonas also seems to think headwinds out of China, which have been cited as part of the reason for Tesla’s recent share price plunge, may continue: “According to Morgan Stanley lead China auto analyst Tim Hsiao, Nio just announced a cut to its 4Q delivery target given Covid-related disruption to production and registrations. Despite sequential volume improvement MTD, the uptick of auto/NEV sales has come in weaker than expected given a surge in Covid cases following reopening.”

“Our China team believes the headwinds will persist at least through Jan/early Feb after Chinese New Year, during which time employees begin arriving back at factories. According to a variety of local sources, Tesla has temporarily stopped production of the Model Y at Giga Shanghai in recent weeks. Tesla’s delivery statistics in China have almost halved from 14-16k/week in late Nov to 8k+ last week. The team expects Tesla China and other major OEMs will still attempt to make efforts to push sales through year-end but this could create downside risk to production in the following weeks. From a sentiment perspective the team in China believes newsflow has the potential to get worse before it gets better.”

For Q4 deliveries, Jonas estimates “~399K units delivered in 4Q vs. cons of ~429K and our data provider EV-Volumes of ~440K”.

“We reduce our PT to $250 from $330 previously. Of the reduction, $43is related to Core TSLA Auto where we have factored in greater levels of price discounting (and still no assumed benefit from IRA), $12 reduction is from Mobility, and $25 is from Network Services where we have increased our probability discount. At our revised $250 PT, TSLA trades at 24×2025 EBITDA and <5xFY25 sales.”

Loading…