Texas’ blackouts might yet claim another victim: the merchant generation sector.

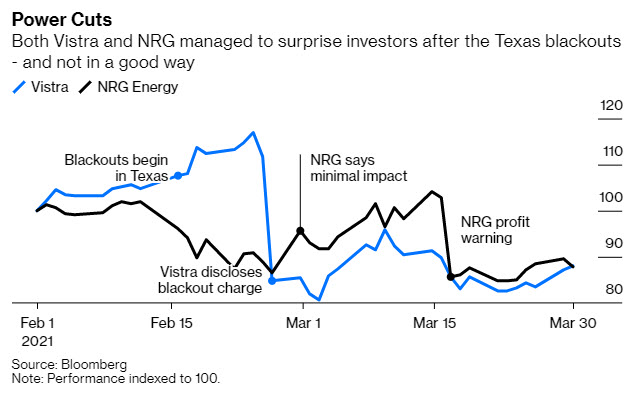

Vistra Corp. and NRG Energy Inc. face big bills arising from the state’s February freeze. Worse, those bills somehow came as a big shock. At first, Vistra’s stock jumped as it was expected to clean up on power-price spikes. Such hopes were reinforced by a big dividend increase — which came three days before the company unveiled a hit to earnings of up to $1.3 billion.

NRG, meanwhile, took its time before saying there would be minimal financial impact. And then took a bit more time before delivering a $750 million sucker punch and withdrawing earnings guidance.

Power Cuts

Both Vistra and NRG managed to surprise investors after the Texas blackouts – and not in a good way

Vistra and NRG are all that is left of the listed merchant generation sector (as opposed to regulated utilities). The other big names — Dynegy Inc., Calpine Corp., among others — have all disappeared from the board; indeed, Vistra bought Dynegy in 2018. After the Texas debacle, maybe Vistra or NRG also yearn for some privacy.

Merchant generation has long been characterized by booms and busts typical of any commodity business, making these stocks catnip for savvy traders but exhausting for the buy-and-hold crowd. Recognizing this, Vistra and NRG took things in a new direction in recent years. Out went high leverage and in came retail customer operations to hedge the traditional generation business.

It worked, up to a point. The two companies generate a lot of cash flow and were headed toward investment-grade credit ratings. NRG, in particular, got a big uplift from an activist-led revamp. But this sector’s reputation is hard to live down. Plus, building pressure on wholesale power markets from the penetration of renewable sources and batteries and an ESG-led aversion to fossil fuels also deter investors. Both stocks had gone nowhere for a couple of years.

Then Texas happened.

A weeklong freeze erased perhaps more than a third of Vistra’s and NRG’s combined Ebitda for the entire year. The clumsy announcement of the losses compounded the shock, even if the grid operator shares at least some of the blame, as information about who owes what to whom has dribbled out over time.

The apparent weakness of the strategy of hedging generation with retail exposure also hurts. Looking ahead, the Texas legislature is working overtime to fix the state’s power market, and politicians faced with headlines about voters freezing to death in their homes can be unpredictable. For a sector working hard to shake off a history of volatility, it is hard to think of a worse turn of events.

Dead stocks, but forecast to generate free cash flow over the next few years equivalent to more than half their (dinged) market value? Sounds like a case for private equity.

Andrew DeVries, analyst at CreditSights, recently cut his recommendation on Vistra’s bonds because of the rising risk of a leveraged buyout. CEO Curt Morgan has long bemoaned the public market’s seeming indifference to Vistra’s stock despite reducing leverage to just 2.5 times Ebitda. As of now, Vistra trades at 5.6 times 2022 Ebitda compared with the roughly 8 times it paid for Dynegy and almost 9 times at which Calpine got taken out.

The sheer size of such theoretical deals presents an obstacle. Another is that once you’ve delisted the entire sector, there are no obvious buyers left when seeking an exit down the road. On the other hand, pay yourself enough dividends and maybe you won’t care too much (see Calpine).

The biggest issue may be the sheer unfashionableness of investing in anything related to fossil fuels. Private equity is, after all, primarily in the business of gathering money; no deal, however compelling, is worth it if the resulting ESG backlash gets in the way of fundraising. There are potentially ways to finesse this; some sovereign wealth funds are less squeamish about such things, for example.

Moreover, as I wrote here, even fossil-heavy energy targets could attract ESG-flavored money if they have a credible transition strategy; not investing in what the company is but what it could be. Both Vistra and NRG, which have been shedding traditional power plants and investing in cleantech, could conceivably be viewed this way — although with more than 90% of their existing generation running on fossil fuels, you would need to wake up in a good mood and squint real hard.

On the other hand, their sizable gas-fired portfolios can be positioned as dovetailing with renewables, at least for a while. And honestly, if oil majors can have net-zero targets, why not these two? In any case, with Texas’ hellish winter likely to cast a long shadow, it wouldn’t hurt to get creative.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Liam Denning at ldenning1@bloomberg.net

To contact the editor responsible for this story:

Mark Gongloff at mgongloff1@bloomberg.net

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal’s Heard on the Street column and wrote for the Financial Times’ Lex column. He was also an investment banker.