The biggest export group — crude oil, petroleum products, natural gas, petrochemicals — retraced part of the 50% spike as prices dropped.

By Wolf Richter for WOLF STREET.

The huge US trade deficit improved – or got less horrible, we might say – by 19% in 2023, with exports of goods and services rising to $3.05 trillion, and with imports of goods and services falling sharply to $3.83 trillion, producing the least horrible trade deficit since 2020, of $773 billion. The US trade deficit with China and Hong Kong was cut by 29%, as other countries such as Vietnam and Mexico picked up some of the trade. As we discussed in detail the other day, it’s a good thing that trade finally improves, and it was a major contributor to the surprisingly strong GDP in 2023.

Despite the horrible trade deficit, the US still exported over $2 trillion of goods alone – not counting services – amounting to roughly half the GDP of Germany. Those exports added $2 trillion to US GDP in 2023. Those are big numbers. But the US is a huge economy, and it doesn’t export enough, given the size of its economy; and it imports way too much.

The biggest US export products.

Industrial supplies and materials include crude oil, petroleum products, natural gas, and petrochemical products that together amounted to $466 billion in exports in 2023, but that was down by 13% from 2022 when $534 billion of the products were exported, amid the 50% surge that year. These products are the largest line items in the overall category “Industrial supplies and materials.” Some of the spike and retracement are related to the sharp movements in prices.

The US has become the largest producer of crude oil, petroleum products, and natural gas in the world, drill baby drill, and it has a large petrochemical industry, and exports large amounts of those products.

Industrial supplies and materials

2023

2022

% change

Total, in billion $

728.0

830.8

-12.4%

Top products:

Crude oil

116.9

119.1

-1.9%

Other petroleum products

77.3

91.2

-15.2%

Fuel oil

47.9

58.5

-18.1%

Plastic materials

44.8

50.2

-10.8%

Natural gas

42.0

63.1

-33.5%

Other chemicals

39.5

42.0

-6.0%

Organic chemicals

34.6

39.8

-13.1%

Other industrial supplies

32.9

32.6

1.1%

Natural gas liquids

30.9

38.0

-18.7%

Nonmonetary gold

29.6

40.1

-26.3%

Finished metal shapes

25.8

25.4

1.6%

Newsprint

12.6

14.7

-14.2%

Precious metals, other

12.3

18.8

-34.5%

Iron and steel mill products

12.2

12.0

1.5%

Coal and fuels, other

11.9

11.8

1.4%

Inorganic chemicals

11.9

13.3

-10.3%

Fertilizers, pesticides, and insecticides

11.1

15.9

-30.2%

Metallurgical grade coal

11.0

13.6

-19.2%

Copper

10.0

9.7

3.6%

“Capital goods except automotive” was the #1 export category until the export surge of crude oil, petroleum products, natural gas, and petrochemical products took over.

Capital goods, except automotive

2023

2022

% change

Total, in billion $

601.2

572.7

5.0%

Top products:

Other industrial machinery

68.8

73.9

-6.8%

Semiconductors

57.1

66.5

-14.1%

Civilian aircraft engines

53.8

44.9

19.9%

Electric apparatus

53.2

49.2

8.1%

Medical equipment

46.4

42.8

8.3%

Telecommunications equipment

39.1

34.6

13.0%

Civilian aircraft

35.9

29.2

23.0%

Industrial engines

29.6

26.8

10.8%

Computer accessories

29.1

31.5

-7.7%

Measuring, testing, control instruments

28.8

27.6

4.5%

Civilian aircraft parts

23.8

20.3

17.0%

Computers

19.7

18.4

7.1%

Generators, accessories

15.1

14.0

8.5%

Materials handling equipment

14.4

13.2

8.8%

Laboratory testing instruments

14.1

13.9

1.7%

Excavating machinery

13.2

12.1

9.0%

Agricultural machinery, equipment

11.0

10.0

9.7%

Photo, service industry machinery

10.9

10.5

4.1%

Metalworking machine tools

7.5

6.9

9.1%

“Consumer goods” exports are dominated by pharmaceutical preparations, and those exports have soared by 70% since 2019.

Consumer goods

2023

2022

% change

Total, in billion $

260.4

245.7

6.0%

Top products:

Pharmaceutical preparations

102.0

89.3

14.2%

Cell phones and other household goods

33.2

31.8

4.5%

Gem diamonds

20.7

20.6

0.6%

Toiletries and cosmetics

15.0

14.4

4.6%

Jewelry

14.4

11.8

21.8%

Artwork and other collectibles

11.3

11.1

2.2%

Toys, games, and sporting goods

10.9

12.4

-11.9%

Textile apparel and household goods

8.2

8.4

-2.3%

“Automotive vehicles, parts, and engines” exports are dwarfed by imports of products in that category.

Automotive vehicles, parts, and engines

2023

2022

% change

Total, in billion $

179.0

159.7

12.1%

Top products:

Other automotive parts and accessories

62.8

54.7

14.9%

Passenger cars

61.6

57.2

7.7%

Trucks, buses, and special purpose vehicles

29.8

24.4

22.2%

Engines and engine parts

21.3

20.1

6.0%

“Foods, feeds, and beverages” exports vary widely from year to year, with some commodities jumping and others dropping. The year 2023 was complicated by low water on the Mississippi that restricted barge grain movements, particularly corn.

Foods, feeds, and beverages

2023

2022

% change

Total, in billion $

162.5

179.9

-9.7%

Top products:

Soybeans

29.5

35.4

-16.7%

Meat, poultry, etc.

24.8

26.5

-6.5%

Other foods

17.5

17.8

-1.4%

Corn

14.3

19.8

-27.5%

Animal feeds, n.e.c.

13.1

12.4

5.4%

Nuts

9.7

9.7

0.2%

Fruits, frozen juices

8.7

8.6

0.8%

Vegetables

7.9

7.5

5.9%

Bakery products

7.7

7.1

8.0%

Dairy products and eggs

6.6

8.0

-16.8%

Wheat

6.3

8.5

-26.3%

“Other goods” is everything else that gets exported that is not part of the five big categories.

Other goods

2023

2022

% change

Total, in billion $

88.4

76.4

15.8%

Exports minus imports: Step in the right direction.

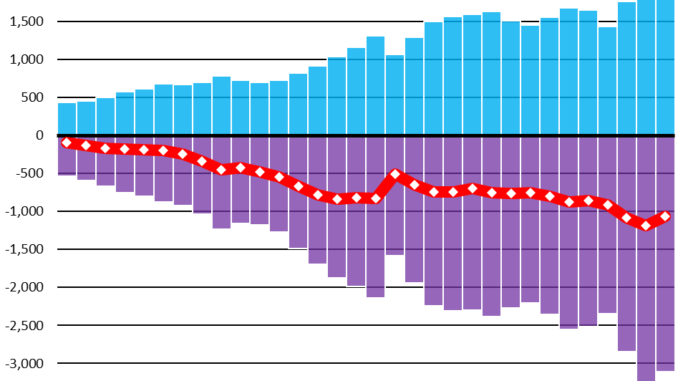

Exports of goods (blue) fell by $39 billion to $2.05 trillion, as we discussed here. Imports of goods (purple) improved by $161 billion to $3.11 trillion. So the trade deficit in goods (red line) improved by $121 billion, to $1.06 trillion, the first major improvement since 2009.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack