By Wolf Richter for WOLF STREET.

EV maker Fisker, which had gone public via merger with a SPAC in October 2020 amid fake promises and ludicrous projections, and then burned over $1 billion of investor cash, has finally filed for bankruptcy protection Monday night, following in the footsteps of a bunch of other EV SPACs.

These EV SPACs were born during the era of free money and what we’ve come to call consensual hallucination, and reality just didn’t matter. They raised billions of dollars in cash from free-money-befuddled investors, went public at sky-high valuations, then their shares collapsed and were inducted into our pantheon of Imploded Stocks. Then they began filing for bankruptcy, one after the other.

All these EV SPACs, those that have already filed for bankruptcy and those that will still file for bankruptcy, have the same problem:

It takes a huge amount of money, engineering expertise, and management expertise to start up an automaker, design vehicles, build a factory, develop the supply chain, and ramp up mass-production of high-quality desirable vehicles, and then sell them in such large numbers – hundreds of thousands of vehicles a year – and at a high enough a price that the company can become cash-flow positive and survive on its own without further cash injections.

It took Tesla over 10 years and about $20 billion to get there, and it has been profitable ever since. The Model Y is now the #2 bestseller in the US, behind the Ford F-150 pickup. So Tesla made it, and it became the most valuable automaker in the world, even though its shares plunged to where in December 2022, Tesla made it into our pantheon of Imploded Stocks (entry requirement: at least -70% from high).

Frisker, run by CEO Henrik Fisker, has been a mess from Day One. And even before Day One: He’d already driven its predecessor company, Fisker Automotive – which made the plug-in hybrid Fisker Karma – into bankruptcy in 2013. Nevertheless, investors were eager to douse him with more money, including over $1 billion when the company went public via merger with a SPAC in October 2020. When money is free, nothing really matters.

Fisker never made it to true mass-production. It didn’t even build its own vehicles – they’re made under contract in Austria by Magna Steyr, a subsidiary of Canada-based Magna International. The batteries came from the Chinese battery giant, CATL. Fisker started selling its Ocean SUV last summer. In 2023, Magna built 10,000 of them. But amid reports of all kinds of quality problems, Fisker was able to sell less than half of them in 2023, and promised to sell the rest in Q1 2024.

At the end of February, Fisker warned in a filing that it might not be able to “continue as a going concern.” And it said that it was in talks with a major automaker over an investment in the company and a joint production deal.

On March 18, Fisker said it paused production of the Ocean for six weeks. At the end of March, Fisker slashed the price of the SUVs by as much as 39%, hoping to sell the ones it still had, though it was no longer producing new ones. But it’s hard to talk people into buying a vehicle when the company is about to collapse.

And on March 25, Fisker said that those talks with the major automaker went nowhere. The New York Stock Exchange then delisted Fisker’s shares, due to their nearly worthless nature – just a few cents at the time. The delisting put Fisker in default on its $180 million in convertible notes. Throughout, Fisker has been laying off employees and closing facilities.

On May 3, Magna International said in its earnings call that “production of the vehicle is currently idled,” and its outlook “assumes no further production.” On May 7, Fisker’s Austrian subsidiary, Fisker GmbH, filed for bankruptcy in Austria. On May 19, Fisker closed its headquarters in California. And so that was the end – sealed by the bankruptcy filing.

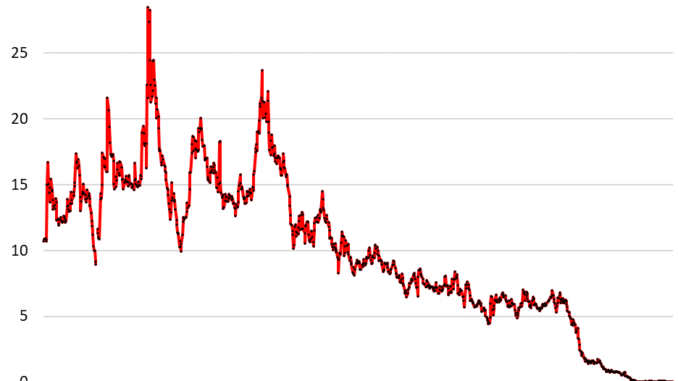

Shares of Fisker closed at 2 cents today, from 4 cents yesterday, on the news of the bankruptcy filing. They’ve been in that range for months.

EV SPACS that are no longer twitching:

Electric Last Mile Solutions took only 12 months from SPAC merger to bankruptcy filing in June 2022.

Proterra, which made mostly a few electric buses, filed for bankruptcy in April 2023, about 25 months after having gone public via merger with a SPAC. It once had a market cap of nearly $4 billion.

Lordstown Motors, which tried to make electric pickups, made the trip from SPAC merger to bankruptcy in June 2023 in a little over 2.5 years, during which it lied to investors to get more of their cash and stay alive.

EV SPACs that are still twitching…

VinFast Auto [VFS], a Vietnamese EV maker that’s part of the conglomerate VinGroup, went public in the US via merger with a SPAC on August 15, 2023, with a minuscule float. Its shares then exploded while we discussed, on August 25, 2023, this misbegotten creature. By October 10, the stock had plunged 92%, becoming one of our all-time favorites in the pantheon of Imploded Stocks. Shares have continued to tank. Today they closed at $3.92, down 96% from the high. Its market cap has imploded from over $230 billion to a still ridiculous $9 billion.

Nikola [NKLA], at $0.48 today, has collapsed amid scandals and lies by 99% from its high in June 2020 when the merger with a SPAC was approved. Last December, CEO and founder Trevor Milton was sentenced to four years in the hoosegow for lying investors about the company’s technology.

Canoo [GOEV], SPAC merger completed in December 2020. In March 2024, it imposed a 1-for-23 reverse stock split, where each 23 shares became just one share to keep the price above $1 to keep it from getting delisted. Today, shares closed at $1.82, down 99% from the peak. Cherry on top: It recently bought some of the assets of bankrupt EV maker Arrival in the UK.

Lucid Motors [LCID], SPAC merger announced in February 2021. The company raised another $1 billion from an affiliate of Saudi Arabia’s Public Investment Fund (PIF), which had already invested $5.4 billion in the company and owns 60% of it. Now $2.57. From peak: -96%.

Faraday Future [FFIE] SPAC merger completed in July 22, 2021. It imposed two reverse stock splits: In August 2023, a 1-for-80 reverse split, where each 80 shares became one share; and in February 2024, a 1-for-3 reverse split. After both splits, 240 shares became 1 share. On May 29, 2024, it withdrew its 2024 production forecast and warned that it might file for bankruptcy. Shares closed at $0.47 today, having plunged by 99.99% from the peak. These kinds of scams are just funny.

Lion Electric [LEV], a Canadian company that makes electric trucks and buses, SPAC merger November 2020, now $1.04, from peak: -96%

Polestar [PSNY] SPAC merger completed in November 2022; started trading in June 2022 at $11, giving it a market cap of $23 billion. The stock is now at $0.69, down 96% from the peak. The company is majority owned and controlled by Chinese giant Geely, which had bought Volvo, which had bought a startup that became Polestar. The vehicles were made in China. This year, its factory in South Carolina has started production.

Rivian is not part of this list because it went public via classic IPO in November 2021. It’s ramping up mass-production, has burned through billions of dollars, but has good vehicles that are now driving around in larger numbers – a big SUV, a big pickup, and commercial vans. It has Amazon as one of its backers and huge customer for its commercial vans. It’s now a question of how much more cash investors are willing to heap upon it to burn. Tesla needed $20 billion to make it. Rivian’s runway may be shorter. It has long been in our pantheon of Imploded Stocks. Its shares closed at $11.02 today, down 94% from the peak in November 2021.

Take the Survey at https://survey.energynewsbeat.com/