In a stunning development that could reshape global energy markets and geopolitics, an internal Russian memo has surfaced proposing a return to the US dollar for settlements as part of a broader economic partnership with the Trump administration.

This move, if realized, might signal the beginning of the end for the ongoing war in Ukraine, as economic pressures from Western sanctions appear to be forcing Russia’s hand. As host of the Energy News Beat Channel, I’ve long argued that President Putin wants to do business with the United States—despite the rhetoric—and this could pave the way for new trade alliances while potentially spelling trouble for the BRICS bloc’s de-dollarization ambitions.

Verifying the Memo: Putin’s Pitch for Dollar-Based Trade

Recent reports confirm the existence of a high-level Kremlin document drafted in 2026, outlining potential areas of US-Russia economic convergence tied to a Ukraine peace deal.

According to Bloomberg, the memo details seven key points where interests align, with Russia’s return to the dollar settlement system—including for energy transactions—at its core.

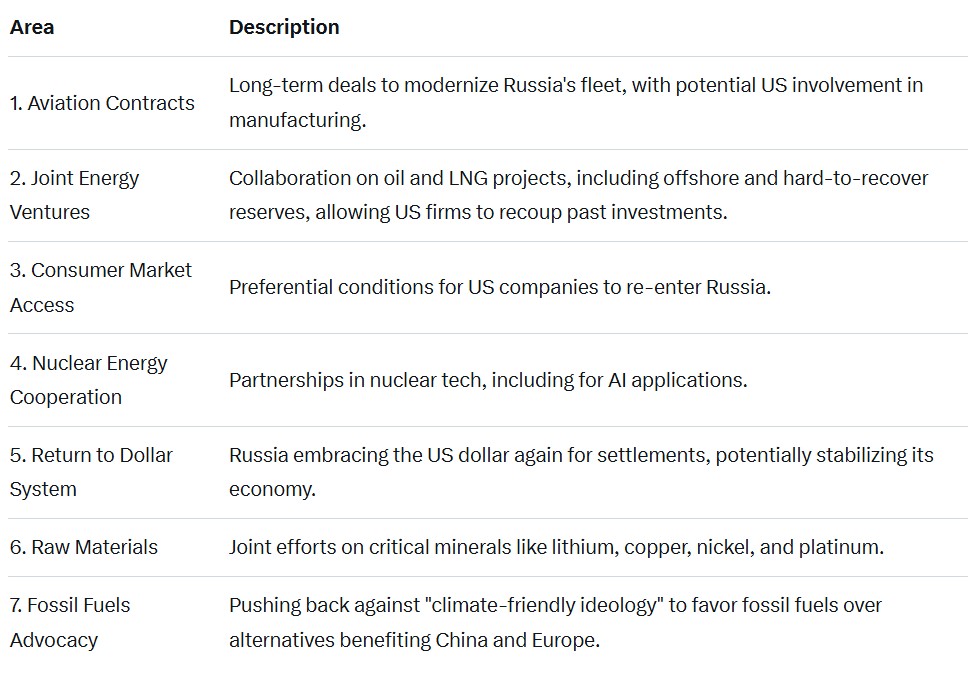

This would mark a dramatic reversal from Russia’s push toward de-dollarization, which accelerated after Western sanctions following the 2022 invasion of Ukraine.The memo’s proposals include:

This pitch comes amid Trump’s administration facilitating peace talks, though Ukraine and the EU have reportedly rebuffed some Russian offers, insisting on territorial concessions like Crimea.

Putin’s overture aligns with my view on Energy News Beat: he sees value in US partnerships, especially in energy, where Russia could benefit from American technology and markets.

The Toll of Embargos on Russia’s Dark Fleet: A Breaking Point?

The memo’s timing isn’t coincidental. Western sanctions, particularly on Russia’s “dark fleet” of shadow tankers used to evade oil export restrictions, have taken a severe toll.

This pitch comes amid Trump’s administration facilitating peace talks, though Ukraine and the EU have reportedly rebuffed some Russian offers insisting on territorial concessions like Crimea.

Putin’s overture aligns with my view on Energy News Beat: he sees value in US partnerships, especially in energy, where Russia could benefit from American technology and markets.

The Toll of Embargos on Russia’s Dark Fleet: A Breaking Point?

The memo’s timing isn’t coincidental. Western sanctions, particularly on Russia’s “dark fleet” of shadow tankers used to evade oil export restrictions, have taken a severe toll.

These vessels—often old, uninsured, and flying flags of convenience—have been crucial for Russia to bypass the G7’s $60-per-barrel price cap on its crude.

Recent enforcement has accelerated:

At least 120 sanctioned tankers are reflagging to Russia due to interdictions by the US, UK, and France.

Ukraine’s “kinetic sanctions”—drone attacks on tankers—have damaged at least seven vessels since late 2025, spiking Black Sea insurance rates by up to 300% and slashing Russian crude exports by 30%.

US sanctions on entities like Rosneft and Lukoil have driven more vessels into the dark fleet, but overall productivity has plummeted—70% for OFAC-sanctioned ships.

The shadow fleet, now over 1,400 vessels (triple its size since 2022), faces environmental risks and fiscal burdens, with potential billion-dollar spill cleanups falling on European states.

This economic squeeze—reducing Russia’s oil revenues that fund the war—may be pushing Putin toward negotiation. If sanctions have “capsized” the dark fleet, as some analysts put it, returning to dollar-based trade could restore stability and signal a willingness to end hostilities.

It’s a clear indicator that the embargos are working, potentially hastening a Ukraine resolution.

New Trade Alliances and Putin’s US Business Aspirations

As I’ve said on the Energy News Beat Channel, President Putin wants to do business with the United States. His past statements criticize the US for weaponizing the dollar but acknowledge its strategic missteps.

The memo envisions joint oil, LNG, and nuclear ventures, which could form new alliances prioritizing fossil fuels and sidelining green transitions that favor competitors like China.

This shift might integrate Russia back into global markets, allowing US energy firms to tap into Russian reserves while providing Moscow with much-needed foreign exchange. It aligns with Trump’s “America First” approach, potentially boosting US exports and influence in critical minerals.

Could This Spell the End of BRICS?

While BRICS continues under India’s 2026 chairmanship—with 11 members, including new additions like Indonesia—the memo could undermine its de-dollarization push.

Russia’s pivot back to the dollar would be a blow to Beijing’s ambitions, as noted in analyses suggesting it slows BRICS’ momentum.

Cracks are already showing: divergent views on governance and Trump’s threats of 100% tariffs on BRICS nations ditching the dollar.

If this deal materializes, it might not end BRICS outright but could fracture its unity, especially on financial alternatives.In summary, this memo represents a potential game-changer for energy geopolitics. If Putin’s dollar overture leads to peace in Ukraine, it validates the impact of dark fleet sanctions and opens doors for US-Russia energy ties. As always on Energy News Beat, we’ll watch how this unfolds—because in energy, deals like this could redefine the global landscape.

By Stu Turley, Energy News Beat Podcast Host

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment