Biggest declines: San Francisco, San Jose, Austin, Denver, San Diego, Seattle, Dallas, Salt Lake City, Honolulu, Phoenix, Portland, Houston, Los Angeles, Nashville, Charlotte, Tampa

By Wolf Richter for WOLF STREET.

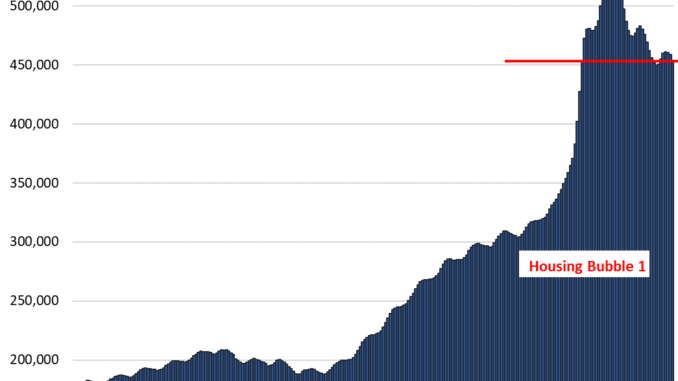

Our series, “The Most Splendid Housing Bubbles in America,” started in 2017 to document visually metro-by-metro the massive surge in home prices that was starting to happen after years of interest rate repression and QE by the Fed. About 10 days ago we explained why we’d replace the Case-Shiller Home Price Index data that this series was based on with the “raw” Zillow Home Value Index (ZHVI). Today is the day! The ZHVI for August was released today.

Just to recap: The ZHVI is based on millions of data points in Zillow’s Database of All Homes, including from public records (tax data), MLS, brokerages, local Realtor Associations, real-estate agents, and individual households across the US. It includes pricing data for off-market deals and for-sale-by-owner deals. Zillow’s Database of All Homes also has sales-pairs data.

The data for the geographic areas that both indices cover are very similar: See our comment with charts. We cited three reasons for abandoning the Case-Shiller Index: It’s limited to 20 metros and excludes even big ones like Houston and Philadelphia; it lags months behind; and it’s not in dollar-prices, but only in index values set at 100 for the year 2000, which makes it impossible to compare price levels in different metros.

Visual depictions of the 28 “Most Splendid Housing Bubbles in America.”

To qualify for this list, the market must be one of the largest Metropolitan Statistical Areas (MSA) by population, and it must have a current ZHVI of over $300,000. The metros of New Orleans, Oklahoma City, Tulsa, Cincinnati, Pittsburgh, etc. don’t qualify because their ZHVI is below $300,000, though they too had huge runups of home prices in recent years.

Down from their 2022 peaks: Home prices of 19 metros, of the 28 metros on this list, were down from their peaks in 2022, ranging from -19.8% in Austin to -1.2% in Minneapolis. The percentage below their 2022 peak is indicated for each metro below.

Declines in August: home prices in 25 metros, of the 28 on this list, declined month-over-month (MoM) in August, most notably these 15:

San Francisco: -1.3%

San Jose: -1.1%

Austin: -1.0%

Denver: -0.7%

San Diego: -0.6%

Seattle: -0.6%

Dallas: -0.5%

Salt Lake City: -0.5%

Honolulu: -0.4%

Phoenix: -0.4%

Portland: -0.4%

Houston: -0.3%

Los Angeles: -0.3%

Nashville: -0.3%

Charlotte: -0.3%

New highs: Only 3 of the 28 metros set new highs: Chicago, New York, and Philadelphia.

So here we go.

Austin MSA, Home Prices

From Jun 2022 peak

MoM

YoY

Since 2000

-19.8%

-1.0%

-4.6%

165%

San Francisco MSA, Home Prices

From May 2022 peak

MoM

YoY

Since 2000

-8.4%

-1.3%

2.4%

299%

Phoenix MSA, Home Prices

From Jun 2022 peak

MoM

YoY

Since 2000

-7.6%

-0.4%

1.2%

225%

Denver MSA, Home Prices

From Jun 2022 peak

MoM

YoY

Since 2000

-5.9%

-0.7%

0.4%

217%

Salt Lake City MSA, Home Prices

From July 2022 peak

MoM

YoY

Since 2000

-5.7%

-0.5%

1.0%

214%

Portland MSA, Home Prices

From May 2022 peak

MoM

YoY

Since 2000

-4.7%

-0.4%

0.3%

221%

Honolulu, Home Prices

From Jun 2022 peak

MoM

YoY

Since 2000

-4.5%

-0.4%

-0.2%

282%

Seattle MSA, Home Prices

From May 2022 peak

MoM

YoY

Since 2000

-4.4%

-0.6%

4.2%

241%

Dallas-Fort Worth MSA, Home Prices

From Jun 2022 peak

MoM

YoY

Since 2000

-3.9%

-0.5%

-0.4%

199%

Nashville MSA, Home Prices

From July 2022 peak

MoM

YoY

Since 2000

-2.3%

-0.3%

1.2%

220%

Las Vegas MSA, Home Prices

From June 2022 peak

MoM

YoY

Since 2000

-2.1%

0.2%

6.1%

180%

Tampa MSA, Home Prices

From Jul 2022 peak

MoM

YoY

Since 2000

-1.8%

-0.2%

0.1%

217%

San Jose MSA, Home Prices

From May 2022 peak

MoM

YoY

Since 2000

-1.5%

-1.1%

9.1%

340%

Houston MSA, Home Prices

From Jul 2022 peak

MoM

YoY

Since 2000

-1.5%

-0.3%

0.4%

155%

Minneapolis MSA, Home Prices

From May 2022 peak

MoM

YoY

Since 2000

-1.2%

-0.1%

0.0%

160%

Charlotte MSA, Home Prices

MoM

YoY

Since 2000

-0.3%

2.5%

173.5%

San Diego MSA, Home Prices

MoM

YoY

Since 2000

-0.6%

6.2%

340%

Los Angeles MSA, Home Prices

MoM

YoY

Since 2000

-0.3%

5.7%

333%

Washington D.C. MSA, Home Prices

MoM

YoY

Since 2000

-0.3%

3.2%

215%

Baltimore MSA, Home Prices

MoM

YoY

Since 2000

-0.1%

2.2%

174%

Miami MSA, Home Prices

MoM

YoY

Since 2000

-0.2%

4.0%

336.1%

Atlanta MSA, Home Prices

MoM

YoY

Since 2000

-0.3%

2.1%

167%

Kansas City MSA, Home Prices

MoM

YoY

Since 2000

-0.2%

2.6%

179%

Columbus MSA, Home Prices

MoM

YoY

Since 2000

-0.1%

3.5%

157%

Boston MSA, Home Prices

MoM

YoY

Since 2000

-0.1%

5.6%

229%

Chicago MSA, Home Prices

MoM

YoY

Since 2000

0.1%

5.0%

114%

Philadelphia MSA, Home Prices

MoM

YoY

Since 2000

0.3%

4.7%

202%

New York MSA, Home Prices

MoM

YoY

Since 2000

0.6%

7.0%

211%

Source:

Take the Survey at https://survey.energynewsbeat.com/