Sales drop further, new listings & inventory rise. Prices: Toronto -16% from peak. Vancouver flat for 9 months, -2.5% from peak. Calgary & Quebec hit new highs. Edmonton condos back to Dec 2006!

By Wolf Richter for WOLF STREET.

Home prices in Canada edged down 0.2% in May from April, the ninth month in a row of declines, seasonally adjusted, according to the Composite MLS Home Price Index from the Canadian Real Estate Association (CREA) today. Condo prices fell faster than single-family prices.

From the peak in February 2022, the index is now down 14.4%, and is back where it had first been in September 2021.

Year-over-year, the index fell 2.4%, the second year-over-year decline in a row (-0.9% in April). But there were big differences, with Calgary and Quebec City rising to new all-time highs, while prices in other metros fell further, such as Greater Toronto where condo prices continue to carve out multi-year lows.

Spring selling season is a dud.

Home sales edged down by 0.6% in May from April, the fourth month in a row of declines. Year-over-year, home sales fell by 5.9%.

New listings rose by 0.5% in May from April, the fourth month of increases over the past five months.

Slower sales and rising listings drove up inventory and supply. Overall inventory listed for sale jumped by 28.4% year-over-year, to the highest level since before the pandemic, and the second biggest jump on record, according to CREA. Supply rose to 4.4 months (up from 4.2 months in April, up from 3.9 months in March), back to prepandemic levels.

The Bank of Canada cut its policy rates by 25 basis points earlier in June, to 4.75% for its target of the overnight rate, after keeping them for 11 months at 5.0%. But it said QT will continue. The BOC has already shed 64% of the securities it had added during the pandemic. This tightening has thrown some cold water on the silly exuberance in the housing market through early 2022, fueled by the BOC’s free-money policies.

Home Prices in the most splendid Housing-Bubble Markets.

Greater Toronto Area, single-family MLS Home Price Benchmark Index (all prices in Canadian dollars):

Month-to-month: -0.3% to $1,309,700; below October 2021, and roughly flat for six months.

From peak in February 2022: -15.8%, or -$246,000

Year-over-year: -2.6%.

Greater Toronto Area, condo benchmark price:

Month-to-month: -0.6% to $669,100, the lowest since November 2021

From peak in February 2022: -12.8%

Year-over-year: -3.0%

Hamilton-Burlington metro single family benchmark price (in the “Greater Toronto and Hamilton Area”):

Month-to-month: +1.2% to $918,100, first seen in August 2021

From peak in February 2022: -18.7% or -$210,800

Year-over-year: -0.5%

Greater Vancouver single-family benchmark price:

Month-to-month: +0.8% to $2,016,200, first seen in January 2022, roughly flat for nine months.

From peak in April 2022: -2.5% or -$42,200

Year-over-year: +5.6%, the smallest gain since July 2023.

Greater Vancouver condo benchmark price:

Month-to-month: -0.4% to $762,200, about the same as in May 2022.

Year-over-year: +2.3%, the smallest gain since June 2023.

Victoria, single-family benchmark price:

Month-to-month: +0.7%, to $1,139,400, first seen in November 2021

From peak in April 2022: -10.1% or -$128,000

Year-over-year: +0.5%.

Ottawa, single family benchmark price:

Month-to-month: +0.8% to $716,600, first seen in October 2021

From peak in March 2022: -10.4% or -$83,000

Year-over-year: +2.7%.

Calgary, single family benchmark price:

Month-to-month: +1.2% to new high of $675,800

Year-over-year: +12.3%.

Montreal, single family benchmark price:

Month-to-month: -0.4%, to $613,000, first seen in February 2022, and essentially unchanged since September 2023.

From peak in May 2022: -3.2%

Year-over-year: +3.4%.

Halifax-Dartmouth, single family benchmark price:

Month-to-month: -0.8% to $536,000

From peak in February 2022: -4.7%

Year-over-year: +1.1%, the smallest year-over-year gain since the year-over-year drop in May 2023.

Edmonton, single-family benchmark price:

Month-to-month: +0.7% to $442,800

From peak in April 2022: -2.2%

Year-over-year: +7.7%

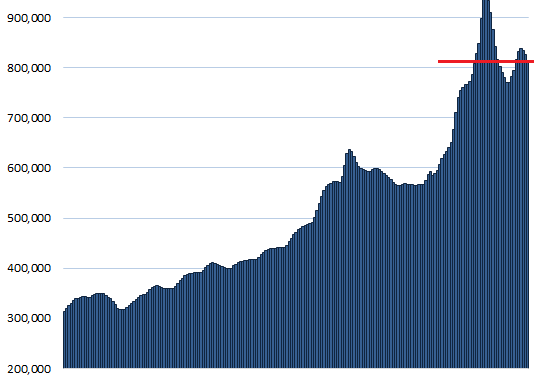

Edmonton, condo benchmark price: What an epic bubble looks like afterwards. Roughly unchanged since December 2006 and down 20.4% from peak in June 2007.

Month-to-month: +1.0% to $190,900

From peak in June 2007: -20.4%

Year-over-year: +11.1%

First seen in December 2006.

Quebec City Area, single-family benchmark price:

Month-to-month: +0.4% to $400,400

Year-over-year: +6.3%

Eked out new high.

Take the Survey at https://survey.energynewsbeat.com/