By Eric Peters, CIO of One River Asset Management

“I am deeply troubled by the Federal Reserve’s rapid series of super-sized interest rate hikes, which may inflict unnecessary pain on millions of individuals and families while sending the economy into a devastating recession,” wrote Chairwoman of the House Financial Services Committee in a public letter to Fed Chairman Powell.

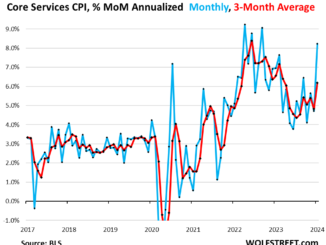

“This week’s Federal Open Market Committee decision marks the fourth consecutive mega rate hike by the Fed, resulting in the highest federal funds rate since before the 2008 global financial crisis and the fastest set of rate hikes by the Fed in four decades. Enough is enough,” continued Maxine Waters.

And this level of political pressure has started with unemployment rising just 0.2% to 3.7%.

* * *

“The last thing I’ll say is that I would want people to understand our commitment to getting this done and to not making the mistake of not doing enough or the mistake of withdrawing our strong policy and doing that too soon,” said America’s central bank chief, speaking to journalists, having just hiked interest rates another 75bps.

“I control those messages,” explained Jay Powell.

“That’s my job.”

And indeed, it is. In 1977, Congress set the Federal Reserve’s goals: maximum employment, stable prices, and moderate long-term interest rates.

Our politicians did not tell central bankers how to achieve these goals. Neither did they quantify how much short-term pain they would be willing to bear in the pursuit of this mandate, nor did they make clear over what time horizon they would measure success.

And naturally, in such an infinitely complex system, there is no singular way to achieve these sensible goals. So, we appoint central bankers we believe will have the judgement required to navigate the labyrinth. But of course, the maze is always changing. So the Fed strategies must adapt to our present circumstances.

What worked during globalization and peace is now largely obsolete. That’s obvious. But what is not yet clear is how the actions of our central bankers and politicians are eroding our collective faith in the value of money. In recent decades, central bankers and politicians grew increasingly aggressive in rescuing speculators from financial folly. Then Covid happened. And they created more money than anyone could possibly imagine. Presto. Magic. Everyone got something.

Now we’re forgiving student debt. Newsweek just reported 63% of Americans support federal inflation relief payments. This is before politicians fund vital projects in the decade ahead: military, infrastructure, environment, inequality.

And now Powell’s job is to navigate a labyrinth, unlike any in American history, in a quest to restore meaning to money.