Last update: 20 October 2022, with the research assistance of Antonio Ferrara, Levi Severson and Cecilia Trasi. This dataset is part of Bruegel’s work on how European Union governments, the United Kingdom and Norway have responded to the ongoing energy crisis. It has been compiled alongside the Bruegel dataset on National energy policy responses to the energy crisis.

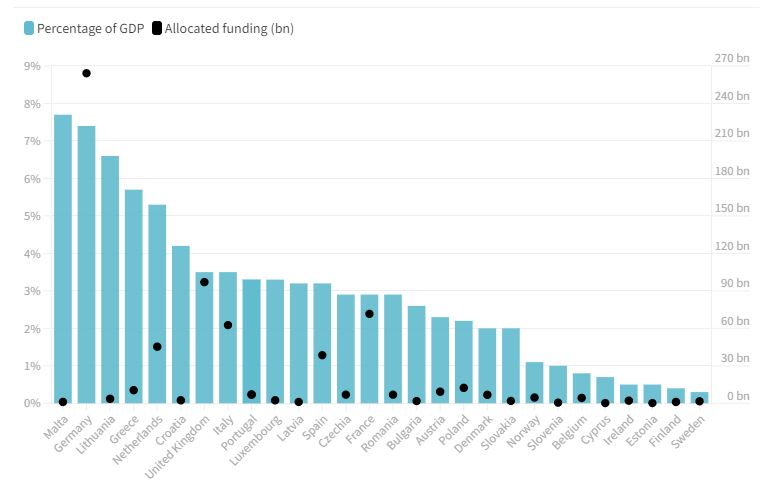

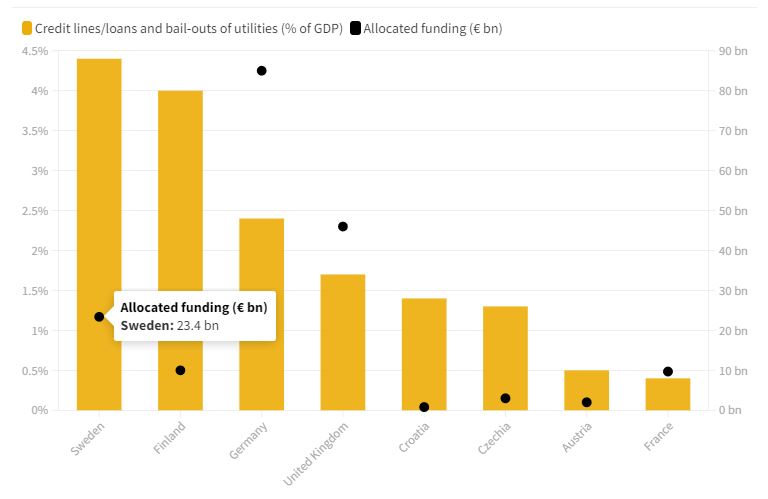

Since the start of the energy crisis in September 2021, €674 billion has been allocated and earmarked across European countries to shield consumers from the rising energy costs.

Here’s the breakdown:

- €573 billion in the EU, of which €264 billion has been earmarked by Germany alone

- €97 billion in the UK, after a U-turn by government that reduced the period of the energy price freeze from 2 years to 6 months

- €4.6 billion in Norway

The current increase in wholesale energy prices in Europe has prompted governments to put in place measures to shield consumers from the direct impact of rising prices. The purpose of this dataset is to track and give a (non-exhaustive) overview of the different policies used by countries at national level to mitigate the effect of the price spike for consumers.

Measures at the sub-national and supra-national levels are excluded from the scope of this dataset, but this by no means implies that they are less relevant. While policies at the regional level can have a sizeable impact on consumers, for example in Belgium, in most European Union countries both energy regulation and levies are set at the national level. Similarly, long-term measures to counteract energy-price volatility are also of extreme importance. At Bruegel we have looked at how to make the EU Energy Platform an effective emergency tool for joint gas purchasing, we have made an assessment of Europe’s options for addressing the crisis in energy markets, and we have called for a grand bargain at the EU level to steer through the energy crisis.

The first tab of the figure below shows the funding allocated in the period September 2021 to October 2022 by selected EU countries to shield households and firms from the rising energy prices and their consequences on the cost of living. The second tab represents how much governments have allocated to support utilities in meeting their liquidity needs – through loans, bailouts and fully fledged nationalisations.

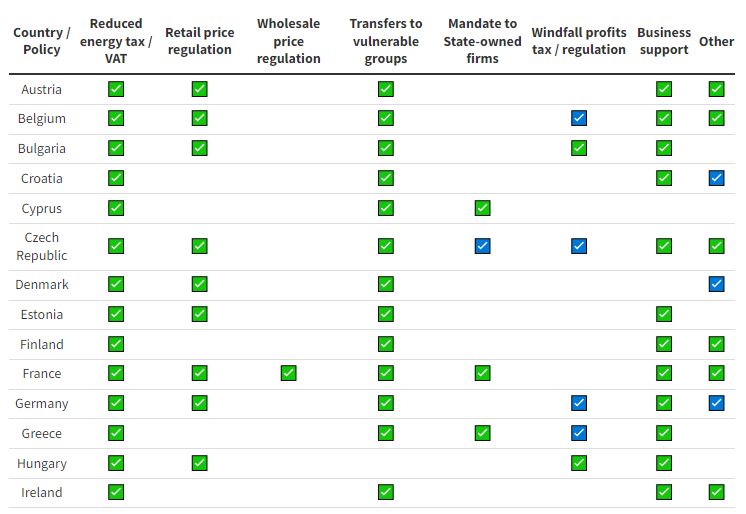

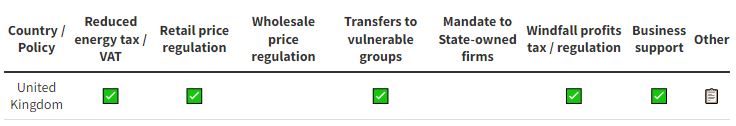

In the table below multiple measures are classified into seven types of responses. All the measures have been discussed, proposed or enacted since September 2021, when the energy crisis was already unfolding. We define a measure to be ‘discussed’ when important actors in civil society, such as political parties, have publicly discussed the measure but no formal action to implement it has been taken. By the term ‘proposed’ we refer to measures that have been publicly announced by high government officials such as ministers. Finally, ‘enacted’ are all those measures already implemented.

DETAILED COUNTRY BREAKDOWN (WITH SOURCES)

On 28 January 2022, the government announced on a relief package of €1.7 billion for almost all households on 28 January 2022. Households will receive €150 in energy cost compensation, an amount that will be doubled for those in need. Moreover, the mandatory green electricity levy (a contribution to support RES adoption) was paused for 2022.

On 20 March 2022, Finance Minister Magnus Brunner and Climate and Energy Minister Leonore Gewessler announced energy subsidies worth €2 billion, including tax cuts and employee compensation, in an effort to ease the burden of rising costs on the economy.

The latest measures include a 90% cut to natural gas and electricity tariffs through mid-2023, at a cost of €900 million, and higher commuting subsidies for employees totalling €400 million.

The government will also offer support to companies by delaying some tax payments, and will provide €250 million in investment support, intended to help ease energy reliance on Russian gas.

On June 14, the Austrian government launched a very ambitious package of measures to contrast energy-driven inflation. The package is worth €28 billion to be rolled out until 2026 (€4 billion coming from the state budget and the remaining €24 billion founded through higher VAT revenues and increased consumption). Payments of (€300) will be made to particularly affected groups with low incomes and low pensions well as contributions to particularly energy-intensive companies. The climate bonus, a money-back bonus, will be raised (to €500 for adults and €250 for children) and tax deductions will also increase for the middle class. Employee bonuses will become tax-free up to €3000. However, Euractive reports that most of the fundings will be spent on abolishing the so-called ‘cold progression’ in income taxes, which will cost €20 billion from 2023 until 2026. ‘Cold progression’ occurs when inflation pushes taxpayers into higher income tax brackets in progressive tax systems as wages increase to stay ahead of rising prices. The carbon tax, €30/tonne, will be postponed until October. The measures also include relief for companies, such as reducing non-wage labour costs.

From September 2022 to September 2023, the federal government of Lower Austria agreed on a deduction from residential electricity prices of €0.11/KWh. The deduction, announced on Wednesday 20th of July, will cover 80 percent of an average household consumption and will cost around €250 million.

In August 2022, a third relief package was passed in August by the Austrian government targeting the increased cost of living due to both rising energy prices and the resulting inflationary effects. From this package, elements relating to energy subsidies, electricity price regulations, and anti-inflationary measures were included in our calculations. A general climate and inflation bonus was offered to the Austrian public, at a combined €500 each. This measure will cost a staggering €2,8 billion. Further, up to €500 were promised to pensioners and self-employed farmers as a part of this deal, costing an additional €520 million. To help struggling low-income families, the package included single meal payment options, with an advance to the family bonus and additional child credit amounts, as well as compensatory allowances targeted at the most vulnerable groups. These programs account for another €835 million in the 2022-2023 timeframe. Finally, a round of subsidies and electricity price compensation measures were granted to energy companies in the package to lower energy prices for consumers. A price brake is currently operating in Austria. These companies were also promised a tax-free inflation premium for their employees that guarantees no taxes on wage and on social security contributions for allowances and bonus payments up to €3000. These measures will cost €1.28 billion. In total, 5.4 of the short term €6.6 billion package is to be spent helping Austrian consumers with the energy crisis.

On 31 August 2022,the government offered a €2 billion credit line to the utility company Wien Energie.

On 21 September 2022, the government introduced an electricity price cap valid from December 2022 to June 2024. The price cap for private households with an annual consumption of up to 2,900 kilowatt hours will be capped at 10 cents. The compensation of a market price exceeding the fixed price will also be capped at 40 cents per kWh. The government estimates that the measure will cost EUR 2.733,195 million in 2023, and EUR 1.093,278 million in 2024.

On 26 September 2022, the government extended the deadline for applying and receiving vouchers for the equalisation of energy costs until 31 October 2022 and 31 March 2023 respectively.

On 2 October 2021, Federal Energy Minister Tinne Van der Straeten proposed extending the social energy tariff introduced during the pandemic to enable vulnerable people to better cope with the health crisis. Ten days later, the measure was introduced in the federal budget and is set to last until the end of March 2022, costing €208 million and targeting nearly 500,000 households.

Moreover, the Minister of Economy and Employment Dermagne has announced that from October 2021 the most vulnerable citizens will also benefit from an €80 energy check to be deduced from their bill. The budget for this energy check will amount to €72 million.

On 12 October, a €16 million Fund for Gas and Electricity was established to support households in need that are not eligible to receive the social tariff.

Certain taxes such as the federal contribution for gas and electricity and green power certificates are being replaced by excise duties which can easily be adjusted by the government to compensate for energy price variations. The point is to keep revenues at a constant level, rather than increasing along with energy prices.

The government has also forbidden unilateral changes in energy contracts, by which energy suppliers could independently increase the down payment invoice of consumers also in fix-price agreements.

On 1 February 2022, Alexander De Croo announced a VAT reduction for electricity from 21% to 6% from March to July. Moreover the government will provide every household with a €100 cheque and will roll-out further charge-reductions for low-income families. The energy package should amount to €1.1 billion.

On 14 March 2022, the Federal government decided to extend a VAT reduction until the end of September and oil-heated households will receive a payment for €200. An extended social tariff benefitting one in five households is extended until 30 September 2022. The total cost of the measures is estimated at €1.3 billion.

Belgian Prime Minister Alexander de Croo said that Belgium will take the lead in pushing for a cap on European gas prices.

On Saturday 19 March 2022, taxes on diesel and petrol were reduced by 17.5 cents per litre and Prime Minister Alexander De Croo announced that “the federal government has decided to take the necessary steps to extend the life of two nuclear reactors by 10 years”. The measure will delay the Belgian phase-out from nuclear that was planned for 2025. Belgium will also increase renewable energy investments, including an additional €1 billion for wind and solar energy projects, according to De Croo.

The extension of the social tariff for energy (from 424 to 880 thousand families, or around 16% of all Belgian households) will cost for the State €600 million for Jan-Sep 2022 (almost double that of 2021).

On 18 June 2022, the federal government decided to extend the social tariff, a 6% VAT on gas and electricity and the reduction in excise duties on fuels until the end of 2022. According to the Minister of the Economy, Pierre-Yves Dermagne (PS), this represents a budgetary effort of nearly €1.4 billion.

On 31 August 2022, the Belgian government announced a coordinated policy response to the continued energy crisis. Social benefits will be increased for vulnerable groups, lowered excise duties on petrol, a continued 6% VAT on electricity and gas, and a financial compensation measure for fuel oil. Banks would provide support for households most hit mostly through the mechanism of deferred mortgage payments and developing means to broaden access to energy savings measures. Companies would receive help through the application of the temporary crisis framework as set by the European Commission. This is targeted at industries seeing the greatest impact of rising energy prices. The government would be looking to the sustainable sector for solutions, including a reduced VAT for investments in solar panels, solar water heaters and heat pumps from 21% to 6% for new homes (less than 10 years old). Also, this will continue the reduction of VAT for demolition and reconstruction costs with the same rules. Finally, Belgium has expressed the intention to act against windfall profits.

On 23 September 2022, the government approved a draft law that allows the postponement of payment of social contributions for employers due for the third and fourth quarters of 2022 and the first quarter of 2023. Within this framework, contribution increases, lump-sum indemnities and/or late payment interest are not accounted for as long as the payment plan is respected. Also, it approved an extension of the social tariff for the BIM category stretching the maximum prices for residential protected customers to the beneficiaries of the increased intervention until 31 March 2023.

On 22 October 2021, the Bulgarian government announced an instrument to compensate companies with €55/MWh for two months. The €225 million required for the subsidies came from windfall profit tax on the nuclear power plant Kozloduy.

On 16 December 2021, the new ruling coalition voted to freeze power and heating prices for households until the end of March.

At the end of December 2021, the Bulgarian Minister of Energy Alexander Nikolov announced a new measure, compensating businesses for 75% of the electricity price increase above a threshold of 95 €/MWh but not more than 30% of the actual average monthly price (the actual price then went to 219 EUR/MWh, the 30% ceiling was activated and the compensation was about 66 EUR/Mwth). The minister said at the time that the compensation for the high electricity prices will exceed €460 million for the four months, with the state budget covering most of the cost.

On 20 January 2022, the formula was amended and maximum compensation, while staying put at 75% of the bill above 95 €/MWh, was brought to 128 €/MWh.

On 10 February 2022, the parliament passed a new budget with a package to mitigate the economic consequences of the surge in electricity and gas prices, for which it will spend €476 million to support businesses.

On 16 May 2022, Bulgaria passed a series of aid packages amounting to €1.1 billion euro targeted at the price of petrol and rising energy prices for consumers. It will fully compensate businesses for the 14% increase in gas prices. It also froze energy prices for households using July 2021 as a threshold. The Bulgarian government will cover 80% of electricity prices above €102/ MWh for business.. Also it discounts the price of petrol by 13 cents per liter from July 2022 until the end of the year for households, and scrapped excise duties on natural gas, electricity and methane.

On 28 July 2022, at its last Council of Ministers, PM Kiril Petkov announced three energy measures among which a the new program for compensating businesses of the price of electricity, starting from 1 July 2022 to 30 September 2022. The cabinet is also allocating €77 million for reducing fuel excises.

On 16 February 2022, Croatian Prime Minister Andrej Plenković presented a HRK 4.8 bilion (€636 million) package to mitigate the growth of energy prices. This package of measures applies to households, businesses and farmers. For households, the package refers to subsidies for the cost of gas to households, to tax relief, to social benefits for citizens at risk of energy poverty, and additionally to pensioners with a one-time payment.For businesses, it refers to subsidies for the cost of gas to entrepreneurs. For farmers, it is small-value subsidies for the purchase of artificial fertilizer and a special subsidy program for fisheries and aquaculture. The package will contain the energy price increases to 9.6 percent for electricity and 20 percent for gas. The package will also address the most vulnerable energy customers, estimated to be over 90,000. This extends the number of eligible people who receive vouchers for both electricity and gas bills. Government measures include, among other things, a permanent reduction in the value added tax (VAT) rate for gas and heat to 13 from 25 percent. In addition, the rate for gas will temporarily fall to five percent, in the period from the beginning of April this year to the end of March 2023. Subsidies to citizens apply to all households that use gas. The amount of support directly on the bill is 10 Lipa per kWh, which is about 20% of the projected price of €66 per MWh, and the discount is shown on the bill as a separate item. The suppliers send the request for compensation for the discount to the Ministry of Economy, which settles it every month from April 2022 to March 2023. The cost of this measure is estimated HRK 600 million (€79.6 million), and the financing would be provided by the sale of greenhouse gas emission units at auction.

On 8 August 2022, the Croatian government announced a Decree containing a multi-part aid package for consumers and the utility company HEP. This package would cost €2.79 billion in total, of which €797 million will be directed towards HEP. The remaining €2 billion is dedicated to helping consumers through the energy crisis and the rising prices associated with it. The decree aimed to cut volatility in the energy market by cutting down on the price that citizens, businesses, entrepreneurs, and public institutions pay for electricity. Basic food staples also saw a price regulation by the Croatian government, like oil, flour, sugar, pork, chicken and milk, lowering current prices by 30% and capping it at that price. Measures for lump sums were included in the decree, targeting the unemployed, and farmers who are dealing with rising costs in agriculture due to the jump in energy prices.

On 8 September 2022, the government announced a 21 billion kuna (€2.8 billion) package that introduced a cap on energy prices. From 1 October 2022 to 31 March 2023, households will pay €59 /MWh, or €88/MWh when consuming above 2,500 kW. Schools, kindergartens, universities, old people’s homes, NGOs, and administrative buildings will pay a blanket price of €62/MWh. For companies, prices will vary between €180/MWh or €230/MWh depending on consumption.

On 17 October 2022, the government adopted a new Regulation establishing the highest retail prices of petroleum products at the level as it has been for the previous two weeks: eg HKR 10.72 (€1.42)/liter for gasoline; HKR 12.3 (€1.6)/liter for diesel; HKR8.49 (€1.18)/liter for blue diesel.

On 17 September, the government announced a 10 percent discount on the electricity bill of all households from November to February.

On 4 November, the cabinet approved a reduction of VAT from 19 per cent to 5 per cent on electricity bills for vulnerable groups for six months. The Minister of Finance Petrides said that the government would also augment the disbursement of cost-of-living allowances.

On July 28 the government announced that it will absorb 25% of the anticipated rise in autumn energy bills. The finance minister Constantinos Petrides has also promised that vulnerable consumers will be completely shielded from upcoming additional costs and that other consumers will get a subsidy, in between 50 and 80 percent of consumption, designed to encourage users to save on energy use. The new measures would apply to almost half a million households and 111,500 businesses.

In November and December 2021, electricity and gas were exempted from value-added tax (VAT). The government also claimed that households (and other consumption points, such as cottages) will be exempted from energy fees if the electricity comes from renewables.

On 29 December 2021, the new coalition government approved the “Aid to households and entrepreneurs” act, to provide targeted assistance for households and entrepreneurs significantly affected by rising energy prices. Small and medium enterprises whose energy provider failed and that have experienced increases of their energy bills of more than 100% are offered a state-backed guarantee with a 0% interest rate to meet the costs of their operational expenses. This is provided under the Guarantee Program 2015 to 2023 through the National Development Bank.

In early February 2022, the Minister of Industry and Trade Jozef Síkela outlined a proposal to support companies facing a rise in energy prices. The package compensates energy-intensive industries with payments from the emission allowances or VAT. Bridging loans from state financial institutions or loans from commercial banks with a state guarantee was also considered.

In March 2022, the Minister of Labour and Social Affairs Marian Jurečka said that energy prices could be capped, or there could be some forthcoming tax breaks, including VAT.

After the Russian invasion of Ukraine, the government cancelled road taxes for cars, buses and trucks up to twelve tons. At the same time, the obligation to add more expensive biofuel to gasoline and diesel was lifted.

In June 2022, the government announced to be setting aside 2.7 billion euros to assist companies (€1.6 billion) and households (€1.1 billion) with the energy bills during the heating season. The mechanism to pass these fundings to consumers will be for the State to pay in full the renewables surcharge from October to December 2023. The Energy Act will be amended to introduce a savings tariff; wherein households can get a discount of around €650. The benefits are expected as soon as this heating season. There is no application process for this tariff, it will be automatically applied, and households will see the credits on their bill. Additionally, households will receive €530 if they are reliant on electricity for everything in their household, like heating, lighting and cooking. This also applies to households that light with electricity and heat with gas. For households that heat water and light their homes with electricity, but heat with gas will be eligible for €650. These measures will cost the Czech government €1.1 billion mentioned above.An additional €81 million euro were allocated to high energy business to prevent failures and closings. These are to help recoup additional indirect costs from the crisis over the next year.

In early July 2022, CEZ, the biggest utility company operating in the country, has signed a credit agreement with the Ministry of Finance for up to €3 billion, providing needed liquidity to the company.

On July 28 2022, the government signed an agreement with CEZ for expanding Dukovany nuclear power plant. If approved by the European Commission, the State will offer an interest free loan of €6 billion to the company in exchange of a fixed cost for the electricity produced by the company.

On 27 September 2022, the government approved the new draft budget law that allocates CZK 100 billion (€4 billion) to cap the price of electricity and gas. For households prices are capped at 6 CZK (€0.24) per KWh of electricity (corresponding to €200/MWh) and 3 CZK (€0.12) for gas, and the changes should be implemented from November deposit payments.

On 6 October 2022, the government proposed a 60% windfall tax on energy companies and large banks in electricity and gas production, distribution and trading, as well fossil fuel mining, oil processing, and wholesale fuels trading for the years 2023-2025.

The Danish government has set aside €13.4 million to top an existing scheme to help vulnerable households with a tax-free payment to help around 400,000 households with their energy bills. By February 2022, the measures were finalised and entered into force with a so-called “heat-cheque” (around €800) for 320,000 of the hardest-hit households. A €33.6 million fund was also rolled out to support the expedited replacement of individual gas heating systems.

On 10 August 2022, larger heat-cheque then previously indicated was paid out to 400,000 households. The final cost of the measure amounted to €320 mm.

In early September, Prime Minister Mette Fredericksen announced a proposed intervention in the electricity market. The proposal tackles the high prices for energy and intends to keep the lights and heat on for Danish citizens. The plan is to allow consumers to delay payment on their upcoming energy bills over a 5-year period for anything exceeding the level of their bills from last autumn. This loan scheme will create credit lines costing 6.05 billion euro for the Danish government.

On 15 October 2022, the Danish Energy Agency provisionally set a price ceiling on surplus heat at DKK 93/GJ with expected entry into force on 1 January 2023.

Low-income households will benefit (also retroactively) from discounted electricity prices between September 2021 to March 2022.Network fees for all electricity consumers (both firms and households) were halved from October this year to March 2022.The Minister of the Environment, Tõnis Mölder, announced that the total cost of the measures amounts to about €100 million.

At the end of 2021, Estonia decided to extend the energy price subsidy to low-income families to households with an income of less than €1,126 per month per first earner. According to the Estonian Minister of Public Administration Jaak Aab, this means that around 380,000 households across Estonia will benefit. The estimated cost of this subsidy is approximately €79 million, to be covered by the proceeds from the sale of CO2 emission credits.

On 25 January 2022, the Estonian government approved a cap on electricity (€0.12/KWh) and gas prices (€65/MWh) for households and the abolition of electricity distribution charges for businesses (previously only halved), in an effort to mitigate the negative effects of rising energy prices. The benefits will be valid from January to March.On 14 September 2022, a statement of Prime Minister Kaja Kallas said that to bring down energy prices, many large energy firms may be permitted to close down for a short time. This did not constitute an official policy, and was disputed by many in her government and coalition. It does, however, hint at a unique approach to the energy crisis in Estonia, involving less fiscal spending and more free market machinations. The outcome remains to be seen.

On 22 September 2022, the government announced that the draft state budget for 2023 considers an energy subsidy equal to €50/MWh of electricity for household consumers, and that it would cover 80% of price increases that go above €80/MWh. Similarly for gas and central heating, it would compensate 80% of price increases. Households will automatically have their bills reduced by this subsidy from October 2022. Also, it announced investment grants for energy security for large industries.

On 18 February 2022, the government decided that the government decided on temporary targeted measures to alleviate the problems caused by soaring energy prices on transport, agricultural entrepreneurs and household. These include a temporary increase of the maximum deduction for commuting expenses from €7,000 to €8,400.The measures will decrease tax revenues by €450 million.

on 17 March 2022, the Executive allocated €219 million in grants to the agricultural sector and decided on a temporary real estate tax exemption for agricultural buildings (costing €13 million) to alleviate the agricultural cost crisis and improve the security of supply of domestic food production. A similar package of €75 million was also rolled out for the logistic sector.

On 7 April 2022, the government agreed on a 7.5 percentage point reduction in the biofuel distribution obligation for 2022 and 2023 to benefit both professional and private drivers.

On 1 September 2022, the government presented the draft state budget for 2023 where it proposes the reduction the VAT on the sale of electricity from 24% to 10% between 1 January 2023 and 30 April 2023, VAT reduction on electricity would only apply to its sale, and not on electricity transmission or on the access to the electricity grid that will still be subject to the standard VAT rate of 24%. The measure is estimated to reduce the state’s tax revenue by around €290 million in 2023. Household purchasing power would be improved also by a temporary reduction in the VAT applicable to passenger transport to 0% that would apply to all passenger transport services currently subject to taxation, such as transport by train, bus, taxi, aircraft and ship. The proposal is estimated to reduce central government tax revenue by €60 million in 2023. Low-income households that face a monthly electricity bill exceeding the deductible of €400 (to maximum €1500) will be entitled to a subsidy covering 60% of the bill for four months between 1.1.2023 and 30.4.2023. Also, it introduced a tax deduction for households that incurred electricity expenses between 1.1.2023 and 30.4.2023. Eligibility for the deduction and its amount would be determined on a per-use basis by the amount of electricity used and the price paid for it. However, the same expenditure could only qualify for the deduction once. A person would be able to deduct 60% of the amount paid as a household allowance for a maximum amount equal to €2400. The household allowance for electricity bills would not be considered when calculating the maximum amount of the household allowance and would therefore not affect the household allowance for other eligible expenses. The tax allowance is estimated to reduce tax revenue by approximately €265 million and to affect around 252,000 households.

On 4 September 2022, the government agreed to set up a €10 billion euro emergency facility of loans and credit guarantees to help utilities weighed by surging collateral demands as they trade on volatile power markets to meet short-term liquidity needs.

On 8 September 2022, the European Commission approved a €5 million Finnish scheme to support commercial fishermen and aquaculture companies to compensate the eligible beneficiaries for part of the additional costs incurred due to the price increase of certain primary production inputs, such as fuel, electricity, fishing gear and packaging materials, linked to the current geopolitical crisis

On 15 September, the government announced plans for a one-off €100 payment to the 5.8 million households that already receive energy vouchers. Prime minister Jean Castex has also announced a cap on the price of gas until April 2022. Both measures were then strengthened on 21 October, augmenting the number of beneficiaries of the voucher (to everyone earning less than €2.000 per month net – around 38 million people), and extending the price cap to the end of 2022. A fuel-voucher and a reduction of the electricity tax rate are also being discussed. Reuters reports that French Economy and Finance Minister Bruno Le Maire said that the payouts to more than 38 million people would cost €3.8 billion, paid mostly this year.

On 9 December 2021, the French government began discussions on changes to the formula used to compute tariffs of the country’s main electricity supplier Électricité de France (EDF), reducing the market link in the formula. The new measure follows Prime Minister Jean Castex’s promise to limit the increase in regulated tariffs to 4% for the whole of 2022. Regulated tariffs represent about 70% of the residential electricity retail market.

Moreover, in December 2021 there were plans to increase the volume of electricity that EDF is obliged to sell to its competitors by 50%, however in March 2022 the increase was agreed at 20% (from 100 to 120 TWh). This compulsory sale, for the period from 1 April 2022 to 31 December 2022 at €46.2/MWh, is part of the Arenh system (a regulated access to historic nuclear electricity), which ensures a preferential purchase price for alternative producers.

As of 7 January 2022, discussions are ongoing, while current measures are beginning to look insufficient to contain increases to 4% over the winter.

By 31 January 2022 the estimated cost for the state has been €8bn, while EDF, forced to lower the cost of electricity by charging below the market rate (to contain the increase to 4%), warned its investors that it would take an estimated €8.4bn financial hit from French energy price cap. Some other estimates put the government spending to contain high energy prices as high as €15.5 billion since the fall of 2021.

From February 2022 to January 2023, the government also reduced the electricity tax from €22.50 per megawatt hour to €1 for households and 50 cents for businesses.

According to Finance Minister Bruno Le Maire’s “the new measures announced since the Ukraine crisis – such as helping companies with the cost of higher gas and power bills – bring the total cost of the government package to €25-26 billion”.

On 19 March the Prime Minister Jean Castex announced that from April to July motorists will be able to benefit from a discount of 15 cents per litre at the pump (and 35 cents per litre for the diesel used by boats in the fishing industry). On the 18 March 2022, road hauliers were also informed that they would receive a direct grant of 400 million euros from the government. This corresponds to a boost ranging from 1,300 euros for tractors and €300 for ambulances. This latest intervention will cost €2 billion.

On 23 June 2022, the government extended the 4% increase cap on regulated power tariff until the end of 2022. This measure, coupled with the gas tariff freeze, cost €38 billion so far.

On July 6 2022, the French government announced a €9.7 billion public takeover bid to nationalise Electricité de France (EDF), by acquiring the remaining 16% share of the company. The government has also announced plans to spend €50 billion by 2030 to extend the lives of existing nuclear reactors at the top of President Emmanuel Macron’s plant to build six new ones by 2035 (for a further €50 billion).

On 27 July 2022, the National Assembly approved a support package of €230 million for households using oil for heating and increased rebate for road fuels.

On 28 July 2022, French Minister for Energy Transition, Agnès Pannier-Runacher, announced regulatory measures to accelerate solar and wind deployment and respond to the risk of writing off of 14 GW of renewable energy installations due to the rising costs of construction materials.

On 4 August 2022, the French parliament passed another relief package, this one worth €20 billion. It offers a generalized set of subsidies instead of targeted support. It renews the cap on electricity price increases to 4% and freezes gas prices until the end of 2022. As a part of this, on September 1st, a petrol-price subsidy of 30 cents/Liter was implemented. Lodging is another important concern to keeping France affordable, and so this measure capped annual rent increases to 3.5%. Because of rising prices, France revaluated its social programs early, the evaluation usually takes place in January. The package includes a 4% in benefits to those in the national safety net, including low-income families, pensioners, and those on disability benefits. The package also includes a one-time back-to-school payment for low-income families on social assistance of €100 per parent and €50 per dependent child.

On 14 September 2022, the government announced that the tariff shield, already extended until December 2022 for gas, and until 1 February 2023 for electricity, will be renewed in 2023. The package includes: capping the increase in gas and electricity prices at 15%; an average increase limit in bills of around €25 per month for households heating with gas; an average increase limit of around € 20 per month for households heating with electricity; support of up to € 200 is also provided for French people heating with oil or wood. According to government estimates, the measures is expected to cost €17.8 billion net (€1.8 billion for the energy bill support, €11 billion for the gas price cap, and €5 billion for the electricity price cap) and benefit 12 million households.

On 6 October 2022, the government officially presented the “Energy Sobriety” plan that aims to reduce energy consumption by 10% over the next two years compared to 2019. The plan aims at consuming less energy and improve energy efficiency in households, businesses, public buildings, and transport. The package provides financial support to households to change heating systems through the MaPrimeRenov program; Sustainable Mobility Package granted to employees is exempt from social security contributions up to 700€ per year and can be combined with reimbursement of public transport up to €800. Also, energy utilities will offer incentives to cut consumption, eg TotalEnergy offers a bonus between ranging from €30 to €120, depending on the energy savings achieved for households heating with electricity that reduce their electricity consumption by at least 5% between 31 November 2022 and 1 March 2023.

On 23 September 2021, Reuters reported that “a spokesperson for the economy ministry said on 22 September that Germany does not see a need for government intervention to counter rising gas prices”. However this position was then reconsidered a few weeks later, when the government announced a reduction on the Erneuerbare-Energien-Gesetz (EEG) surcharge – a levy on the price of electricity – from 6.5 to 3.72 cents on the wholesale price per kilowatt-hour of electricity. The measure, costing €3.3 billion, became effective on 1 January 2022 and will be financed by the federal budget and higher CO2 pricing.

On 9 January 2022, the new coalition government announced targeted measures to help vulnerable households cover their heating bills in full, while the minister for environment and consumer protection, Steffi Lemke, told Reuters she will “clamp down on suppliers who try to profiteer from contract expiries, competitor insolvencies and people moving house”.

The state has also offered a €130m package of one-time grants to low-income households, which will be paid over the summer when households receive their bills from energy suppliers.

At the start of February 2022, multiple politicians, within and outside the coalition government, started calling for a further reduction of the EEG surcharge before 2023, which would relieve households by an average of €300.

Electricity prices for German households are the highest in the European Union. Reuters indicates that some 4.2 million German households will see their electricity bills rise by an average 63.7% in 2022 while 3.6 million face gas bills 62.3% higher than in 2021 as suppliers pass on record wholesale costs.

A first relief package was passed on 24 February, which included an increase in commuter allowance a €135 lump-sum payment for students and vulnerable citizens, tax reductions on income tax, increased payments for poor children (extra €20/month per child), and a €100 subsidy to unemployed people.

On 24 March, Germany’s ruling coalition agreed on additional measures worth about €15 billion, including a temporary reduction in fuel prices for three months through a tax cut (by 30 cents for gasoline and 14 cents for diesel). Other measures encompass a one-time payment of €300, a €100 cheque to boost child support and a monthly reduction to €9/month for public transport. Other measures encompass a new subsidy program to replace gas boilers with heat pumps, the increase of the energy efficiency standard for new buildings to KfW55 by 2023, the obligation that newly installed heating systems need 65 % renewables by 2024, and an increase in biogas production. These new measures will complement the already agreed subsidies for low-income households, the increase in allowance for commuters and the EEG surcharge cut. Chancellor Scholz indicated that the overall cost of these policies bring the total cost of shielding consumers from the rise in energy prices to around €30 billion.

At the end of April 2022, the Bundestag passed a law to eliminate the EEG surcharge altogether from July this year. The government claims that a typical family of four will benefit from that by around €300 per year compared to 2021.

In the months of April and May the federal government has secured the trusteeship of Gazprom Germania, by transferring the previous trustee under foreign trade law into a trustee under the Energy Security Act. At the same time, the German government saved the company, which had faltered due to Russian sanctions, from insolvency with a loan of EUR 9-10 billion.

On the 19th of June 2022, a new program was rolled out by the government. Some of the measures covered by the package are: greater reliance on coal power plants in substitution to gas-fuelled ones, the kick-start of designing a new gas auction model that should encourage industrial gas consumers to save gas, lines of credit to gas storing companies, and renewed support to energy- and trade-intensive companies that are particularly affected by increases in natural gas and electricity prices (with a narrowly defined cost subsidy with no repayment obligations).

In July the German government agreed to provide a 17 billion euro rescue package to bail-out utility company Uniper. A few weeks later, on July 28, the government announced an energy levy in the range of 1.5 to 5 cents per KWh and it warned that utilities will be allow to pass on the increase in energy costs to consumers starting in October. The measures could add as much as €1000 per year to the living costs of households.

The German government announced September 4th an additional €65 billion to provide inflation relief and support for households struggling with energy prices. The package includes spending and support for an EU wide profit cap on energy companies, a brake in the price for electricity used in basic consumption, and subsidies to electricity grids to dampen the rising prices. With energy prices already surging, it also delays an increase on the price of carbon emissions to 2024. Outside of the energy crisis, the plan also tackles the issues with inflation. It offers a one-time lump sum of €300 to pensioners and €200 to university students. There will also be increases to rent subsidies, child benefits (by 18 euros a kid) and welfare payments (by 500 euros). As additional stabilization measures, changes were made to income tax brackets to prevent bracket creep, there were expansions to various KfW Development bank programs and a continuation of subsidization of public transit.

September 13th, it was revealed that Germany plans to spend €68 billion offering loan guarantees to failing energy companies disrupted by the Russian supply cuts. The state bank for development, KfW, would be the main mechanism and overseer for this transfer of loan guarantees. The Ministry of Finance will use credit authorization already established for the Corona relief programs to fund these guarantees.

Also in early September, Uniper reported a €12 billion loss from the energy shock. This prompted calls in the German government to buy a majority share of the company, according to one source within Uniper on September 14th. Some even are considering full nationalization. Uniper’s parent company, Fortum, however, is Finnish. With Finland’s state government owning a majority of shares in Fortum, the German and Finnish governments have entered discussions on the fate of Uniper.

It was reported September 16th that Germany was expanding upon these talks, and was reportedly considering nationalisation of not only Uniper but also other gas importing firms and oil refineries from Russia’s orbit. These companies were either owned by Russia, like Rosneft, or imported mainly Russian oil, like Schwedt. These entities will fall under the trustee ownership of BNetzA, the grid regulator, echoing a similar takeover of Gazprom Germania earlier this year.

On September 29th, Germany announced its largest package yet targeting the rising gas prices. It amounts to a 200 billion euro, “economic defence shield”. There are three main new things about this. According to Bruegel’s Simone Tagliapietra, Georg Zachman and Jeromin Zettelmeyer, “First, it involves a much larger fiscal commitment than previously (a German package announced on 7 September amounted to €65 billion, mostly financed through levies, not new borrowing).

Second, a new support measure, named the ‘gas price brake’, is intended to reduce average gas prices. This was mentioned in the previous package, but details are now to be fast-tracked, by end-October. According to preliminary estimates, the measure would cost between €15-€24 billion if applied to private households only.

Third, a plan to introduce a levy on all gas consumption of €0.027 per kilowatt hour as of 1 October has been scrapped as “no longer needed”, in the words of Chancellor Olaf Scholz. Support for struggling importers that lost contracts with Gazprom will instead come from the new fund.”

This package seeks to shield German families and industry at the risk of European neighbours. It calls for circumventing the German fiscal rules on debt brakes, setting aside funds now, for use next year when a 0.35% of GDP federal deficit limit goes into effect.

Further, within these packages is funding provided for the full nationalization of Uniper, the German energy company. Previously, 17 billion euro had been provided to partially nationalize the firm, and this package brings that total to 30 billion euro.

On October 10th, the expert group created by the German government for finding the best way to reduce gas prices presented their short-term plan. The goal, avoid gas shortages while reducing the impact of rising gas prices. For consumers, this plan was set to cover one month’s gas bill in December, and then subsidising 80% of the normal September consumption at €0.12 per KWh starting in Spring. Further, the plan stated that starting in January, industry members will receive 70% of 2021 gas consumption at €0.07 per KWh.

This plan will consume some €91 billion of the €200 billion set aside by the German government in the month prior, €66 billion dedicated to consumers and small and medium sized firms, and the remaining €25 billion dedicated to the support of industry.

Plans were announced on 14 September 2021 to offer subsidies on the electricity bills of to the majority of Greek households and small businesses by the end of the year and were then expanded in mid-October. The value of the subsidy was initially €9 for the first 300 kilowatt-hours (KWh) consumed per month and was later increased to €18 for low voltage consumers and €24 for the beneficiaries of the social household tariff. On January 7 2022, the subsidy for households was then raised to €42 for the first 300KWh and €65/MWh for businesses (regardless of size, sector and voltage level). For households included in the Social Housing Tariff (CTO) the subsidy will amount to 180 €/MWh, ie 90% of the increase. The government-owned Public Power Corporation also expanded its existing discount policy to fully cover the price rise for the average household with a consumption of up to 600 kWh per month.

At the same, heating allowances caps and inclusion criteria have been expanded and the government estimates that the number of beneficiaries will exceed 1 million, compared to 700,000 in 2020.

For January 2022, natural gas will also be subsidised for both households and firms at €20/MWh and €30/MWh respectively. VAT subsidies have also been implemented for both groups.

Some of the funding to shield consumers up to December 2021 were funded through the Special Support Fund for the energy transition, with at least €150 million diverted from the increased revenue from the Carbon Emissions Trading Rights System for Greece in 2021. However, the total cost of the measures is around €500 million, while the cost of the January 2022 package (for the month of January alone) is estimated to be €400 million.

Finally, Environment and Energy Minister Kostas Skrekas announced €100 million from the Recovery and Resilience Fund for the construction of photovoltaic stations by municipal energy communities will be used to provide power to vulnerable households.

In March, the government €65/MWh subsidy to the industrial sector fell far from covering for the spike in wholesale electricity prices observed after the start of the war in Ukraine (€360/MWh on the Greek exchange).

Reuters reported that Greece spent some €2.5 billion in power and gas bill subsidies since September and detailed additional aid of €1.1 billion of upcoming help, which includes a fuel rebate for low-income households (fundings coming from utility bills that citizens already paid – profits off RES charges in utility bills, ~0.35bn in late 2021, ~0.7bn in early 2022 -).

In April 2022, the government also introduced a one-time support cheque of €200 for all low-income pensioners.

On Thursday 5 May 2022, Finance Minister Christos Staikouras announced a new package worth €3.2 bn to relieve pressure on household budgets and businesses from soaring energy prices. The measure would come after the subsidies for power and gas and the one-off grant to vulnerable groups that already costed €4 billion. Prime Minister Kyriakos Mitsotakis also said that the government will set a ceiling on wholesale electricity prices and refund up to 60% of all the surcharges that electricity consumers with annual incomes of up to €45,000 have paid from December 2021 to -May 2022. The disbursement of these fundings is expected to happen in the future.

In May the Ministry of Environment and Energy announced that the Greek government will impose a 90% tax on profits made by domestic power companies.

The tax will be determined using the months of October 2021 and March 2022. The country’s energy regulator, RAE, has calculated that these earnings will total more than €900 million. PPC, a state-owned utility, has already forgone €336 million in order to assist customers.”

On July 5th, Greece announced it will be extending the subsidies for households and businesses for the month of July, costing the government more than 700 million euros. These subsidies award 200 euro per megawatt hour to households to cover some 84% of the rising energy bills. Shops will receive 192 euro / MWh and farmers receive 213 euros / MWh. Lastly, industries will receive 148 euros per MWh.

With costs of energy prices still rising, Greece announced August 24th that it is again extended its sweeping energy bill subsidies. This round of subsidies directly compensates households and businesses, and aims to help against the rising energy prices. These households will receive 639 euros per megawatt hour covering 94% of the rise in energy prices. For small and medium sized businesses, the aid will be 604 euros per MWh. Farmers receive 639 euros per MWh, and industries will receive 342 euros per MWh. The total cost for the month of September is estimated to be 1.9 billion euros.

On September 21st, Greek Energy Minister Kostas Skrekas said the government would pay out an additional 1.1 billion euros to households and businesses to shield them from the rising energy prices ahead of winter. These subsidies have three parts:

- Households with monthly consumption up to 500 kilowatt hours, the value is 436 euros per megawatt hour. This constitutes the majority of Greek households, and compensates consumers for about 90% of the rise in energy bills.

- For households consuming above 501 kilowatt hours per month, the subsidies will compensate for about 70-80% of the rise in prices

- For businesses with consumption over 2000 kilowatt hours, 398 euros are promised per megawatt hour, with agricultural businesses, namely farmers, receiving 436 euros per megawatt hour.

In addition to these benefits, a 50 euro per megawatt subsidy is further offered to consumers who cut their average daily consumption by 15% year on year.

Prices for households are regulated below cost and on 11 November the government announced that it will also put a price-ceiling of €1.30 per litre on petrol and diesel. Initially planned to last for three months the cap was extended to last until July. Márton Nagy, Minister for Economic Development, said that the government will raise around €2.06 billion over the next two years from new windfall profits taxes. While covering many sectors of the economy most of the revenues will come from energy sector companies (€760 million), with a large chunk to be collected from Hungarian oil and gas company MOL.

On July 13, the government declared a state of emergency and adopted a 7-point plan on energy security. The government intends to increase domestic natural gas production to 2.0 billion cubic meters, as well as look for additional sources of gas. Budapest will ban exports of energy resources such as firewood and increase domestic production of lignite. In addition, one lignite-fired power plant in Matra will be reopened and the work of the Paks nuclear power plant near Budapest will be extended. From August 2022 Hungary will scrap caps on gas and electricity prices for high-usage households(those that consume more than the national average).

On July 30th, Hungary changed the eligibility for price-capped fuel and increase the windfall profit tax levied on the oil and gas firm MOL. The price-capped fuel, petrol and diesel, is now only available to privately owned vehicles, farm vehicles and taxis. The main exclusion is that of company owned cars. For the windfall profit tax on MOL, on August 1st it will be increased from 25% to 40%.

The Commission approved Hungary’s amendments to a company’s support scheme to increase the maximum amount of aid to €62,000 per company active in the agriculture sector, €75,000 per company active in fisheries and aquaculture sectors and €500,000 per company active in all other sectors. In addition, Hungary notified an overall budget increase by approximately €459 million. This will bring the total budget of the scheme to approximately €1.58 billion.

Electricity prices for Irish households were the fourth-highest in the EU in the first half of 2021, rising to number one when taxes are stripped out. Presenting the Irish budget for 2022 on 12 October, Finance Minister, Paschal Donohoe, introduced a 30% tax rebate on vouched expenses for heat and electricity. Other measures include spending for €202 million from carbon tax revenue in residential and community retrofit schemes (over 22,000 home energy upgrades in total). More than half of the funding will be for free upgrades for low-income households at risk of energy poverty. A new low-cost loan scheme for residential retrofitting will also be introduced.

On 14 December 2021, the government approved a €210 million scheme to credit all domestic electricity customers with €100 in 2022. Approximately 2.1 million account holders will benefit from the scheme for a one-off, exceptional payment.

In March 2022, the electricity credit payment to households was doubled to €200 and will continue through to March and April. Funding for the scheme had also to increase accordingly, from €215 million to €400 million.

On September 27th, the Irish government put forth it’s budget for 2023 and in it were a couple measures to address the worsening energy crisis. In the largest single measure so far, Ireland committed 1.25 billion Euro to its Temporary Business Energy Support Scheme (TBESS). This measure will provide eligible businesses with compensation of 40% of the increase in their energy bills (gas and electricity), capped at €10,000 a month. It is targeted at small businesses, but medium and large businesses will also benefit. The Revenue Commissioners will oversee the implementation, and the bill covers backwards from the start of the month and last until February 2023. In addition to this, €200 million was committed in the Ukraine Enterprise Crisis Scheme, which seeks to further help businesses impacted by the energy crisis and war in Ukraine. It is targeted towards the manufacturing and internationally traded services sector. In one part of the scheme, €2 million will be provided to energy intensive companies seriously impacted by the rising energy prices in the form of grants. Eligible businesses must, however, provide a plan that demonstrates future energy efficiency and steps on how they will reduce their energy costs.

On 27 September, Italy approved short-term measures worth short of €3 billion to offset the expected rise in retail power prices until the end of 2021.

The funding is split into €2 billion to eliminate general system charges in the electricity sector and €480 million to reduce general charges on gas bills. The system charges on electricity bills will be offset with €700 million from the proceeds of CO2 auctions and €1.3 billion from the National Fund of Energy and Environmental Services.

VAT on the use of natural gas will drop to 5% on supplies for “civil and industrial uses”. The measure applies from the last quarter of 2021 (October to December). VAT on gas bills is now at 10% and 22% depending on consumption. Italy is also set to strengthen the ‘social bonus’ on bills for families in economic difficulty and with serious illnesses, for which €450 million will be allocated. The facilities will be redetermined by the energy authority for the last quarter of 2021 to “minimise increases in supply costs”.

For around 6 million small businesses (with low-voltage users up to 16.5kW) and around 29 million domestic customers, the rates relating to general system charges are set at zero for the last quarter of 2021.

New measures will likely be introduced early next year, bringing the total cost of containing energy prices for the government to around €5 billion.

On 9 December 2021, the Italian government agreed to supplement the €2.8 billion spending already planned for 2022 with an additional billion.

On December 18 2021, the government outlined how it will spend the funds for 2022: €1.8 billion will be used to eliminate system charges for electricity users (households and micro-businesses with power needs up to 16.5 kilowatts). A further €480 million has been earmarked to cancel the charges on gas bills for all users. Then, as in September, there will be a reduction in VAT to 5% for both civil and industrial uses, with an estimated revenue loss of €608 million . Finally, €912 million will be used to increase the social bonus (the discount on bills for economically disadvantaged families or those with serious health conditions) in order to compensate for new increases. The Italian government also introduced the possibility for consumers to pay their energy bills in multiple instalments for the whole of 2022.

On January 12 2022, the Italian Minister of Industry announced a forthcoming increase in corporate taxes on energy companies that have benefited from surging power prices. This comes days after Matteo Salvini, the head of the Minister of Industry’s political party, called for a deficit-hike of at least €30 billion .

Overall, state support for struggling households is expected to reach €8.5bn through March 2022.

On 21 January 2022, the Council of Ministers announced new measures (up €1.7 billion) against high bills. These are on top of the planned €3.8 billion and bring the total to €5.5 billion for the first quarter of 2022 alone. The extra measures are more targeted to support the business world with a 20% tax credit for all energy-intensive companies experiencing a 30% price increase with respect to 2019. Some of the extra funding will be financed through a windfall profit tax from February to the end of 2022 on solar, wind, hydro and geothermal electricity producers.

On 19 March 2022, Italy approved a new €4.4 billion package to enlarge the social bonus to 5.2 million households (who will pay electricity and gas at 2021 summer’s prices) and to reduce the price of gasoline by 25 cents until the end of April. Other measures contained in the package are tax-credits for firms and allowing citizens to pay their energy bills in instalments. The funds will be found by a 10% windfall tax on energy companies and bring the total amount to €20.4 billion spent since September.

On 21 April 2022 the Senate approved €8 billion in extra spending, 5.5 billion of which is to counteract rising energy prices and the rest to help the most affected productive sectors of the economy. System charges on electricity bills will be kept at zero throughout summer and VTA will be fixed at 5% of gas bills. Also the social bonus for electricity and gas was extended for all low income households (whose category was previously expanded). Tax credits for energy-intensive companies were also designed and a fund of 800 million was activated for the automotive sector. Measures to favour the installation of renewables (photovoltaic and wind in particular) were also adopted. The degree also envisages that air conditioning will need to stay above 25 degrees Celsius during the summer period.

On 2 May PM Mario Draghi outlined a new package of measures worth 14 billion to help families and business but also to speed up the deployment of renewable energy and regassification plants. The flag-measure of the package is a €200 one-off bonus for 28 million workers and pensioners (with an income level lower than 35.000 euros). Then the decree includes a 0.8 percentage points cut on the social security tax rate of civil servants, a €200 million fund for businesses trading with Russia, Ukraine and Belarus and tax credits for SMEs for investments in intangible assets (50%) and for training (70% for small firms and 50% for medium ones). A €600 million fund has also been designed to help big cities with the implementation of the Recovery and Resilience Facility objectives. The Superbonus (a 110% tax credit on energy efficiency improvements for buildings) and the social bonus for energy expenses (regarding families with an income lower than 12 thousand euros) have been extended until the end of September. The cut in excise duty on fuels has also been prolonged: the discount, worth 30 cents per litre on petrol and diesel, is expanded to methane cars, whose excise duty will get to zero and VAT will be reduced from 22% to 5%. This will last for all fuels until 8 July 2022. For companies, the tax credit for the purchase of gas and electricity increases to 25%. And hauliers will benefit from a 28% tax credit for the first quarter of 2022 for the expenditure incurred on the purchase of diesel. A 10% tax credit is also targeted at energy-intensive firms for natural gas purchased in the first quarter of 2022. Three billion euros will be used to adjust the prices of public procurement, as the raw materials used in construction are affected by high inflation. The draft decree allocates 3 billion for 2022, 2.5 billion for 2023 and 1.5 billion for every year from 2024 to 2026. The measures will mainly be funded by increasing the windfall taxation of energy firms from 10 to 25%.

By the end of June 2022, the government passed a new €3bln-worth decree to lower the increases in energy bills. Most of the fundings will be needed to extend previously adopted measures (for example levelling-off distribution charges for low-income households, or VAT reduction to 5% for gas bills). The new part of the package provides for Arera (the authority for the regulation of energy grids and the environment) to maintain unchanged general system charges for the natural gas sector. A measure, the latter, which requires coverage for EUR 292 million to which a further EUR 240 million must be added for consumption brackets up to 5,000 cubic metres per year. The decree also regulates the social bonus for electricity and gas linked to the Isee (an income declaration made by households) and intended for less fortunate families. Reductions are envisaged so as to maintain unchanged, compared to the previous quarter, the expenditure of subsidised customers corresponding to the typical profiles of the holders of the aforementioned benefits. Finally, the provisions to accelerate the storage of natural gas are also confirmed.

Towards the end of July, the government delineated a draft-bill named ‘Aiuti bis’ of the value of 13 billion, with 2 extra billon of additional measures. More than 6 bn will be used to cover the extension of previously adopted measures: 1.05 bn to extend the cut on gas VAT (from 22% to 5%) and on fuel levies by (30 cents per litre), 5 bn for cancelling off taxes on energy bills. Additionally, until 31 October 2022 the effectiveness of any contractual clause that allows the electricity and natural gas supplier company to unilaterally modify the general contractual conditions relating to the definition of the price is suspended. Moreover, the tax-free limit on company bonuses was doubled to €516 if this is used for households’ bills expenses. 350 million were allocated to townhalls and 50 to metropolitan cities to help them with energy expenses. The transport sector also benefitted of the bill, with additional 101 million at the top of the 79 million already allocated within 2022. 3.3 billion were then used for extending tax credits for businesses, including firms in the agricultural sector. Then, 6.5 bn should be used for a new 200-euro voucher for workers and pensioners that didn’t benefit from it in spring and it also adjust for a 2% inflation increment pensions for pensioneers with income lower or equal to 35 thousand euro. Similarly, workers with an income below 35 thousand euros per year will benefit from a tax discount of 1.2 percentage points on their wages until the end of 2022, for a cost of 1.2 bln to the State.

On 13 September the Aiuti-bis bill was approved by the Senate for an overall budget allocation of €17 bn (€2 bn more than previously envisaged). New measures in this version of the package concern the extension of smart working for vulnerable workers and parents, the birth of the provisional Parliamentary Committee for the Security of the Republic (Cosapir), the permanent hiring of temporary workers called in the Public Administration under the Recovery and Resilience Fund and it has been removed a remuneration cap of 240 thousand euros for apical figures in the public administration. Moreover, concerning the Superbonus, the liability in assigning the credits of bonuses is configured only if the participation in the violation occurs “with wilful misconduct or gross negligence”, hence limiting the liability of trading the credits to particular cases.

On September 16th, the government approved law decree Aiuti-ter. The new package has a value of € 14 billion (€ 6.2 billion from the extra income). For enterprises, the government has decided on an enhanced tax credit for businesses, strengthened both in the discount percentage and in the number of companies eligible to include small businesses, bars and restaurants (for the next three months). Enterprises with electricity meters with an available power of 4.5 kW or more are granted a tax credit equal to 30 percent of the expenditure incurred for the purchase of the energy component, and equal to 40 percent for the purchase of natural gas. For households, Aiuti-ter has increased the audience for the “social electric and gas bonus” by raising the qualifying income level ceiling to 15,000 euros, thus reaching an additional 600 thousand households. The package foresees a one-time bonus of 150 euros for those with incomes below 20,000 euros gross annually, including pensioners, employed, self-employed and seasonal workers, and will address an audience of 22 million people. The draft also includes new allocations for the 60 euros transportation bonus to purchase public transportation passes. Overall, the Fund created with the first Aiuti decree is increased by 10 million euros for 2022.

In Latvia, around 150,000 of the most vulnerable households, including those with a disabled member and large families, will receive between €15 and €20 per month from November until at least the end of 2022 to pay their electricity or gas bills.

The Ministry of Economics developed and on 30 November the Cabinet of Ministers supported, a proposal reducing the country’s mandatory procurement component to €7.55/MWh (from €17/ MWh in 2021).

The government also rolled out a 50% reduction in fixed-term electricity distribution tariffs. The subsidy is allocated to the distribution system operator, compensating it for the reduced distribution tariffs it applies to end-users.

Residents over the age of 60 and disabled citizens have been receiving a monthly subsidies of €20 per month from November 2021 until the end of March 2022. Households with children are getting €50 per child.

The previously proposed aid instrument, a time-limited reduction in value added tax, was not approved.

In January 2022, the Latvian government passed legislation to compensate gas consumers for rising energy costs. Anyone who consumes more than 250 cubic meters gas annually will be compensated for the rise in gas prices over the January to April 2022 heating period. This is automatic and there is no need for application.

The overall cost for the government is estimated to be €450 million.

On April 14, the Cabinet of Ministers announced an energy crisis in the supply of oil products, which is set to last till December 31st 2022. The State Energy Crisis Center was appointed to be the institution responsible for the coordination of activities during this period, responsible for the release of safety reserves of petroleum products and to establish obligations for holders of petroleum product reserves in the Republic of Latvia. The new measures also impose a ban on exports of oil products outside of Latvia.

On August 23, the government amended legislation to provide for the compensation of electricity system service costs for businesses from October 10 2022 to April 30, 2023, measures to partially cover the increase in heat supply and heating costs for households, and partial compensation of energy resource prices for energy-intensive companies. The measure could cost the state approximately 123 million euros. In addition to the planned support for entrepreneurs, amendments to the Law on Measures to Reduce the Extreme Increase in Energy Prices have also entered into force, which provides for a series of measures to partially cover the increase in heat supply and heating costs for households. The total amount of support for the measures included in the support package will be approximately €442 million. Moreover, about 250 energy-intensive manufacturing companies could receive support due to the rising prices of energy. It is expected that the average support will amount to 200,000 euros. Thus, the Ministry of Economy predicts that support for energy-intensive companies could cost the state about 50 million euros.

On 14 October, the Lithuanian government announced that it will delay the final stages for liberalising the energy market, due to the possible disruptions caused by the spike in energy prices. Moreover, the increase in heating and gas prices will be spread to consumers over 5 years.

Finally, the extension of heating-aid for the poorest 110,000 households is also under discussion.

The Lithuanian Parliament has also passed new legislation enabling more people to apply for heating subsidy to cover around 110,000 people. The government also planned to set a ceiling on electricity prices for consumers, spreading the increase over the next five years.

On 1 April 2022, the government launched a €2.26 billion package to counter the effects of inflation and to strengthen energy independence.

To partly absorb the energy price shocks the Government compensates a share of gas and electricity prices paid by people by allocating €570 million. At the same time, businesses are offered not only gas and electricity price compensation solutions, with a budget of €120 million, but also targeted funds for the affected sectors in the amount of €142 million. Other measures target the elderly and people earning the minimum wage citizens by increasing social benefits and implementing heating compensations. EUR 315 million is foreseen in the Government’s plan to increase personal income.

The plan also rolls out investments in energy independence by budgeting €1.12 billion. EUR 275 million will be allocated to a new renovation investment platform, while the grants for green renovation and modernisation of multi-apartment buildings amount to additional €277 million. In addition, €46 million is earmarked for private charging infrastructure for electric vehicles in the yards of multi-apartment buildings, households and private companies. EUR 60 million is planned to promote the purchase and installation of solar power stations, and additional EUR 19 million − for the replacement of biomass and fossil fuel boilers by technologically advanced installations. In total, these measures will make up a share of EUR 677 million. Additional investments in energy independence for businesses (€254 mm) and for public projects (€193 mm) are also detailed in the package.

In October, to address the continued crisis, the Lithuanian government released their budget bill earlier than usual including several items to help with the energy crisis. €1.5 billion was set aside for helping raise consumers income, through increasing the minimum wage and through increasing pensioner’s wage. The average old-age pension will increase by €65 euro to €575 in the coming year. The minimum monthly wage will be €840. Consumers are not the only group struggling, and like other countries, Lithuania has set aside €2.5 billion for helping businesses caught in rising energy prices.

Luxembourg Energy Minister Claude Turmes says he continues to monitor the evolution of energy prices closely and to inform the Council of the Government.

On 1 January 2022 the government increased its cost-of-living allowance by €200 to better protect vulnerable households from rising energy prices.

In February 2022, the government approved the “Energiedësch” pack, putting €75 million in use for the following elements:

- A one-off energy premium with a ceiling of €400 for low-income households was introduced. The benefit went to households receiving the cost- of-living allowance (COLA) and households whose income is up to 25% higher than the income of those eligible for COLA.

- Electricity prices were stabilised through an increase in the state’s contribution to the compensation mechanism for renewable energy.

- Gas network costs were temporarily covered by the state. The reduction in energy costs was estimated at around €500 per household.

Financial aid measures were being stepped up to accelerate the energy transition by supporting energy renovation, the installation of renewable energies and even sustainable mobility.

On 31 March, the government introduced new measures to shield companies from the higher energy prices effective until the end of 2023.

The measures were: a guarantee scheme aiming at facilitating bank loans for eligible companies (those with liquidity needs due to the war in Ukraine). The state guarantee could cover up to 90% of the loans. An overall amount of €500 million is allocated to the scheme. An aid scheme to compensate for part of the additional costs of higher electricity and natural gas prices. This scheme provides support to companies that are qualified as energy-intensive (whose purchases of energy products account for at least 3% of their production value/turnover) and in the commercial sector, covering between 30% and 70% of the additional cost exceeding the doubling of natural gas and electricity prices. The granting of aid with an intensity of more than 30% is, however, subject to the conditions that the company is making a loss and that the eligible costs are at least 50% of the loss. The government also proposed to analyse the possibility of opening the scope to the road haulage sector, the construction sector and to the food industry. Then a measure was specifically drafted for the agricultural sector and designed to compensate for part of the additional costs linked to the rise in the price of energy, fertilisers and inputs, up to a limit of €35,000 per enterprise. Another aid scheme to offset the extra costs of the greenhouse gas emission allowance trading system (ETS) for the period 2021-2030. This measure covers part of the indirect emissions costs incurred in the years 2021 to 2030 by companies exposed to a real risk of carbon leakage. In return for this aid any beneficiary company is required to make investment commitments that promote the energy transition. Other measures concerning the medium term were also rolled out.

Additional support schemes, tax credits and the reduction of 7.5 cents/euro per litre of fuel (diesel, petrol) and per litre of heating oil until the end of 2022, were introduced to increase the purchasing power of citizens and vulnerable groups. Finally, housing measures were introduced or revised to help with the increasing costs for households. These are a temporary rent freeze until December 2022, higher rent subsidies for large families and the revision of the financial support scheme to renovate fist houses.

On September 28th, the government signed into law a tripartite agreement in association with the three major labour unions, and the Luxembourg Employer’s Association. The package included a variety of supports to consumers and businesses continuing to struggle under the rising energy costs. To support households the government enacted a price cap on gas prices at a 15% maximum increase, with a total price freeze on electricity prices from January to December of 2023. In the fuel sector, there was a reduction of 15 cents per litre in heating oil prices, and overall, a general reduction in VAT. The standard VAT fell from 17% to 16%, the intermediate rate fell from 14% to 13% and the reduced rate became 7% from a prior 8%. The package also attacked the cost of living by increasing the minimum wage and restructuring wage indexation. Further, it put cash into the hands of low-income households and retirees by handing out energy bonuses to eligible households of €200 to €400, and contributing to the costs of energy prices in retirement homes.

In support of businesses, compensation for rising energy prices was offered through a series of aid schemes. The existing tax credit system has been adapted to encourage investing in the green and digital transitions. As part of this, businesses are being encouraged to provide their own electricity, with new subsidies for solar panels being offered. “Power purchase agreements” are being further offered to incentivise firms to get the majority of their energy directly from renewable energy suppliers

The government has mandated Enemalta, the (67%) state-owned energy provider in the country, to freeze prices at their 2014 level. To make it business feasible, the government has been compensating the firm for the losses the price cap implied due to the increasing cost of energy imports. In 2021, the government has committed €200 million and the same amount has been allocated for this year.