ENB Pub Note: This is from the Energy Bad Boys Substack. Please follow Isaac and Mitch HERE: And check out our podcast interview HERE: ENB #206: Decoding Energy Dynamics: The Intersection of Policy, Monopoly, and Innovation in the U.S. Energy Sector

Before we analyze the Environmental Protection Agency’s (EPA) finalized greenhouse gas regulations on power plants, we want to let you know that we have exciting professional news to share. We will have more details in the not-too-distant future. Stay tuned!

On Thursday, April 25, 2024, the U.S. EPA issued a slate of rules further regulating the U.S. power sector. Chief among them were the finalized rules on carbon dioxide emissions from existing coal and new natural gas, commonly referred to as the Clean Power Plan 2.0.

The finalized rules span 1,020 pages and introduce too many changes from the proposed rules issued last May to list in this article. However, we have selected three major aspects of the rules to discuss this week, with more details to come soon.

The Good: Existing Natural Gas Plants Are Exempt From the Rules…For Now

The biggest change to the finalized rule is positive for near-term grid reliability because it exempts the nation’s existing natural gas plants from any restrictions on greenhouse gas emissions.

Previously, the entire natural gas fleet was required to reduce its carbon dioxide emissions based on how frequently the gas plants operated.

For example, under the proposed rule, baseload gas plants, defined as plants over 300 megawatts (MW) operating at a 50 percent capacity factor or higher, would be required to install carbon capture and sequestration (CCS) equipment to capture 90 percent of their emissions by 2035 or burn 30 percent “green” hydrogen by 2032, with this number jumping to 96 percent green hydrogen by 2038.

Intermediate plants, those operating between 21 and 49 percent capacity factors, would have been required to co-fire 30 percent green hydrogen by 2032. Peaker plants operating less than 20 percent capacity factors would not have been required to install equipment to reduce their emissions under the logic that they do not operate frequently enough to justify the cost of installation.

While exempting existing natural gas plants from the regulations was a positive step for reliability, it will almost certainly be short-lived. The EPA is currently planning to issue greenhouse gas regulations on existing power plants in a separate rulemaking, and we can’t know how stringent they will be until they are announced.

The biggest concern we have is that the EPA’s decision to exempt existing natural gas plants could be a bait-and-switch to pass the rule, as the agency could decide to reimpose its original regulations on these plants after using their continued existence to argue that the Clean Power Plan 2.0 will not negatively impact grid reliability.

The Bad: Coal Plants Face “Retrofit or Retire” Scenario

Therefore, the regulations force coal plant owners into a situation where they must either retrofit their coal plants with CCS or agree to shutter the facilities. Considering the strong incentives investor-owned utilities have to Green-Plate their grids, it is little surprise that only a handful of coal plant owners have expressed serious interest in adding CCS equipment to their facilities. As a result, the rules will almost certainly cause more coal capacity to close.

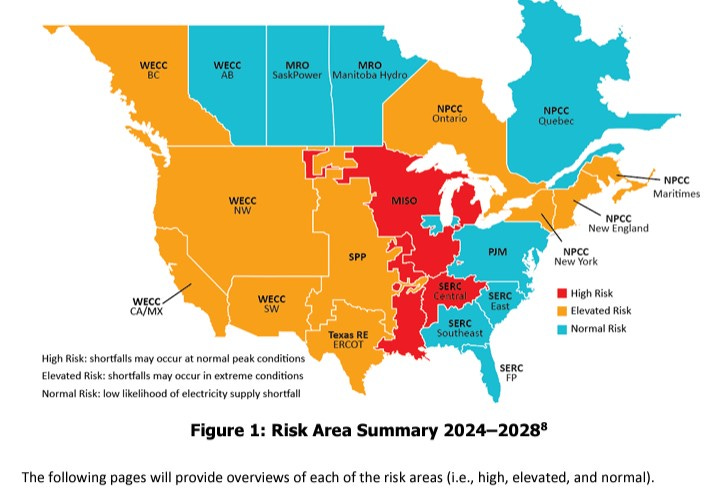

This is not good news for grid reliability in coal-heavy regions of the country like the Midcontinent Independent Systems Operator (MISO), which has already been identified as the region most at risk of rolling blackouts by the North American Electric Reliability Corporation (NERC) due to the closure of thermal generators, most of which are coal-fired power plants.

Because new natural gas plants will still more-or-less be held to the standards described above, with some modifications to the rules in terms of capacity factor limits and implementation deadlines, EPA is making it more difficult to build the new natural gas capacity needed to replace the retiring coal fleet. Something’s gotta give.

The Ugly: “Green” Hydrogen is Out

However, EPA likely dropped the hydrogen pathway in its final rule because the economics of so-called green hydrogen are downright ugly.

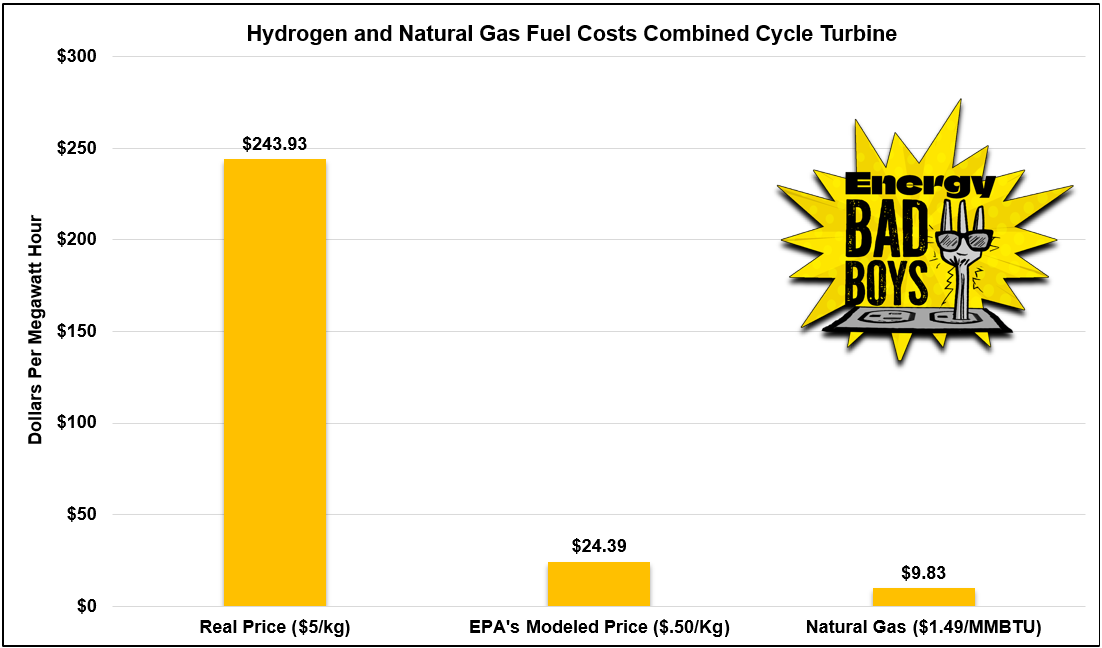

For example, to justify the use of green hydrogen in the proposed rule, the EPA inexplicably assumed the fuel would cost just $.50 per kilogram, but the U.S. Department of Energy notes that the current cost is ten times higher at $5 per kilogram.

These fuel costs are astronomical. The graph below compares the cost of generating a megawatt hour of electricity using the real cost of green hydrogen, the Biden Administration’s unreasonable assumption, and natural gas. You can see how these costs were calculated by clicking here.

Even using the EPA assumption of $.50 per kilogram, a 10x decline in the real cost of green hydrogen, it is still nearly 2.5 times more expensive than using natural gas based on current Henry Hub costs, which are admittedly below historical costs. As a result, the idea that green hydrogen was ever a cost-effective way to reduce emissions didn’t stand up to scrutiny.

Conclusion

The agency’s decision to temporarily delay regulations on existing gas plants will help, but we are eager to dig deeper into the agency’s Regulatory Impact Analysis to see if this change is enough to keep the lights on. Stay tuned! – The Energy Badboys Substack