In a significant blow to the UK’s domestic energy production, French energy giant TotalEnergies has secured a High Court victory allowing it to decommission the Gryphon floating production, storage, and offloading (FPSO) vessel in the North Sea. The ruling, handed down on August 12, 2025, paves the way for the shutdown of a key hub that supports five oil and gas fields, effectively stranding millions of barrels of recoverable reserves. Critics argue this decision is a direct consequence of the Labour government’s aggressive Net Zero agenda, spearheaded by Energy Secretary Ed Miliband, which prioritizes emission reductions over energy security and economic stability.

The Gryphon FPSO, anchored approximately 200 miles northeast of Aberdeen, has been operational since 1993 and was responsible for processing output from multiple fields, including its own and those operated by partners like Nobel Upstream. The closure follows TotalEnergies’ announcement earlier this year to cease operations amid rising costs and a punitive fiscal environment in the UK. Nobel Upstream, a minority stakeholder, challenged the move through a judicial review, claiming it would prematurely end production and violate obligations to maximize economic recovery. However, the High Court dismissed the case, citing alignment with the UK’s Net Zero targets as a justifying factor.

Are you Paying High Taxes in New Jersey, New York, or California?

This marks a troubling precedent, accelerating the decline of the North Sea basin at a time when global energy demands remain high.

Job Losses: Hundreds at Risk in an Already Struggling Sector

The shutdown of the Gryphon FPSO is projected to result in the direct loss of around 200 jobs, primarily affecting offshore workers, engineers, and support staff in Aberdeen and surrounding areas.

These roles, often high-skilled and well-paid, are part of a broader wave of redundancies sweeping the North Sea oil and gas industry. Since the introduction of the windfall tax in 2022, over 10,000 jobs have been lost across the sector, with major operators like Harbour Energy announcing cuts of 250 positions in May 2025 alone due to the “punitive fiscal regime.”

Unite the Union has highlighted the human cost, noting that the North Sea has shed more than 31,000 jobs from decommissioning activities over the past decade.

The Gryphon closure exacerbates this trend, potentially triggering a domino effect on supply chain jobs in logistics, maintenance, and fabrication. Industry body Offshore Energies UK (OEUK) warns that without policy reversals, thousands more positions could vanish, undermining communities in Scotland that have relied on the sector for generations. As one analyst put it, this is not just about immediate layoffs—it’s about eroding the skilled workforce needed for any future energy transition.

Tax Revenue Hit: £150 Million Down the Drain

The financial implications for the UK Treasury are equally stark. The Gryphon FPSO contributed up to 2% of the UK’s domestic oil and gas production, and its shutdown is estimated to result in a £150 million loss in tax receipts by the end of 2027.

This figure accounts for foregone corporation tax, petroleum revenue tax, and supplementary charges on the approximately 9 million barrels of oil equivalents left unrecovered in the fields.

To put this in perspective, the North Sea oil and gas sector has historically been a major revenue generator, peaking at £10.6 billion in 2008/09 but plummeting to £0.5 billion by 2020/21 due to declining production and policy shifts.

Recent tax changes, including extensions to the energy profits levy, are projected to cause a further $16 billion drop in government revenues over the coming years.

The Gryphon loss alone equates to the equivalent of winter fuel allowance payments for 750,000 pensioners, highlighting the opportunity cost of prioritizing environmental goals over fiscal prudence.

As production falls by 2%, the UK becomes more reliant on imported energy, exposing the economy to volatile global prices and reducing self-sufficiency.

The Soaring Cost of Net Zero: How Policies Have Inflated Energy Bills

The UK’s forced march toward Net Zero by 2050, including the shutdown of assets like Gryphon, has imposed substantial costs on consumers through higher energy bills. Environmental levies and subsidies for renewables, embedded in household and business tariffs, totaled £17.2 billion in 2023/24.

With approximately 29 million households in the UK, this equates to an average additional burden of about £593 per household annually (£17.2 billion ÷ 29 million households).To arrive at this calculation: First, identify the total Net Zero-related costs (£17.2 billion from official figures). Divide by the number of UK households (estimated at 29 million based on recent census data). The result is £593, representing the per-household share of subsidies for schemes like the Renewables Obligation (£89 per year on average) and other green initiatives that add up to £116 or more.

This doesn’t include indirect costs from supply chain disruptions or higher wholesale prices due to intermittent renewables.

Experts forecast even steeper rises: By 2030, the average household bill could surge by £900 annually due to Net Zero mandates, pushing electricity costs up by at least 75% as the grid shifts from reliable fossil fuels to weather-dependent sources.

Since the energy crisis began, bills have already climbed from £603 to £926 per year for electricity alone, with Net Zero policies accounting for 12% of recent increases—far from the promised savings.

Shutting down North Sea operations exacerbates this by increasing import dependency, which drove up costs during the 2022 crisis.

Ed Miliband’s Targets: Fueling a Looming Financial Collapse?

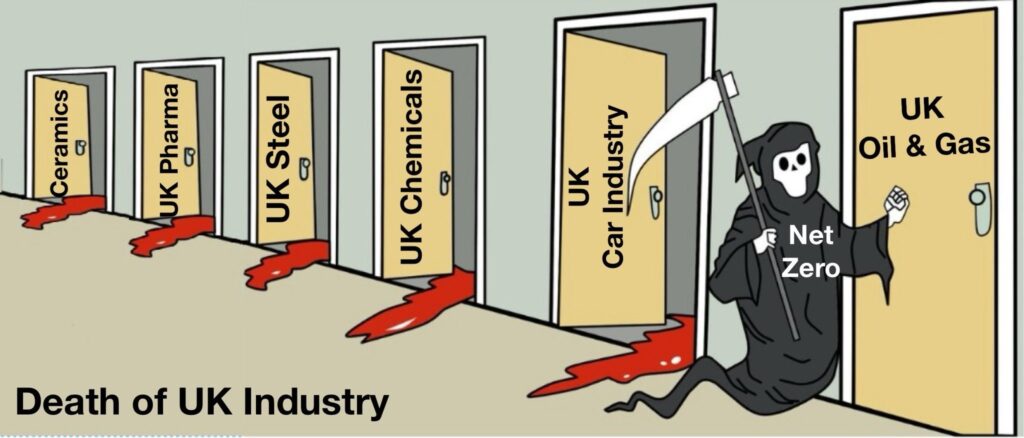

Ed Miliband’s stringent Net Zero targets, including a ban on new North Sea licenses and accelerated decarbonization, are increasingly blamed for steering the UK toward economic peril. His department’s oversight of regulators like the NSTA and Offshore Petroleum Regulator has greenlit decisions like the Gryphon shutdown, using emission reductions as a legal justification despite the economic fallout.

Critics contend this “eco-zealotry” could provoke an economic shock comparable to the 1973 oil crisis, wiping out up to 10% of GDP growth by 2030 through reduced investment, job losses, and higher energy costs.

Miliband’s pre-election pledge of £28 billion annual green spending was scaled back, but his policies still impose billions in subsidies while deterring fossil fuel investments.

The Office for Budget Responsibility (OBR) warns that unchecked climate policies could cost hundreds of millions in lost revenues, yet Miliband insists Net Zero will boost growth— a claim disputed by reports showing the sector growing three times faster but at the expense of traditional industries.

With the North Sea in decline and bills soaring, these targets risk a “financial collapse” by eroding competitiveness, inflating public debt through subsidies, and leaving the UK vulnerable to energy shortages. As Reform UK’s Lee Anderson accused in Parliament, Miliband’s approach is “bankrupting Britain” one closure at a time.

In conclusion, TotalEnergies’ legal win underscores the tensions between environmental ambitions and economic realities. While Net Zero advocates celebrate reduced emissions, the costs—in jobs, taxes, and household bills—are mounting, threatening the UK’s energy independence and fiscal health. Policymakers must reassess this trajectory before it’s too late.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack