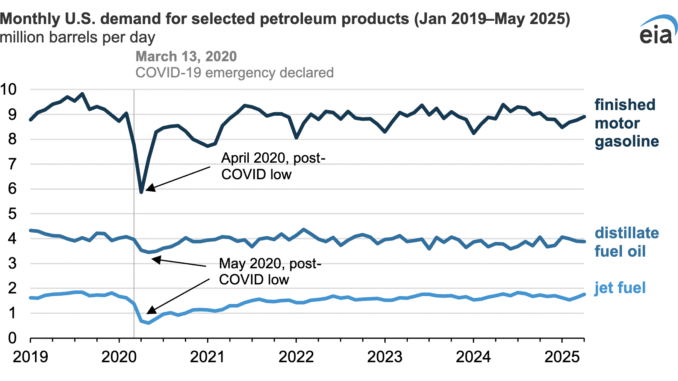

Five years after the COVID-19 national emergency was declared, gasoline demand, distillate demand, and jet fuel demand all remain less than pre-pandemic averages. Several factors are keeping demand, which we track as product supplied, below pre-pandemic levels. For example, increased fuel efficiency in the vehicle and aircraft fleets has offset increased travel, and demand for petroleum-based distillate fuel oil has been partially replaced by biomass-based distillate fuels.

Finished motor gasoline

In April 2020 (the first full month following the March 13 declaration of the COVID-19 national emergency), U.S. gasoline demand fell to 5.9 million b/d, the lowest since January 1974. In April 2025, U.S. gasoline demand averaged 8.9 million barrels per day (b/d), 52% higher than it was in April 2020 but below the April 2019 average of 9.4 million b/d.

Gasoline demand gradually increased in the months following the emergency declaration. On an annual basis, between 2016 and 2019, U.S. gasoline demand averaged 9.3 million b/d. In 2020, it fell to 8.0 million b/d before averaging 8.9 million b/d in 2023 and 2024.

Are you Paying High Taxes in New Jersey, New York, or California?

Increased vehicle efficiency has offset increased driving activity, measured as vehicle miles traveled (VMT). U.S. VMT reached an all-time high in 2024, at 9.0 billion miles per day, which was higher than the 2016–19 average of 8.8 billion VMT/d. However, increased fuel efficiency and electrification of the vehicle fleet has resulted in less gasoline consumption despite increased driving activity.

Petroleum distillate fuel oil

In May 2025, petroleum distillate fuel oil demand was 3.8 million b/d, 10% (0.3 million b/d) more than in May 2020, when demand for distillate fell to its lowest point following the COVID-19 declaration. Because distillate fuel oil is largely used in shipping goods and other economic activity, distillate consumption was less affected by COVID-19 mitigation efforts than gasoline and jet fuel, which are more closely tied to commuting and personal travel.

In 2024, petroleum distillate demand averaged 3.8 million b/d, less than the 4.1 million b/d consumed in 2019. The primary cause for this decline was substitution of petroleum diesel with biofuels, namely renewable diesel, which has gained a larger market share of the diesel pool due to clean-fuel programs that provide incentives for biofuels. In 2019, only 110,000 b/d of renewable diesel and biodiesel were consumed as product, whereas in 2024, 310,000 b/d were consumed. Including biodiesel and renewable diesel, total distillate demand in 2024 was closest to pre-pandemic levels, at only 1% below 2019 distillate demand.

Jet fuel

In May 2025, U.S. jet fuel demand averaged 1.8 million b/d, significantly more than in May 2020, when demand fell to 597,000 b/d, the lowest since May 1968. In the three years prior to the pandemic, jet fuel demand gradually increased. However, jet fuel demand has not returned to pre-pandemic levels in part because the fleet of aircraft has become more efficient, and in 2024, jet fuel demand was 3% below 2019 levels.

In 2024, data from the Bureau of Transportation Statistics indicate the number of passengers and the available seat miles, a measure of aircraft carrying capacity, both increased from 2019, although the total number of flights decreased. Efficiency gains and changing flight patterns, among other factors, have contributed to jet fuel consumption remaining slightly lower than pre-pandemic levels.

Principal contributor: Kimberly Peterson

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack