In a bold escalation of U.S. policy toward Venezuela, President Donald Trump has ordered a “total and complete blockade” of all sanctioned oil tankers entering or leaving the country. The announcement, made via Truth Social, comes amid rising tensions over Venezuela’s use of shadowy “dark fleet” vessels to evade international sanctions and export crude oil, primarily to markets in Asia.

This move has sent ripples through global energy markets, with oil prices spiking as traders factor in potential disruptions to supply.

Just three days ago, on December 13, Energy News Beat published an in-depth report highlighting the docking of two dark fleet supertankers at Venezuela’s Jose port. These vessels, operating under aliases like “Crag” and “Galaxy 3,” loaded nearly 4 million barrels of Merey 16 crude for export to Asia, underscoring the persistent challenges the U.S. faces in enforcing sanctions against the Maduro regime. Our article detailed how Venezuela’s exports had surged to around 880,000 barrels per day (bpd) in recent months, up from 586,000 bpd in November, thanks to tactics like ship-to-ship transfers and falsified documentation that allow these ghost ships to slip through the net.

Now, with Trump’s blockade directive, one can’t help but wonder: Does President Trump’s team read Energy News Beat?

Our timely coverage on the 13th exposed the very vulnerabilities in the dark fleet operations that the administration is now targeting head-on. The parallels are striking—our report noted that only about 30% of Venezuela’s exports might be directly vulnerable to U.S. interventions, per analysis from Rapidan Energy Group, while emphasizing the need for stronger enforcement to curb the flow of sanctioned oil.

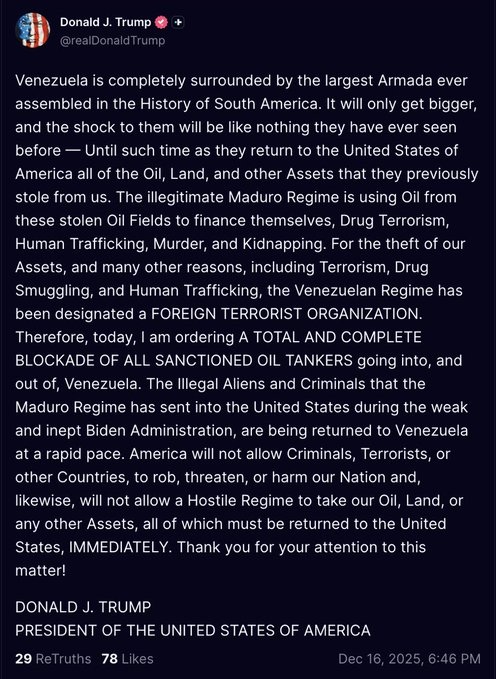

Trump’s statement didn’t mince words. “Therefore, today, I am ordering A TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela,” he posted.

He further designated the Venezuelan government under Nicolás Maduro as a “foreign terrorist organization” and boasted of assembling “the largest Armada ever assembled in the history of South America,” vowing it would only grow until Venezuela returns what he claims are U.S.-owned oil, land, and assets.

The blockade aims to combat not just oil smuggling but also associated illicit activities, including drug trafficking and human smuggling tied to the regime.

This isn’t the first aggressive action from the Trump administration. Earlier in December, U.S. forces seized the tanker M/T Skipper off Venezuela’s coast, an operation that stranded millions of barrels in local waters and halted most exports temporarily.

That vessel, loaded with about 1.8 million barrels of heavy crude, was allegedly transporting sanctioned oil from Venezuela and Iran.

The blockade builds on these efforts, focusing on the “shadow fleet” that has enabled Venezuela to maintain roughly 850,000 bpd in exports, mostly to China, despite years of U.S. restrictions.

The geopolitical fallout is already evident in energy markets. Oil prices jumped sharply following the announcement, with West Texas Intermediate (WTI) crude futures rising 1.25% to $55.96 per barrel in early Asian trading.

This spike reflects heightened risk premiums as investors brace for reduced Venezuelan supply hitting the market. While global oil oversupply—estimated at 3.8 million bpd by the International Energy Agency—might cushion some impacts, any prolonged disruption could tighten balances, especially if it affects key buyers like China.

Notably, licensed operations by U.S. companies, such as Chevron’s joint ventures, are expected to remain untouched, allowing continued exports to the U.S. without direct payments to the Venezuelan government.

However, the broader dark fleet—comprising aging, uninsured vessels that often disable transponders or fly false flags—poses a formidable enforcement challenge. As Energy News Beat reported on the 13th, these operations require international cooperation to dismantle, something the Trump administration’s unilateral approach may test.

Venezuela’s response has been defiant. Maduro has accused the U.S. of imperial aggression, vowing to defend the nation’s sovereignty and resources.

With the country’s vast reserves but chronically low production—needing an estimated $58 billion in investments for recovery—the blockade could further starve the regime of revenue, potentially accelerating political change or, conversely, entrenching Maduro through retaliatory measures.As events unfold, the intersection of energy, sanctions, and geopolitics remains a powder keg. Whether this blockade succeeds in curbing the dark fleet or merely escalates tensions, one thing is clear: the energy world is watching closely. For more on the evolving situation, check out our previous coverage at Dark Fleet oil ships dock in Venezuela, showing a challenge for the U.S., and the latest market analysis at https://oilprice.com/Energy/Energy-General/Oil-Prices-Spike-as-Trump-Orders-Blockade-of-Sanctioned-Venezuelan-Oil-Tankers.html. Stay tuned to Energy News Beat for updates on how this impacts global oil dynamics.

Source: Energynewsbeat.co, TruthSocial, OilPrice.com, USNN.news