In a stunning early-morning announcement on January 3, 2026, President Donald Trump revealed via Truth Social that U.S. forces had executed a “large-scale strike” against Venezuela, resulting in the capture of President Nicolás Maduro and his wife, Cilia Flores.

The operation, reportedly carried out by the elite U.S. Army Delta Force, marks a dramatic escalation in U.S.-Venezuela relations and the culmination of months of mounting pressure from the Trump administration.

Maduro, who has ruled Venezuela since 2013, faces longstanding U.S. indictments on charges of narcoterrorism, drug trafficking, and corruption, with a $50 million bounty on his head that was escalated during Trump’s second term.

Eyewitness accounts from Caracas described a chaotic scene: at least seven explosions rocked the capital, with low-flying aircraft overhead and smoke billowing from key military sites like the La Carlota airfield and Fuerte Tiuna base, where Maduro was believed to reside.

Venezuelan authorities reported civilian and military casualties but provided no specific numbers.

Vice President Delcy Rodríguez, who may now assume leadership, appeared on state television demanding “proof of life” for Maduro and Flores, condemning the strikes as “imperial aggression.”

The Venezuelan government declared a national emergency and mobilized defenses, while the opposition, led by figures like Maria Corina Machado, has remained silent so far.

Trump confirmed the capture in a brief phone interview with The New York Times, calling it a “brilliant operation” resulting from “a lot of good planning” and crediting U.S. troops.

He scheduled a press conference at Mar-a-Lago for 11 a.m. ET to provide more details. Secretary of State Marco Rubio echoed the announcement, stating Maduro would stand trial in the U.S.

The Pentagon deferred comments to the White House, but sources indicate the mission was coordinated with U.S. law enforcement.

The White House’s Months-Long Telegraphing

This operation didn’t come out of nowhere. The Trump administration has been openly signaling its intentions toward Maduro for months, framing Venezuela as a “narco-state” under his rule.

In October 2025, Trump warned that Maduro “doesn’t want to f— around with the United States.”

White House Chief of Staff Susie Wiles was even more blunt in a November interview, saying Trump aimed to “keep on blowing boats up until Maduro cries uncle.”

By mid-December, Trump boasted of assembling the “largest Armada ever” to surround Venezuela, imposing a blockade on sanctioned oil tankers and conducting over 30 strikes on vessels in the Caribbean and Pacific as part of a counter-narcotics push.

A CIA drone strike on a Venezuelan port facility in December marked the first known U.S. attack inside the country.

Maduro, in response, had called for dialogue with Trump, offering expanded access to Venezuelan oil reserves—the world’s largest—to ease tensions.

Just hours before the strikes, Chinese officials met with Maduro in Caracas, highlighting the geopolitical stakes.

Venezuelan dictator Maduro has been arrested by US forces and brought to the US for trial pic.twitter.com/x1SPKffMqF

— Energy Headline News (@OilHeadlineNews) January 3, 2026

China went to meet with Maduro today to discuss joining forces, then Trump captures Maduro the same day.

Savage.

In fact, the Chinese delegation is still in Venezuela.

Trump captures Maduro and sends a powerful message to Xi and China at the same time.

Savage. pic.twitter.com/xpjOOidNp3

— Mila Joy (@Milajoy) January 3, 2026

What Impacts Will The U.S. Military Operations in #Venezuela Have on Oil Prices?

I have some thoughts in the thread below. Read on.#oilprice #NicolasMaduro #oil #exports #DonaldTrump #PersianGulf #StraitofHormuz #HugoChavez pic.twitter.com/SkZigW0wXf

— David Blackmon’s Energy Absurdity (@EnergyAbsurdity) January 3, 2026

From General Flynn on X. “There may be some ties to the Democratic voting issues.

.@SidneyPowell1 was correct then and this still statement stands the test of time. @realDonaldTrump would be wise to hone in on “stolen elections” during the interrogation of Maduro. https://t.co/j1tgWGUPtz

— General Mike Flynn (@GenFlynn) January 3, 2026

Most presidents hide the footage.

This one added a soundtrack. pic.twitter.com/ZBJ1BNDCe8— Shanaka Anslem Perera ⚡ (@shanaka86) January 3, 2026

Implications for Oil and Gas Markets

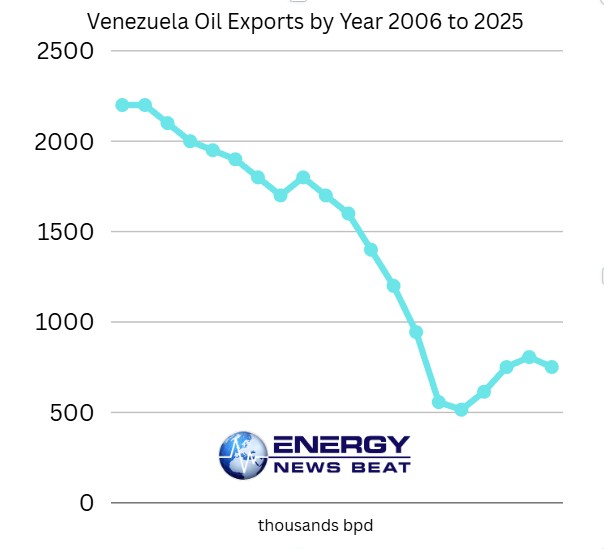

Venezuela’s oil sector, crippled by years of sanctions, mismanagement, and low production (currently around 800,000 barrels per day), stands at the center of this upheaval.

The immediate market reaction has been muted, with analysts predicting limited short-term disruptions to global supply—Venezuela accounts for less than 1% of world output.

Oil prices, already down 22% over the past year, may see a modest uptick due to uncertainty, but experts like those at Argus Media foresee no major spike unless infrastructure damage halts exports entirely.

Long-term, Maduro’s removal could be a game-changer. A U.S.-friendly interim government might lead to eased sanctions, attracting investment from American firms and boosting production toward 2-3 million bpd within years.

This could flood the market with heavy crude, pressuring prices downward and benefiting U.S. refiners who rely on Venezuelan naphtha exports.

Gold and silver prices have already surged to record highs amid safe-haven buying, while crude faces supply risks if chaos persists.

However, risks abound: prolonged instability could damage key facilities like the Orinoco Belt, delaying recovery. Venezuela’s oil ties with China (its top buyer) and Russia might complicate matters if those powers retaliate economically.

Overall, markets are watching for Trump’s Mar-a-Lago briefing, which could clarify post-Maduro plans and stabilize sentiment.

Potential Impact on the War in Ukraine

Trump’s bold move in Venezuela could ripple into the ongoing conflict in Ukraine, where Russia has been entrenched since 2022. This operation demonstrates Trump’s willingness to use military force against adversaries, potentially signaling to Vladimir Putin that the U.S. won’t hesitate in other theaters. We hope that does not happen.

By disrupting Venezuela—a key Russian ally that has hosted military advisors and arms deals—Trump might aim to weaken Moscow’s global influence, forcing Putin to divert resources or negotiate in Ukraine to avoid overextension.

Analysts suggest this could accelerate an end to the Ukraine war by pressuring Russia economically; Venezuela supplies discounted oil to allies like Cuba and has been a conduit for evading sanctions.

If U.S. actions cut off these lifelines, Putin might seek a face-saving deal in Ukraine. However, it could backfire: Russia might view this as escalation, hardening its stance or prompting asymmetric responses like cyberattacks.

Trump has repeatedly promised to end the Ukraine war “in 24 hours” through diplomacy, and this Venezuela strike might be a flex to bring Putin to the table.

Geopolitical Oil Risks in Early 2026: A Volatile Landscape

Russia and China’s Potential Responses: Economic Retaliation Over Kinetics

Russia and China, Maduro’s key backers, have condemned the U.S. actions but are unlikely to intervene militarily due to their own commitments—Russia in Ukraine and China in the South China Sea.

Russia: With military advisors in Venezuela, Moscow might bolster proxy support or push UN resolutions, but direct confrontation risks overstretch. Energy-wise, it could cut European gas supplies or coordinate OPEC+ cuts to counter Venezuelan supply increases.

China: As Venezuela’s top oil buyer (80% of exports), Beijing faces supply risks and billions in unpaid loans. Retaliation might include dumping U.S. Treasuries, accelerating petroyuan deals, or restricting rare earth exports—potentially hiking global energy costs indirectly.

This could erode the petrodollar, with BRICS nations controlling 50-67% of oil reserves if Venezuela aligns with the West.

Joint responses might involve rallying anti-U.S. coalitions at the UN or economic forums, amplifying risks to global supply chains.

Overall Market Outlook and Mitigation

Despite these risks, 2026 forecasts lean bearish due to surpluses from non-OPEC producers like the U.S. and Brazil, potentially outstripping demand by millions of bpd.

iGeopolitical premiums might cap downside, with Brent trading in a $50-70 range unless major disruptions occur.

As Stu Turley has mentioned on the Energy News Beat Stand Up Podcast, the actions taken in Venezuela by the Trump Adminstration are not entirely around Narco Terrorists. It is about China and Russia’s involvement in South America, and the Monroe Doctrine is in full play.

Safe-haven assets like gold have surged, reflecting uncertainty. As the Petro-Dollar has been eroded and the US Dollar has lost favor as the global currency, it is not quite dead yet. There are a lot of moving pieces in this mix, and more countries have purchased gold, silver, and other commodities to back their own currencies.

One cannot overlook that global debt owed by countries has never been higher, and that debt interest and wealth transfers are also at record levels.

|

Risk Factor

|

Potential Price Impact

|

Probability (Short-Term)

|

Key Mitigators

|

|---|---|---|---|

|

Venezuela Instability

|

+5-15% (disruption) / -10-20% (supply surge)

|

High

|

U.S.-led stabilization, investment inflows

|

|

Ukraine Escalation

|

+15-25% (sanctions tighten)

|

Medium

|

Diplomatic breakthroughs under Trump

|

|

Middle East Flare-Up

|

+10-20% (chokepoint threats)

|

Medium

|

De-escalation talks, OPEC+ buffers

|

|

China/Russia Retaliation

|

+5-10% (economic spillovers)

|

Low-Medium

|

Trade negotiations, diversified supplies

|

Will Russia or China Respond?

Russia and China, Maduro’s staunchest backers, have already voiced strong condemnation.

Moscow, which has provided military aid and radar overhauls to Venezuela, offered to mediate but labeled the strikes “unorthodox and contrary to international law.”

Putin could respond with diplomatic isolation of the U.S. or bolster support for other allies, but direct military intervention seems unlikely given Russia’s commitments in Ukraine.

China, which owed billions in loans and was reliant on Venezuelan oil to offset U.S. tariffs, criticized similar U.S. actions like a recent tanker seizure.

What is more important about China is this week’s announcement from President Xi that the “Reunification of Taiwan is Inevitable” will impact the global markets more than a new U.S.-favored government in Venezuela. What is interesting is the oil leases and equipment that were sized by Maduro from ExxonMobil and Chevron.

Beijing might retaliate economically—perhaps by dumping U.S. Treasuries or escalating trade tensions—but experts doubt a kinetic response, as it could disrupt global markets where China holds sway.

Both powers have condemned U.S. “aggression” at the UN, potentially rallying anti-U.S. coalitions.

Iran, another Maduro ally, has also denounced the operation.

In summary, Maduro’s capture could reshape global energy dynamics by unlocking Venezuelan oil, but it risks broader geopolitical fallout. President Trump on Fox this morning was congratulating the entire U.S. Military for an outstanding job, and Stu Turley loved the “Maduro was bumrushed so fast that he could not close the door to his bunker”. This was a surgical strike, and Bondi has posted on X that Maduro will stand trial in New York.

The oil prices will not be impacted globally in the short run, as Maduro has devastated the Venezuelan oil fields through neglect and mismanagement. It will take billions in CapEx development to rebuild the worlds largest oil reserve to a market impact force that it could be.

As Trump prepares to address the nation, the energy sector—and the world—holds its breath. Stay tuned to Energy News Beat for updates.

Sources: democracynow.org, jpost.com, reuters.com, latintimes.com, anasalhajjieoa.substack.com, cnn.com