Turkmenistan’s Struggles with Emissions

This coming November, the annual United Nations Climate Change Conference (COP 28) will be taking place. This conference will be focused on carbon capture, utilization, and storage. Turkmenistan has recently been facing pressure from the international community in regard to its significant contribution to methane emissions and it would not be a surprise if these emissions are brought up as a topic during the conference.

But why is such a high volume of Methane gas emissions a concern? Methane is a greenhouse gas that is far more potent compared to other gases, such as carbon dioxide (CO2). For example, in 2021 Turkmenistan emitted over 5 million tons of methane which is equivalent to 366 million tons of CO2. A study done by the Guardian revealed that methane leaks from Turkmenistan’s two main fields contributed more in 2022 to carbon emissions than the entirety of the United Kingdom [1].

President Serdar Berdimuhamedov of Turkmenistan recently approved a roadmap for 2023-2024 in order to help curb these emissions. The measures in the roadmap, “Include improving national legislation, cooperation with foreign partners to set up pilot projects and collaboration with IMEO (International Methane Emissions Observatory of the UN)” [2].

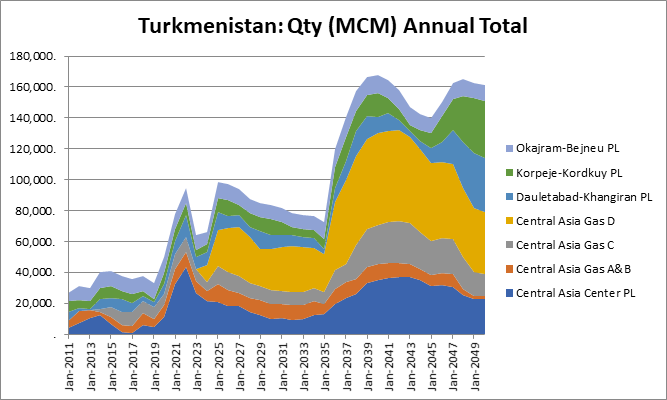

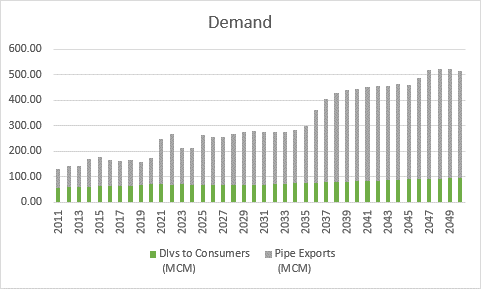

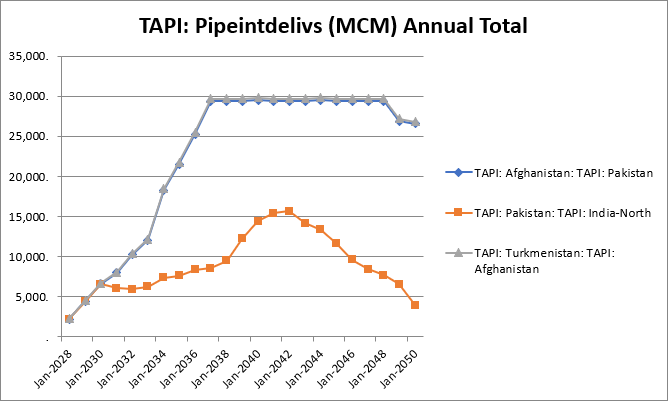

Even with these initiatives taking place in hopes to lower emissions at their current production rate, what happens if production were to increase?

The Darvaza gas crater, also known as the Gates of Hell, which has been continuously burning since 1971, contributes significantly to Turkmenistan’s emissions.