Including by 7.9% annualized for the not-seasonally adjusted PPI, worst since June 2022. So we’ll take a look.

By Wolf Richter for WOLF STREET.

The Producer Price Index data got a lot of attention today because it didn’t increase as sharply as a month ago, and so that was seen as a relief on the inflation front.

The thing is these figures are very volatile from month to month, as the blue lines in the charts below show, and the smaller increases in March on top of the spikes in February weren’t nearly small enough, and all the three-month rates – the month-to-month increases in January, February, and March combined – that iron out some of the month-to-month volatility, jumped.

The other thing is these figures are seasonally adjusted – and that makes sense, a lot of this stuff is very seasonal, such as gasoline prices, which drop to their seasonal lows in the winter and rise to seasonal highs during driving season in the summer. And seasonality is not inflation.

But the seasonal adjustments in March were huge.

Those seasonal adjustments in March were far larger than in the Marches during the years before the pandemic. So we will look at the seasonally adjusted PPI and at the not-seasonally adjusted PPI. And we will see that the seasonal adjustments this March were much bigger than in the five years before the pandemic, likely skewed by the distortions during the pandemic that then became part of the base for current seasonal adjustments.

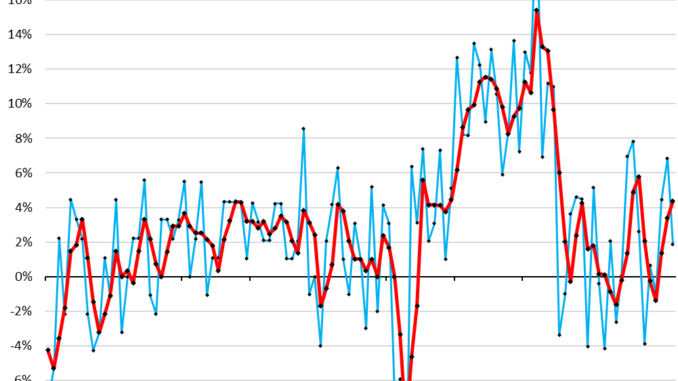

The PPI, not seasonally adjusted, jumped by 6.2% annualized in March from February, which was a smaller spike than the 9.2% in February.

The three-month rate, which irons out the month-to-month squiggles, jumped 7.8% annualized, the highest since June 2022. You can see from the blue line how crazy volatile the non-seasonally adjusted data is. The three-month rate irons out only some of that volatility (red):

The PPI, seasonally adjusted, rose by 1.9% annualized in March from February, a sharp deceleration from February’s 6.9%. The three-month rate jumped by 4.4%.

A much bigger difference than before the pandemic. After seasonal adjustments, the three-month rate in March (4.4%) came in a lot tamer than not seasonally adjusted (7.8%). A difference of 3.4 percentage points! That’s a big difference.

In the five years before the pandemic, the difference in March was between 1.5 percentage points and 2.5 percentage points. This March, the difference was 3.4 percentage points, meaning that the seasonal adjustments were much larger than before the pandemic, likely skewed by the distortions during the pandemic as the past years.

When seasonal adjustments go awry, they self-correct later in the opposite direction, like a pendulum. So we will likely see some surprises in the next few months in the other direction, and then we won’t be surprised by the surprises.

On a three-month basis, the PPI rates jumped.

As we can see the charts above, the three-month rates jumped both seasonally adjusted and not seasonally adjusted. This is based on the big increases over the last three months.

Below we look into the seasonally adjusted major categories – core PPI, services PPI, and core goods PPI – and all of them jumped on a three-month basis in a disconcerting manner.

Core PPI, which excludes energy costs, rose 2.8% annualized in March from February, and that was less hot than the 3.5% and 6.2% readings in the prior two months (seasonally adjusted).

But the 3-month rate jumped 4.2% annualized, the worst since August 2022 (seasonally adjusted).

Services PPI rose 3.4% annualized in March from February, not much slower than in February (3.4%). But the 3-month rate jumped by 4.8%, the highest since May 2022 (all seasonally adjusted).

These are services that producers use. They weigh 62% in the overall PPI. And producers will try to pass those price increases on to their customers.

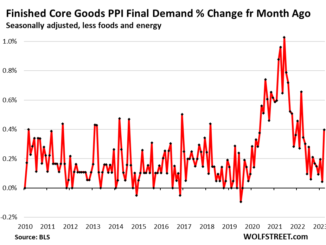

The finished core goods PPI, which excludes energy costs, rose by 2.8% annualized in March from February, a smaller increase than the 4.1% jump in February. These are core goods that producers buy, and whose costs become part of their input costs.

But the three-month rate jumped 3.6%, the biggest increase since March 2023. After the plunge of the 3-month rate from mid-2022 through late 2023, the rate has turned around.

So if we get three months of low PPI readings going forward, the three-month rates will back off their jump. But if we continue along this path of higher lows, and higher highs, the trend goes in the other direction, which will eventually feed into other inflation data. And aside from that, we may be dished up a surprise in future months when the too-big seasonal adjustments self-correct.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.