Reheating services inflation isn’t a surprise. But the PPI for finished core goods saps hopes for goods “deflation” to continue to hold down overall inflation.

By Wolf Richter for WOLF STREET.

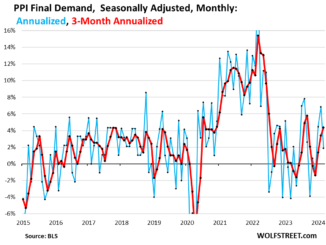

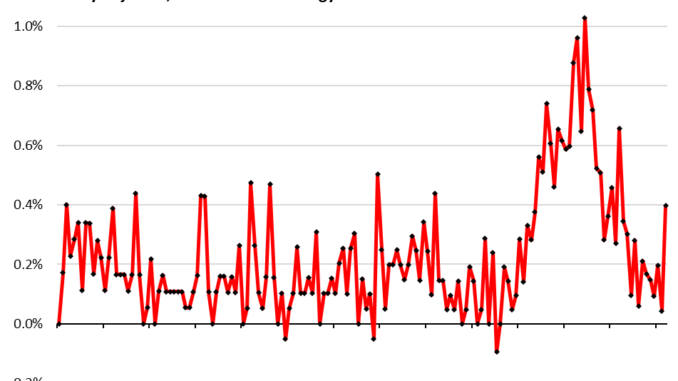

The Producer Price Index for final demand services jumped by 0.57% in January from December, seasonally adjusted (+7.1% annualized), and by 0.65% not seasonally adjusted (8.1% annualized), according to the Bureau of Labor Statistics.

So now there’s the sudden surge of inflation in services that producers use, after months of benign readings. Since the red-hot days of early 2022, there has only been one higher reading, in July 2023.

Final demand services weigh 62.3% in the overall PPI. The surge in the services PPI was driven by a big jump in its biggest component: “Finished consumer services less trade, transportation, and warehousing,” accounting for 32.9% of PPI. It spiked by +1.0% month-to-month or 12.7% annualized.

All of this month-to-month inflation data is very volatile and noisy with big ups and downs, and trend changes take some time to be confirmed, and one month isn’t enough. So we need to exercise some caution. But this was the first big jump in the services PPI in months and it parallels developments over the past few months in the CPI for services, and so the warning lights are blinking.

On the consumer-side of the economy – the prices that consumers pay directly – the surge of services inflation in the CPI has been reheating for months and in January spiked from there.

So now services inflation hit producers, not just consumers. And producers are going to try to pass it on.

Finished core goods inflation suddenly reheats as well: The final demand PPI for finished goods less food and energy – which weighs 19.0% in the PPI – after months of benign increases, suddenly spiked in January by 0.40% or by 4.9% annualized.

The spike is a breakout from the prior 7 months when the core goods PPI remained in the same benign range, after the long plunge from the 2021 spike.

This is disconcerting because the whole disinflation momentum in consumer prices (CPI) last year was driven by drops in prices of durable goods (negative inflation or deflation) and the plunge in energy prices. This PPI data on finished goods is now throwing some cold water on the hopes that goods-deflation will continue, and will continue to hold down overall inflation measures:

This surge in services PPI and finished goods PPI fueled the jump in the core PPI, which covers goods and services excluding foods and energy.

Core PPI final demand jumped by 0.50% seasonally adjusted (6.2% annualized) and by 0.62% not seasonally adjusted (7.7% annualized). Since March 2022, there was only one month with higher readings (July 2023) and only barely higher:

The surge in services PPI and the finished goods PPI also fueled the rise in the overall PPI final demand: it rose by 0.33% in January from December (4.0% annualized), despite continued negative readings in the energy PPI:

The surge of services inflation, and the possible reheating of core goods inflation is a very disconcerting development.

The issue with services inflation is particularly grave because of services’ weight of over 60% in the producer and consumer inflation baskets.

And this parallels what we have already seen in the CPI: “Core services” CPI jumped by 8.2% annualized in January from December. And the three-month moving average jumped by 6.2% annualized, the worst since March 2023, according to the CPI data released earlier this week: