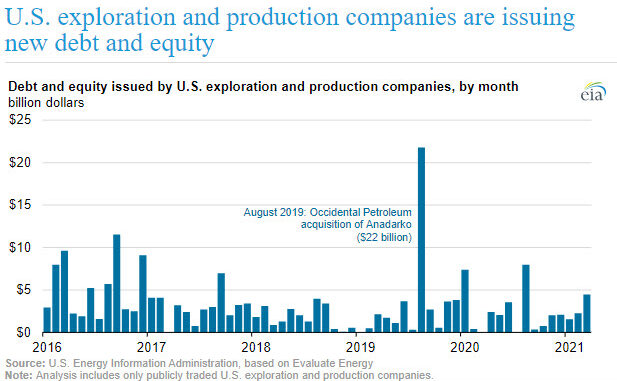

Based on all announced corporate press releases, the amount of debt and equity issued among publicly traded independent U.S. exploration and production (E&P) companies totaled $4.4 billion in March 2021, the most since August 2020. EIA analyzed and compiled the amounts via Evaluate Energy, a data service that tracks financial information for all publicly traded oil companies. Since September 2020, the amount of issued debt and equity has increased from the previous month in all but one month.

We based our analysis primarily on the published financial reports of publicly traded companies, so the conclusions do not necessarily represent the sector as a whole because the analysis does not include private companies that do not publish financial reports.

One reason U.S. E&P companies are issuing more debt and equity is to take advantage of increasing crude oil prices. Crude oil prices have been steadily increasing since reaching multiyear lows in 2020. Brent crude oil prices averaged less than $40 per barrel (b) from March 2020 to May 2020 and have since increased, averaging more than $65/b in March 2021. Since crude oil prices began increasing, U.S. crude oil producers have been raising debt and equity to refinance debts, resume drilling activities, or purchase acreage.

In addition to higher crude oil prices, low interest rates have lowered the cost of debt and have likely contributed to the recent growth in issuing debt and equity. The Federal Reserve System’s Federal Open Market Committee has held the federal funds rate, which affects interest rates across the market, at a target of 0.00% to 0.25% since March 2020.

Corporate bond yields have also been low in the United States, contributing to lower interest rates on new bonds that companies issue and reducing the cost of issuing debt. For example, the Moody’s seasoned AAA corporate bond yield, which represents average bond yields for investment grade companies across the market, averaged 2.70% in February, which is lower than the 2011–20 average of 3.78%. In addition, corporate bond yields specific to energy sector companies with a rating lower than investment grade are at multiyear lows.

Because U.S. producers have increased access to debt and equity (among other factors), we forecast that U.S. crude oil production will increase from 10.7 million barrels per day (b/d) in first-quarter 2021 to 12.2 million b/d in fourth-quarter 2022.