The following article was written by Dr. Rob Jeffrey when completing his PhD Thesis at the University of Johannesburg. With his permission I am republishing it . The data was based on the South African 2019 Integrated Resource Plan (IRP).

It stands, in my view, as an excellent critique against the levelized cost of electricity (LCOE), exposing the hidden subsidies and the complexity involved in determining the full cost of electricity (FCOE). The article is also a defense of a mixed electricity system and the numerous benefits that it will bring to the South African economy.

Dr. Jeffery is an advocate of the relative cost of electricity metric, that takes into account the load factors. The RCOE is easy to use for a matchbox calculation, and it makes intuitive, sense if one is to compare the output in kwh by taking into account how much overbuild is required.

Relative cost of electricity = LCOE divided by the load factor.

The reason why he divides by the load factor is that it takes into account the cost of overbuilding wind and solar, because the metric aims to compare the total output in kWh.

For the calculation below he uses 0.35 , 0.26, 0.90 and 0.80 as the respective load factors for wind, solar, nuclear and coal in South Africa. I used 0.70 for LNG, based on a different source.

- LCOE of Wind = R0.62/kWh, RCOE of Wind = R0.62/kWh ÷ 0.35 = R1.77/kWh

- LCOE of Solar = R0.62/kWh, RCOE of Solar= R0.62/kWh ÷ 0.26 = R2.38/kWh

- LCOE of Nuclear = R1.30/kWh, RCOE of Nuclear = R1.30/kWh ÷ 0.90 = R1.44/kWh

- LCOE of LNG= R1.50/kWh, RCOE of LNG= R1.75/kWh ÷ 0.70= R2.55/kWh1

The difference is substantial and it clearly shows that coal and nuclear might be more competitive than we are being told.

Dr. Rob Jeffery furthermore advocates that we use “global reality” by simply comparing residential prices.

Another warning is that a higher penetration of renewables will eventually make us geopolitically dependent on natural gas import, effectively depriving us of energy sovereignty.

The final nail in the coffin for South Africa is that increased penetration of wind will lead to a rapidly rising import bill for gas imports and the demise of its coal mining industry if not the entire mining industries. These are catastrophes which could ensure that the future of South Africa will move towards rising unemployment, increasing poverty and increasing social and political instability. South Africa needs to focus its energy plans on HELE or ‘clean’ coal, nuclear, domestic solar and limited gas apart from some use of other sustainable energy sources such as biomass, Hydro and pump storage.

In my opinion, the world is currently incurring a significant opportunity cost by moving away from coal, and by demonizing nuclear power as “too expensive”. We are going to burden future generations with the deprived opportunity and asset destruction that is being converted into debt. Countries like Japan, whose leadership remain committed to clean coal, may likely have an advantage in the future.

South Africa should, in my view, draw fewer lessons from Europe and North America, but instead focus on Asia for insights into the energy transition. The electricity mix and geographic challenges in Asia are more comparable to ours, and their leadership comprises generally speaking of technically qualified individuals rather than lawyers and economists without practical experience.

There are various metrics involved in comparing the true cost of electricity, price and value and they are by no means perfect. I wouldn’t say that the RCOE is a final nail in the coffin, but it does make one rethink the simplistic story that we are being told by looking at LCOE only.

Below is his article.

Weaknesses of solar and wind, Myths and Questions that require an answer

Introduction

It is claimed that wind and solar are far the cheapest source of electricity and these sources should dominate future electricity supply. There is substantial debate regarding this subject. There are many and complex issues that are involved. These include climate change, environmental issues and many other externalities. This paper focuses on known costs and subsidies and excludes these other issues. That is not to say these other issues are not important or that there are not additional costs involved. All sources of energy and their associated technologies are subject to similar issues and additional costs to varying degrees. These will need to be addressed in a separate paper.

Wind and solar claim a cost of 62cents/kWh. This is the price at the gate of the supplier. It does not include all the costs of supply necessary to convert this electricity from non-dispatchable electricity supply at the gate to dispatchable electricity supply at the point of supply to the customer. In order to achieve this result, these costs are paid either by the utility, in this case Eskom, or by other suppliers or they are passed through directly to the customer. Either way customers pay either directly or via additional taxation. These are in effect direct subsidies to solar and wind suppliers whereas they should be added as cost to the renewable energy suppliers.

Critical to the debate are the following basic facts concerning the energy sources considered in this paper namely solar and wind called solar and wind in this paper and coal and nuclear. Solar and wind such as hydro biomass and thermal have different qualities and are not considered here. Hydro and thermal are not options as they are not available in quantity in South Africa. Gas is another fossil fuel which at this stage is not found in major economic quantities in South Africa. They receive large subsidies paid by other energy suppliers and the electricity utility, in this case Eskom or by other customers. Critical issues are that solar and wind have very low load factors in the case of wind an average of 35% or less and solar 26% or less. Their supply being weather dependent is highly variable, intermittent, interruptible unpredictable and unreliable. Since on average supply is not available on average more than 65% of the time electricity supplied from these sources needs substantial back up. This back- up must be available at any time i.e. 100% of the time 24/7. In summary the availability of back-up supply must be 100% of the time, its utilisation is at least 65% of the time or greater. Coal has a load factor on average of approximately 80% and nuclear an average of 90%. The load factors here are affected by predictable maintenance requirements and normally to a lesser extent by unpredictable repair requirements. A reserve margin (or back up) of 20% has traditionally been considered sufficient to cover for both these events.

Additional costs of solar and wind

To the claimed costs of 62cents/kWh for solar and wind the additional costs that should be added include the items that follow in this list. At this stage it is apparent that these costs are not included in costs and should be added to the quoted cost of 62cents/kWh Ultimately, it is essential that these additional costs be measured in cent/kWh. The additional costs to Eskom, other suppliers or directly by customers can be measured in R millions /annum.

- Additional grid costs: Most wind farms are some distance from the existing grid and customers. Not only do transmission lines have to be built but they will only be used less than 35% of the time. This suggests that at minimum grid costs of wind must be at least approximately 3x the grid costs of dispatchable power units if not far more. The capital cost per kWh and the running cost per kWh must be approximately 3X that of reliable dispatchable power supply.

- Back up costs: 100% back up must be available 100% of the time. Back up is utilised on average 65% of the time or more. Taking coal or nuclear as a comparison with a load factor of 80% and 90% respectively. Only 20% back up power needs to be kept and this will only be used on average 20% of the time or less. This suggest that back up capital costs of wind would be approximately 5X higher per kWh than say coal with running costs approximately 3.25X that of reliable dispatchable power supply such as coal.

- Efficiency loss of back up and alternative electricity supply: Back-up power or other power supplies would only be used where necessary. As a result, due to low utilisation back up facilities would normally be running well below their optimal efficiency. There efficiency loss is in effect a direct subsidy of the solar and wind in this example say wind. The wind price would need to be increased by the efficiency loss incurred by back up suppliers or alternative electricity suppliers.

- Excess supply of electricity: Because electricity supply from solar and wind is variable, unreliable intermittent and unpredictable there will be periods where a surplus of electricity will be generated. In terms of the power purchase agreements (PPA), Eskom must pay the renewable producers for the excess power being produced. There are periods when other electricity producers producing secure dispatchable power cannot close the plant or reduce power. All these are additional cost that at present are passed on to the utility (Eskom) or other electricity producers or to consumers. SA cannot export surplus electricity to other countries, which European countries e.g. Germany or States in the USA do.

- Insufficient electricity supply as a result of technology being unable to immediately close the gap between supply and demand: Because electricity supply from solar and wind is variable, unreliable, unpredictable and intermittent there will be periods where a shortage of electricity supply will exist. Despite the fact that they require substantial back up there will be periods when the back-up will not be available. This will arise because whilst models indicate certainty of supply the real world is governed by uncertainty and back up will not be immediately available. There will for a period be no supply before supply increases sufficiently to cover the deficit. This will arise purely because the system will not adjust immediately to meet the supply demand imbalance. This would suggest that the deficit would be determined by the statistical variability of the different electricity technology sources. The economy would suffer as a result of the Cost Of Unserved Energy (COUE).

- High Economic Cost Of Unserved Energy: The economic Cost Of Unserved Energy (COUE) can be measured and these costs are extremely high. The IRP estimates the COUE at R87.85/kWh. This COUE of R87.85/kWh is as per the National Energy Regulator of South Africa (NERSA) study. In December, a senior energy expert estimated that load shedding has cost South Africa over R1.0 trillion over the previous decade or over 1.5% GDP growth per annum.

- Insufficient electricity supply as a result of extended periods of weather-related conditions: Because solar and wind are dependent on unpredictable and highly variable weather-related conditions there will be extensive periods when electricity supply could fall well below average supply and could not be available at all for an extended or unexpected period. This could involve long periods of excessive cloud, no wind or excessive wind making electricity generation impossible. The country and/or parts of the country could be entirely dependent on backup generated electricity, which cannot immediately be supplied to meet demand.

- The Higher the penetration of low load, high variable intermittent technologies the higher the Cost Of Unserved Energy: Models invariable are only as good as the assumptions used. In addition, most models assume certainty of output and do not take into account risk and uncertainty. The fact is that the real world is subject to risk and uncertainty. There are a number of uncertainties and risks apparently not taken into account in the current set of models. Firstly, there is a pause and delay before new generation technologies coming on line when a technology closes down. Secondly, as set out previously, the period of stoppage can increase and exceed the average planned for stoppages. This can result in back up supplies becoming inadequate.

- Reduction in sales by Eskom as a result of artificially low prices offered by renewable suppliers: Installation of renewable power direct at customers or potential customers premises of Eskom reflect finally as lost demand or sales at Eskom or lack of growth of demand at Eskom. A simplistic example would be at a factory or mine or even a solar installation at a customer in a shopping centre or domestic house.

- Cost of back up for installation directly supplied by solar and wind: If there is a reduction in such customers electricity supply due for example to several days of no wind or clouds Eskom is expected to provide immediate back up supply at normal rate costs. Eskom must have substantial back up readily available which is costly.

- Cost of purchasing electricity from customers who have their own renewable installations: The trend is that customers can sell their surplus electricity supply to Eskom. Invariable there is a commitment to purchase which in return reduces the perceived back up required. However, this is not true as back-up is still required for normal back up requirements but also for the full installation of the renewable supply at the customer’s premises. The truth is such customers are receiving hidden subsidies from Eskom paid for by Eskom unless passed on to other Eskom customers. Either way customers are paying for the additional costs involved.

- Destruction of industries and political social economic impacts: The move to solar and wind as set out in the IRP would result in the South Africa’s coal industry shrinking by 46%. Coal mining accounted for 26.7% of the total value of mining production in 2015 making it the most valuable in terms of sales of the 14 main mining commodities. A number of previously prosperous communities in Gauteng and South Africa would become ghost towns with rising unemployment and increasing poverty levels. Social benefits would increase dramatically.

- job Lack of permanent creation: Renewable energy sources do not give rise to permanent jobs being created. Most jobs created by solar and wind relate only to the construction phase. In fact, most jobs, particularly skilled jobs, are created overseas in countries supplying equipment. These countries would primarily be Germany in the case of wind related equipment and China in the case of solar equipment.

- Export of jobs and Loss of energy sovereignty: The move towards solar and wind will mean that South Africa loses it energy sovereignty, primarily to Germany for imports of technology and equipment related to wind and China for equipment related to solar. South Africa will effectively export its skilled jobs overseas and suffer a loss of skills. Instead of South Africa being an energy exporter it will become an energy importer as a result of losing coal exports and becoming dependent on gas imports.

- Creation of a current account deficit and not utilising valuable natural assets: Coal is one of South Africa’s largest commodity products. It is also one of the country’s largest exports. It is also the country’s largest by value commodity export. The importation of gas and loss of coal exports will result in an increasing and substantial current account deficit. Coal mining accounted for approximately 26% of the total value of mining production in 2015 making it the most valuable in terms of sales. Potential uranium reserves are also substantial. The drive for wind would deprive South African citizens of these benefits.

- Levelised Cost of Electricity (LCOE) is not a sound methodology to compare highly variable and interruptible electricity technologies with electricity supplied by reliable and virtually continuous energy generating technologies. A report entitled ‘Critical Review of The Levelised Cost of Energy (LCOE) Metric’, by M.D. Sklar-Chik et al, South African Journal of Industrial Engineering December 2016 concludes that “LCOE neglects certain key terms such as inflation, integration costs, and system costs.” They note “Many international reports prove that such electricity supply is extremely expensive due to its variability, interruptibility, inefficiency and its requirement of 100% backup”. The work of Paul Joskow et al of the Massachusetts Institute of Technology published in February 2011 wrote a paper entitled Comparing The Costs of Intermittent and Dispatchable Electricity Generating Technologies. The paper demonstrated that LCOE comparisons are a misleading metric for comparing intermittent and dispatchable generating technologies, because they fail to take into account differences in the production profiles of intermittent and dispatchable generating technologies. The paper uses a simple set of numerical examples that are representative of actual variations in production and market value profiles to show that intermittent and dispatchable generating technologies with identical Levelised total costs per kWh supplied can have very different economic values due to differences in the economic value of the electricity they produce.

- Methodologies and more realistic estimates of the true costs of solar and wind: There are many methods of calculation trying to prove one side of the argument or the other. A simple or “simplistic” method using the load factor alone, gives the cost of wind at R1.77/kWh and the cost of solar at R2.38/kWh. These compare to coal of R1.31/kWh and nuclear at R1.44/kWh. More complex methodologies taking risk and uncertainty of outages into account and using variance or standard deviation as the estimate of risk put the costs of wind at R2.52/kWh, coal R1.10/kWh and nuclear R1.33/kWh.

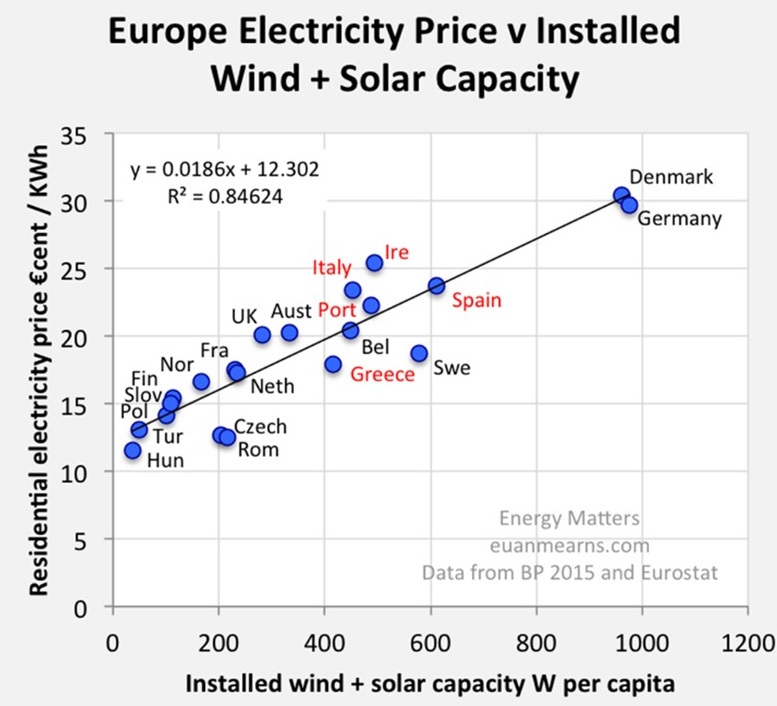

- The test of global reality: There is nothing like the test of global reality. In 2016, the prices paid by industry in Germany were approximately 52% higher than France (nuclear) and 86% higher than Poland (coal). The average estimates discussed above result in costs that are close to this global reality.

Corruption

It is a separate exercise to ensure that all technologies are under all circumstances kept free of corruption at all levels. Corruption must be stamped out. It is essential that the correct electricity generating sources are selected. This must be made on the basis of efficiency, effectiveness and long-term cost and viability free of any corruption. Corruption is a separate exercise to dealing with the economic choice of electricity technologies.

Conclusion

Emerging economies need to focus on those technologies which are efficient and effective. In South Africa, mining, manufacturing and industry need security of supply of electricity at competitive prices. The only two electricity generation sources of energy that can achieve these objectives in this country would appear to be High Efficiency Low Emissions (HELE) coal, otherwise called ‘clean’ coal and nuclear.

The country must focus on raising its economic growth rate by ensuring it has sustainable secure supply of electricity at the lowest economic cost. This must be accompanied by the necessary supporting condition fostering domestic and foreign investment into its economy. The arguments above show clearly that solar and wind in the form of solar and wind in particular, almost certainly have substantial additional costs which are not fully accounted for in the current costs being utilised for them. This also means that the so called least cost optimum mix is wrong. As a result, this methodology as currently defined and used is badly flawed. Furthermore, increased penetration of technologies such as solar and wind, which are variable, unreliable, intermittent and unpredictable, will automatically lead to higher cost of the optimum mix. Finally, the risk and uncertainty posed by solar and wind leads to rapidly increasing economic costs as measured by the COUE. All these are not currently allowed for or measured accurately in current models associated with the least cost energy mix. The impact and economic COUE as set out by the IRP is approximately R87.85/kWh. The technique and methodology recommended uses statistical calculations based on variable calculations utilising the variance and mean of each technology to calculate the COUE. Current models do not utilise any such statistical technique.

The above arguments and estimates lend force to the argument that solar and wind in particular are unaffordable in the current economic situation in the country. The estimates strongly suggest that the least cost methodology is badly flawed and that going forward the renewable technologies of solar and wind should play a marginal role in any future technology mix for the country.

The final nail in the coffin for South Africa is that increased penetration of wind will lead to a rapidly rising import bill for gas imports and the demise of its coal mining industry if not the entire mining industries. These are catastrophes which could ensure that the future of South Africa will move towards rising unemployment, increasing poverty and increasing social and political instability. South Africa needs to focus its energy plans on HELE or ‘clean’ coal, nuclear, domestic solar and limited gas apart from some use of other sustainable energy sources such as biomass, Hydro and pump storage.

Appendix Notes 0n the Costs of solar and wind are substantially less than coal and nuclear

This leads to the myth which is accompanied by loads of misinformation. Operating costs are low for solar and wind and far higher for coal and nuclear. The argument then becomes one of comparing Levelised Costs of Electricity (LCOE). This is another flaw and myth that leads to much public misinformation championed by idealists, vested financial and business interests and overseas experts with little interest in the long term sustainable economic development of the South African economy.

It is estimated by the CSIR that the LCOE, which takes capital cost and all the above factors into account, for wind and solar is 62c/kWh, coal is R1.05/kWh and nuclear R1.30/kWh. Solar and wind apparently now becomes the clear winner. However, solar and wind need full back up plus all the additional costs set out in this paper. The fact remains that, using wind as an example, solar and wind need 100% back up. Despite technological improvements, this leads to huge grid and integration problems, which substantially increase the real costs of solar and wind. The reports avoid the issue that the renewable industry then effectively receives hidden subsidies from more reliable energy sources to cover these weaknesses as set out in this paper.

In summary, the rankings are quite clear, wind again becomes the most expensive option, Solar and wind, despite the protestations of many so-called environmentalist, are not capable of driving reindustrialisation and creating conditions suitable for high economic growth in a country such as South Africa. This paper has not touched on the vast land area required for windfarms and their grids and the devastating impact on the environment that goes with this. The following notes on each point raised previously are in addition to and should be read in conjunction with the points raised in the previous sections.

1. Additional grid costs: This suggests that at minimum grid costs of wind must be at least approximately 3x (100/35) the grid costs of dispatchable power units if not far more. The capital cost per kWh and the running cost per kWh must also be approximately 3X that of reliable dispatchable power supply.

2. Back up costs: This suggest that back up capital costs of wind could be approximately 5X higher per kWh [100/20] than say coal with running costs could be approximately 3.25X [65/20] that of reliable dispatchable power supply such as coal.

3. Efficiency loss of back up and alternative electricity supply: This would suggest the efficiency loss could be approximately 54% [(100-65)/65]. There would need to be a price increase of the back-up or alternative electricity supplier of the same amount namely 54%. This estimate is based on all solar and wind particularly wind require 100% back up which is used only 65% of the time i.e. it is running at only 65% efficiency.

4. Excess supply of electricity: This would suggest that such events increase with increased use and penetration of solar and wind. Based on usage where for coal the load factor is say 80% of the time, nuclear say 90% and only 35% for wind suggests that surplus electricity occurs at least about 2.3X [80/35] more frequently using wind energy.

5. Insufficient electricity supply as a result of technology being unable to immediately close the gap between supply and demand: This will occur despite having a spinning reserve. This occurs more frequently when such changes are unplanned and occur more often in an unplanned or unpredictable way. This is the case with renewable technologies particularly wind and solar. There is a statistical risk of non-supply which would increase with lower load factors combined with a higher variability arising out of low load factors and high variability and intermittency. This is a statistical calculation based on load factors and standard deviations of each technology. Basically, the lower the load factor the higher the standard deviation and the higher would be the resulting COUE. Equally the higher the penetration of low load factors and high variability solar and wind automatically increases the economic COUE.

6. High Economic Cost Of Unserved Energy: The impact of Eskom’s latest stage 2 load shedding of 2,000MW is set to cost South Africa’s productive economy R2 billion in 13 hours daily according to some energy analysts. Together with corruption these are frightening figures. No wonder there is insufficient domestic and foreign investments. Investors have lost confidence in South Africa managing itself.

7. Insufficient electricity supply as a result of extended periods of weather-related conditions: This would suggest that risk parameters would rise rapidly with increasing penetration of low load factor solar and wind with unreliable, high variability, high intermittency and low predictability. This is a statistical calculation based on load factors and standard deviations of each technology. As far as is known this is not fully taken into account at present in the models.

8. The Higher the penetration of low load, high variable intermittent technologies the higher the Cost Of Unserved Energy: The extent to which these can or will occur increases risk of electricity supply shortages whether these be due to multiple short period inadequate supply or as a result of the extended period shortages. Both cases result in economic costs to the area region or country resulting in an increasing economic COUE.

9. Reduction in sales by Eskom as a result of artificially low prices offered by renewable suppliers: This results in a loss of revenue for Eskom however Eskom must still provide full back up for these facilities.

10. Cost of back up for installation directly supplied by solar and wind: Eskom must have substantial back up readily available which is costly. This is therefore a direct subsidy to solar and wind and these additional costs should be added to the renewable cost.

11. Cost of purchasing electricity from customers who have their own renewable installations: The actual cost to Eskom will depend on the terms arranged. A calculation based on the current arrangements would almost certainly reveal that as a system it would be cheaper to have permanent supplies from Eskom. For the customer as long as he continues to have cheap back up electricity available from Eskom the perception that he has achieved lower cost electricity is a reality. In effect the customer is receiving a subsidy. The outcome for the country and entire system is negative even though for the customer it appears to be positive.

12. Destruction of industries and political social economic impacts: A report by Econometrix prepared in 2018 indicates that the countries coal industry would be adversely affected. The report found that the negative impact on the coal industry would reduce the GDP of South Africa by over 2.5% or R75.2. billion. Compensation of employees would be reduced by R25.1 billion. Investment would be expected to be R3.8 billion lower per year. Government tax income would be reduced by R16.2 billion. There would be a loss in employment of 29000 jobs in the coal mining industry alone, and almost 162000 jobs in the economy. Approximately 1 million dependents would be adversely affected.

13. Lack of permanent creation: It is interesting to note that Energiewende or the movement towards solar and wind in Germany is considered by many to be a total failure. Germany has closed its solar related production facilities. China has expanded its manufacturing of solar related equipment. These goods are primarily for export. Chinas primary major energy thrust is focussed on High Efficiency Low Emission (HELE) “clean” coal and nuclear. This is also the case in other high growth ASEAN countries and India.

14. Export of jobs and Loss of energy sovereignty: In Germany the Energiewende programme has resulted in Germany becoming dependent on energy trade with other countries. This involves both the export of surplus electricity and the import of electricity when faced with electricity deficits. South Africa is not in the fortunate position to trade energy with other countries on any scale. This happens more frequently than generally recognised. In fact, during the winter of 2016 Germany had an extended period with a chronic shortage of electricity. Many people suffered as a result. Germany and much of Europe has become dependent on gas from Eastern Europe and Russia. International energy experts and strategist consider that Germany has lost its energy sovereignty to Russia. There is real concern about this situation.

15. Creation of a current account deficit and not utilising valuable natural assets: South Africa has 55 billion tons of coal left which would last over 100 years. The discounted value of coal reserves is more than a ten trillion Rand. The value of Uranium reserves is probably equal to this. South Africa cannot afford to leave these valuable assets and their value added buried in the ground. They represent to each South African of working age a value of over R500000 per working person (R0.5 million/per working person).

16. Levelised Cost of Electricity (LCOE) is not a sound methodology to compare highly variable and interruptible electricity technologies with electricity supplied by reliable and virtually continuous energy generating technologies. A study entitled “Nuclear Energy and Solar and wind: System Effects in Low-carbon Electricity Systems investigated” 2012 by the Nuclear Energy Agency (NEA) and Organisation for Economic Co-Operation and Development (OECD) estimated the additional grid costs alone would amount to more than R0.3/kWh. A similar result and other factors can be found in the study entitled The Full Costs of Electricity Provision 2018 by the NEA and the OECD. Various in-depth studies by experts around the world substantiate this fact. Such papers and reports include a recent Australian Research study by GHD and Solstice Development Services entitled “HELE Power Station Cost and Efficiency Report.” Another study by B.P. Heard et al entitled a ‘Burden of proof: A comprehensive review of the feasibility of 100% renewable-electricity systems’ concluded that “there is no empirical or historical evidence that demonstrates that such systems are in fact feasible”. They also reviewed the CSIR proposals. The study concluded “both the use of the terms ‘technically feasible’ and the attempted costing of the proposed system are inappropriate and premature”. A research report by D. Weißbach et al (2013) on Energy Returned from Energy Invested (EROI) in Germany showed that solar and wind are uneconomic and will lead to economic stagnation. Another scholar, Tim Mount et al in his paper entitled The Hidden System Costs of Wind Generation in Deregulated Electricity Markets, brings an interesting angle to this discourse. In his paper of January 2011, he deals with the hidden system costs of wind generation. These hidden costs appear to completely ignored in current models.

17. Methodologies and more realistic estimates of the true costs of solar and wind: The simple or “simplistic” method using the load factor alone uses simple logic. The argument is that each technology should be able to support its own electricity supply. The simplistic calculations are that the cost of wind is R1.77/kWh (100/35XR0.62)). The cost of solar is R2.38/kWh (100/26X62) cents. These costs compare to coal which are estimated R1.31/kWh (100/80XR1.05) and nuclear at R1.44/kWh (100/90XR1.30). These are purely guideline estimates and do not take into account the additional grid costs and other costs set out previously. The more complex methodologies taking risk and uncertainty of outages into account and using variance or standard deviation as the estimate of risk need to be discussed separately.

18. The test of global reality: If any further proof is required, it is a reality that there is no country in the world with high penetration solar and wind, where electricity prices are cheaper than coal or nuclear-powered electricity where available. This includes countries such as Denmark, Germany, Ireland, and states within countries such as Australia like South Australia and the USA such as California. Many such countries and states are experiencing energy poverty and deindustrialisation. High growth emerging economies such as China, India, the Asean countries are focussing on using fossil fuels and nuclear. This is also true of Russia and countries in Eastern Europe including countries such as Poland.

Other Factors

There are many other factors that need to be taken into account. This includes cost environmental economic political and social factors.

Such other factors that need to be taken into account include:

1. Reduction of sales by Eskom from economic policies: The poor economic policies of government have effectively reduced economic growth. In particular they have reduced the growth of industry mining and generally goods producing industry. This has led to a structural change in the economy where the service sectors particularly government with low electricity intensivity and public sectors have experienced high growth whilst goods producing sectors with high electricity intensivity have experienced low growth. This has led to relatively low electricity demand growth. In the long term this is an unsustainable economic growth model for a country such as South Africa which require as set out in the National Development Plan NDP high growth in its good producing sectors. This would suggest that the below average electricity growth of Eskom has been as a result of factors beyond Eskom’s control. If correct policies are followed electricity growth should increase. Planning must take this into account. This will require an increase in reliable base load power.

Hügo’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. We highly recommend subscribing: HERE