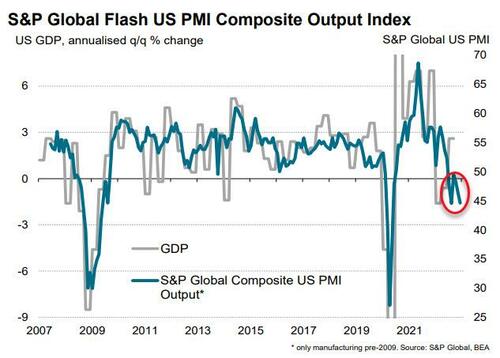

After tumbling to their lowest since the COVID lockdown collapse, S&P Global’s PMI surveys were expected to rebound modestly in preliminary December data this morning. However, the consensus was very wrong as both Services and Manufacturing saw further – and notable – deterioration.

US Manufacturing PMI dropped from 47.7 to 46.2 (contraction), below 47.8 exp

US Services PMI dropped from 46.2 to 44.4 (contraction), below 46.5 exp.

Source: Bloomberg

The last time PMIs fell to this level, things got ugly fast.

A gauge of new orders at manufacturers slipped further into contraction, falling to its lowest level since May 2020.

New business at service providers also shrank by the most since the early months of the Covid-19 pandemic.

The US Composite Index fell to 44.6 (well below expectations) to its lowest since May 2020 and diverging from upticks in the rest of the major global economies…

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualised rate of around 1.5%. Jobs growth has meanwhile slowed to a crawl as firms across both manufacturing and services take a much more cautious approach to hiring amid the slump in customer demand.

Williamson goes to note a silver lining (inflation is fading)…

“The upside is that weaker demand has taken pressure off supply chains which had been stretched during the pandemic. December saw a second successive month of faster supplier delivery times, a phenomenon which not only signals improving supply conditions but also tends to herald the shifting of pricing power away from the seller towards the buyer.

“Hence price pressures continue to moderate sharply. In fact, December saw the largest monthly cooling of firms’ input cost inflation seen in the 13 year history of the survey barring only the lockdown related slump in April 2020.

In short, the survey data suggest that Fed rate hikes are having the desired effect on inflation, but, as Williamson concludes “that the economic cost is building and recession risks are consequently mounting.”

Loading…