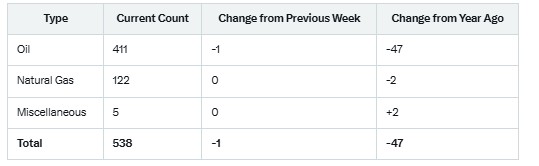

The U.S. rig count continues its downward trend, reflecting a cautious approach by drillers amid fluctuating oil prices, economic uncertainties, and a focus on capital discipline rather than aggressive expansion. According to the latest data from Baker Hughes, the total number of active drilling rigs in the United States dropped by one to 538 for the week ending August 22, marking the fourth decline in five weeks and the lowest level since mid-July. This drop brings the count down 47 rigs, or approximately 8%, from the same period last year, signaling a broader slowdown in drilling activity.

U.S. Rig Counts by Type: Oil vs. Natural Gas

The decline was driven entirely by oil-targeted rigs, which fell by one to 411. Natural gas rigs held steady at 122, while miscellaneous rigs remained unchanged at 5. This breakdown highlights the ongoing pressure on oil drilling, where producers are prioritizing efficiency and shareholder returns over new projects. Oil rigs are now at their lowest since early August, while gas rigs have stabilized after earlier volatility.

This trend aligns with forecasts from the U.S. Energy Information Administration (EIA), which projects U.S. crude output to rise modestly to around 13.4 million barrels per day in 2025, despite lower rig activity, thanks to improved well productivity. On the gas side, higher spot prices expected in 2025 could encourage a rebound in drilling, but for now, operators remain conservative.

Rig Counts by Major Basins

Drilling activity varies across key U.S. shale basins, with the latest changes reflecting selective cutbacks. Based on the most recent detailed data available (for the week ending August 15, with the overall trend persisting into August 22), major basins showed the following:

Permian Basin (West Texas and New Mexico): 255 rigs, down 1 from the prior week. As the largest U.S. oil-producing region, the Permian accounts for roughly half of the nation’s rigs and has seen consistent declines, hitting its lowest level since September 2021.

Eagle Ford Basin (South Texas): Approximately 45 rigs, up 1 recently, showing some resilience in oil-focused areas.

Haynesville Basin (Louisiana and Texas): Around 40 rigs, down 1, amid steady gas prices.

Mississippian Basin: About 2 rigs, down 1, reflecting minimal activity.

Other basins like the Bakken (North Dakota) and DJ-Niobrara (Colorado) have remained relatively flat, with small fluctuations. The overall reduction in the Permian, the engine of U.S. oil growth, underscores drillers’ strategy to “play it safe” by reducing exposure to price volatility and focusing on high-return wells.

Rig Counts by State

State-level data mirrors the basin trends, with major producing states bearing the brunt of the slowdown (based on August 15 figures, adjusted for the latest total decline):Texas: 242 rigs, down 1, the lowest since September 2021. As the epicenter of U.S. energy production, Texas hosts the majority of Permian and Eagle Ford activity.

New Mexico: Around 90 rigs, stable but part of the Permian’s broader caution.

North Dakota: Approximately 35 rigs, unchanged, with focus on the Bakken shale.

Wyoming: 13 rigs, down 1, the lowest since August 2024.

Louisiana: About 40 rigs, up 2 in recent weeks due to offshore and Haynesville adjustments.

Smaller states like Oklahoma and Colorado have seen minor shifts, but the emphasis remains on cost control across the board.

International Rig Count:

A Global PerspectiveShifting to the global stage, Baker Hughes’ latest monthly international rig count for July 2025 stood at 914, up 1 from June but down 20 from July 2024. This modest monthly increase suggests some stabilization in overseas drilling, though the year-over-year drop indicates ongoing challenges from geopolitical tensions, energy transition pressures, and varying demand outlooks.

While detailed regional breakdowns for July 2025 are limited, historical trends show activity concentrated in key areas:

Middle East: Typically, the leader with around 320-330 rigs, driven by OPEC+ production goals.

Asia Pacific: About 220 rigs, with growth in offshore projects.

Latin America: Roughly 170-175 rigs, supported by developments in Brazil and Argentina.

Africa: Around 105-110 rigs, focused on North African and sub-Saharan plays.

Europe: Approximately 115 rigs, including North Sea operations.

The international count excludes North America and certain sanctioned regions like Russia and Iran. Globally, rig activity remains below pre-pandemic levels, with drillers worldwide adopting a similar “play it safe” mentality amid uncertain oil demand growth and rising costs.

Why the Caution?

Drillers’ conservative stance comes as U.S. crude prices hover around $70-80 per barrel, down from peaks earlier in the year, influenced by global economic slowdown fears and ample supply. Independent exploration and production companies have cut capital expenditures by about 4% in 2025, prioritizing debt reduction and dividends. As one industry analyst noted, “The era of drill-baby-drill is over; it’s now about smart, sustainable growth.”Looking ahead, if gas prices surge as projected (up 65% in 2025 per EIA), we could see a pickup in gas rigs. However, oil drillers may continue to hold back unless prices stabilize above $80. For now, the falling rig count serves as a barometer of an industry in transition, balancing short-term caution with long-term opportunities in the energy sector.

Stay tuned to Energy News Beat for more updates on rig counts, production forecasts, and global energy trends.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack