The US Treasury Department on June 25 imposed sanctions on parts of a shadow banking network that Iran uses to launder billions in oil proceeds used to provide weapons to Russia and regional proxy groups like the Houthi rebels in Yemen.

“We have sanctioned hundreds of targets involved in Iran’s illicit oil and petrochemical-related activity since President Biden took office, and we will continue to pursue those who seek to finance Iran’s destabilizing terrorist activities,” Wally Adeyemo, deputy secretary of the Treasury, said in a statement.

The new sanctions come after Iran in May announced that it plans to raise its crude oil production capacity by 400,000 b/d.

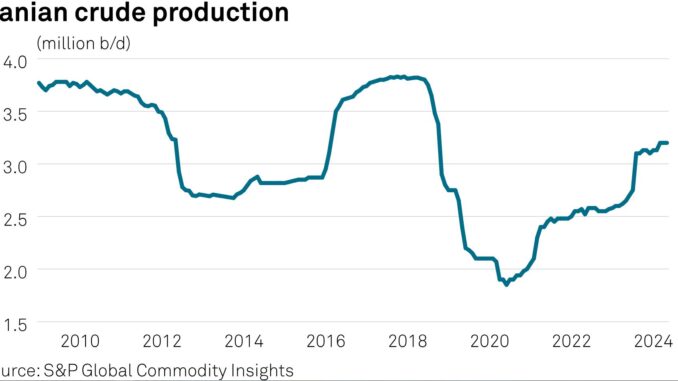

The latest Platts OPEC+ survey by S&P Global Commodity Insights has Iranian crude production at 3.17 million b/d for May, up from 2.66 million b/d a year ago.

Tehran achieved a 3.8 million b/d crude output before former US President Donald Trump’s 2018 “maximum pressure” sanctions campaign, which pushed output as low as 2 million b/d.

Sanctions impact

The sanctions are designed to impair Iran’s support for regional partners and increase the costs of illicit transactions, but they are not a real escalation, said Rachel Ziemba, a senior advisor at Horizon Engage.

“Overall, I think this is calibrated for the US domestic audience to seem like they are doing something meaningful,” Ziemba said. The sanctions will not have a big impact on the global oil markets because the volumes affected are low and because OPEC members would be delighted to pump more oil, she said.

If the administration really wanted to stop Iranian oil flows, it could designate Chinese, Emirati and Malaysian entities involved in the illicit trade, Ziemba said. But the US is unlikely to be willing to do this ahead of the elections in Iran and US, she said.

Brenda Shaffer, an energy expert at the US Naval Postgraduate School argued that the Biden administration’s lax enforcement means the new US sanctions will have little effect on Iran’s ability to export oil, fund its proxies and advance its weapons production.

“Adding to the weakness of sanctions is the growing cooperation between Iran, Russia and China,” Shaffer said. “These countries do not need Western banks and financial systems to move money between them and to the proxies.”

Shadow banking

Shadow banking networks give sanctioned Iranian entities access to the international financial system and obfuscate their trade with foreign customers, Treasury’s Office of Foreign Assets Control said in the statement.

Iran does this by using exchange houses in Iran that manage cover companies registered in places like Hong Kong or the United Arab Emirates to launder the revenue from activities like oil sales, Treasury said. The same cover companies then use the laundered foreign currency to buy weapons components on the international market, Treasury explained.

Treasury sanctioned a number of key individuals in the network, including Seyyed Mohammad Mosanna’i Najibi, an Iranian Turkish moneychanger. Najibi works to set up cover companies and accounts for Iran, hold money in accounts outside of Iran, transport hard currency across borders, retrieve revenue from Iranian oil sales and transfer funds to weapons suppliers, Treasury explained.

Treasury also designated 27 cover companies based in Hong Kong, UAE and the Marshall Islands that are controlled by Najibi and used to obfuscate international financial activity.

Other sanctioned individuals include Ramin Jalalian, an Iranian currency exchanger, Siavash Nourian, the owner of an Iranian exchange house, and Seyyed Reza Mir Mohammad Ali, another owner of an Iran exchange company. Treasury also designated companies in the UAE and Hong Kong owned by these sanctioned individuals as well as companies owned by Asadollah Seifi, who was sanctioned in 2019.

Take the Survey at https://survey.energynewsbeat.com/