- This year’s Berkshire Hathaway investor letter should be sobering for US electric utility investors.

- Mr. Buffett discusses two reasons why he appears to have soured on the business prospects for US-regulated electric utilities.

- Buffett recognizes that the US electric utility industry has a voracious need for new investment but at the same time a deteriorating investment climate prevents him from investing incremental sums.

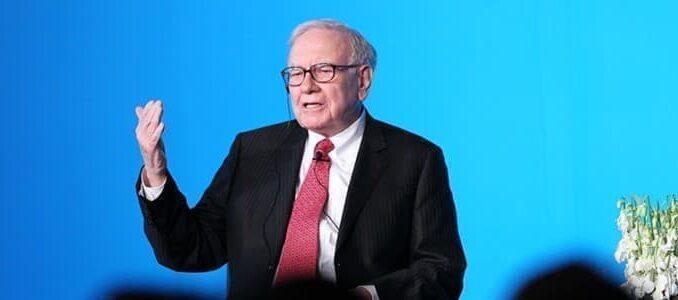

Every year investors eagerly anticipate the arrival of Warren Buffett’s annual letter to Berkshire Hathaway shareholders. In this year’s letter, after discussing favorite companies like Coke, Apple, and Occidental Petroleum, Mr. Buffett turned to two areas of financial disappointment, railroads and utilities. But there was one key difference. As a large investor, he was disappointed with the performance of BNSF rail lines but he acknowledged the considerable economic potential in the business, its centrality to the US economy, and reaffirmed his commitment as a long-term holder. Not so for his electric utility holdings. One theme of Mr. Buffett’s letter this year was explaining why, as an investor controlling a balance sheet of about $1 trillion in assets, he can’t commit more capital to certain businesses he really likes. With respect to utilities he wrote that “It will be many years until we know the final tally from BHE’s forest fire losses, and can intelligently make decisions about the desirability of future investments in vulnerable western states. It remains to be seen whether the regulatory environment will change elsewhere.” If there was any doubt, he meant a change for the worse, and let’s explore why.

Mr. Buffett discusses two reasons why he appears to have soured on the business prospects for US-regulated electric utilities: 1) Ongoing business disruption from increasing wildfire risk due to climate change which has led to two bankruptcies thus far. He writes, “Other electric utilities may face survival problems resembling those of Pacific Gas & Electric and Hawaiian Electric.“ Of his three electric utilities, PacifiCorp’s heavily forested service area most closely resembles fire-prone Northern California. 2)) The erosion of rate base, rate of return regulatory norms at the state level to the detriment of capital providers like Berkshire Hathaway. Mr. Buffett refers to the “ fixed-but-satisfactory-return” method of rate base regulation and states this “pact has been broken in a few states and investors are becoming apprehensive that such ruptures may spread.” He states that this may eventually lead to a reemergence of public power movements like those in Nebraska in the 1930s. One of the reasons he initially found utilities attractive was their ability to earn in excess of their cost of capital, a high return-relatively low business risk enterprise. But now with climate change and wildfires throughout the west causing two utility bankruptcies thus far, the business risks are elevated while the financial returns granted by regulators are declining.

There is almost a sadness here. Throughout his letter. Mr. Buffett discusses his desire to deploy capital domestically, preferably in very large sums. He recognizes that the US electric utility industry has a voracious need for new investment but at the same time a deteriorating investment climate prevents him from investing incremental sums. He states that “ I did not anticipate or even consider the adverse developments in regulatory returns and… I made a costly mistake in not doing so.“ Interestingly, when he mentions future utility capital expenditures he cites the potential burying of transmission lines in response to wildfire risk and the extraordinary cost to do so.

This year’s Berkshire Hathaway investor letter should be sobering for US electric utility investors. Mr. Buffett has basically given the industry two thumbs down. Wildfires due to climate change have led to the utility bankruptcy of PacifiCorp’s neighbor, Pacific Gas & Electric. Meanwhile, he cites the so-called regulatory compact as being broken and says earned equity returns are getting skimpy. And lastly, the specter of public ownership looms over the industry. There is an old Wall St. expression that they never ring the bell at the market top (to notify investors that the party’s over so to speak). When an investor of Mr. Buffett’s stature plainly expresses his discomfort in committing new capital to a supposedly stable, mature industry like electric utilities, that’s as close as we can get.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack