California’s energy policies have continued to negatively impact its citizens over the last 10 years. and the world’s geopolitical situations have just caused some real problems for oil prices. While the Russian and Iranian geopolitical stories in the top of the news, people are wondering how California’s pain at the pump is right in the middle. So Putin starts a war, and at the same time, our current administration tries to get the Iranian nuclear deal across the finish line. How does putting Russia in charge of the Iran nuclear deal help? The Russian negotiating team said they will keep “all enriched uranium for weapons in Russia for safekeeping”. This is the same Russia that was putting “Peace Keeping forces” in just a few weeks ago.

California has a long history of having the highest prices for gas at the pump in the United States for a long time. There are several key components that help California win the prize of highest gas prices in the U.S. They are taxes, geography, political energy decisions, and the huge consequences of forcing oil companies to leave California rather than remain and supply oil and gas to local markets. The lobbying group American Petroleum Institute stated that state and local taxes in California add an additional 61 cents on every gallon, and the federal taxes add yet another 18 cents per gallon. So even before you take any of the other items into play, taxes jump right to the forefront on a key reason for the California citizen’s high out-of-pocket expenses. Additional taxes of 19.8 cents per gallon for spot-market cap and trade and another 14.9 cents for low carbon taxes.

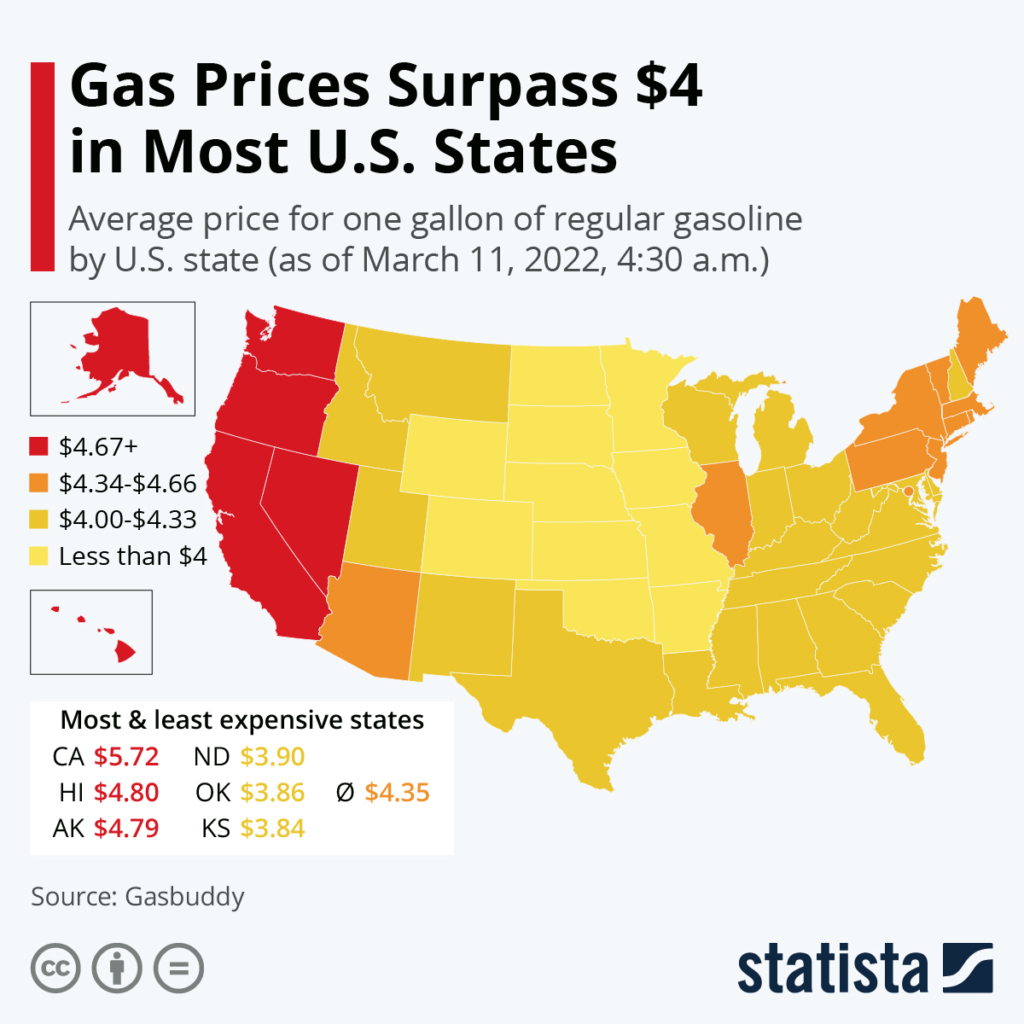

When the Biden administration announced the banning of imported oil from Russia, gas prices started going higher at an accelerated pace. Even some places reached up over $7 in Las Angeles on March 7th. Gasbuddy published this morning the price of gas of a gallon of regular at $4.35 on average, which is just above the all-time high of $4.11. The highest price of $4.11 was in 2008 was in July just before the great recession. Even in Texas, the prices are up around the $4.00 mark and the graphic below from Statista shows the U.S. average costs per region.

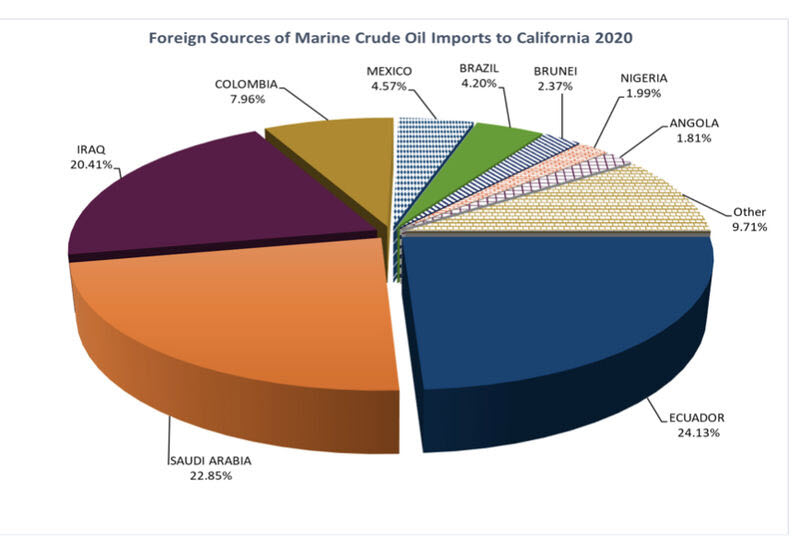

The political and environmental movement in California successfully shut down the oil and gas companies. Most oil companies fled the state or were put out of business through high taxes, high regulations, and permit denials. So how does California get its gasoline? That is a great question. They import it from countries like Iran, Saudi Arabia, and Ecuador. For the last 4 to 5 years over 20% of the California oil was imported from Iran, even when sanctions were in place. So United States sanctions were in place against a country that was enriching uranium for manufacturing nuclear weapons, and California bypasses those federal mandates against importing Iran oil.

The regulatory agencies in California have also stopped any refineries from being updated or new ones being built. Both would help by upgrading the older refineries to new technologies that would not impact the environment nearly as much. The regulatory processes have actually done more harm to the environment, than if they allowed companies to upgrade and put in newer technology to reduce greenhouse gasses.

The current administration’s banning of Russian oil and gas will have less of an impact than you would think. Russia will sell its oil outside of sanctions to survive. Iran has been selling its oil outside of sanctions for years to countries and states like California. It took Iran years to build its oil pipeline outside of sanctions, to which Russia now has China’s contracts to help support their cashflow requirements through any world sanctions imposed because of the invasion of Ukraine. The chart below is an excellent representation of the impact of the United States sanctions. China imports 22 times more oil than the United States. The only countries willing to ban the importing of Russian oil are on the bottom of the import list anyway.

The Bottom Line

The gas prices boil down to several key factors. Taxes, drilling costs, oil world pricing, energy policy, supply, and demand are all part of the mix. Now we have to ad geopolitical issues to the mix and we see an extremely bullish run for oil in the long term. Having States like California buy oil from countries that are not practicing good ESG, or commit crimes against humanity, and support human trafficking, while banning sources close to home seems like the pain at the pump is actually like a self-inflicted gunshot wound.

As always check with your CPA if alternative investments are good for your portfolio Take the assessment and see if it is right for you HERE.

Please reach out to our team at any time for answers to your questions.

Jay R. Young, CEO, King Operating

And visit the King Operating Website for more market information and insights.