ENB Pub Note: This article is a LinkedIn article from Tammy Nemeth, podcast host, and international energy expert. She is a key global energy and ESG leader on the Energy Realities Podcast, and The Nemeth Report. Please follow and connect with Tammy on her LinkedIn HERE:

Over the past two years I’ve attended or watched many webinars on ESG, sustainability, and climate-related financial disclosures. There is a mantra repeated that “investors are demanding this information”, particularly GHG emissions data, and they want it verified. Whenever someone asks, “which investors?” The answer is always silence.

Recently, I came across a paper by law professor Sean Griffith of Fordham University regarding the US Securities and Exchange Commission’s (SEC) climate disclosure rule, “What’s “Controversial” About ESG? A Theory of Compelled Commercial Speech Under the First Amendment.” Prof. Griffith offers a very interesting and compelling case that one of the main drivers of this movement for climate disclosure are the institutional investors.

What’s “Controversial” About ESG? A Theory of Compelled Commercial Speech under the First Amendment

In a summary of the paper on the Harvard Law School Forum on Corporate Governance website, Prof. Griffith explains, “Climate disclosures—greenhouse gas emissions in particular—are a boon to asset managers because they allow them to automate ESG portfolios while passing the necessary information costs onto investors generally. But the SEC does not have the authority to benefit one class of investors at the expense of others. Rather, the investor protection rationale requires the SEC to consider investor interests on a class basis—the interests of investors as such—rather than focusing on the idiosyncratic preferences of individuals or groups. Ultimately, this means focusing on financial return.”

You can hear Prof. Griffith talk about these issues on the “Bite-sized Business Law” podcast:

https://podcasts.apple.com/us/podcast/sean-griffith-on-the-secs-authority-to-mandate-esg/id1671246836?i=1000606240100

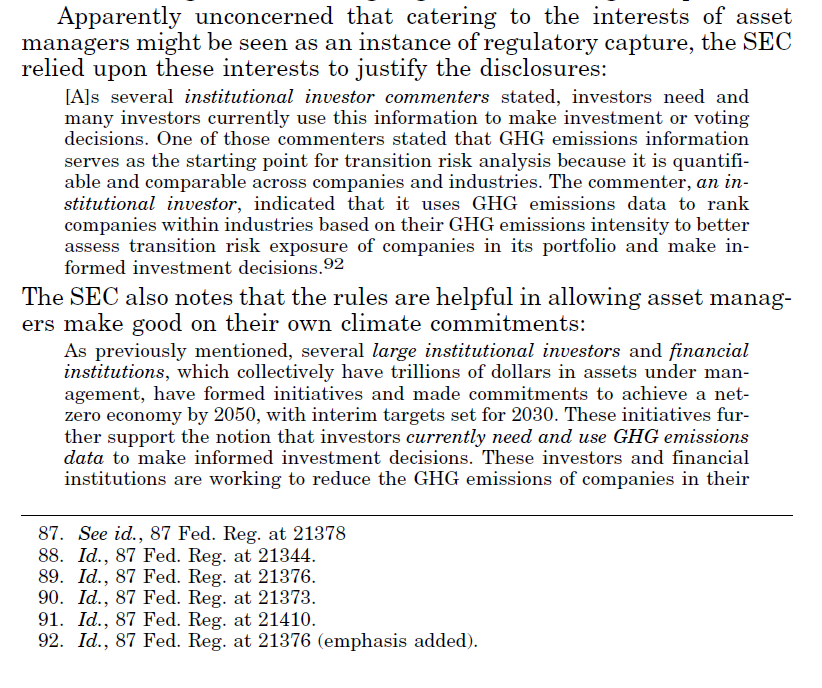

In the longer paper, Prof. Griffith offers detailed evidence of the influence of asset managers and institutional investors on the SEC’s rationale for putting forward the climate disclosures (see p.891-892 in particular).https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4118755

“”The value of GHG disclosures lies in the fact that they are quantitative and therefore easily compared across companies and industries.88 This makes the information useful to institutional asset managers.89 According to the proposed rule release: “[I]nstitutional investors and other commentators have indicated [that] GHG emissions information is important . . . because GHG emissions data is quantifiable and comparable across industries . . . .”90 GHG emissions numbers allow asset managers to automate ESG investing.91 For example, quantitative GHG disclosure can be programmed into an algorithm that screens companies on climate without anyone having to wade through narrative risk disclosures. This in turn allows asset managers to advertise their sensitivity to clients’ ESG concerns while also minimizing the cost of designing and maintaining ESG portfolios.”

The article goes on to use direct quotes from the SEC that could be seen as an example of regulatory capture.

This raises a few questions: Why are securities administrators in several countries doing this for the benefit of a subset of investors? What about the concerns and interests of other investors? What happened to the principle of financial return? Why do securities administrators have to create rules and standards so that institutional investors can meet their non-binding self imposed climate commitments?