But a drop in energy prices had a soothing effect on overall PPI, which also accelerated, but by less.

By Wolf Richter for WOLF STREET.

The Core Producer Price Index bounced back sharply in August from the negative reading in July that had been heralded as yet another sign that inflation was dead. So inflation is not dead. The bounce-back was driven by the massive bounce-back of the Services PPI and, very interestingly, a spike in the Finished Goods PPI.

“Core” PPI jumped by 3.9% annualized in August from July, seasonally adjusted (blue in the chart below), driven by services (+4.6%), which dominate core PPI, and also by finished core goods (+4.1%), according to data from the Bureau of Labor Statistics today.

The 6-month rate – which irons out some of the whiplash volatility of the month-to-month readings and includes the often-hefty revisions – remained at 2.8% in August, same as in July. Note how the 6-month rate shifted higher this year, after being well-behaved in much of 2023 near 2% (red).

Year-over-year, core PPI rose by 2.4%, after the big deceleration in July that had been driven by the base effect in services that will abate for the remainder of the year.

Services PPI jumped by 4.6% annualized in August from July, seasonally adjusted, after the negative reading in July (-3.7%) that had followed to hot readings in the prior months (blue in the chart below).

The 6-month average rose 3.0% annualized, roughly the same increase as in July. Note how it shifted higher this year, after the lower readings last year.

Year-over-year, the services PPI accelerated to 2.6% in August after the sharp deceleration in July that had been the result of the base effect, when the freak month-to-month spike of +9.9% annualized in July 2023 (highest in over two years) fell out of the 12-month range of the year-over-year readings and was replaced by the plunge of -3.7% annualized in July 2024 (the lowest since March 2020). Going forward, the low-to-negative month-to-month readings last year in August through December will come out of the 12-month range and be replaced by the readings going forward, and the base effect that rattled the index in July will fade out.

“Finished core goods” PPI started to act up again in 2024, after being well-behaved in 2023. The 4.1% annualized jump in August from July was the biggest since February and the same as January 2024, and all three had been the highest since January/February 2023.

As we have seen all around, there have been no major inflation pressures building up in core goods in over a year. Inflation has been largely wrung out of core goods. And core goods have been a big factor in bringing inflation down. So this spike in August is not welcome.

But compared to the fiasco in 2021 and 2022, the current situation with core goods is benign:

The PPI for “finished core goods” includes finished goods that companies buy but excludes food and energy products.

Year-over-year, the finished core goods PPI accelerated to 2.3% in August from 2.1% in July, and the highest since February. Just a bump in the road, or a change in direction? A change in direction would be very unwelcome.

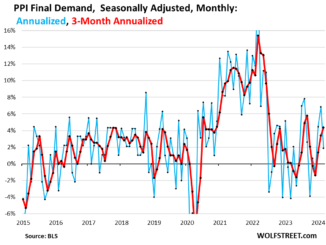

The overall PPI for final demand jumped by 2.9% annualized in August from July, after a negative reading in July, as drops in energy prices softened the impact of jumping prices for services and core goods.

The 6-month rate decelerated to an increase of 1.9% annualized. So, driven by the drop in energy prices, overall PPI looks normal. But energy prices cannot drop forever.

The overall PPI tracks inflation in the goods and services that companies buy and ultimately try to pass on to their customers.

Year-over-year, overall PPI rose by 1.7%, a deceleration from July and June. June had been the highest since February 2023:

Take the Survey at https://survey.energynewsbeat.com/