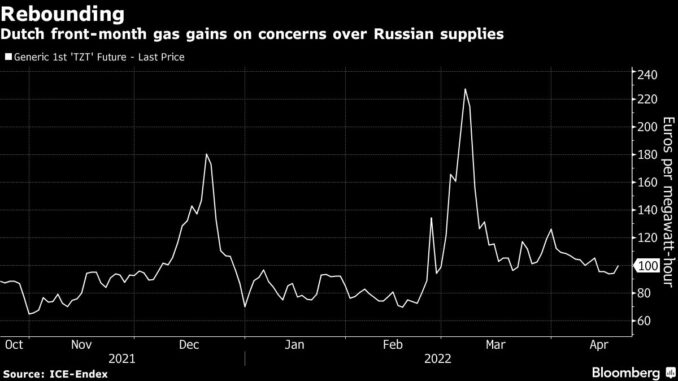

Natural gas prices in Europe extended gains for a second day as traders weighed the security of supplies when Russia’s demand for ruble payments comes due next month.

Front-month futures gained as much as 3.2%, after having largely stabilized over the past week. Russian President Vladimir Putin’s order to switch to ruble payments for gas supply to “unfriendly” nations has been at the forefront of market risks for days after warnings that supply may be curtailed if buyers don’t shift to the new system. But price gains have been kept in check by a steady supply of liquefied natural gas to Europe.

“Concerns about the future of European gas supply remain high as the fears of further escalation to the war in Ukraine and a potential complete stop to Russian gas flows to Europe continue to add bullish pressure to the market,” Energi Danmark A/S said in a note.

Nations are also pressing on with lowering their dependence on Moscow for their energy. Italy is snapping up supplies from Africa and is prepared to cut dependence on Russian gas sooner than expected.

Benchmark European gas futures were 2% higher at 96.10 euros per megawatt-hour by 10:13 a.m. in Amsterdam, after rising 0.5% on Wednesday. The equivalent contract in the U.K. gained 3.1%.

No Immediate Risk

Some analysts, though, don’t see any immediate risks to supply as most payments under the new payment system aren’t due until later next month.

“We are still a month away from this really being an immediate issue,” said Tom Marzec-Manser, head of gas analytics at ICIS in London. “I certainly don’t see any risk to pipeline supply in the coming month in relation to the currency decree, and really not into June either.”

Russian supplier Gazprom PJSC could also be obliged contractually to continue sending gas to Europe, Thierry Bros, a professor at the Paris Institute of Political Studies, said by email. “If Putin decides to close the tap that would send prices soaring but this will solve the lengthy discussions on the EU side on when to ban Russian exports.”

Meanwhile, gas flows from Russia via Ukraine were expected to remain below capacity on Thursday, after orders dropped before Easter. But a flotilla of LNG vessels is heading to Europe, delivering the fuel from the U.S. and Qatar, but also from Russia. Shipments of the superchilled fuel are exempt from the ruble payment order.

The Kremlin’s demand has faced some resistance. Germany on Wednesday rejected that companies should have to set up special accounts to pay for gas in the Russian currency. Italy may also refuse to comply. European Union lawyers have drafted a preliminary finding that the payment mechanism would violate EU restrictions on Russia following its invasion of Ukraine.

Source: Bloomberg