Highlights of the Podcast:

04:26 – So, What Takeover targets remain in the Permian Basin

11:01 – OPEC Secretary General believes long-term demand outlook is robust

14:28 – Saudi Aramco’s management

16:59 – The petroleum reserve here in the US

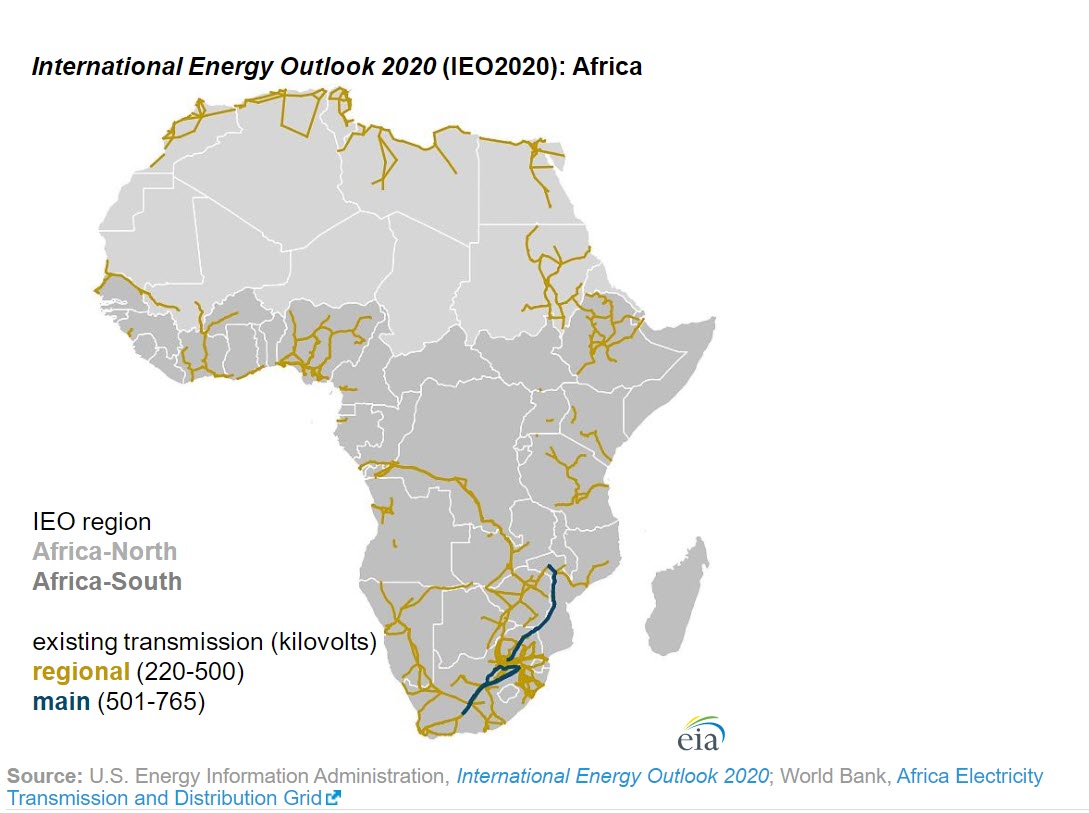

18:14 – Visualizing the rise of U.S. as top crude oil producer

21:02 – Uncertain global economic recovery looms over copper

23:56 – Scraping Russian, gas deal would cause prices to explode

25:21 – Talks about Turkey

27:49 – The UK administration

30:42 – The weaponization of the sanctions that the United States

36:35 – The Department of Energy

#podcast @thecrudetruth9585

@davidblackmon6807 #energytransition #oilandgas #geopolitics

David Blackmon – https://davidblackmon.substack.com/

Rey Trevino – https://thecrudetruth.com/

Stu Turley, – https://energynewsbeat.co/

With 3 unique personalities, backgrounds, and one horrible team sense of humor, it makes for fun talks around the energy markets.

David Blackmon is a Forbes author and currently writes Energy Absurdities of the Day. He has several active podcasts with ….. His industry leadership is evident, but a dry, calm way of expressing himself adds a different twist.

R.T. Trevillon is the podcast host of The Crude Truth filmed in Fort Worth Texas and runs an oil and gas E&P company. Pecos Country Operating has been in business for ….years and has a constant commitment to all of their stakeholders and is actively working in this oil and gas market.

Stu Turley is the co-podcast host of the Energy News Beat Podcast. While Stu is a legend in his own mind, Theenergynewsbeat@substack.com

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

David Blackmon LinkedIn

The Crude Truth with Rey Trevino

Rey Trevino LinkedIn

Energy Transition Weekly Conversation

David Blackmon LinkedIn

Irina Slav LinkedIn

Armando Cavanha LinkedIn

Follow Stuart On LinkedIn and Twitter

If you have any questions, please reach out to us. We want to answer all questions, and if you have what it takes to be a podcast host and you want your show reach out.

Also, sponsor slots are available. There is excellent reach with the four podcasts.

David Blackmon LinkedIn

The Crude Truth with Rey Trevino

Rey Trevino LinkedIn

Stu Turley LinkedIn

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter. Comming soon

3 Podcasters Walk in a Bar Episode 47 – OPEC says oil out look is robust, US Top Oil Producer and Critical Mineral Supply Chain.

Stuart Turley [00:00:07] Mr. Blackmon, I know you did. Can you hear me?

David Blackmon [00:00:16] Yeah. You know, what’s weird is I’m not seeing the option for me to stream my stuff on, stream this on my LinkedIn and acts.

Stuart Turley [00:00:25] Like you did. Like you have.

David Blackmon [00:00:28] Yeah. I don’t know what’s what’s changing.

Stuart Turley [00:00:30] See here I.

David Blackmon [00:00:32] Put it is streaming on yours.

Stuart Turley [00:00:35] Yeah, I had it set up when I had the invite go out where it says allow people to stream. And I did because I want RT to stream it on your own. I think that’s one of the reasons that it goes nuts is because, on the other one.

David Blackmon [00:00:53] Yeah.

Stuart Turley [00:00:54] You ready for this one? I got a secret meeting. A secret meeting of them of, Granholm working to try to help us out. You ready?

Stuart Turley [00:01:14] Okay. This is Granholm in one of her meetings .

David Blackmon [00:01:30] Is that EV burning.

Stuart Turley [00:01:31] Just a regular car. But wait. Anyway, so there’s a lot of fun there. Let me start this back up here and then remove. And then this one is one of my articles. Look at that. We need any more We need 80 of these.

David Blackmon [00:01:59] What is that? Cobalt.

Stuart Turley [00:02:01] Copper. Come in. We need 80 of those.

David Blackmon [00:02:05] At least. Yeah. I mean, S&P global put out a report two years ago saying we needed 300 of them globally. Look, there’s. we must already be. Live.

Stuart Turley [00:02:19] Oh we are. Oh my goodness! I can’t believe this. Vicki, we hear you. We see you there. That is funny. I’m over here playing these things. We don’t even know we’re live yet. I can’t believe it went live. All right, let’s get rolling here.

David Blackmon [00:02:33] Here’s RT.

Stuart Turley [00:02:34] Vicky is going to. Vicky is going to make fun of us. Oh my Goodness. .

David Blackmon [00:02:39] Well, that’s okay. We’re easy targets.

Stuart Turley [00:02:41] That’s right. Hey welcome everybody, to the Energy News Beat podcast. Oh, wait a minute. Hello, everybody. Do you ever have those three crazy uncles that just happened to be weird? And they go live and they didn’t know they went live? Well, these three guys were walking into a bar, and I happen to know the other two guys I know, David Blackmon. David, how are you today?

David Blackmon [00:03:01] Oh, I’m just lovely, man. So happy to be here. I’m happy to be anywhere. Every day I wake up.

Stuart Turley [00:03:06] There you go in RT. How are you doing today?

Rey Treviño [00:03:09] I’m doing well. I think that, if you were to ask me last year where I would be spending my Valentine’s Day, and then if you told me I would be spending it was with you two, I would be like, no, no, no.

David Blackmon [00:03:21] No, that’s.

Rey Treviño [00:03:22] No, here I am. I, three five jesters. Well, walk into a bar and live on YouTube, Twitter and LinkedIn today.

Stuart Turley [00:03:31] And, and and I’ll tell you, what’s. Kind of funny is, we were sitting here last week, guys. We were at Nape. We had the great Steve Reese. We had, so many wonderful people, all of the other, Kim and Kimberly from, Steve Reese as well. Want to give a shout out to Vicki, Dawkins. And, I mean, we had 32 podcasts that we did, guys. That was just about as nuts as it gets. Yeah. So, that’s a lot. The guys are running through those right now. Anyway, let’s get started with our stories here today. And let’s go here. David, since we’re learning how to do this. Can you see on yours how to move this one? Nice. Okay, let’s start off with you. This was your. So what? Take over targets, remain in the Permian Basin. And then we also have your other article there.

David Blackmon [00:04:34] Yeah. So I, published a piece at Forbes this morning about the big tech takeover targets left in the Permian following Diamondback Energy’s, big $29 billion merger with Endeavor Energy Resources. $26 billion buyout and $3 billion of assumed debt. You know, there’s still some plums out there. Endeavor was the big target, but but then you’ve also got newborn oil, which is a privately held family company through the, what, three generations now? I think of the the newborn family been producing in Texas for a long, long time. They’re producing more than 360,000 barrels a day out there in the Permian. So they’re a big plum for somebody. Katari Energy, which, was created in 2022, through the merger of Cimarex and Cabot Oil and Gas Company has holdings, big holdings over 300,000 barrels a day in the Permian and also major assets in the Anadarko and and, Marcellus shale basins. So they could be a big target. Oh, vintage of the company we used to know is in Cana. Another one that’s ripe for takeover, assuming management here.

Stuart Turley [00:05:51] Is that like Prince? The former artist.

David Blackmon [00:05:56] Yeah. The company formerly known as in Canada. Yes. And Ken has been through a lot of permutations, like Neil. They’ve been kind of like Chesapeake over the last ten, 12 years. They’ve remade their asset base several times over and, completely changed themselves. And they they made a big entry into the Permian a few years ago and, seemed to be in pretty good financial condition now, so might be a ripe takeover target. And then you got companies like EOG resources, huge growth independent for 30 years now. They they have 660,000 barrels a day of production in the Permian right now. Devon Energy has 478,000 barrels a day of production in the Permian. But neither of those companies, you know, they they have not their management teams have not been obviously, trying to refine their asset bases to make them prime takeover targets. They haven’t gone through the big divestiture programs you expect to see from an independent producer trying to set itself up as a target. So I just, you know, EOG and Devon are out there, but I it doesn’t feel like they’re they’re trying to be taken over, at least at this point in time. They still plan to be going concerns for a while. So, you know, there’s a lot of targets out there. Permian is going to still be active. But the really big fish who were obviously setting themselves up to be bought have now been bought. So, you know, now you’re left with some targets who may or may not want to be bought out.

Rey Treviño [00:07:33] Well, you know, I thought that was a pretty, pretty cool move. By, Diamondback. I was able to pick up, that that other company. I did have a question, David. And maybe you can explain it to me. This was a 20, basically, you know, rounded numbers here. $25 billion purchase merger. And this company was a lot bigger than pioneer as far as locations go and whatnot, if I’m correct. What made this a 25 billion versus Exxon buying pioneer for over $60 billion. What was the difference here?

David Blackmon [00:08:08] Well, actually, pioneer was substantially bigger. And and and had a lot more existing production than in Denver. But also what pioneer really had was a lot more, drilled locations, that, you know, Exxon gets to add to its inventory of future drilling locations out into the future. I mean, ExxonMobil’s now got a ten year inventory of, potential drilling opportunities in the Permian Basin. That’s a big deal. And, so that that made pioneer really attractive. The other, other part of it is that Pioneer’s assets and and ExxonMobil’s assets there in the Midland Basin, the eastern third of the Permian, were just highly contiguous to each other, their next door to each other, all over the place. And so you get these economies of scale, when you when you make an acquisition like that, where there’s that high degree of contiguous city, I think is the word they use for it.

Rey Treviño [00:09:08] Okay. Because, I mean, I do know that with this merger of, Diamondback and Endeavor, you know, they’re now basically I mean, they’re larger in some form or fashion. Is that correct?

David Blackmon [00:09:19] Well, they’re going to have that combined company. You’ll have about 815,000 barrels equivalent of production. Exxon and Pioneer’s combined company is going to have about 1.3 million barrels equivalent in the Permian. And so, you know, I think it moves. I believe Diamondback going to be the third largest producer in the basin, behind Exxon Mobil and Oxy. Once that deal closes. So it’s huge. And you know that 800, more than 800,000 barrels of oil per day, that’s more than was being produced out of the entire Permian Basin in late 2008. So, I mean, that’s how much things have changed in 15 years, because because of the ability to produce this oil out of all those shale formations.

Rey Treviño [00:10:07] Golly. That’s a that’s a real big number. That’s

David Blackmon [00:10:11] It’s a crazy Number.

Rey Treviño [00:10:11] Yeah. You know, with everything that’s going on out there, I mean, it’s really right now almost a seller’s market in a way. Would you say, David?

David Blackmon [00:10:21] Yeah. Yeah. It has been, really for the last year. That’s why it’s why Exxon and Chevron had to pay such high valuations for, for their deals with, Pioneer and Hess and, of course Hess they didn’t even have anything in the Permian. They had big back and shale assets. But the big deal there was was a 25% stake in the in the Guyana play down there. That’s going to be producing a million barrels a day here in a few years.

Stuart Turley [00:10:49] Nice. It’d be nice for your retirement.

Stuart Turley [00:10:52] Yep.

Rey Treviño [00:10:54] It’d be real. Nice.

Stuart Turley [00:10:55] What was your other, article there?

David Blackmon [00:10:57] Oh, right. Yeah. So OPEC, OPEC, secretary general made a speech, here on Tuesday in which he proclaimed, his continuing belief that demand for crude oil is going to remain strong through 2050. They are projecting OPEC is projecting global growth in demand for crude. This year will grow by 2.2 million barrels of oil per day, a slow down slightly next year to 1.87 million barrels a day of growth. And so you’re looking at 2% growth each of those years, which is pretty steady compared to the past few years. And and it just it just gives you the sense that these, these oil giants understand that even though, we’re going to have rapid growth of solar and wind and electric vehicles, probably to some extent, although the EV thing is kind of on thin ice right now. There’s going to be strong demand for oil and gas for many years to come. And coal as well. I mean, they don’t talk about coal at OPEC, obviously, but the same picture is true for coal. Yeah. And so, you know, while we, you know, all the hype at the legacy media outlets is about the renewables and the electric vehicles, the reality is we’re going to be needing a lot more of all of it, because demand for energy just is growing exponentially every day.

Stuart Turley [00:12:31] All forms of energy.

David Blackmon [00:12:33] Yep.

Stuart Turley [00:12:34] Only if they’re sustainable without printing money.

David Blackmon [00:12:37] Yeah. Well, I mean, and that doesn’t include any of the renewables, obviously.

Rey Treviño [00:12:45] Well, you know. That article I read, you know, just really shows how important Saudi Arabia is not only to OPEC and more importantly, not how important they are, how much influence they have, not necessarily with just OPEC, but with throughout the world with everything going on. You know, it’ll be really interesting to see how this continues to go. Especially like you’re saying, with the way people are saying, you know, we’re transitioning, we’re doing this. It’s like we’re not guys, we may be earning more. I mean, look, here in Texas, you know, last week when we were at night, and they had that, governor speaking, you know, here in Texas, we are leading the world in, solar and wind, let alone also in oil and gas to some degree. I would like to say, but yet look what’s still making look what’s still making the world move every day. And that’s oil and gas. So until we have another form of energy that can make the world move the way oil and gas does. I don’t see wind and solar really being a thing of any substance moving forward. Unless, like you said, printing money by printing money. I take that as subsidies. So whenever I hear somebody telling me that it’s a great investment in solar and wind, I’m like, so basically you’re taking money from the taxpayer just to pay yourself a return on your investment. That’s not the way I’ve ever done business. And, you know. But good for those that do do that on a daily basis.

Stuart Turley [00:14:10] Hey, we got a great, comment from Vickie. Does, Dawkins.

David Blackmon [00:14:15] Hey, actually, I was going to raise this myself, so. All right.

Stuart Turley [00:14:18] Isn’t that great, Vickie?

David Blackmon [00:14:19] Yeah. Yeah. No, that’s a good comment. You know, what Saudi Arabia did was they had, about two years ago, told Saudi Aramco’s management to try to, to make plans to increase the national production by an additional million barrels of oil a day. So right now, their capacity is 12 million barrels a day, but they’re only producing about seven and a half to 8 million every day because of all the cuts, in in supply that have been made in cooperation with OPEC plus, Saudi Arabia, told Aramco two weeks ago, the government told Aramco to cancel the plans to expand their, their existing or their excess production, their reserve capacity, for now and to delay it out at least a couple of years into the future because looking out over it, what’s the what’s motivating that? Well, what’s motivating that is what’s happening in the United States. We we we produced our own, or we increased our own national production in the US last year by a million barrels a day. Unexpectedly. No one expected that at the first of 2023. You know, I thought we might might add another 300,000 barrels a day, but we added a million. And then you have Guyana growing so rapidly in the offshore West Africa growing so rapidly. Again, surprising all the quote experts out there. Yeah. And so Saudi Arabia is looking out over the landscape. And they do this periodically and saying, well you know what. Let’s leave that in the ground for now. We can save that for future years when we need it. And I don’t think I think it’s been misinterpreted what they did by the media, as some sort of retreat. Saudi Arabia’s not retreating on oil.

Rey Treviño [00:16:14] You know. Would you say that they’re doing what we used to do with what you just said right there, which was actually by turning it around, you know.

Stuart Turley [00:16:24] I thought you’re being Hawaiian there for a second there.

Rey Treviño [00:16:27] Which is, you know what? Let them produce all the extra oil they want. It will save us for another,.

[00:16:32] Right. Yeah

Rey Treviño [00:16:33] You know, it’s just it’s just such an interesting time. And we’ve said it on here before in, on other shows, which is, it’s such an upside down world. I mean, today as we’re live, you know, oil’s gone up almost 6 or $7 in the last 24 hours. And what I’m hearing is that, we’re filling up capacity again right now, but yet oil prices are going up. I don’t heard anything about that. David or Stu.

David Blackmon [00:16:56] Yeah, the government’s making a move to add some more barrels back into the petroleum reserve here in the US and also in China and India. So? So countries are beginning to refill their reserves now. And yeah, I’m glad we’re doing it in the United States. Because it countries. Dangerously.

Stuart Turley [00:17:16] US.

David Blackmon [00:17:17] Yes, countries other than the US.

Stuart Turley [00:17:19] I just thought I’d check.

David Blackmon [00:17:21] Have been doing that too. And so. You know, if you take that. So why do you have the reserve? It’s for national security. It’s for times of war. You want to have a big reserve of oil For times of war. And the fact that not just the United States, but these other countries are also doing it. You know, it’s it’s it makes me a little nervous about what they see coming in terms of conflicts in the future.

Rey Treviño [00:17:53] That that it really does. I mean, India maybe not as much, but the fact that China is now filling up their reserves right now. And that was, you know, very interesting. That one definitely raises the eyebrow of what’s going to happen, what’s going on with Taiwan and so on and so forth.

David Blackmon [00:18:08] Yeah.

Stuart Turley [00:18:09] All right, RT, you got a couple of them here. This one went out on your Substack. They’re visualizing the rise of U.S. as top crude oil producer. I thought this was just an amazing.

Rey Treviño [00:18:21] You know, I thought so, too. And as an oil and gas producer, I’m just thinking to myself, how many of us that drill oil wells for a living have always visualized? You know, that we want to be the top producing company, and I want to be higher than Exxon. I want to be I want to use the biggest and the baddest. But whoever visualized that America could actually be the top crude oil producer in the world,

Stuart Turley [00:18:48] You know. Yeah. I was sitting there looking at that chart and it says, 11.9 million for a podcast listeners, the U.S. at 11.9. I didn’t mean to interrupt, but, Saudi Arabia at 10.6, Russia at 10.3 million barrels per day, Canada drops down to 4.5. Iraq is at 4.5. China is at 4.1 million. UAE is 3.5 million. Iran is at 3.3 million. It’s actually, I think, a little higher than that. And then Brazil’s at 3 million and Kuwait is at 2.8 million.

Rey Treviño [00:19:28] Yeah. Mean, it’s just awesome to see where we’re at. And here I am just talking about how the price has gone up of West Texan intermediary in the last 24 hours. However, it’s because of this production that we’ve had here in America that we’ve been able to fight the higher prices. I do believe, with the amount of output that we have. So if we were below Russia right now, you know, if we were third in line, I think we would easily see a $15 increase right now in the price of oil. So technically, the United States and more importantly, I’ll say Texas, we’re fighting against the price of high oil right now just by continuing to produce all that we’re producing right now here in America. And I think that’s great. Where we need to go as a, as a producer is we need to see those service companies. Now, come on and be patriotic, and let’s figure out a way that we can drill some more wells at an affordable rate so that we can only, be able to replace all this oil that we’re producing right now. Because what I’m afraid of is here in about 6 to 8 months, when we finally start to realize and, oh, dang, we’re producing way more than we’re, you know, creating that, that’s when the price will then start to hike up, and I think it’ll have come quick. So that’s just kind of what I thought. But no, this was just a great article to really show individuals in America that, hey, you want the gas industry? Right now we are fighting high oil prices the best we can by producing as much as we can in America.

Stuart Turley [00:20:57] Oh. You bet. A rolling over here. There’s a couple articles that I had to pick out here. Uncertain global economic recovery looms over copper. Let me, go over this one here for a little bit. This article was amazing, guys, because it said China. It had a couple pieces in it. China’s recovery is still uncertain. You know, I got another note from someone else saying that there are, tens of thousands of people that have been committing suicide in China because of their economic failure. I’m like, Holy smoke. So their recovery is kind of questionable that people are committing suicide. So, but let’s they need 80 of this. Let me go ahead and share this, video here. This is 80 of these.

Stuart Turley [00:21:54] Look at this thing.

David Blackmon [00:21:56] Love the commentary.

Stuart Turley [00:21:59] And. Well, man. Like. Whoa, dude.

David Blackmon [00:22:03] Looks like the grand Copper Canyon.

Stuart Turley [00:22:06] And. And so if we need 80 of these things. Look at this.

Rey Treviño [00:22:10] Yeah, you’re absolutely right, David. It makes Earthmovers look like. Yeah, this thing is.

David Blackmon [00:22:16] You know what’s so interesting? These trucks you’re seeing that look like little ants. Yeah, they’re as big as your house, folks. They’re they’re gigantic. The big the tires on those things are, like, 30ft high.

Rey Treviño [00:22:28] Yeah. Exactly.

David Blackmon [00:22:29] Believable.

Stuart Turley [00:22:30] And so when you take a look also on this, the China’s, slump property market remains headwind to copper demand. So if you take a look at their housing and you take a look at most of their economy. The, the green, New Deal folks are wanting to say, hey, we gotta roll down this. You need 80 of these copper mines to make their goals. There’s 12 other minerals that are. Holy smoke, Batman, we’re going to need. It’s not going to happen. Yeah. I mean, yeah.

Stuart Turley [00:23:07] I.

David Blackmon [00:23:07] Don’t the main limiter to all this. Yeah, it’s it’s a real problem. And and you know, governments there are governments are, you know, making some efforts to try to figure out how to, how to get all these mineral minerals out of the earth. But, you know, the same people that are pushing the the energy transition are the ones that are going to protest every one of these mines that gets proposed and hold them up for years.

Stuart Turley [00:23:36] So Nimby is a thing, Not my backyard.

David Blackmon [00:23:39] Yeah, and it’s even more than Nimby. It’s. It’s banana. It’s build absolutely nothing, anywhere, at any time.

Stuart Turley [00:23:46] Banana. Banana. Banana banana. Yeah. Okay.

Rey Treviño [00:23:52] We’re at no time.

Stuart Turley [00:23:54] You know. Yeah. Okay. Let me go to, scraping Russian, gas deal would cause prices to explode. Austrian, minister there. Hey, I want to also kind of say their. This article is pretty cool. Austria’s plan to end a long term contract for Russian gas would cause energy prices to explode. Let’s go in here, quote unquote, from, guess whatever. The market in the energy companies that are part of the, are fulfilling their responsibility to reduce the dependency on Russian gas efficiently. The minister said we must prepare to exit OMV long term contracts. Here’s. And I want to ask your guys’s opinion. In my opinion, I think you’re going to see the Ukraine war, which is not on this article, but I think Tucker’s, interview is going to have a longer with Putin, a longer impact. I think we’re going to see the end of the Ukraine war, because it came out that Boris came out with his hair on fire, Biden admitted. You know, the administration asked him to go stop the deal that they had. They’ve had like what? I think, David, eight deals or something like that.

Rey Treviño [00:25:12] I want to jump in. In here. Okay. Right. Let’s let’s talk about this and let’s talk real. Let’s talk let’s talk Turkey.

Stuart Turley [00:25:22] Okay. Turkey.

Rey Treviño [00:25:25] Let me say that again. Russia does not like America. The Russians don’t care about America at all are Americans. But Putin is a KGB man. He wants the USSR back put together. He wants that band back together. So what is wrong with us continuing to surround them rather than him surround us? Let’s let’s talk about that. Let’s not get into his hole that.

Stuart Turley [00:25:54] I’m in.

Rey Treviño [00:25:55] This. That. No.

Stuart Turley [00:25:58] No, no, hang on, hang on. Let’s talk about this. Absolutely.

Rey Treviño [00:26:04] And that Tucker was able to get the truth.

Stuart Turley [00:26:06] Yep.

Rey Treviño [00:26:08] However. I want a freaking wall around Russia. No different than I want a wall around Texas.

Stuart Turley [00:26:16] Okay. I, I think it’s a great conversation already, but let’s ask this question. Why is it that Putin has spent billions on the church and and Tucker was putting out there that that you can actually go through the subways without being raped in Russia, in every blue state, every blue city is, death before dishonor, and you’re getting raped in all the subways.

Rey Treviño [00:26:44] So what I heard you say that you would rather live in Russia than in America.

Rey Treviño [00:26:49] Is that what I. you say? You feel more safer in Russia?

Stuart Turley [00:26:51] That. Yes, it’s coming to that.

Rey Treviño [00:26:54] Okay. That’s not what I heard you say.

Stuart Turley [00:26:59] That’s a crude truth, baby. Now it’s because what is missing and this is a whole different discussion. This is. I need a I need I need a beer. Not just a root beer, but a beer. And that is when you sit back. And for folks that know me, I haven’t drank in 30 years. But when we sit back and take a look at this, I’m about to. When we talk about, I think that there is Tucker has exposed. And my point is that the Biden administration shut down the war from being solved two months into it, that Biden administration in the UK.

Rey Treviño [00:27:39] Two weeks. Two months. Weeks and weeks. Yes.

Stuart Turley [00:27:42] Millions of people are dead because of this administration, because of the UK administration. Was it because Putin invaded in? I don’t know, the man is a KGB dude. I would love to have interviewed him, but I’d be scared out of my gourd that I’d never be leaving Russia because they’d probably haul my buddy in, you know, who knows what it is. But I tell you what, you feel safer in Russia than you do in the U.S. because the elimination of the family, the planned elimination of the family that has been planned for years. Men are no longer men in the family. They’re wearing dresses. Men are not leading the families. There is, minority on minority. Is the leading killer of people in the U.S. and that is minority on minority. And that is despicable because it is the religion. It’s the man out of the households and it’s destroying the house. What is growing in Russia? Those are growing.

David Blackmon [00:28:58] I’ve never been to Russia. I know who you are.

Rey Treviño [00:29:00] Yeah. You know, my my my, my grandfather went to Russia many, many years.

David Blackmon [00:29:04] What I know, here’s what I know about it. We’re $34 trillion in debt. We’re paying $1 trillion in interest on that debt this year. And our Congress just, our Senate just voted 70 to 29 to print another $96 billion, 60 billion of which is going to go to Ukraine. And none, not a single one of those senators can tell me why there’s $60 billion going to Ukraine is going to be any more effective than the 120 billion we’ve already sent over there and and beating Putin, and is going to win that war unless we put our military and our sons and daughters on the ground there to fight and die, because Russia has an overwhelming advantage in total national resources to Ukraine. And eventually, eventually, our country and our people are going to get tired of funding that war, just like we did in Vietnam, just like we did in Afghanistan, just like we did in Iraq. How many forever wars do we have to lose in this country before we learn a lesson?

Rey Treviño [00:30:13] Well.

David Blackmon [00:30:15] I don’t want. My grandkids.

Stuart Turley [00:30:17] In RT. I want to come back on your command of. You want to encircle, natural gas, and you want to cut off all resources for Russia to make money off of their exports, of their energy. And you’re sitting there saying that now, here’s what the U.S. has been trying to do for all of these years RT, and it’s still going on. Let’s take a look at the weaponization of the sanctions that the United States has done. We have weaponized the U.S. dollar. We’re about to take the U.S down financially from printing the money for the Green New Deal. We’re also printing the money for the sanctions that we are imposing on folks. But let’s take a look at Iran. Iran is at 3.2 3.3 million barrels per day. Under Trump, it was 400,000. They have had over $80 billion on the way north to $100 billion thanks to this administration.

Rey Treviño [00:31:22] No, this administration, y’all, has has been the biggest joke I’ve ever seen in my life. Whoever’s running the the whoever is running this administration is does not know what they’re doing, and they’re just playing with everybody. Then you get back to the Ukrainians. And when I have a President Zelensky. Thinking. On Twitter, the senators for passing that bill, if that doesn’t raise your eyebrow going, what’s going on? Why are we thanking them? That really worries me after we’ve already sent them hundreds of billions of dollars. So, you know, there’s a lot of things that are going on when I’m trying to get out here is I would much rather I’m proud to be an American. I’d much rather live in America than in Russia. And if you take anything that Putin says as truth, then good for you, because I’m going to take everything he says with a grain of salt.

Stuart Turley [00:32:17] I agree. So but here’s what I would like to do. I want to know what’s in that folder that Putin gave to Tucker. How much documentation that he has on our compromised administration. I want to know what was in that folder.

Rey Treviño [00:32:35] Who knows? Who knows? We it was almost like those little envelopes that everybody got when, former President Bush passed away. What was in the envelope? We’ll never know.

Stuart Turley [00:32:46] It was a note from George himself.

Rey Treviño [00:32:48] There you go. He did like to to everybody.

David Blackmon [00:32:53] He did say, we’ve got a very long comment here. From Mark Salazar, Centella.

Stuart Turley [00:33:01] Hello, Akbar. How are you today? Let’s see what we got.

David Blackmon [00:33:06] Treaties are obligatory between our counterparts, only to hear.

Stuart Turley [00:33:12] How do you stem three podcasters? You actually ask an intelligent question.

David Blackmon [00:33:16] Yes, this is an intelligent question. I don’t know the answer. The New Economic Order could accelerate the conditions of the search for general normative criteria for nations. This in turn being a new global economic order. Well, sure. Yeah. Well. Yeah, I, I’m kind of like RT on this one. I enjoy being an American rather than a global.

Stuart Turley [00:33:39] I’m a I’m an American. Two guys don’t take my comments that. I’m not that I’m. Not American. I am American, but I am disappointed in America right now.

David Blackmon [00:33:51] Well, there’s there’s no doubt that, our society is is being taken.

Rey Treviño [00:33:57] No, this whole thing, I mean, you.

David Blackmon [00:33:58] Had directions.

Rey Treviño [00:34:00] You read Stanley. You know Ridge’s book? You know, talking about how the colleges have indoctrinate, I get it, I see it, in the way that the man has been taken out of the family here in America. I mean, you know, and so quickly, too, you know, you watch those old school Robert Mitchum John Wayne movies. You know, where they may have a father son type of dynamic, that that went away so quickly. And that’s what’s really scary, is how fast we were able to erode the American family, because what happened to the American dream to the 1950s were you did own a home. You had two cars. You know, you lived on one income. And, you know, you had 2.3 kids. What what happened to that?

Stuart Turley [00:34:45] Well, this past month, we had more illegal, invasion. I mean, migrants come in than we had births. So, we are being replaced. If there’s any other question on that will probably be canceled on YouTube this afternoon. Counting one, two.

Rey Treviño [00:35:03] Oh, we are on Youtube right now.

Stuart Turley [00:35:05] We are on YouTube right now.

David Blackmon [00:35:06] I feel like much longer.

Stuart Turley [00:35:08] Not much longer.

Rey Treviño [00:35:11] I feel a little commercial. Do you know how to post videos on YouTube. Right there, you know?

Stuart Turley [00:35:15] Yeah. Where’s the beef? Okay, let’s go to this last one here. I got a and as Vicki was listening here early, this is actually Secretary Granholm, and we’ve got a meeting of the Energy Department going on here. Okay. You ready?

Stuart Turley [00:35:38] An unbelievable meeting going on right, About. I bet that guy Peterson. Got out of that engine has yet to go.

David Blackmon [00:35:49] It ain’t working.

Stuart Turley [00:35:51] No. And the guy on a motorcycle got. Look a Okay, that’s a distraction. We’re going to do more. Hey, dude, you’re alright?. All right. You got to let it go. I’m sorry. Hey, if there are any more questions or anything else, let’s.

David Blackmon [00:36:22] Oh, my. Goodness,

Stuart Turley [00:36:23] Fun. That was Secretary Granholm running a meeting.

Rey Treviño [00:36:27] Man, I thought you were. You know, I had a I had a presentation due yesterday with the team there at TCU. And, you know, we were talking about, just the Department of Energy and how much of a joke because, I believe it was Jimmy Carter that created the Department of Energy.

Stuart Turley [00:36:41] Yes, it.

Rey Treviño [00:36:43] And, you know, and then I turned around and I told my group, I said, look, when you have Rick Perry, who I like the great things in the great state of Texas when he’s been one of the best secretary of Energy’s we’ve had, what’s the point of the whole department? I mean. You know, you know,

David Blackmon [00:37:00] well. Now we have Jennifer Granholm. So we’ve really upgraded the position. By the way, folks. Well, let’s don’t go there. We can talk about next. Oh, yeah. God bless her. She’s doing best, I guess.

Stuart Turley [00:37:16] Okay.

Rey Treviño [00:37:16] But anyway, they are also impeach my orchids yesterday. Speaking of the. Water. You think the. Senate will do it?

David Blackmon [00:37:24] Oh, no. The Senate won’t even take it up.

Stuart Turley [00:37:26] This is, this is another one.

David Blackmon [00:37:29] That’s really the Rolling Stones. It looks like. No it isn’t. It’s just some guys, some kind of look like.

David Blackmon [00:37:55] to do with the big ears? Looks a lot like, what’s his name? The guitarist. And the guy behind him looks a lot like the other guy. Mick. What’s his name?

Stuart Turley [00:38:04] Yeah. Anyway, I thought that was pretty cool. Hey, guys, what do we have coming around the corner for y’all this next week?

David Blackmon [00:38:10] I don’t know, I hope it’s not any more videos like that one.

Rey Treviño [00:38:13] Yeah, I’m kind of hoping as long as if I don’t see any more videos. Like that one. We need to do, sir. Who’s speaking out some of these videos here as we go live

Stuart Turley [00:38:25] Then from now on, you guys may pick the video. And the funny thing, all.

David Blackmon [00:38:33] I know is we are persona non grata in the halls of the Energy department as of right now.

Rey Treviño [00:38:39] Yeah, we are.

David Blackmon [00:38:39] Already were anyway.

Stuart Turley [00:38:41] Well, yeah. What what what what.

David Blackmon [00:38:45] Persona non grata in the halls of the energy. No one’s ever going to invite us to a meeting at the D.o.e..

Stuart Turley [00:38:53] Oh, no. RT and I are out in the middle of the field pumping oil, going. What? What the heck?

Rey Treviño [00:39:02] Well, I will say this was coming around the corner. I am excited about the 32 interviews that we were able to do combined while we were there at that NAPE Expo. It was great. From Steve Reese to Jay Young to Rep Bennett to George P Bush to Keith Stelter, Brian, Stubb’s Jim Holmes, goodness gracious. Just so many.

David Blackmon [00:39:26] months.

Rey Treviño [00:39:27] And months. Thank you.

Stuart Turley [00:39:28] Doomberg.

Rey Treviño [00:39:29] Doomberg. That was huge

David Blackmon [00:39:31] Daniel Yergin?

Rey Treviño [00:39:31] Yes. Yeah. I didn’t know that. Dan Yergin on that one

David Blackmon [00:39:35] remotely. Yeah, yeah, I wasn’t able to be there. Robert Bryce.

Stuart Turley [00:39:39] Dittmar.

David Blackmon [00:39:41] Dittmar? Yes, sir. The, M&A guru at embarrass.

Stuart Turley [00:39:45] Yeah, he was a lot of fun.

Rey Treviño [00:39:48] No matter who knows.

Stuart Turley [00:39:50] And the batteries ran out of the recorder at right in about two minutes left to go in the interview. So I got to cut a. Oh, by the way, we’re idiots in producing this one.

David Blackmon [00:40:04] Oh, well, stuff happens with.

Stuart Turley [00:40:06] RT? How do people find you?

Rey Treviño [00:40:07] Oh, yeah. No. Definitely. Please reach out. You know, you can reach me at, you know, on LinkedIn, YouTube. The Crude truth.com. Thank you, as always in this live thing. It was a little different for me today. I don’t know how I feel. I’ve kind of felt like. I don’t know what. I know what to do with my hands.

Stuart Turley [00:40:23] I like it when both of your hairs went up. Dude, you came at me, like, saying, hey. Don’t you talk bad. About the USA.

Rey Treviño [00:40:30] You know, believe me, there’s certain things in the world that are tough to stomach. And, for me to sit there and stomach Biden in the not. Yeah, it’s it’s tough, but yeah.

Stuart Turley [00:40:42] It was. Dude. It is. I’m disgusted that I have to say that the you don’t have to get raped on I mean, that’s other people’s word, not mine.

David Blackmon [00:40:53] No, you realize you say that word automatically. YouTube takes you down. You can’t say that word. You can’t say Nazi. You can’t say Hitler. You can’t say you’re.

Stuart Turley [00:41:04] Bringing all. The other word that.

David Blackmon [00:41:06] Will get. Yeah, I’m just going to throw them all out there and.

Rey Treviño [00:41:10] We’re done as it is. Yeah. Can you say oil and gas?

Stuart Turley [00:41:13] No.

David Blackmon [00:41:14] I don’t even know, man.

Stuart Turley [00:41:15] I mean, we’re being on that one. We’re going to find out that we won’t. Be alive anymore.

Rey Treviño [00:41:20] Yeah, we’ll find out.

Stuart Turley [00:41:22] All right, David, out if people find you.

David Blackmon [00:41:25] I don’t know, man. I may be banned from everywhere after this. Substack, Blackmon. Substack.com. You just find me there, and you’ll find everything else.

Stuart Turley [00:41:35] Oh, we got an a. Vickie, we love you. And.

Rey Treviño [00:41:38] Thank you, Vickie.

Stuart Turley [00:41:40] Thank you very much.

David Blackmon [00:41:41] Akbar

Rey Treviño [00:41:42] Yeah. Thank you. Akbar.

Stuart Turley [00:41:44] Yep. Akbar. We do appreciate everybody. Thank you again. That was a great question. And anyway with that, thank you to everybody. And next time we’ll have actually funny videos that we’ll see you guys later.