Recent Rebound in Russian Crude Shipments

Russia’s seaborne crude oil exports have climbed to their highest levels in nearly a month, averaging 3.23 million barrels per day (bpd) in the four weeks ending July 13, 2025.

This represents a 3% increase from the prior period and coincides with a significant reduction in domestic refinery runs, allowing more crude to flow into international markets. Notably, shipments from Russia’s Baltic ports reached their peak in almost 10 months, underscoring a strategic push to maximize exports ahead of potential disruptions. This uptick comes at a critical juncture, as global oil prices hover around $69 per barrel for Brent crude, influenced by broader market dynamics including Trump’s recent statements on Russia.

Analysts attribute the rebound to seasonal factors and opportunistic sales, particularly to buyers in Asia who continue to purchase discounted Russian oil despite existing Western sanctions.

Trump’s Sanctions Ultimatum and Its Immediate Context

President Trump has escalated pressure on Russia by threatening 100% secondary tariffs if the Russia-Ukraine war does not conclude within 50 days, setting a deadline around early September 2025.

These secondary tariffs would not only target Russia directly but also penalize third-party countries, such as China and India, that enable Moscow to circumvent sanctions by importing Russian energy above the G7’s $60-per-barrel price cap on oil. The move is framed as support for Ukraine, with Europe expected to shoulder additional costs for arming Kyiv. The threat has already rippled through energy markets, contributing to slight fluctuations in oil prices as traders assess the likelihood of enforcement.

If implemented, these tariffs could disrupt an estimated 1.5 to 2 million bpd of Russian oil supply, potentially driving Brent crude prices to $90–$100 per barrel by mid-2025.

This scenario is compounded by other policy shifts, including the European Union’s ban on transshipments of Russian LNG starting in March 2025 and reinstated U.S. tariffs on Venezuelan oil in April 2025, which could further tighten global supply and elevate costs for consumers worldwide. Politically, the tariffs pose risks for Trump, as higher oil prices might hinder U.S. economic recovery and fuel inflation, potentially affecting midterm elections and control of Congress.

Energy stakeholders are bracing for volatility, questioning whether the ultimatum will compel Russia to negotiate or instead solidify higher prices and entrenched geopolitical tensions.

Projections for Russian Oil Exports in 2025

Looking ahead to 2025, Russia’s crude oil production is forecasted to stabilize around 10.04 million bpd under the government’s baseline scenario, with potential for slight variations based on global demand and sanctions enforcement.

Export estimates have been revised downward, with total oil exports projected at 229.7 million tonnes for the year—equivalent to approximately 4.6 million bpd—reflecting a reduction of about 4 million tonnes from earlier forecasts due to falling prices and market pressures.

Recent monthly data paints a mixed picture: Seaborne oil exports fell 7% month-on-month in May 2025, with roughly half transported on tankers from G7+ countries, highlighting ongoing reliance on Western infrastructure despite sanctions.

By June, fossil fuel export revenues rose 4% to €593 million per day, driven partly by oil, but overall, Russian crude and product exports dipped to 7.3 million bpd.

If Trump’s secondary tariffs materialize, these figures could plummet, exacerbating revenue shortfalls already projected under scenarios where average export prices drop to $55 per barrel.

The International Energy Agency (IEA) anticipates global oil supply growth of 2.1 million bpd in 2025, but demand growth is slated at a modest 700,000 bpd—the lowest since 2009 outside of the COVID-19 period—potentially limiting Russia’s export opportunities.

In a sanctions-intensified environment, Russia’s strategy may shift toward domestic consumption or alternative markets, though disruptions could still push prices higher, as evidenced by Goldman Sachs’ revised Brent forecast of $66 per barrel for the second half of 2025.

Implications for Russian LNG Exports in 2025

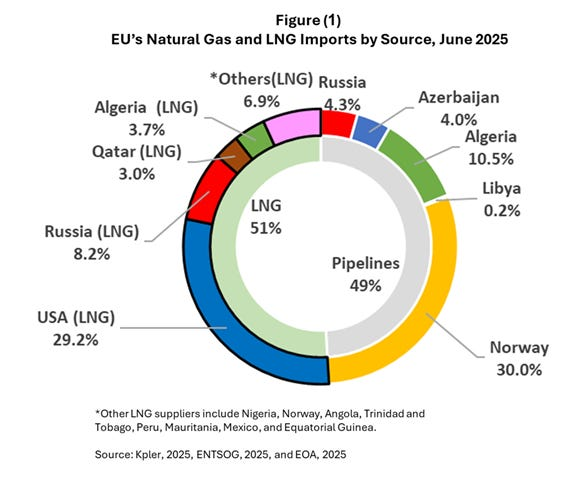

Russia’s LNG sector faces similar headwinds, with exports declining 4.4% year-on-year in the first half of 2025, totaling lower volumes to Europe (down 13% to 7.9 million tonnes) amid shifting trade patterns.

Efforts to expand capacity, such as the Arctic LNG 2 project, remain stalled by U.S. sanctions, with the IEA excluding it from firm supply forecasts due to the restrictive environment.

Only limited additions, like the first phase of the Ust-Luga project, are expected online by year’s end.

Projections indicate a pivot toward Asia, with China set to increase imports of Russian LNG in 2025, building on a 3.3% rise in 2024.

However, overall growth may be muted: The IEA forecasts global LNG supply increases partially offset by reduced Russian piped gas to Europe, while Europe’s LNG demand is expected to peak in 2025 before declining through 2030.

Russian piped supplies to the EU are limited, and an uptick in LNG imports to Europe (averaging 74.3 million cubic meters per day early in 2025) could reverse if secondary tariffs extend to gas.

New projects could theoretically add up to 80 billion cubic meters per year (bcm/y) of capacity atop the existing 41 bcm/y, but sanctions and tanker shortages may cap actual exports.

The EU’s March 2025 transshipment ban will further constrain flows, potentially benefiting U.S. LNG exporters but at the cost of higher global

If Trump’s 50-day deadline passes without resolution, LNG could face similar disruptions as oil, reducing Russia’s revenues and reshaping trade routes.