In a bold push to bolster domestic energy production, the Trump administration has advanced plans to open approximately 82% of the National Petroleum Reserve-Alaska (NPR-A) to oil and gas leasing. This move, announced in June 2025, reverses restrictions imposed by the previous Biden administration and aims to unlock vast untapped resources in one of the world’s most promising oil frontiers. The NPR-A, a 23-million-acre expanse on Alaska’s North Slope, was originally designated in 1923 as a strategic oil reserve for the U.S. Navy. Today, it represents a critical opportunity to enhance U.S. energy independence amid fluctuating global markets.

This decision has sparked debate, with proponents highlighting economic benefits and job creation, while critics raise concerns about environmental impacts on Arctic wildlife and Indigenous communities.

For the energy sector, however, it signals potential growth, with implications for companies, investors, and oil supply chains.

Background on the NPR-A

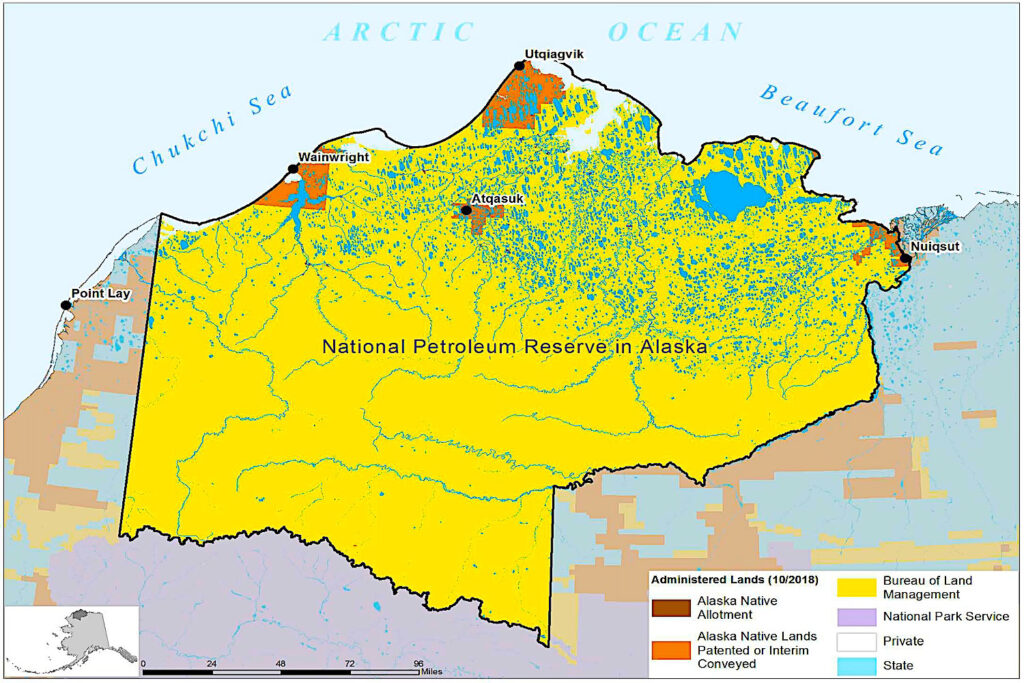

The NPR-A spans roughly 23 million acres and is managed by the Bureau of Land Management (BLM). It has long been eyed for its hydrocarbon potential, with early explorations dating back to the mid-20th century. During Trump’s first term, the administration opened over 80% of the reserve to leasing in 2020, but the Biden administration finalized protections in 2024 that restricted development on about 13 million acres, creating a presumption against new oil and gas activities in sensitive areas like Teshekpuk Lake.

The current proposal, detailed in a June 17, 2025, announcement by the Department of the Interior, seeks to rescind those 2024 rules and allow leasing across 18.6 million acres—effectively 82% of the reserve.

This includes reopening areas around Teshekpuk Lake, a vital habitat for caribou and migratory birds.

The plan aligns with broader Trump-era policies to expand Arctic resource extraction, as outlined in a January 2025 executive action emphasizing Alaska’s untapped energy potential.

Timelines for Development

The path from policy announcement to oil flowing through pipelines is lengthy, involving regulatory reviews, leasing, exploration, and infrastructure buildout. Here’s a breakdown of key timelines based on historical precedents and current projections:

Regulatory Finalization (2025-2026): The proposal was issued on June 17, 2025, with a public comment period likely extending into late 2025. Finalization could occur by early 2026, pending environmental impact statements and legal challenges.

Leasing Sales (2026-2027): Once approved, the BLM could hold lease sales as early as mid-2026. The agency has indicated a focus on expediting this process, similar to the 2020 sales under the first Trump administration.

Exploration Phase (2027-2030): Successful bidders would conduct seismic surveys and exploratory drilling. This stage typically takes 2-4 years, as seen with projects like Willow, where exploration began in the late 2010s following earlier leases.

Production Ramp-Up (2030+): Full-scale development and production could start 5-10 years after leasing, accounting for permitting, infrastructure (e.g., roads, pipelines), and environmental reviews. For context, the Willow project, approved in 2023, is slated for first oil in 2029—about 6 years post-approval.

Analysts estimate that new NPR-A fields could contribute meaningfully to output by the mid-2030s, potentially doubling Alaska’s current oil production of around 500,000 barrels per day (bpd).

Delays could arise from lawsuits by environmental groups or Indigenous stakeholders, as evidenced by ongoing challenges to Willow.

Companies Poised to Benefit

Several oil majors and independents with established footprints in Alaska are well-positioned to capitalize on expanded NPR-A access. These firms hold existing leases or have expressed interest in further exploration:

ConocoPhillips (COP): The dominant player in the NPR-A, ConocoPhillips is developing the Willow project, which could produce up to 180,000 bpd at peak. The company announced plans in July 2025 for significant winter exploration in the reserve, leveraging its infrastructure on the North Slope.

Expanded leasing could add to its portfolio, which already includes major holdings in the area.

Hilcorp Energy: As Alaska’s largest private oil producer, Hilcorp operates fields adjacent to the NPR-A and could bid on new leases to expand its North Slope operations.

88 Energy (Australian firm): This smaller explorer has permits for drilling in the NPR-A and could accelerate projects under the new regime.

Other Potential Entrants: Majors like ExxonMobil and Chevron, with historical interests in Alaska, may re-enter through joint ventures. The Alaska Oil & Gas Association notes increasing interest from firms eyeing the NPR-A’s untapped potential.

These companies benefit from proximity to existing infrastructure, such as the Trans-Alaska Pipeline System, reducing development costs.

Investor Outlook: Potential Oil Volumes and Timelines

For investors, the NPR-A opening presents opportunities in energy stocks, particularly those with Alaska exposure. However, returns will materialize over medium to long terms due to development timelines.Estimated Oil Volumes: The U.S. Geological Survey (USGS) conservatively estimates 2.7 billion barrels of technically recoverable oil in the NPR-A, with up to 114 trillion cubic feet of natural gas.

Broader assessments suggest mean undiscovered resources could reach 10 billion barrels or more, depending on exploration success.

At peak, new developments could add 200,000-500,000 bpd to U.S. supply, helping offset declines in mature fields like Prudhoe Bay.

|

Metric

|

Estimate

|

Source Notes

|

|---|---|---|

|

Total Recoverable Oil

|

2.7-10 billion barrels

|

USGS and broader appraisals

|

|

Peak Daily Production Potential

|

200,000-500,000 bpd

|

Based on Willow-scale projects scaled up

|

|

Natural Gas

|

114 trillion cubic feet

|

USGS estimates

|

Investment Timelines and Strategies: Short-term (2025-2026): Monitor stock reactions to leasing announcements; ConocoPhillips shares could see uplifts from exploration news. Medium-term (2027-2030): Focus on exploration results, which could drive valuations higher if discoveries exceed expectations. Long-term (2030+): Production phases offer steady revenue growth, with dividends from majors like COP appealing to income-focused investors.

Investors should watch for risks, including oil price volatility, regulatory reversals, and climate-related pressures. Diversifying into ETFs like the VanEck Oil Services ETF (OIH) or direct holdings in Alaska-focused firms could provide exposure. Overall, this move underscores Alaska’s role in U.S. energy security, with substantial upside for patient capital.

Stay tuned to Energy News Beat for updates on this developing story.