As we kick off 2026, the global oil landscape is a whirlwind of geopolitical maneuvers, supply gluts, and shifting alliances. With Brent crude hovering around $59 per barrel and a projected surplus of 1-3.8 million barrels per day (mbpd) looming large, markets are bracing for volatility. Non-OPEC production surges, OPEC+ unwinding voluntary cuts, and fresh supplies from sanctioned nations like Venezuela and Iran are reshaping dynamics.

Meanwhile, protests in Iran and U.S. interventions in Venezuela add layers of uncertainty. For U.S. shale producers, this could mean tougher times ahead, while opportunities beckon for American firms eyeing Guyana and a post-Maduro Venezuela. Let’s dive into the real-time shifts, drawing from recent developments in Iranian discounts, Venezuelan oil flows, and broader market pressures.

The Venezuelan Oil Revival: A Game-Changer for Global Supply

The U.S. military operation on January 3, 2026, which led to the capture of Venezuelan President Nicolás Maduro, has thrust Venezuela’s vast reserves—estimated at over 300 billion barrels—back into the spotlight. Commodity giants Vitol and Trafigura are already in talks to offload 30-50 million barrels of stored Venezuelan crude to Asian buyers, primarily in India and China, at discounts of $8-8.50 per barrel below ICE Brent for March deliveries.

This marks a pivot from shadowy, sanctioned trades to U.S.-approved legitimate flows, potentially injecting billions into the market and reshaping supply chains.

Historically, Venezuelan heavy crude has been a staple for Chinese “teapot” refiners, averaging 0.47 mbpd imports to China and 0.15 mbpd to India in 2025.

Narrower discounts could squeeze refining margins, pushing buyers toward alternatives like Russian or Iranian oil. For the global market, this influx exacerbates the 2026 surplus, with analysts forecasting Brent prices in the $54-62 range and WTI around $48-62.

U.S. refiners stand to gain quick access to these barrels, but the broader effect is downward pressure on prices amid already high inventories in China and record U.S. production.

Restoring Venezuela’s output to pre-sanction levels (around 2-3 mbpd) could take $183 billion and over a decade, but even modest increases—say, 500,000 bpd in the short term—could flood the market further.

This aligns with President Trump’s “drill baby drill” push, urging U.S. firms to invest, but it risks environmental fallout from the “very dense, very sloppy” Orinoco Belt crude.

Iran’s Discounts and Protests: A Ticking Disruption BombIran, OPEC’s third-largest producer, has ramped up output to 3.2-4 mbpd despite U.S. sanctions reinstated in 2018 and tightened under Trump’s second term.

Nearly 90-95% of its exports—1.8-2.3 mbpd—head to China at steep discounts of $7-12 below Brent, rebranded as “Oman Blend” or “Malaysian Light” via ship-to-ship transfers and UAE/Malaysian shell companies to evade penalties.

In 2025’s first half, China imported 1.38 mbpd, making up 13.6% of its total oil buys, mainly for low-margin teapot refiners.

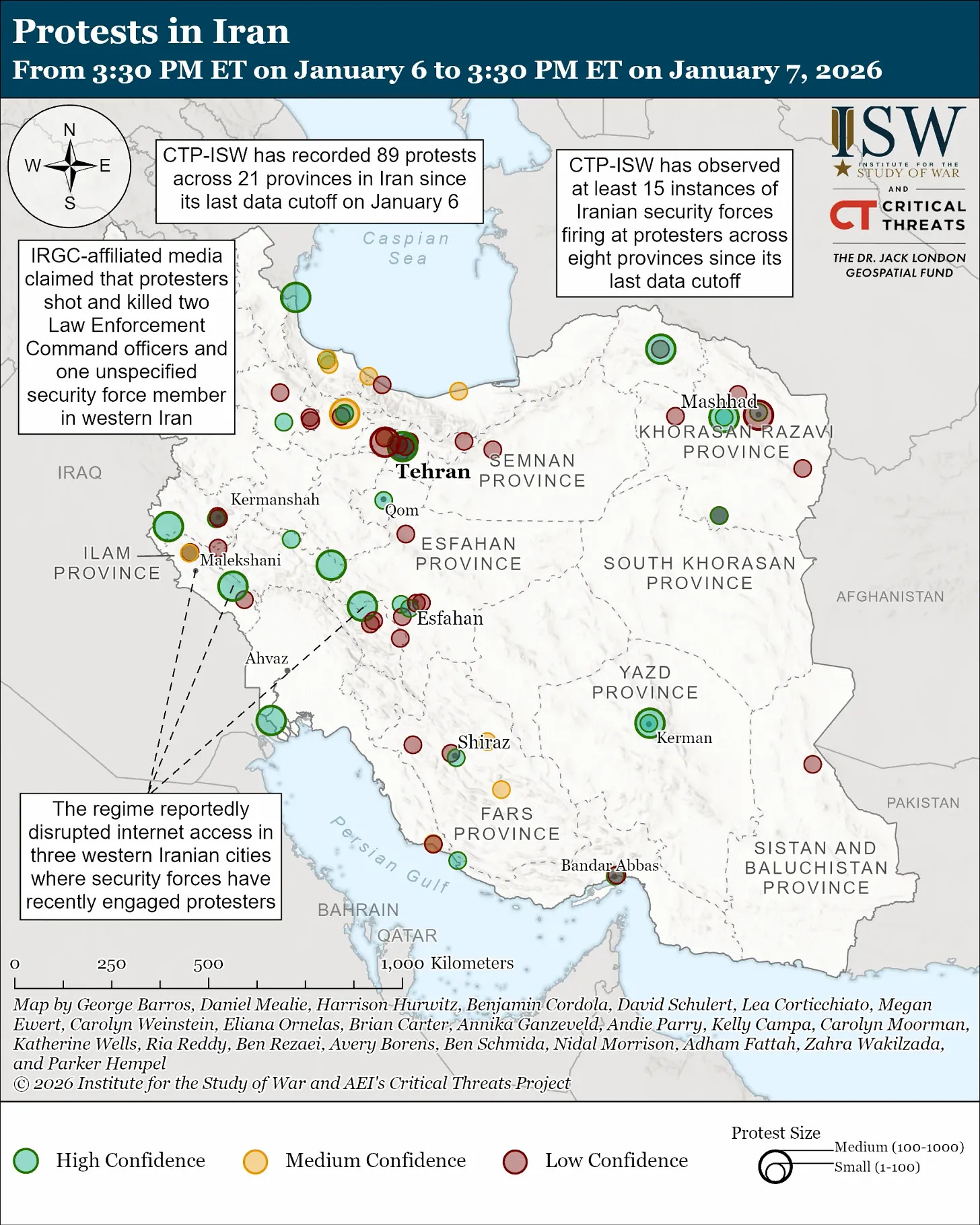

But cracks are showing. Nationwide protests, fueled by economic woes like 42.2% inflation and subsidy cuts, have escalated, with human rights groups estimating thousands dead amid a brutal crackdown.

Oil prices ticked up recently on fears of supply disruptions, with a potential loss of 2 mbpd to China forcing refiners to scramble for alternatives.

In a surplus market projected at 3.8 mbpd, a full Iranian export halt could halve the glut, adding a $5/bbl geopolitical premium.

Yet, U.S. penalties on Chinese refiners may already curb demand, risking Iran’s economic collapse.

Regime change could open doors for reforms and eased sanctions, potentially boosting output long-term, but short-term chaos might spike volatility.

Iraq’s Steady Climb: Adding Fuel to the Surplus Fire

Iraq, OPEC’s second-largest producer, is quietly ramping up. Producing around 4.01 mbpd in late 2025, it’s nationalizing fields like West Qurna 2 (480,000 bpd) and planning boosts at West Qurna 1 and East Baghdad.

As OPEC+ phases out voluntary cuts through 2026, Iraq’s exports—averaging 3.2 mbpd in 2024—could rise, countering any Iranian shortfalls.

This pivot toward higher output, amid currency risks from low prices, positions Iraq as a stabilizer—or disruptor—in a glutted market.

If Iranian unrest spreads regionally, Iraq’s proximity could amplify impacts, but for now, it’s bolstering the supply wave pressuring prices.

Ripple Effects on U.S. Shale: Navigating the Glut

U.S. shale firms, fresh off record 2025 production, face a reckoning. With global surpluses forecast at 2.3 mbpd, prices could dip below $50 before recovering.

Venezuelan oil’s return and Iranian discounts flooding Asia indirectly compete with U.S. light sweet crude, potentially depressing WTI and sparking consolidation.

Shale executives warn that Trump’s Venezuela push could harm domestic producers by adding supply when U.S. output is set for its first drop in four years.

In a $55-60 market, high-cost shale break-evens (around $50-60) get squeezed, leading to reduced drilling and possible bankruptcies. However, lower prices might fuel demand growth, offering a rebound later in 2026.

Opportunities for U.S. Companies in Guyana and Venezuela

For U.S. firms, Venezuela presents a mixed bag. Trump is pressuring giants like Chevron, ExxonMobil, ConocoPhillips, Halliburton, and Occidental to invest billions in reviving fields, potentially recouping owed billions and modernizing infrastructure.

Chevron, already operating joint ventures, could see quick boosts, while service firms like Halliburton handle upgrades.

But risks abound: political instability, $183 billion rebuild costs, and climate scrutiny.

Neighboring Guyana offers a brighter spot. With ExxonMobil, Chevron, and CNOOC driving output toward 1 mbpd by 2027 from discoveries in the Stabroek Block, it’s a low-risk, high-reward hub amid Venezuela’s Essequibo territorial dispute.

U.S. firms can leverage Guyana as a stable alternative, potentially offsetting Venezuelan uncertainties.

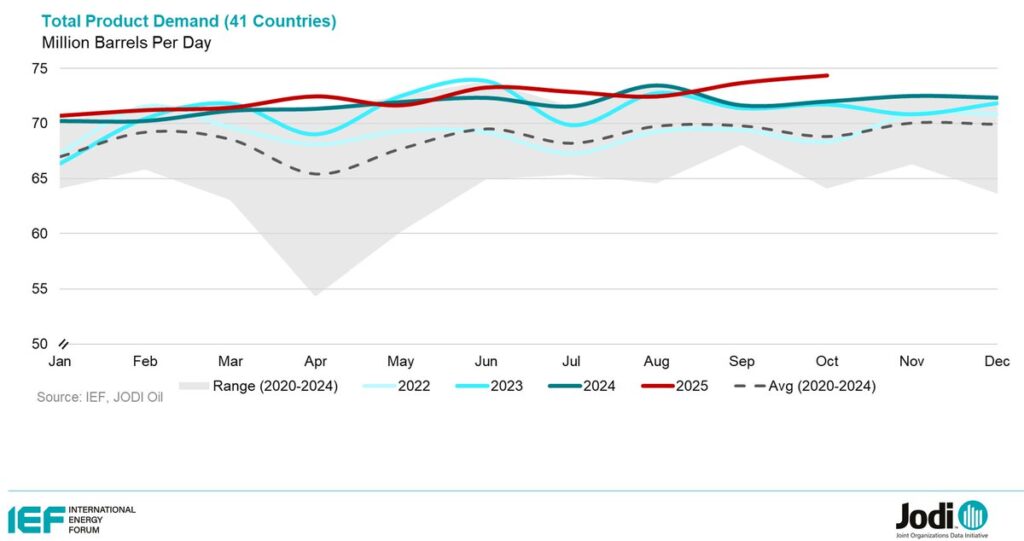

Demand is Increasing

Wrapping Up: A Transitional Year of Surplus and Sparks

2026 shapes up as a transition year for oil, with surpluses stabilizing prices post-Q1 but geopolitical flashpoints—like Iran’s protests and Venezuela’s reboot—injecting upside risks.

Iran and Iraq could disrupt the supply by either withholding (Iran via unrest) or flooding (Iraq via ramps), amplifying the glut or creating shortages. For the U.S., it’s a balancing act: shale resilience tested, but doors opening in South America. Stay tuned to Energy News Beat for more on these fast-moving shifts—Stuart, this one’s primed for your podcast deep dive!

Sources: energynewsbeat.co, investing.com, cnbc.com, themerchantsnews.substack.com