The Outlook for Selected Critical Minerals indicated that these minerals will play a critical role in the global industrial shift towards electric vehicles, renewable energy generation and stationary battery storage systems.

Economic security and supply chain reliability are major factors in the critical mineral sectors as governments seek to minimise trade dependency and related market shocks.

Australia has already cemented its position as the world’s largest producer of hard rock lithium essential for the cathodes of lithium-ion batteries, but there are growth opportunities for cobalt, graphite, rare earths and vanadium.

Against the backdrop of the global EV fleet growing by 30 pc/yr up to 2050, cobalt, graphite and rare earths are regarded as critical along with nickel, lithium and copper. Lithium, nickel and copper are well established in Australia’s diversified mining sector, but cobalt, graphite and rare earths are much less entrenched.

Australia has around 19pc of global cobalt reserves and is the second largest producer. Almost 60pc of cobalt demand is from the battery sector. Cobalt is usually produced as a nickel by-product in Australia.

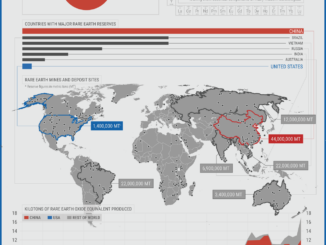

The country is the world’s fourth largest rare earths producer with around 3.4pc of reserves. Lynas Rare Earths, which mines in Australia and completes processing in Malaysia, is the biggest producer outside of China. A few firms are in the early stages of bringing projects into production. Rare earth applications are growing for batteries, magnets and catalysts.

Australia is estimated to only have around 3pc of global graphite resources, but the Siviour deposit in South Australia is regarded as the largest natural graphite resources outside of Africa. At least two significant graphite projects are under development in the country to meet growing demand from the battery anode sector.

The study forecasts that renewable energy generation will see global wind power capacity rise by 6 pc/yr up to 2050. This will also drive demand for rare earth permanent magnet products such as neodymium, praseodymium and dysprosium.

Global stationary battery storage is expected to increase by around 8 pc/yr to 2050, boosting demand for vanadium redox-flow batteries and other solutions. Australia has around 18pc of the world’s vanadium reserves, but is a very minor producer. Two large new projects are at advanced stages of evaluating mining and downstream processing.