In a bold move that underscores the intertwining of energy ambitions and regional politics, British Petroleum (BP) has activated a massive $25 billion redevelopment project in Iraq’s northern Kirkuk region.

This investment, formalized earlier in 2025 and kicked into gear on October 2, isn’t just about extracting crude—it’s a strategic play that could reshape power balances in the Middle East, bolster Iraq’s energy independence, and ripple through global markets. Coupled with Iraq’s recent agreement with U.S.-based Excelerate Energy for a floating liquefied natural gas (LNG) import terminal, these developments signal Baghdad’s push to diversify its energy portfolio amid ongoing geopolitical tensions.

Got Tax Planning Questions?

Unpacking BP’s Kirkuk Megadeal

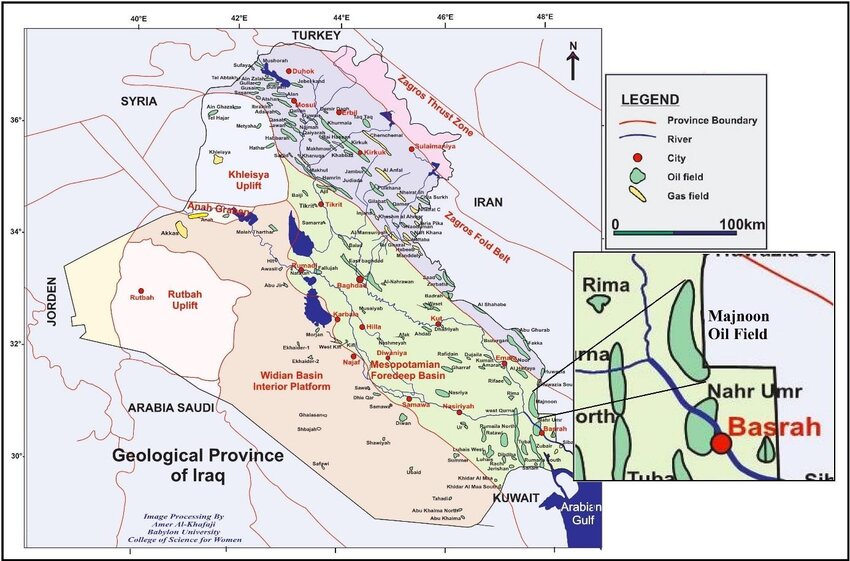

The agreement positions BP as the lead operator for rehabilitating and expanding production across five key oil and gas fields in Kirkuk: the Baba and Avana domes (part of the supergiant Kirkuk field), Bai Hassan, Jambur, and Khabbaz.

These fields hold immense potential, with estimates suggesting they could collectively produce up to 750,000 barrels per day (bpd) at peak, though the initial target is a more modest 328,000 bpd.

The $25 billion figure represents BP’s projected spending over the project’s lifetime, covering everything from infrastructure upgrades to enhanced recovery techniques.

This isn’t BP’s first foray into Iraq—the company has been active in the southern Rumaila field for years—but Kirkuk marks a return to a historically contentious area.

The deal, ratified by Iraq’s federal government in March 2025, involves close collaboration with state-owned entities like the North Oil Company.

BP has already begun on-site assessments and is issuing tenders for major works, signaling rapid progress.

Beyond oil, the project includes gas capture initiatives to curb flaring, aligning with global sustainability pressures.

Geopolitically, Kirkuk’s fields sit in a disputed territory long contested between Baghdad and the Kurdistan Regional Government (KRG). By empowering federal oversight through this deal, Iraq aims to centralize control over these resources, potentially easing ethnic tensions and strengthening national unity.

This pivot could marginalize Kurdish influence in energy matters, while inviting international players like BP to act as stabilizers in a volatile region.

Iraq’s LNG Import Deal with Excelerate Energy: A Step Toward Energy Diversification

Complementing the oil focus, Iraq has inked a $450 million agreement with Excelerate Energy to establish its first floating storage and regasification unit (FSRU) for LNG imports.

Signed on October 28, 2025, this five-year contract (with extension options) will see Excelerate provide a fully integrated solution: an FSRU capable of storing and regasifying LNG, plus supply services to feed Iraq’s power grid.

The terminal, Iraq’s inaugural floating LNG platform, addresses chronic gas shortages that have forced reliance on imports from Iran and domestic flaring.

While the user query referenced an “export” deal, the agreement is firmly for imports, aimed at bolstering domestic supply rather than exports.

Excelerate’s lone FSRU newbuild will be deployed here, marking a significant U.S. footprint in Iraqi energy.

This move comes as Iraq seeks to ramp up power generation and reduce blackouts, with the FSRU expected to handle minimum contracted volumes while offering flexibility for growth.

Shifting Dynamics in the Middle EastTogether, these initiatives could profoundly alter Middle Eastern energy landscapes. BP’s Kirkuk project enhances Iraq’s oil output, potentially adding hundreds of thousands of bpd to global supply and challenging OPEC+ quotas.

In a region dominated by Saudi Arabia and Iran, a stronger Iraqi presence might dilute Tehran’s leverage—especially as the LNG import deal reduces Baghdad’s dependence on Iranian gas pipelines, which have been prone to disruptions.

Geopolitically, the deals signal Western re-engagement in Iraq post-ISIS, countering Russian and Chinese inroads. Kirkuk’s stabilization could foster better Baghdad-Erbil relations, while LNG imports enable Iraq to monetize its own flared gas in the future, potentially flipping to exports down the line. However, risks abound: sectarian divides, corruption, and security threats from militias could derail progress, exacerbating regional instability if not managed.

Key Considerations for Investors

Investors eyeing these developments should prioritize several factors:

Company-Specific Exposure: BP’s stock (NYSE: BP) could see upside from Kirkuk’s long-term revenue, but monitor execution risks in a high-threat environment.

Excelerate Energy (NYSE: EE) stands to gain from the $450 million contract, boosting its FSRU portfolio amid global LNG demand.

Broader plays include Iraqi bonds or ETFs tracking Middle Eastern energy.

Geopolitical Risks: Watch U.S.-Iran tensions, as sanctions or conflicts could disrupt operations. Kirkuk’s disputed status adds volatility—any flare-up between federal forces and Kurds might halt projects.

Commodity Prices: Increased Iraqi oil supply could pressure Brent crude, while LNG imports might stabilize regional gas markets. Track OPEC+ meetings for quota adjustments.

Sustainability Metrics: With gas capture in Kirkuk and LNG reducing flaring, ESG-focused funds may favor these assets. However, Iraq’s environmental track record warrants scrutiny.

Diversify across energy majors and consider hedging against oil price dips.

Broader Impacts on Global Markets

On a global scale, BP’s investment could contribute to a looser oil market, potentially capping prices below $80 per barrel if production ramps successfully.

This might ease inflationary pressures in importing nations like Europe and Asia but squeeze revenues for high-cost producers in the U.S. shale patch.The LNG deal, while modest, fits into a broader trend of floating terminals accelerating energy transitions. It could draw more LNG cargoes to the Middle East, tightening Atlantic Basin supplies and elevating prices for European buyers.

Long-term, a more energy-secure Iraq might export surplus gas, competing with Qatar and Iran in Asian markets.

Overall, these moves highlight Iraq’s emergence as a pivotal energy player, but success hinges on political stability. For global markets, expect heightened volatility in commodities, with opportunities for those betting on Middle Eastern resurgence. As always, energy geopolitics remains a high-stakes game—stay informed and agile.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack