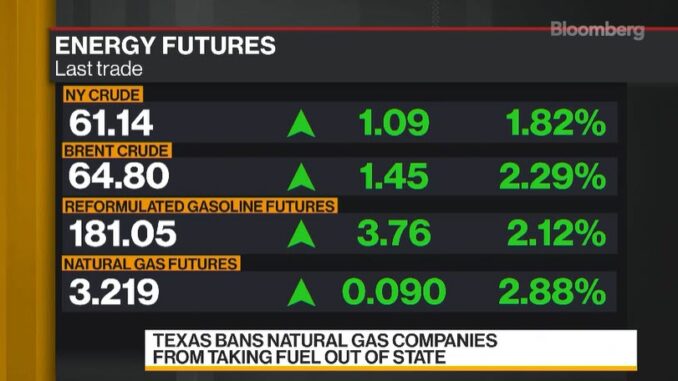

Brent oil traded near $65 a barrel as a cold blast that’s taken out almost 40% of U.S. crude production morphed into a global supply shock.

Futures in London rose 0.8% after closing at the highest in almost 13 months. The global crude benchmark earlier jumped above $65, a level it hasn’t reached since Jan. 21, 2020, before Covid-19 roiled energy markets.

More than 4 million barrels a day of U.S. oil output is now offline, according to traders and executives, amid an unprecedented cold snap that’s frozen well operations and led to widespread power cuts. A spate of refinery outages has curbed demand for crude in the country, however, while gasoline consumption is also down as the icy conditions keep many Americans off the roads.

Estimates for how long the U.S. outages may last have gotten longer in recent days as analysts try to figure out the timespan involved in thawing out infrastructure. As American barrels are removed from the market, North Sea traders have been frantically bidding for the region’s cargoes. Buyers in Asia, meanwhile, have been snapping up Middle Eastern crude at higher premiums.

Crude is up 25% this year as Saudi Arabia’s deep output cuts and an improving demand outlook encourage investors. The rally was tempered on Wednesday following a Dow Jones report citing unnamed advisers that the kingdom is planning to boost output in the coming months. Many analysts expect that the Saudis will pump more from April given the recent surge in prices.

“This cold snap is the perfect storm for the oil market, but it’s probably not the only catalyst that has driven oil to these heights,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. “We have Saudi Arabia supporting the market and the U.S. inventories are coming off at such a rapid pace.”

| PRICES |

|---|

|

Saudi Arabia’s energy minister, meanwhile, urged fellow members of the OPEC+ alliance to remain cautious as they prepare to consider further output increases. The group will gather in early March to decide whether it can revive some more of the production halted during the coronavirus pandemic.

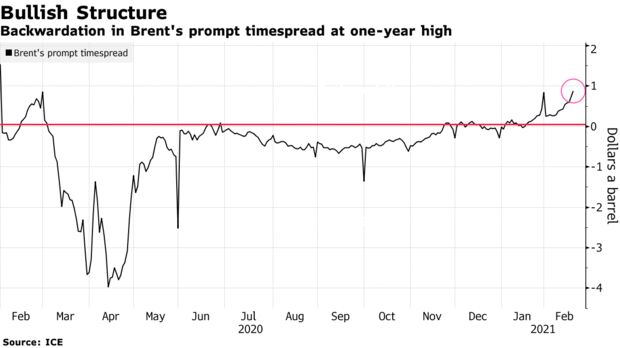

The cold blast has pushed WTI’s prompt timespread into a bearish contango structure, given the lack of demand from disrupted refineries. However, the similar spread for Brent is now 83 cents a barrel in backwardation, compared with 29 cents at the start of last week.

Bloomberg