ENB Pub Note: This article was originally posted on Elementalenergy.substack.com. I highly recommend following them and interacting with their other readers through comments.

Remember those American offshore wind projects that were cancelled last year due to unexpected cost escalation? The offshore wind industry always said they’ll be back after negotiating for a price that makes them profitable under current conditions. It seems like this is exactly what is happening.

Recall leading developer Orsted were hit with $5.6 billion in impairments for walking away from multiple deals. Now they are signing new ones with prices that are almost double. Industry publication ReNews reports:

“The weighted average all-in development cost of the awarded offshore wind projects over the life of the contracts is $150.15 per MWh which is on-par with the latest market prices. Empire Wind and Sunrise Wind had previously signed deals for $83.3 per MWh, but cancelling their contracts in favour of rebidding for higher prices.”

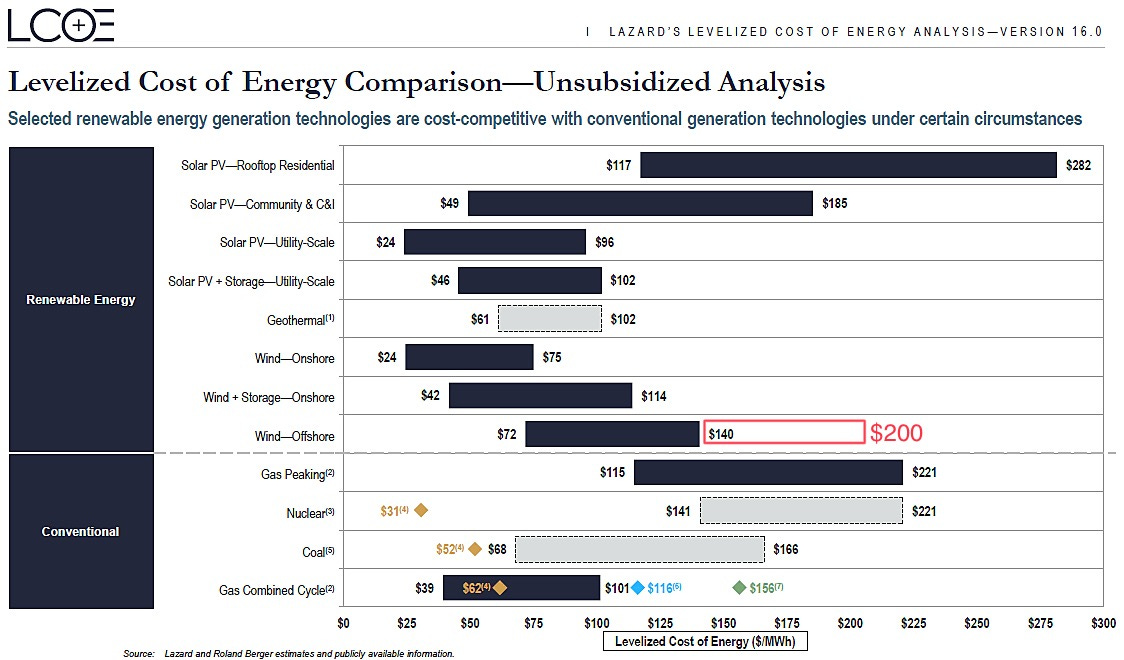

On top of the Power Purchase Agreement (PPA) price, Offshore Wind projects in the US receive subsidies in the form of tax credits which industry sources tell me is equal to a value of up to $50/MWh, making the ‘true’ PPA price actually closer to $200. This blows out the cost of US offshore wind way beyond Lazard’s 2023 estimate of offshore wind Levelized Cost of Energy (LCOE) at $72 to $140/MWh, unsubsidized.

What price clean energy?

I assume Empire Wind 1 and Sunrise Wind are just the first projects to be revived. And I’m OK with that. We need clean power for sure. I’m just surprised that there is so little attention paid to the huge increase in prices.

As a point of comparison, the cost of Vogtle is around $178/MWh, or $188/MWh adjusted for inflation. Frankly, a lot of the articles I read about the project returning do not even mention the specific numbers, just that the projects are back. Talk about burying the lede…they drop it altogether. So say it with me: The price of Offshore Wind in the US is going to be about twice as much as we anticipated. Should we still build it? Maybe. But we should be cognizant of the costs!

If we accept, however, the price of clean energy can be as high as $150/MWh (with an additional $50 in tax credits), all of a sudden, the Vogtle, despite the eye-watering cost overruns, suddenly look like a relative bargain. Unlike Empire or Sunrise Wind, the power delivered by Vogtle is clean as well as firm, meaning it is of higher value to the system and requires less firming or balancing resources.

The real enemy: Gas

I have been accused of throwing shade on renewables simply for pointing out the facts above on Twitter. That’s ridiculous. I have never been against renewables, but we must understand their costs so that we may weigh things fairly. Is $188/MWh for Vogtle outrageously, damningly high? Are you shocked…just shocked that NuScale cost estimates went up from $55/MWh to $129/MWh ($89/MWh + $30/MWh IRA subsidy)? Then when offshore wind projects come in at $200/MWh (or $150/MWh+IRA subsidies) they ought not celebrated as “We’re so back! More expensive, but back.”

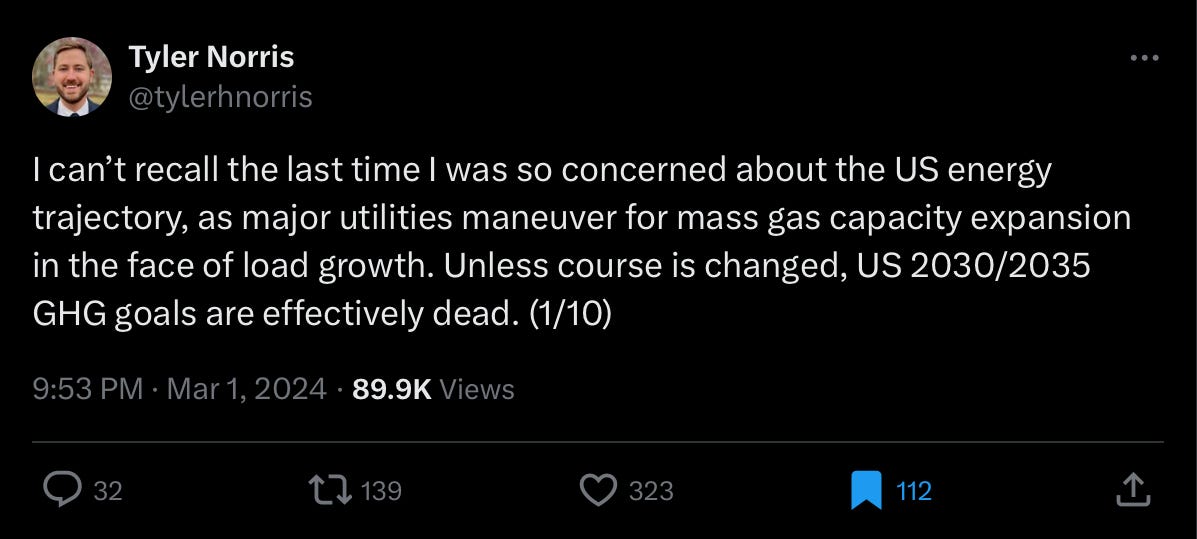

Apparently I’ve made people very angry just by pointing out this double standard. But the real problem with nuclear is not offshore wind or vice versa. The problem is if both don’t start pricing down soon, utilities are going to just build gas like crazy:

Tyler Norris has a great thread about how everybody is trying to load up on gas. Indeed, unless clean energy get a lot cheaper, that is exactly what America is going to burn.

As Jesse Jenkins observed over on X, “I have serious concerns about an electricity decarbonization strategy centered on resources that cost north of $100/MWh, whether rooftop solar, offshore wind, nuclear, whatever. We need to massively expand electrification, and that makes electricity affordability paramount.”

THE ELEMENTAL TAKE

I’ve often heard it said that solar have gotten so inexpensive it makes nonsense of building nuclear energy. Many of the same people who make that statement will then often turn around to support another source of energy that is just as expensive and uncertain such as advanced geothermal, hydrogen and now offshore wind, at least in some markets.

Now why is that?

Of course, this should not be taken as I’m complacent and happy with Vogtle. The industry must do better than Vogtle. But we should resist the gaslighting that Vogtle was such a terrible failure that the nuclear industry should never be given another chance.

It just so happens that Vogtle Unit 4 joined grid for the first time today. The fact that they got the job done is not just a point of pride for Georgians, but an asset for 80 years already attracting industry to the Peach State. To get on the cost-down curve is no rocket science: build reactors, the same kind, over and over again.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack