As global energy dynamics shift amid geopolitical tensions and fluctuating supply chains, China remains a pivotal player in the crude oil market. In 2025, the world’s largest oil importer will continue its aggressive stockpiling strategy, building strategic petroleum reserves (SPR) at a multi-year high pace. This move not only secures China’s energy needs but also influences global oil balances. Meanwhile, India, emerging as a key driver of oil demand growth, is maintaining robust import levels, particularly from discounted sources like Russia. This article explores China’s stockpiling plans through 2026, key suppliers and volumes, India’s parallel strategies, and the broader implications for the oil market and investors.

China’s Stockpiling Strategy

China has been stockpiling crude oil at an estimated rate of 530,000 barrels per day (bpd) throughout 2025, a pace that has helped absorb excess global supply.

This aggressive buildup is part of a broader effort to expand its SPR to approximately 1 billion barrels by 2026, driven by state-owned giants like CNPC and Sinopec.

Beijing’s plans include purchasing up to 140 million barrels (mb) of crude between July 2025 and March 2026, leveraging commercial storage tanks amid lower oil prices.

Analysts expect this stockpiling to persist into 2026 at similar rates, providing a buffer against potential supply disruptions.

Despite slowing domestic demand growth—projected to peak around 2027—China’s strategic reserves could add nearly 300 mb of additional capacity if maximized.

This approach reflects China’s long-term energy security focus, with investments in storage infrastructure mitigating risks from Middle East crises and other global uncertainties.

In the first half of 2025, surplus crude reached 1.06 million bpd, as imports outpaced refining needs.

Who China Is Buying From and the Amounts

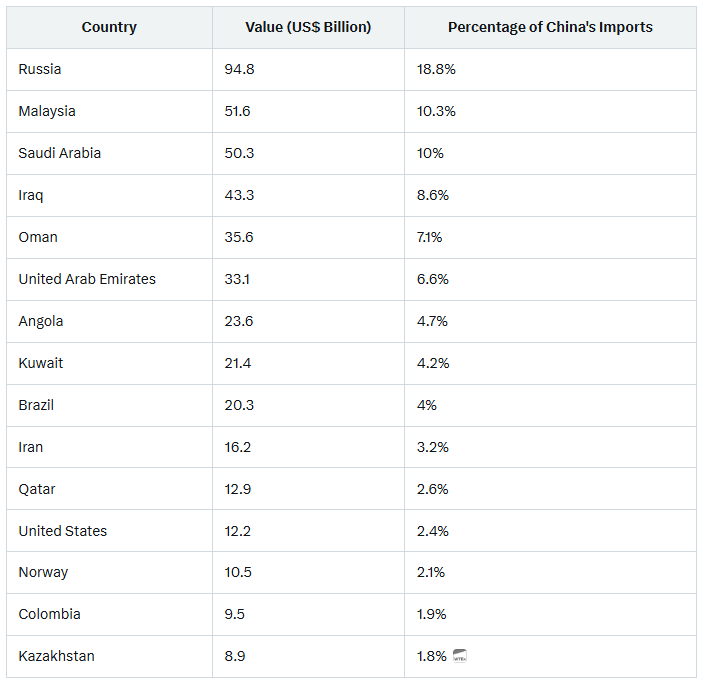

China’s crude oil imports averaged around 11.1 million bpd in 2024, with similar levels persisting into 2025, including 11.11 million bpd in July alone.

Domestic production added about 4.27 million bpd in July, contributing to the stockpiling surplus.

In 2025, Russia continues to dominate, accounting for a significant portion of imports—up to 42% of Russia’s fossil fuel exports went to China in July.

Seaborne Russian crude imports rose marginally in June, comprising about 11% of China’s total.

Overall imports from January to July 2025 totaled around US$1.45 trillion in goods, with energy playing a major role.

Iran’s supplies also remain strong, contributing to a 7.5% rise in April imports.

India’s Oil Purchase Plans

India, now poised to outpace China in underlying oil demand growth, is planning to sustain high import levels through 2025 and into 2026.

Despite a dip in July 2025 imports to a near 18-month low (down 4.3% year-on-year), analysts expect a rebound in the second half of 2025 due to higher refining capacity and seasonal demand.

Russian oil imports are set to rise in September, with India defying potential US tariffs and committing to continued purchases.

Finance Minister statements confirm India will persist with Russian sourcing, which accounted for over 36% of imports in March 2025.

In the first 20 days of August, Russian crude imports held steady at 1.5 million bpd.

However, a shift away from Russian oil could spike India’s oil bill by $9–11 billion annually due to higher costs from alternative suppliers.

India’s diesel exports to Europe have surged ahead of the EU’s January 2026 ban on products refined from Russian crude, leveraging discounted imports for refining profits.

Overall, India’s demand is forecasted to grow by 3.2% in 2025, faster than China’s 1.7%, driven by urbanization and rising incomes.

What This Means for the Oil MarketChina’s stockpiling has offset a global oil surplus in 2025, absorbing excess from OPEC+ production increases and non-OPEC growth in the Americas.

However, analysts warn of a 1.9 million bpd glut by 2026, potentially pressuring prices downward.

Global demand is projected to rise modestly by 680,000 bpd in 2025 and 700,000 bpd in 2026, reaching 104.4 million bpd, with Asia (led by India and China) accounting for over 65% of gains.

India’s robust demand provides a counterbalance to China’s slowdown, but uncertainties like geopolitical risks and economic policy could disrupt supply chains.

Lower prices are supporting consumption in advanced economies, but overall growth remains subdued.

This dynamic may lead to volatile markets, with OPEC+ potentially extending cuts to stabilize prices.

What This Means for Investors

For investors, the shift in Asian oil demand presents both opportunities and risks. India’s accelerating growth—expected to surpass China’s and account for over one-third of global increments—signals potential in Indian refiners, infrastructure, and related stocks. Stu Turley on the Energy News Beat podcast has been very upfront about two key indicators for how the long-term oil price works. If India can pick up the slack for any decline in China’s purchases, we will see a strong market for demand numbers on the pricing equations. From what we are now seeing, this shouldn’t be a problem, and the numbers will likely be higher. The calls for an oil glut and below $60 oil are overrated, says Stu Turley. The world still

Companies tied to Russian exports or diversified suppliers could benefit from sustained discounted flows, though US tariffs pose headwinds.

Conversely, China’s impending demand peak and global surplus forecasts suggest bearish pressure on oil prices, potentially hitting upstream producers and leading to reduced upstream investments (down 6% to $420 billion in 2025).

Investors should monitor energy tech trends like decarbonization and AI, which could reshape demand, while favoring diversified portfolios amid volatility from China-India dynamics.

Long-term, opportunities lie in emerging markets like India, where urbanization drives sustained growth.ConclusionChina’s continued stockpiling through 2026 underscores its proactive energy strategy, while India’s resilient imports highlight its rising role in global demand. Together, these trends stabilize short-term markets but foreshadow potential gluts and price pressures. For the oil sector, adaptability will be key, with investors eyeing Asia’s evolving landscape for strategic gains.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack