One of the fastest-growing corners of China’s energy market is facing a potentially devastating blow as Xi Jinping’s government increases scrutiny of high-emission fuels.

Chinese regulators are considering a new tax on imports of so-called light-cycle oil, or LCO, and have asked energy companies and government agencies to provide feedback on a draft plan, people with knowledge of the matter said. The levy could take effect as soon as the first half of 2021 if approved, the people said.

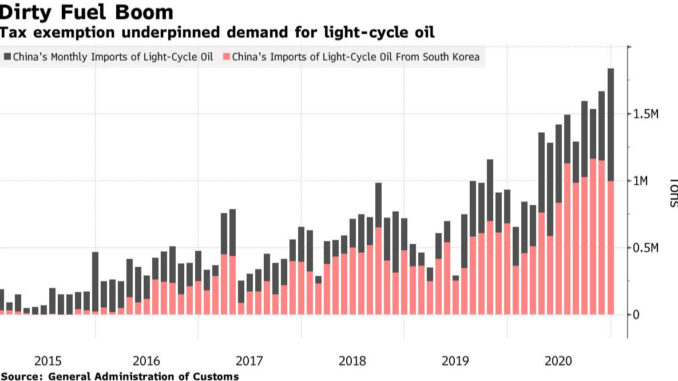

Taxing LCO imports would upend the economics of a market that ballooned to $7 billion last year from almost nothing in 2014. Demand has soared in part because LCO’s exemption from China’s fuel consumption tax means it can be used to make diesel and fuel oil at cheaper prices than those charged by state-owned Chinese refiners including Sinopec and PetroChina.

LCO imports — mostly from South Korean suppliers like SK Innovation and GS Caltex — hit a record in 2020 as China ramped up construction and industrial production to revive its Covid-battered economy, stoking demand for diesel and other fuels.

While Chinese refiners have long lobbied for an end to the LCO tax exemption, their pleas are gaining more traction after Xi vowed in September that China would become carbon neutral by 2060. Emissions from LCO consumption are larger than standard diesel products because of the oil’s higher sulfur content, density and carbon residue.

China’s Ministry of Finance and General Administration of Customs didn’t reply to faxed requests for comment.

LCO is currently exempt from fuel consumption tax because it’s considered a petrochemical feedstock, not a finished fuel.

Uncertainty over whether that will change has caused some importers to temporarily halt LCO orders, according to FGE, a London-based energy consultancy. Overall imports will probably slip from as much as 450,000 barrels per day — or about two million tons a month — at the end of last year to as little as 300,000 in March and April, before recovering in the middle of 2021 due to seasonal factors, FGE said in a March 16 report.