A recent survey indicates that the coal industry in the United States is showing a marked upsurge in demand. In fact, it has been revealed that the nation’s output of this fossil fuel is expected to rise by around 10% in the coming four years. This year, the United States may produce as much as 900 million tons of coal. That’s 30 million more than last year – and the largest production level since the 1990s.

Coal demand is topping expectations, according to the annual Mining Economic Data Book, which tracks economic activity and production in the coal, oil, natural gas, and nuclear industries. Last year was the highest for U.S. coal production since 1980, with output rising 26 percent over 2013 levels, the Energy Information Administration said this week. The book projects industrial demand will continue to rise this year as utilities ramp up spending on clean energy, including greater use of coal for electricity.

From Bloomberg today: Everything that could happen that’s positive from the demand standpoint is happening,” said Andrew Cosgrove, a mining analyst with Bloomberg Intelligence. “The stars are aligning.”

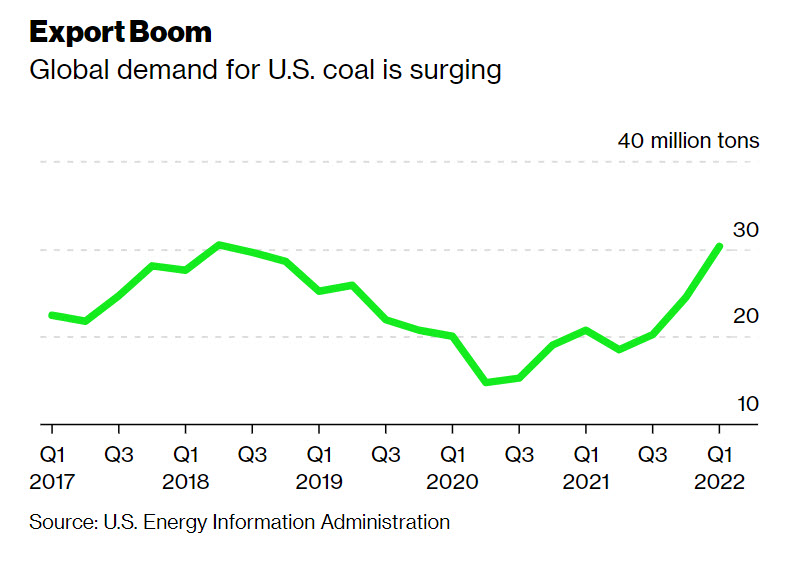

That growing appetite will help boost U.S. exports of the fuel by 21% this year, and another 19% in 2022, the Energy Department said Wednesday in its latest short-term outlook report. The department said its projections are based on forecasting firm IHS Markit’s projection that the world’s largest economy will grow by 7.4% in 2021.

The outlook also is driving up mining company share prices. Peabody Energy Corp., the biggest U.S. coal producer, and rival Arch Resources Inc. both hit 18-month highs this week. Consol Energy Inc. is trading near the highest since August 2019.

And the coal boom is unlikely to lose momentum anytime soon. As long as economic growth remains robust, so too will energy demand, according to Lucas Pipes, an analyst at B. Riley Securities.

The Bottom Line: Worldwide energy demand is up and it will be filled by the lowest cost of energy available to the consumers except for mandates from governments. What does this mean for our “Green New Deal” is that we are going backward while creating worldwide dept that even our descendants will not be able to recover. Let’s start with the United States and have open dialogues with everyone about the best path forward on the “Balanced Diet of Power’. A balanced diet could include fossil, renewables, and nuclear in all types. Being good stewards of the earth also means producing the energy with the least impact on the environment. Simply put: Fiscally producing the “Balanced Diet of Power” at the lowest impact to our environment.

Please send me your ideas and thoughts about the article. I can be reached at my LinkedIn account at: https://www.linkedin.com/in/stuturley/

Stu Turley, President, Sandstone Group