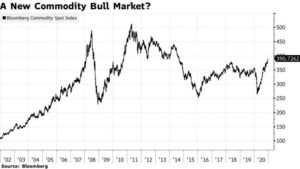

For the best part of a decade, commodities have been deeply out of fashion. Now, as investors scour the market for the great reflation play, they’re hot again.

Investing luminaries from Point72 to Pimco are calling for commodity prices to move higher. Goldman Sachs Group Inc., the bellwether of Wall Street, is predicting a new commodity bull market to rival the China-driven boom of the 2000s and the oil price spikes of the 1970s.

“We very much believe that the fundamentals are now in place for a new, structural, bull market to begin,” said Robert Howell, senior research strategist at Gresham Investment Management LLC, the commodities-focused unit of Nuveen with $5.8 billion in assets in the sector. “In the years to come, it’s highly probable that a great many investors will look back on 2020 and wonder how they missed these signs of a new commodity bull market.”

Prices have already jumped from their low point in the spring. Copper, iron ore and soybeans have risen to their highest levels in more than six years, spurred by a Chinese buying spree.

But now Chinese importers are being joined by global macro investors, drawn to commodities as a bet on the recovery of the global economy as well as a hedge against the prospect of high inflation.

But now Chinese importers are being joined by global macro investors, drawn to commodities as a bet on the recovery of the global economy as well as a hedge against the prospect of high inflation.

Commodities are stereotypical cyclical assets, rising and falling in synchrony with the global economy. That puts them first in line to benefit from the recovery that could be unleashed by virus vaccines.

“We are optimistic on commodities overall, as recovering global economic growth and the possibility of higher inflation should be supportive for prices,” says Evy Hambro, who helps manage $16 billion as global head of thematic and sector investing at BlackRock Inc.

Nic Johnson, who manages about $20 billion of commodity index investments as well as a separate hedge fund at Pimco, believes commodities “will benefit from the global reflationary theme.”

The enthusiasm marks a turnaround for an asset class that has been unloved for years. While investors piled in to commodities as prices soared in the decade to 2011, since then they have soured on the sector. Many of the highest profile hedge funds specializing in commodities exited the markets — including Astenbeck Capital Management, Blenheim Capital Management, and Clive Capital, each of which managed billions of dollars at its peak.

But now that trend is beginning to reverse. The hedge fund industry as a whole has seen outflows this year, but hedge funds focused on commodities have managed to raise money. They pulled in more than $4 billion in flows through October this year compared to about $55 billion in outflows from the industry overall, according to data from eVestment.