Daily Standup Top Stories

Rishi Sunak announces U-turn on key green targets

Rishi Sunak has announced a major U-turn on the government’s climate commitments as he promised to put his party on a more radical path in an attempt to close the gap with Labour before the […]

Breaking Records: Nat Gas Supply, Exports Driving U.S. Energy Growth

As elites gather in New York City for Climate Week, record-breaking future supplies of natural gas and exports are lifting America’s energy and future environmental gains to new heights. Last week, data from the federal Energy […]

How BP’s Strategy Stacks Up Against the Supermajors

BP’s strategy is under the microscope following the departure of CEO Bernard Looney, who resigned after failing to disclose the extent of personal relationships with company staff. Wholesale changes — whether embracing the renewables-free approach of its US competitors […]\

US Army’s Electric Tanks on Hold as Battery Technology Develops

Army needs a 20-fold increase in battery charging No EVs currently deployed in the battlefield The military’s grand vision of an all-electric fleet of tanks is being stymied by a battery sector that’s not even […]

Highlights of the Podcast

00:00 – Intro

02:47 – Rishi Sunak He’s the Prime Minister over in the UK announces U-turn on key green targets.

06:54 – Breaking records, nat gas supply exports, driving U.S. energy growth.

08:45 – How BP strategy stacks up against the super majors.

11:47 – U.S. Army electric tanks on hold as battery technology develops.

15:24 – Markets Update

15:39 – Jerome Powell’s Federal Reserve announcement.

19:12 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:15] What is going on. Everybody, welcome into another edition of the Daily Energy News Beat Standup here on this gorgeous Thursday, September 21st, 2023. As always, I’m your humble correspondent, Michael Tanner, coming to you from an undisclosed location here in Dallas, Texas, joined by the executive producer of the show, the purveyor of the show and the director and publisher of the world’s greatest website, energynewsbeat.com, Stuart Turley, my man. How are we doing today? [00:00:40][24.5]

Stuart Turley: [00:00:40] It’s a beautiful day in a neighborhood here in West Texas. Having a blast. [00:00:44][3.2]

Michael Tanner: [00:00:44] Yup. And we have an absolutely banger of a show lined up for you today. As we go out and finish out the week, a strong UK Prime Minister announces U-turn on key green targets. Absolutely fantastic. So we’ll cover what’s going on in the UK. Breaking records, natural gas supply, exports, driving U.S. energy growth. We will then kick it over how BP strategy stacks up against the super majors. That’s in light of the executive shakeup going on. And then finally, U.S. Army’s electric tanks on hold as battery technology develops. Thank goodness. Looks like Ukraine won’t be seeing those any time soon. Still, then kick it over to me. I’ll quickly cover mainly what’s going on in the oil and gas markets, what the fallout is from the Fed decision to go ahead and hold interest rates and kind of the fallout from Jerome Powell comments and press conference that he held afterwards. And then we’ll check in with the EIA to actually drop the official crude oil storage numbers. So we will dive into all that and a bag of chips, guys. But first, before we do all that, all the stories and analysis you about to hear is brought to you by the world’s greatest website, EnergyNewsBeat.com. The best place for all of your energy in oil and gas news. Stu and the team does a great job of curating that website to make sure it stays up to speed with everything that you need to know about the energy business. You can follow us and subscribe to the show on Apple Podcasts, Spotify and YouTube at Energy News Beat . If you really want to support the show, the best way to do that is go subscribe on YouTube. If I was a 16 year old, I would slam my fist and say, Smash that like. But. But I won’t. I will let them do that. You can also interact with the show questions@energynewsbeat.com. You can go ahead and hit the description below in the podcast. If you’re listening to it or on YouTube, you could see all the different timestamps and you can hit a form where you can fill out the interact or again, emails, questions@energynewsbeat.com Dashboard.Energynewsbeat.com. It’s our data news combo. Check that out. We love the feedback we’re getting. Team is hard at work at v2. I’m out of breath. Those two. Where do you want to begin? [00:02:45][120.6]

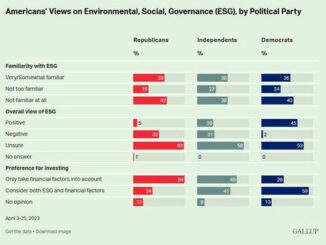

Stuart Turley: [00:02:45] What a day in the neighborhood did Rishi Sunak He’s the Prime Minister over in the UK announces U-turn on key green targets. Michael, can you hear this? I’ve got this Papaya. Papaya in the green heads blowing up in about all these. These heads are just exploding. Okay. He announced a major U-turn in the government’s climate commitments as he promised to put his party on a more radical path in an attempt to close the gap with Labor before the general election. What he’s doing is several key moves in. Let’s get down into the meat here, he says. I’ve got an opportunity to change things and what I don’t want to do is make another short term decision, easy ways out, and ultimately not be straight with the country. What those mean for them if we continued. Just a hair’s more if we continue down this path, we risk losing the consent of the British people. The resulting backlash would not just be against specific policies, but the wider mission itself, meaning we might never achieve our goal. I got to hand it to it. He is going in and one of the biggest things that he’s doing is way down in the bottom of the article. He’s also rolling back the sale of ice cars or internal combustion engine cars so that it’s going to add another, I believe it was three or four years on it. And so he’s trying to extend that out. The average person cannot afford the EVs with. Yeah, I mean, we talked about that yesterday with the strikes going on in the U.S. This is really going to change things. And when you sit back, the last thing in here, prices in the UK for energy, Michael, when somebody is actually having to pay their electric bill or e that’s where they are right now in the UK. So do politicians want to get reelected or do they want to get mugged by the people? Let’s see, really? And then you’re going to see that this is part of the ESG movement that is now collapsing. And so the investors started it in saying we need our money and then now the politicians in the UK are going. We can’t pay for this. [00:05:14][149.1]

Michael Tanner: [00:05:15] Now because, I mean, amongst all of these rollouts, the one that has everybody up in arms is the sale of EVs or the phasing out of petrol diesel vehicles, as they call it in the UK, in the UK from 2013 to 2035. So that’s it’s really only five years. I mean, people are heads are exploding over really just a five year rollback. That’s what I think’s the craziest part about this. Everyone’s freaking out. Didn’t really do anything other than say, Hey, we’re going to give ourselves more time to achieve this goal, to allow us to actually realistically hit it. I mean, again, I would have gone for hopefully gone to going farther. You know, you got to remember, this came after a pretty crazy 24 hours. You have to remember he was going to announce this in a planned speech, but it was leaked to the press. So he had to basically announce this 48 hours sooner than he would like to, because cab in the UK, the way their government works, the cabinet still needs to sign off on this. [00:06:09][54.1]

Stuart Turley: [00:06:10] Right. Well, this is just like New York City when you and I and New York when you and I were talking yesterday, all those in favor, let’s go ahead and cut all petroleum products and oil and gas out of New York. All those in favor. Okay. Yeah, we’re in cut off. And it’s the same thing with the UK. It’s now done no better anyway. It’s the same thing with the UK. This is almost like Brexit in that they are now admitting that they have a problem. And if you want to go ahead and get there, they need natural gas, they need less renewables and they need to keep their cars because they can’t afford the batteries. Doug Absolutely. [00:06:49][39.1]

Michael Tanner: [00:06:49] What’s next? [00:06:50][0.3]

Stuart Turley: [00:06:50] Let’s go around the corner to natural gas supply breaking records, nat gas supply exports, driving U.S. energy growth. Michael This is pretty darn cool. Hats off to the nat gas team and the export now by far the biggest exporter in the world in the first half of the year. Allied nations, including the UK, Netherlands, France, Spain and Germany combined receive 50% of the U.S. LNG, according to the EIA, Appalachia, roughly a third of America’s total natural gas production. That’s pretty darn cool, dude. That’s a big field up there. [00:07:34][43.5]

Michael Tanner: [00:07:34] Yeah, it’s it’s it’s pretty incredible. And I love how this all comes the week that the elites are gathering for Climate Week in New York in our favorite city, New York City. I’m surprised we didn’t get an invite. [00:07:46][11.8]

Stuart Turley: [00:07:47] Oh, I would have loved an invite. I would have had a few heads exploding when I walked in the room. Like the pope. I’m the pope of humanity. You know, I don’t care about wind, solar, batteries, but I walk into a room like the pope and energy Pope. I’m the energy pope. I may not get to say I’m going to be all right. Give me the keys. I’ll drive. That was Eddie Murphy. That was Stuart Turley doing an Eddie Murphy imitation that Never mind. So, yeah, the increase is 3978 trillion cubic feet. In 2022, we got some gas, and it’s just not politicians, baby. [00:08:28][40.9]

Michael Tanner: [00:08:29] No, it’s. Hey, we’re getting we’re getting everybody full of heat. Let’s talk about BP. [00:08:33][3.9]

Stuart Turley: [00:08:33] I love me some BP. You know, I still love it when you wave that loony and go, hey, don’t go to the Christmas party. That was neat. That was nice that you did that. Okay. BP strategy How BP strategy stacks up against the super majors. We talked about this about a month ago, two months ago. And part of the thing is total energy in Texas. Way to say total. You had Shell and you had BP all went total, all in on renewables. BP has then come back in and let’s go through some of these numbers. These numbers are pretty interesting. And then the big boys, the real oil and gas companies, Exxon and all the U.S. companies just getting okay. BP has curbed capital spending and projects while boosting shareholder payouts. The UK’s CapEx frame of 14 to 18 billion, is that in line with Total and Chevron? But those two companies have larger market caps. They have the highest percentage of spending devoted to low carbon business. So they also wanted to go back in. The key difference, Michael, is BP. They’re putting a they want to spend as much on shareholder distributions as it invests in business. This formula will not work by them not investing more in CapEx in oil and gas. You peel out your profitability out of oil and gas and you try. To do more what they just said in the carbon, low, carbon, everything else, you’re not going to be able to give the money back to the investors. [00:10:22][108.8]

Michael Tanner: [00:10:23] This author does a great job of pointing out that while that distribution, as you mentioned, the allocation of 60% or more of so-called free cash flow to share buybacks and to support dividend increases of at least 4% annually, that comes on the heels of the 2020 dividend cut, which lost about 50% of the dividend value came in 2020 due to a write down of a lot of that renewable stuff we talked about. So it’s a double edged sword. You, you, you, you, you on one hand say you’re going to continue to invest free cash flow into shareholders. But if there’s no free cash flow to go around because it’s being dumped into offshore wind, it’s like what’s going on with Ford? They’re losing $67,000 on cars, yet they can’t figure out how to pay their employees. [00:11:10][47.1]

Stuart Turley: [00:11:11] Oh, yeah, that that whole thing is just turning out to be a debacle. Michael, I mean, your assessment yesterday was spot on and I agree with the union workers they deserve. I mean, when you get a 40% pay raise as the CEO and you’re not taking one for the team, you don’t deserve to be the CEO as far as I’m concerned. [00:11:32][20.9]

Michael Tanner: [00:11:33] I know, Steve, we’ll talk about your pay after this. We probably got to do some. [00:11:36][3.2]

Stuart Turley: [00:11:37] Work every day. [00:11:37][0.8]

Michael Tanner: [00:11:38] Just doing the hard time that we got to do. This last one cracks me up. Do electric tanks on electric batteries. On tanks. Got to love it. [00:11:46][7.8]

Stuart Turley: [00:11:46] Oh, U.S. Army electric tanks on hold as battery technology develops. You can’t buy this kind of entertainment. And, you know, do you remember, what, four months ago or so we had that maybe even five months ago we had the solar panels going on the EV. I mean, on the tanks, there’s some technology and physics involved in this. Let’s go through this here in a sec. Army needs 20 fold increase in battery charging. Let me give you some numbers here. There are no EVs deployed in the battlefield because right now, Michael, if you park in a electric bike into your apartment, they blow it up. I mean, like Larry the Cable Guy would go that just blowed up the whole apartment. I mean, you hit a shell or a 22 round at a tank, it will blow up. All right. Let’s go in here. And it says the technology challenges mean not a single all electric fighting vehicle is currently deployed in the field. Really? [00:12:51][65.2]

Michael Tanner: [00:12:52] But don’t worry. Your Defense Department is hoping intense interest in scaling up batteries for consumer utilities will lead to break. No, it probably won’t. [00:13:01][8.2]

Stuart Turley: [00:13:01] No. Okay. To charge a 50 ton tracked combat vehicle inside the Army’s preferred envelope of 15 minutes, soldiers would need a 17 megawatt charging station more than 20 times bigger than the largest mobile generator the Army currently has. Do you know how much diesel you got to hold of the front line to charge these tanks? [00:13:28][27.1]

Michael Tanner: [00:13:29] Yeah. [00:13:29][0.0]

Stuart Turley: [00:13:30] I just. Okay. Which came first? You bring the charging thing and then you bring all the tankers to charge it. And then they said, Oh, this is safer for the men because they won’t have to deal with the fuel, the very volatile fuel. Hogwash. There aren’t. I mean. [00:13:52][21.7]

Michael Tanner: [00:13:54] Here’s my thing. If you could actually come up with a battery that’s stored more in theory, this Army Lieutenant governor general, General Ross Kaufman, who says this, he uses the phrase ideally, and I agree with him. Ideally, you would be able to go all electric because of the benefit. The problem is we don’t live in an ideal world. We live in a world and we live in reality. And unfortunately, reality and physics still mean something. [00:14:19][25.3]

Stuart Turley: [00:14:19] Oh, yeah. And now when you sit back and take a look, we have to be mindful of equipping, equipping our sons and daughters of this nation with something that’s going to be reliable and useful in the battlefield. All right. Leave that one. [00:14:33][14.1]

Michael Tanner: [00:14:34] Alone. I know what’s going to be useful in the battlefield. Not batteries. [00:14:36][2.8]

Stuart Turley: [00:14:37] No wood. Okay, Michael, when you’ve got a 50 ton tank and you add 48 tons of battery to make that 50 ton tank work, you’ve got a 90 ton piece of crap driving around. You think it’s going to get through the mud and the rations? No, no. [00:14:57][19.9]

Michael Tanner: [00:14:58] End up in some battery graveyard in the middle of Africa. [00:15:00][2.3]

Stuart Turley: [00:15:01] Oh, yeah. And the kids are going to get to mine it. It’s going to kill all the elephants. Oh, yeah. It’s horrible. [00:15:07][5.6]

Michael Tanner: [00:15:07] Hey, now it’s going to move from saving the whales to saving the elephants. I think you buy dead. Five. The neck round for PETA. Save the elephants, folks. [00:15:16][8.6]

Stuart Turley: [00:15:17] They call me the People’s Man, the purple poster. [00:15:22][5.1]

Michael Tanner: [00:15:22] We appreciate it. We’ll go ahead and move over due to finance, guys. Overall, markets took a little bit of a plunge today. S&P down 9/10 of a percentage point. NASDAQ dropped over 1.5 percentage points off the back of the QE2 prediction of no rate hike increase. Fair, Chad. Jerome Powell comes out today at 1:00 Central Time, speaks at 1:30 p.m. Central Time today. Or as you listen to this yesterday and confirm that that benchmark, 5.25 to 5.5 federal funds rate does stay in effect. And what he the problem is what he went ahead and signaled and what caused markets to crumble here is mainly the fact that that rate is going to stay there most likely through 2024. So unfortunately, not taking Stu’s advice of lowering it, but he did exactly what Stu’s prediction was, was go ahead and leave that at that five, two, 5 to 5 five federal funds rate. Stu, what is your initial reaction to what Fed Chair Jerome Powell said today? I know you were earnestly watching. [00:16:19][56.4]

Stuart Turley: [00:16:20] I was. As a matter of fact, I think he’s a complete nimrod. And what he was saying spoke out of both sides of his mouth. I mean, he he’s he’s a politician. He said he said that the American people that are in the lower income and they’re having to borrow money off of their credit cards at 26% are doing just fine. What chatter ahead. Okay. Then he went in and he went even further on. Billions do. He doubled down on QE2, but he does not know how to fix it. [00:16:53][33.9]

Michael Tanner: [00:16:54] No, he does not. For what that means for oil prices. We actually did see a little bit of a tumble in prices, mainly because of that tighter policy the Fed expects through 2024. That really is what caused rates to turn out. We only saw Brant down about three quarters of a percentage point. So $0.70 for Brant, only $0.38 for crude oil. We did see the EIA do come out today. They only did about a 2.1 million barrel draw. We are expecting about a 5 million barrel draw. So again, to ease prices a little bit, all that circles into the mixed sentiment. I think we’re still in a demand surplus going forward, but it’s clear some of that stuff is beginning to wane a little bit. I don’t think we back up our predictions. Do Do you still see $100 oil even after today’s Fed announcement? [00:17:36][42.3]

Stuart Turley: [00:17:37] Yes. And I even I even see more buying more. Yes. And and part of that is due to the interview. I got to see part of the interview with M.D.s and Brett Baird. I recommend everybody go watch that. It’s funny, This is his first interview he’s ever done in English. He speaks pretty good English. And so do you want to speak English or do you just hold off until you’re the ruler of the free world? And he is. So he’s he’s got some interesting thing to say. I again, Saudi Arabia, first they got it going. [00:18:14][37.2]

Michael Tanner: [00:18:14] And next, next, next, we’ll be doing the show live from Riyadh. I guess. [00:18:18][3.1]

Stuart Turley: [00:18:19] I think it’d be great. I did get Warren today on LinkedIn, by the way. [00:18:22][3.8]

Michael Tanner: [00:18:23] You got a warning from LinkedIn for saying what it was. [00:18:26][2.9]

Stuart Turley: [00:18:26] Actually, I commented on Tom Kirkman and I. [00:18:30][3.9]

Michael Tanner: [00:18:30] Said, You’re insane, by the way, in Insane. [00:18:32][2.2]

Stuart Turley: [00:18:33] I basically said that Ukraine was a crime scene and that I don’t approve of giving the money anymore. And Tom politely reminded me and he says, There is a new death squad funded by the U.S. and anybody in the U.S. now saying that bad things about Ukraine. Well, I love Tom. I don’t I can’t tell when he’s joking. When he’s not. [00:18:58][24.8]

Michael Tanner: [00:19:00] I can’t either. [00:19:01][0.4]

Stuart Turley: [00:19:03] So I’m going to I’m going to quit talking about Zelensky and Ukraine. Ukraine, That’s our. [00:19:07][4.0]

Michael Tanner: [00:19:07] CEO, folks. Right. You got anything else to do? What should people be scared of? Is our last show, the week. We got the weekly recap coming on Saturday. And we’ve got you’re what do you drop it on Friday interview wise? [00:19:22][14.3]

Stuart Turley: [00:19:23] The staff has a couple good ones in there and I’m not sure which one they’re going to give me first. So it’s going to be a surprise. But I have had phenomenal guests and I’ve got phenomenal guests coming around the corner. [00:19:34][11.8]

Michael Tanner: [00:19:35] We do have one with my combo curve, their director of client success, I can’t pronounce. Dan What’s his last name? [00:19:41][6.4]

Stuart Turley: [00:19:42] Galati Yeah, that’s it. He’s a bit Italian. [00:19:45][2.9]

Michael Tanner: [00:19:45] Hey, hey. [00:19:46][0.9]

Stuart Turley: [00:19:48] Hey, hey. So now we’re going to have a bunch of great podcast, bro. [00:19:53][5.6]

Michael Tanner: [00:19:54] No, so it’ll be great. You hear the weekly recap on Friday and did Stu and I will be back raging on Monday to bring you all of the news. We appreciate you sticking with us through this week. But with that, we’re going to let you get out of here and let you get up, finish your week. You made it through the week, guys. Great job for Stuart Turley. I’m Michael Tanner. We’re going to give it up to weekly recap. We’ll see on. Monday. [00:19:54][0.0][1142.2]