Daily Standup Top Stories

Shell agrees to sell stake in two U.S.-based renewable energy projects

Shell Wind Energy Inc. and Savion Equity, LLC, subsidiaries of Shell plc, have agreed to sell partial ownership stake in two U.S.-based renewable energy projects to InfraRed Capital Partners. Shell will sell 60% interest in […]

Yes, Heavy Regulation Hurts the Economy. Just Look at France.

It’s fashionable to claim that the free market ideas of Nobel laureate economist Milton Friedman have failed the country, and that it’s time for new policies. Campaigning in 2020, Joe Biden declared that “Milton Friedman […]

When Climate Ambitions Meet Energy Realities

In what is simultaneously receiving praise for being a historic achievement and criticism for not being ambitious enough, nearly 200 countries closed COP28 by agreeing to transition away from fossil fuels in energy systems. The agreement calls […]

Bitumen beyond combustion: how to triple oil sands value, reduce emissions, and create an advanced material industry for 2% of a battery plant’s subsidies

What if some phenomenally large energy/materials breakthroughs were right here in front of us, vastly more accessible than experimental aspirations, but held back by an image problem? To help ponder that question, it is necessary […]

Missiles from Houthi-controlled Yemen target commercial tanker, report says

Two missiles launched from territory controlled by Yemen’s Houthi rebels have targeted a commercial tanker near the strategic Bab el-Mandeb Strait, according to a United States official cited by The Associated Press news agency. The […]

Highlights of the Podcast

03:38 – Shell agrees to sell stake in two U.S.-based renewable energy projects

06:49 – Yes, Heavy Regulation Hurts the Economy. Just Look at France.

08:53 – When Climate Ambitions Meet Energy Realities

10:40 – Bitumen beyond combustion: how to triple oil sands value, reduce emissions, and create an advanced material industry for 2% of a battery plant’s subsidies

13:47 – Missiles from Houthi-controlled Yemen target commercial tanker, report says

16:10 – Markets Update

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:15] What is going on, everybody? Welcome to another edition of the Daily Energy News Beat Standup here on this gorgeous Thursday, December 14th, 2023. As always, I’m your humble correspondent, Michael Tanner. Coming to you from an undisclosed location here in Dallas, Texas, joined by the executive producer of the show, the purveyor of the show, and the director and publisher of the world’s greatest website, energy news beat, Stuart Turley, my man. How are we doing today? [00:00:38][23.5]

Stuart Turley: [00:00:39] Well, it’s a beautiful day in the neighborhood. And I’ll tell you what, it’s wild out there, man. [00:00:43][3.9]

Michael Tanner: [00:00:43] You’ve got an excellent menu for us lined up. First up, we’re going to cover today on the show, Shell agrees to sell a stake in two U.S. based renewable energy projects. Next up, this is an interesting opinion piece from my. I’m trying to find the article here from reason.com. Yes, Heavy regulation hurts the economy. Just look at France. Probably one of the great cover images of all time. We’ll make sure the YouTube audience gets the i e get that. Another opinion piece is up next from our friends over at the what’s this place? [00:01:16][32.8]

Stuart Turley: [00:01:16] C3 solutions Drew bonds class act. [00:01:21][4.7]

Michael Tanner: [00:01:21] We love them when climate ambitions meet energy realities. He will be on the podcast later next week. So we wanted to tee up a great opinion piece. And then finally, another friend of the show over at BOE report, Terry Etam Bitumen Beyond Combustion How to Triple Oil Sands Value, Reduce emissions and create substantial advanced material industry for 2% or a battery plant subsidies. Very interesting article. We absolutely love Terry over there for BOE reports as do will cover all that. And then finally, missiles from Gucci controlled Yemen target commercial tanker. That was one part of kind of the two part or really three part news that drove oil prices up. Stu’s going to kick it over to me and I will cover that price increase along with the CIA’s massive cut relative to what the AP saw. And then we’ll quickly kind of opine. The Fed did come out and announced today that they’re going to hold rates steady, but they did drop that. They indicate three rate cuts coming in 2020 forces do. And I will go back and forth on what we think that means for the broader economy and then we will let you get out of here, finish up your day, Finish up your week. Will bill will be off Friday. You’ll be able to hear an interview with Congressman who again. [00:02:29][67.2]

Stuart Turley: [00:02:29] Zach Nunn. He is out of District three in Iowa and he is a class act. You know, I’m I’m not too fond of too many politicians. And he’s a class act. [00:02:41][11.4]

Michael Tanner: [00:02:41] Absolutely. We appreciate the congressman for coming on. So you’ll hear that Friday and then you will get all of the weekly recap on Saturday. Before we dive into the show. Guys, as always, the news and analysis you are about to hear is brought to you by world’s greatest website. www.energynewsbeat.com. The best place for all of your energy and oil and gas news. Stu and the team do a tremendous job of keeping that website up to speed with everything you need to know to be the tip of the spear when it comes to the oil and gas and energy business. You can email the show questions@energynewsbeat.com you can hit the description below whether you’re on Spotify, Apple, Podcasts, YouTube. If you’re watching us there, hit the description below. Find all the links and timestamps to the articles and pop ahead to all of the different segments. You can hit us up Dashboard.energynewsbeat.com The best place for all your data and energy news combo. We’re really trying to push that as kind of a product. We got some great stuff in Q one lined up for that one, so appreciate the feedback we get on that. I’m out of breath though. Stu. Where do you want to begin? [00:03:38][56.5]

Stuart Turley: [00:03:38] Hey, let’s run off here to Shell. Shell agrees to sell stake in to US based renewable energy projects. My goal, you know, we’re doing that deal. Spotlight I always wonder if combo curve and well database would have anything on a renewable project. [00:03:57][19.0]

Michael Tanner: [00:03:58] Probably not. And B, but we could we you know, it’d be nice. [00:04:02][4.2]

Stuart Turley: [00:04:03] I’m the reason I bring this up in a little silly way is it might be good to go through their financials. So let’s take a look at this deal first. Shell Wind Energy and Salmon Equity, LLC subsidiaries of Shell PLC have agreed to sell a partial ownership stake in two renewable projects to Infrared Capital Partners. They’ll sell 60% in their Brazos wind holdings, 182 megawatt onshore wind farm in Slovenia. Texarkana Live, Louisiana and 50% interest in Madison Fields. Class B member LLC. Madison Fields a one 80 megawatt solar development in Madison County, Ohio. Hmm. Let’s see. Shell retain 100% of the offtake. Oh, I wonder how that. I was wondering how that would handle. Shell will retain 100% of the offtake. [00:05:01][57.9]

Michael Tanner: [00:05:02] Yeah. They got to sneak in there. That shell will be the asset manager of both these fields and projects will benefit from the Inflation Reduction Act tax credits. It just goes to show you we don’t know the financials on this transaction. So it. Goes to show there’s not that there’s something afoot, but there’s clearly some losses in here. The only reason I know of flu Varna is, is is I’ve done some and I’ve done some work for an oil and gas job very close to move on. And there’s some interesting stuff. There is a lot of wind out. There’s I wonder if some of the stuff I’ve driven by is actually those fields. But. But now there’s there’s clearly going to be some losses being hide here or there would have been a really fat dollar sign on this you know, on this agreement. [00:05:41][39.3]

Stuart Turley: [00:05:42] Well, you know, you are such a financial beast that I think that with all of our request for a deal spotlight, this would be kind of interesting. I would love to dig through these numbers somehow. So let’s. Before you raise your hook arm, let’s go over here. I would love to have producer Andy, if you can slide in for our YouTube pictures. This man is he’s one of the most rugged looking dudes I’ve ever seen on the planet. Got some good look in here, got a good dark thing, and he’s holding up a gas nozzle that is of European. And it looks like it’s French on Roma’s Pompei, a shell gas pump. And this. And he’s in a John Belushi toga party outfit in that fun. [00:06:33][50.7]

Michael Tanner: [00:06:34] It is funny. It is funny. [00:06:35][1.1]

Stuart Turley: [00:06:36] So can you imagine going trick or treating, holding that? Think of that thing that looks like a gun to your head. [00:06:41][5.3]

Michael Tanner: [00:06:41] No, don’t dilute us. Brutus just died. [00:06:44][2.7]

Stuart Turley: [00:06:49] Heavy regulations urge the economy. Just look at France and the free markets of Nobel Laureate economist Milton Friedman have failed the country. And Joe Biden declared that Milton Friedman isn’t running the show anymore. No kidding. Our regulations legislation through regulation is absolutely abysmal. Branch regulatory process is also covering many aspects of employment, business operations and environmental protection. That’s what’s killing their nuclear. They’re trying to bring back is there and they just slaughtered it. Look at this. The paragraph we’re under. It says right under. Let’s see how it’s doing. Look at the US. GDP per capita is now 76,003 98. France is 40,009 64. The US unemployment is 3.9, France’s was 7.2. [00:07:47][58.1]

Michael Tanner: [00:07:48] But that’s insane to me. It’s insane to me that the under that the millennial unemployment rate is 17.2%. We think it’s bad here. It you know, we’re at 4 or 5, 6%. We think the numbers are skewed. They’re not pulling any punches. [00:08:01][13.1]

Stuart Turley: [00:08:01] 17.2%. Exactly. And it’s showing an average of 20% in 1983. Why do you think there’s so much social disruption over there? The youth have nowhere to go. They were sitting there and they have no upward mobility. They are definitely not going to lose. They have the open border and then they have the youth not being able to get a job. It is regulatory issues out the wazoo. No wonder that guy looks like that. [00:08:30][28.1]

Michael Tanner: [00:08:31] Yeah, he’s also 15 years old. So that’s the other thing you have to realize. He’s only 15 years old. [00:08:36][5.8]

Stuart Turley: [00:08:37] So I swear that was a tanner funny. And I know you got the hook arm going there. [00:08:44][7.0]

Michael Tanner: [00:08:44] I’m here to get us. [00:08:45][0.5]

Stuart Turley: [00:08:45] What’s next that we got Captain Hook here. Wing climate. If you call me Tinker Bell, I am absolutely going to go nuts when climate bill climate ambitions meet energy realities. Okay. I want to give a shout out to Drew Edmonds. He is absolutely a class act. He’s over there at Three Seas Solutions and he’s over at Cop 28 and he just got back today. We’re going to record next week after he gets some sleep. Anyway, this article says any transition in the world’s energy system will not come from a language hammered out on the 11th hour in Dubai. I agree on Kerry, who was wound up because he thought nothing was going to get happened in the way the oil as the language in the communique says the transition must occur in a just and orderly and equitable manner. After all, may look bad to have sessions at camp on environmentally sustainable yachts while yelling at people at developing in country. It’s okay if their refrigeration is lost for days at a time. [00:09:53][67.7]

Michael Tanner: [00:09:55] Yeah, we don’t need refrigerators. It’s all good. [00:09:57][1.9]

Stuart Turley: [00:09:58] It’s all good. But you know. [00:10:00][1.4]

Michael Tanner: [00:10:00] The guys over at C three Solutions, I love them. They’re one of they’re a policy focused energy website, which I think is a little bit you know, I’m always big on find your niche that you’re good at and you love. They’ve found a good niche. [00:10:12][12.2]

Stuart Turley: [00:10:13] I’ll tell you, I learned so much on my last podcast with Drew. He is a class act and following on, you can find his news articles on C three news mag.com. Cool cool guy and is going to be just an outstanding podcast. So let’s go to the next one as I’m raising my arm up for him. Okay. We both got an arm. All those in favor going to the next show? Okay. So, Bitumen, beyond combustion, how to triple oilsands value, reduce emissions and create advanced material industry for 2% of battery subsidies? This is crazy. First, let me give Terry Itam a shout. Michael, if you’ll scroll down to the bottom of the article and Andy, producer Andy, if you could roll the picture out. Terry sent me a book and he says he signed it. Stu you are the best podcast host in the industry. Grumpy. Terry Etam. That was so nice of him to sign that book that it was really, really pretty cool, you know, say I was the best podcast host. Notice he didn’t put your name on there. Okay, so let’s go up here to this article. What is some phenomenally large energy material breakthroughs? We’re right in front of us, dude, I don’t care. I’m energy agnostic. I’d love to say let’s do it Beyond combustion. How to triple the let’s see here. We might get more comfortable on nuclear energy. The world seems hell bent on carbon free energy, and the only way that’s going to happen is if we make up a billion is nuclear power. I agree that nuclear has got to happen. Let’s go where he is talking about this. Okay. So coming out of the oil sands, just a real quick update on the oil sands, oil sands, when they get done with that. It is the cleanest land on the planet. So, I mean, Canadians do a great job regulatory issues up there on that. So the barrel bitumen as a whole, the BBC white paper estimates the following benefits If 1 million barrels per day measurement is sold to refineries at $50 per barrel after diluent removal, the revenue is 18 billion per year. If the same volume was used to create BBC products, the potential revenue is 42 billion. The number includes the value is plus the value of the light ends remaining at 14. Unbelievable. If you take a look at how all of this could come back around and. [00:13:03][169.5]

Michael Tanner: [00:13:03] It seems like they’re they’re funding it at just 30 million a year, that’s how much is coming in the Canadian government. They could they could have 40 billion on the table. And instead they’re like, we’re just going to invest 30 million. It’s insane. [00:13:16][12.9]

Stuart Turley: [00:13:16] It is it Terry Etam. I just want to give you a shout out. Don’t tell him that was my Biden imitation. Again, don’t tell Terry that he’s a good guy. I mean, it doesn’t make sense. Here’s some energy technology that makes sense. Yeah. [00:13:34][17.3]

Michael Tanner: [00:13:34] And it’s a way to sustainably make sure. I mean, if we’re all about ESG folks, this is stuff that can help. So we love Terry bringing that up. Let’s do this last one because this really moved oil. This helped move oil prices today. Oh, you. [00:13:47][12.3]

Stuart Turley: [00:13:47] Bet. Missiles from the hoody controlled Yemen Target commercial tanker says the report. I’ll tell you, there are several choke points. Let’s start with just a couple of them. Everybody knows the Suez Canal in the Gulf of Suez is up at the other end going into the Mediterranean. We have the Red Sea going along. And then Yemen is in the Bab el Mandeb Strait between the booty and Yemen. The Swabi Islands and the Yemen’s permanent island is in the middle of it. That’s where this happened. And it’s a very short strait to go through That is extremely small. [00:14:30][43.4]

Michael Tanner: [00:14:30] Yeah, it really is. That ship was carrying Indian manufactured jet fuel that was most likely headed to Rotterdam, which is in the Netherlands or Sweden by the AMA, the Amador Shipping Corporation. That’s what they said in a statement. And if you want to hear something funny. [00:14:44][14.0]

Stuart Turley: [00:14:45] Yeah, it came out. It came from Mangalore in southern India and had an armed crew on board. That was Russian crude coming from India because that’s there in order for roach athletes. [00:14:59][14.1]

Michael Tanner: [00:14:59] Yeah, luckily nobody was injured in this, according to the shipping company. But still, you know, that’s it’s something that that, you know came out of the Houthi official Muhammad Ali Al howdy warned cargo ships in the Red Sea to avoid. Traveling towards Israel and who promptly respond to any who she attempts or who the attempts to contact them. So, you know what’s funny is prices were only up slightly today off the fact this and another piece of data that we’re coming to. So the geopolitical I think risk that’s out there right now is really never been higher. The problem is, is it really being priced into where the market is right now? I don’t. [00:15:36][36.8]

Stuart Turley: [00:15:36] Know. Well, let me throw that one. You hit on one paragraph that I want to talk about is because as they’re coming out of the Gulf of Aden and they’re going into the Red Sea to where they were attacked, you could go up to the Suez Canal and off to the Mediterranean. How do you how did they call up ahead of time and go, hey, are you going to Israel? Well, yeah, I’m going to the Suez Canal and I’m going to the Mediterranean. Boom. You know, they may not have even been going to Israel and they got attacked. Does that make sense now. [00:16:09][32.3]

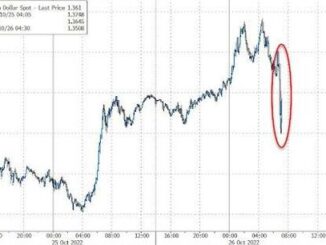

Michael Tanner: [00:16:10] Guys? Markets rallied pretty heavy today. S&P 500 up 1.37 percentage points. Nasdaq up 1.2 percentage points, mainly off the back of the Fed deciding to hold interest rates steady through 2023. Also indicating three rate cuts come in in 2024. I had to give you guys an idea. They went ahead and kept the benchmark overnight borrowing rate at at the targeted range between five and a quarter percentage points and five and a half. That’s via the Federal Open Market Committee, which is made up of the board of Fed Governors and some rotating members. What’s interesting is that markets rallied off this, even though we were pricing already in for rate cuts in 2024. So kind of shows you where that sentiment lies. Anything of value is going to help that actually rose The Dow Jones Industrial average more than 400 points, surpassing 37,000 for the first time ever in history. To give you guys an idea, you know, this this you know, the market is sort of widely anticipated, this decision to stay put. We are already at the highest level in 22 years. So nothing, nothing decision there. You know, the famous dot plot of all the individual members expectations indicates for rate cuts in 2025 or another hope of full percentage point. And those reductions in 20 of those three more reductions that they’ve also pegged for 2026 theoretically would take that fence fund Fed funds rate down to 2 to 2 and a quarter percentage point through the final two years of what they’ve anticipated. And it could be even more aggressive, as Jerome Powell said, in an aggressive you know, you know, he’ll you know, the quote really they got everybody was inflation is eased from at highs and has come without significant increase in unemployment. That’s very good news. I don’t know what world Jerome Powell is living in, but I think inflation is still pretty high, even though he did go on to say that prices were still elevated. So he’s fed speaking out of both sides of his mouth. That did drive oil prices up a little bit. We did end up the day about a percent and a half off the lows as we currently sit here. About 530 on the 13th, oil sits at about 69, 95. Hopefully we can roll over to 70 in kind of that overnight trading session. And we also did see the EIA drop a 4.3 million barrel draw from the Strategic Petroleum Reserve. That again, in concert with that tanker off of Yemen getting fired. And they go ahead and braise. Those are the big two sentiment movers, but again, only up about 1%. Again, traders were also elated that Jerome Powell is going to go ahead and hopefully cut rates in 2024. So all leads were where do you see you know, it’s clear Jerome Powell speaking out of both sides of his mouth. It’s what he’s got to do Is the Fed, as the Federal Reserve chair, where do you see what do you see the Fed doing in 2024 QE2? [00:18:54][163.9]

Stuart Turley: [00:18:54] I don’t think the Fed knows what they are going to do. I don’t think they ding. Here’s the thing. I think they they can’t fix inflation. Inflation is beyond repair with their skill set, with their tools. I think that you will see by March them lowering the interest rate to try to help the election. That is my opinion. I think January they’ll hold. I think February you’ll start seeing them down, down turning in order to try to do anything they can to help Biden get reelected. Oh. [00:19:28][34.3]

Michael Tanner: [00:19:30] Nothing. Yeah, no kidding. So, well, we’ll follow that conspiracy all the way to just my opinion. I know. I know. Why show the weakness, too? Why should people be worried about this weekend? Oh, I’ll tell you. [00:19:41][11.4]

Stuart Turley: [00:19:41] It is so great that cop is over with, and I’m d analyzing and interviewing folks and my production staff. And your production stab is absolutely going to be thrilled out of their mind. They’re going to have a little bit of a break before nap next year. [00:19:59][17.7]

Michael Tanner: [00:19:59] Oh yeah, they better they better buckle up for an It’ll be fun guys. Well, we appreciate you guys sticking with us this week. We have our Eye a podcast with what’s this Congress? Adam Nunn. [00:20:09][10.4]

Stuart Turley: [00:20:10] Zach Nunn. [00:20:11][0.5]

Michael Tanner: [00:20:11] Zach Nunn We’ve got. Bless you, Zach Nunn District one out there in Iowa. He’ll be on the podcast Friday. District three or 4 or 5, whatever. Whatever. It’s all good. [00:20:21][9.7]

Stuart Turley: [00:20:21] He’s cool and I salute. [00:20:23][1.5]

Michael Tanner: [00:20:23] He beat me up. I’m sure. [00:20:24][0.9]

Stuart Turley: [00:20:25] He would. [00:20:26][0.1]

Michael Tanner: [00:20:26] You would put me in a corn fed chokehold. [00:20:28][2.2]

Stuart Turley: [00:20:29] Yeah, he’s military. [00:20:30][0.6]

Michael Tanner: [00:20:31] Yeah, he’d be. They’d take me out. The point of the matter is, guys, we’ve got that interview coming on Friday. You’ll hear our weekly recap where we cover our top segments from the week on Saturday, and then we’ll be off Sunday. And we will see you back in your favorite podcast platform via Monday. With that, guys, have a great weekend for Stuart Turley on Michael Tanner and the entire energy news beat team. We’ll see you on Monday, folks. [00:20:31][0.0][1182.2]

– Get in Contact With The Show –