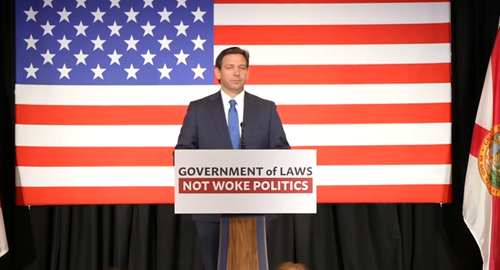

Florida Governor Ron DeSantis (R) on Monday announced a proposal to eliminate ESG banking and prohibit the financial sector from implementing social credit scores that would otherwise prevent Floridians from obtaining loans, lines of credit and opening bank accounts.

“Today’s announcement builds on my commitment to protect consumers’ investments and their ability to access financial services in the Free State of Florida,” said DeSantis in a statement. “By applying arbitrary ESG financial metrics that serve no one except the companies that created them, elites are circumventing the ballot box to implement a radical ideological agenda. Through this legislation, we will protect the investments of Floridians and the ability of Floridians to participate in the economy.”

The proposal “seeks to protect Floridians from the woke ESG financial scam” by:

Prohibiting big banks, trusts, and other financial institutions from discriminating against customers for their religious, political, or social beliefs — including their support for securing the border, owning a firearm, and increasing our energy independence.Prohibiting the financial sector from considering so called “Social Credit Scores” in banking and lending practices that aim to prevent Floridians from obtaining loans, lines of credit, and bank accounts.Prohibiting banks that engage in corporate activism from holding government funds as a Qualified Public Depository (QPD).Prohibiting the use of ESG in all investment decisions at the state and local level, ensuring that fund managers only consider financial factors that maximize the highest rate of return.Prohibiting all state and local entities, including direct support organizations, from considering, giving preference to, or requesting information about ESG as part of the procurement and contracting process.Prohibiting the use of ESG factors by state and local governments when issuing bonds, including a contract prohibition on rating agencies whose ESG ratings negatively impact the issuer’s bond ratings.Directing the Attorney General and Commissioner of Financial Regulation to enforce these provisions to the fullest extent of the law.

“That is a way to try to change people’s behavior. It’s a way to try to impose politics on what should just be economic decisions,” said DeSantis, of ESG. “We are also not going to house in either the state or local government level deposits. And we have a lot of deposit, we got a massive budget surplus in Florida, you have deposits all over the place that go in where state and local government use financial institutions, none of those deposits will be permitted to be done in institutions that are pursuing this woke ESG agenda.”

As Florida’s Voice notes,

The proposal would also aim to make sure ESG will not “infect decisions” at both the state and local governments, such as investment decisions, procurement and contracting, or bonds.

House Speaker Paul Renner said Bob Rommel, R-Naples, will introduce the bill in the House.

“The biggest thing that I think ESG represents is a total hijacking of democracy,” said Renner.

“We’re lucky here in the state of Florida, that we’ve got a governor who will stand up to things like ESG, when others will not.”

Loading…