The OPEC+ meeting that began on Dec. 1 is still technically “in session” 11 days later. Remarkably, perhaps, it’s still short of being the oil producer group’s longest gathering — it has another week to go to beat the one held in October 1986.

This time, of course, it is much easier to conduct a lengthy meeting. With the deliberations held by videoconference, ministers are free to conduct their normal duties until the chairman decides they need to reconvene. Thirty-five years ago, the ministers and their delegations were ensconced in Geneva hotel suites, far from their desks back home. Then, as now, they were grappling with a market that was slowly recovering from an unprecedented demand shock — although the trigger was very different.

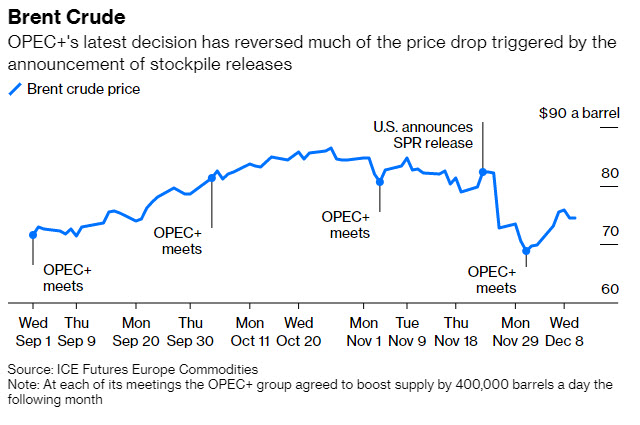

Right now, the OPEC+ group is doing most good by doing nothing. The meeting is “in session” in name only. Nonetheless, it is proving to be a very successful strategy to support crude prices in the face of uncertainty over the omicron variant’s impact on oil demand.

The ministers convened amid widely held expectations that they would delay January’s planned output increase.

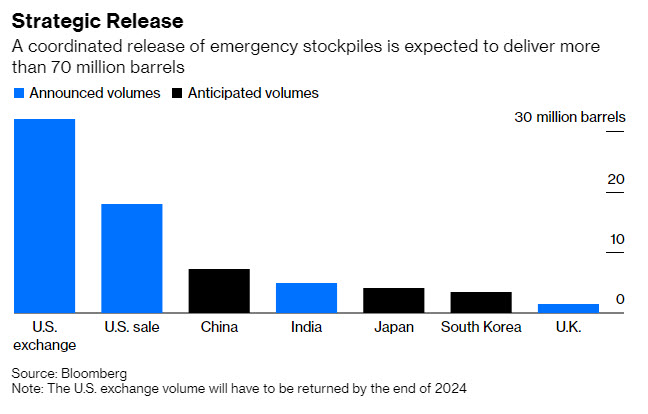

Back in July they decided to add 400,000 barrels a day to supply each month until they restored all the production they’d agreed to cut back in April 2020. But forecasts of the oil market swinging from deficit to surplus by the year’s end had OPEC+ worried, as did the world’s five biggest oil-consuming countries outside the group coordinating a release of strategic stockpiles to ease inflation. None was more concerned than Saudi Arabia’s Prince Abdulaziz Bin Salman, who has consistently urged a cautious approach to boosting supply.

To the surprise of many, the group agreed to go ahead with January’s planned output increase. That decision undoubtedly helped defuse tensions with the Biden Administration in the U.S. The strain was triggered by the producers’ earlier refusal to make a larger increase in production in December and then exacerbated by the announcement that the U.S. and other countries would release crude from emergency stockpiles.

Note: At each of its meetings the OPEC+ group agreed to boost supply by 400,000 barrels a day the following month

That move put a floor under crude prices, which had fallen by $13 a barrel, or 16%, since the new Covid-19 variant emerged just two days after Biden announced the stockpile release.

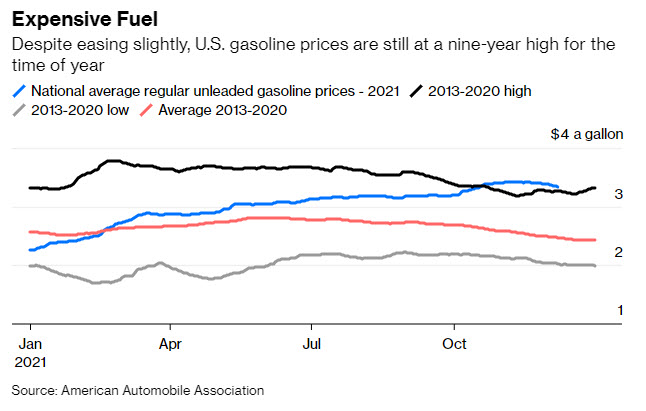

Meanwhile, U.S. gasoline prices have eased, if only slightly, allowing Biden to quietly claim success for his strategy. But he can’t shout too loudly as prices are still the highest for the time of year since 2012.

The release of strategic stockpiles is still going ahead, although they have yet to hit the market. The deadline for bids for the initial 32 million barrels of U.S. crude was Dec. 6, with contracts to be awarded on Dec. 14. Only then will we know the strength of buyers’ appetites. There’s no guarantee they will want all the oil on offer.

Other countries that said they would join the U.S. — India, Japan, China, South Korea and the U.K. — are also yet to release oil from their reserves.

That plan of keeping the meeting live while actually doing nothing is looking like a master stroke. After all, the world needs to digest the impact of both the omicron variant and the release of emergency stockpiles.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.