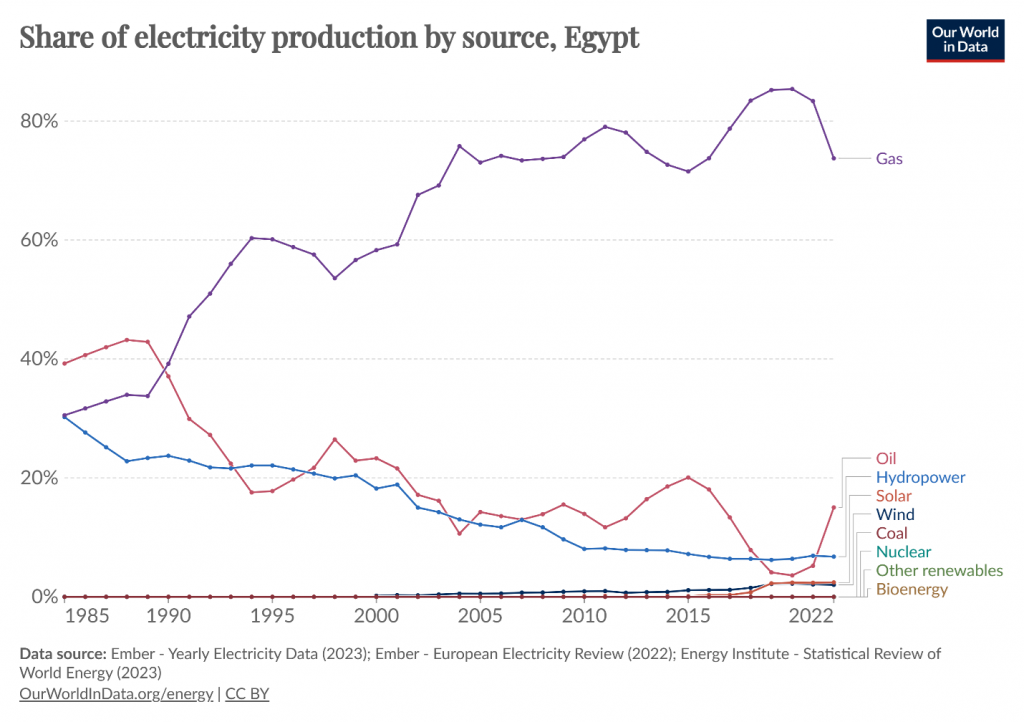

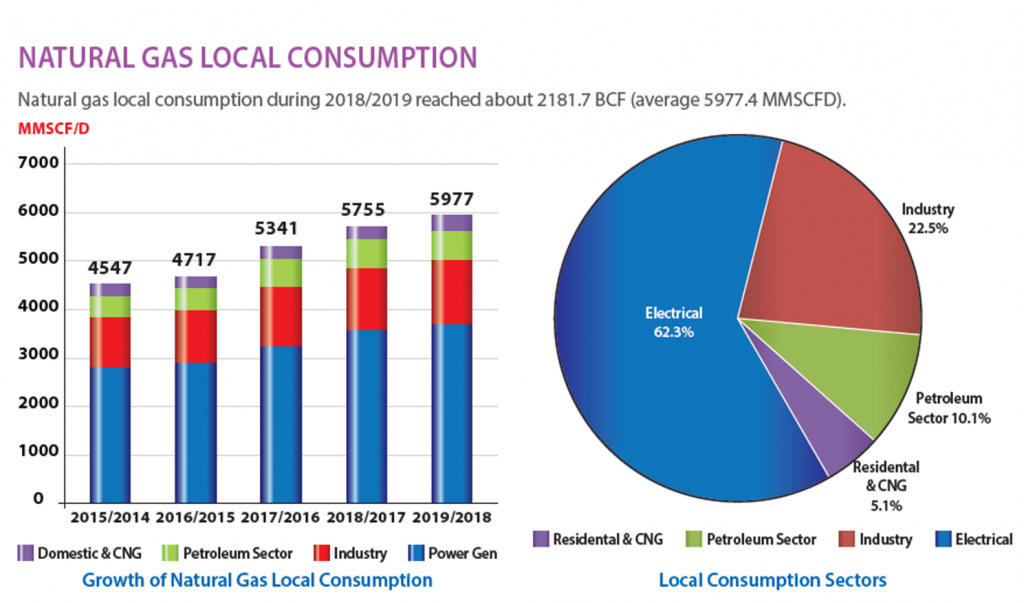

Egypt has a long and storied history across thousands of years. It has seen the world develop from a hunter-gatherer society to the modern globally connected world. Egypt has long relied on the presence of the Nile River to sustain the country, however in terms of energy the famous river only plays a small part in the now fossil fuel powered country. Egypt has significant oil and gas reserves which form the foundation of its energy industry with natural gas being responsible for over 70% of its electricity production.

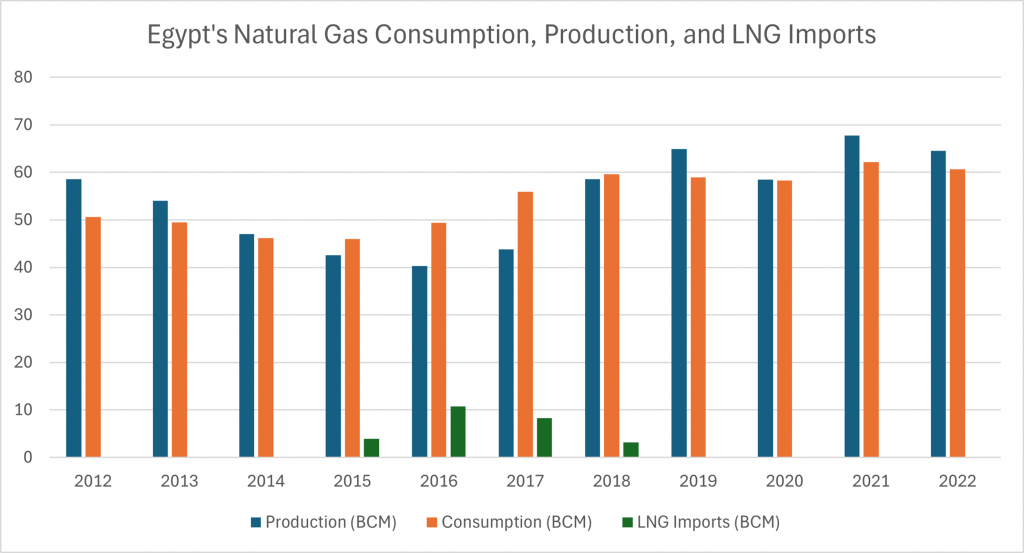

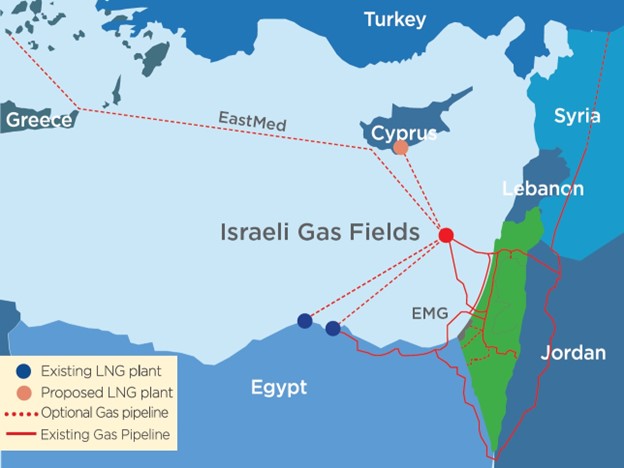

With natural gas as a main staple in its energy mix and despite having abundant gas reserves of its own, Egypt often cuts it close on meeting its demand with domestic production and has even had to import LNG at times to avoid shortfalls. That LNG was obtained via two floating storage and regasification units (FSRUs) located at the Egyptian Red Sea port of Ain-Sokhna, south of the Suez Canal. One of these, the Hoegh Gallant, relocated to Jamaica in 2018. The second, the BW Singapore, sailed to Dubai in late 2023 and is scheduled to be operating in Ravenna, Italy, in 2025. Thus, Egypt no longer has the capacity to import LNG. Its only sources of gas are domestic production and imports of Israeli gas via the Arish-Ashkelon Pipeline and gas that is being rerouted through Jordan.

The top producing gas field in Egypt is the Zohr field which was discovered in 2015 and began production in 2017. It is estimated to contain 30 tcf (850 BCM) of natural gas. This field is also the largest within the Mediterranean. Other significant fields contributing to Egypt’s domestic production include the Nooros gas field currently producing 1.2 bcfd and a collection of projects within the West Nile Delta producing 1.3 bcfd.

However, despite Egypt’s top fields containing the reserves necessary to meet forecast consumption for the next several years, there have been recent reports that the gas within these fields is becoming difficult to reach due to water infiltration causing declines in production. Egypt has challenged these reports and has highlighted recent investments into the gas field which is expected to be reaching $15 billion within the next three years. Egypt is investing more into its domestic production in hopes that not only will it be able to avoid potential shortages, but also increase its presence in the global LNG market.

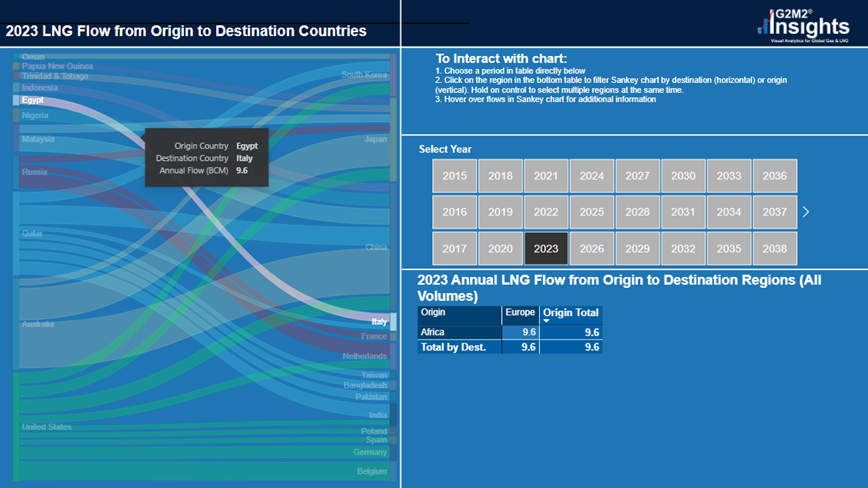

Egypt, by a combination of pipeline imports and production, already exports a significant amount of LNG, with its primary customer being Italy which is set to have imported 24.4 bcm in 2022 through 2024.

In addition to being its top customer, Italy also has a significant stake in Egypt’s LNG industry. In April of 2022, Italy’s ENI signed a deal to “Boost gas production in Egypt and boost liquefied natural gas supplies to Europe.” This is one of several initiatives by European countries to find alternative sources of gas supplies in the wake of the war in Ukraine. ENI has a presence in several Egyptian gas fields: Zohr, Nooros, Baltim W, and Meleiha. ENI also has a 50% stake in the Damietta Segas LNG export terminal which has a capacity of 5 mtpa.

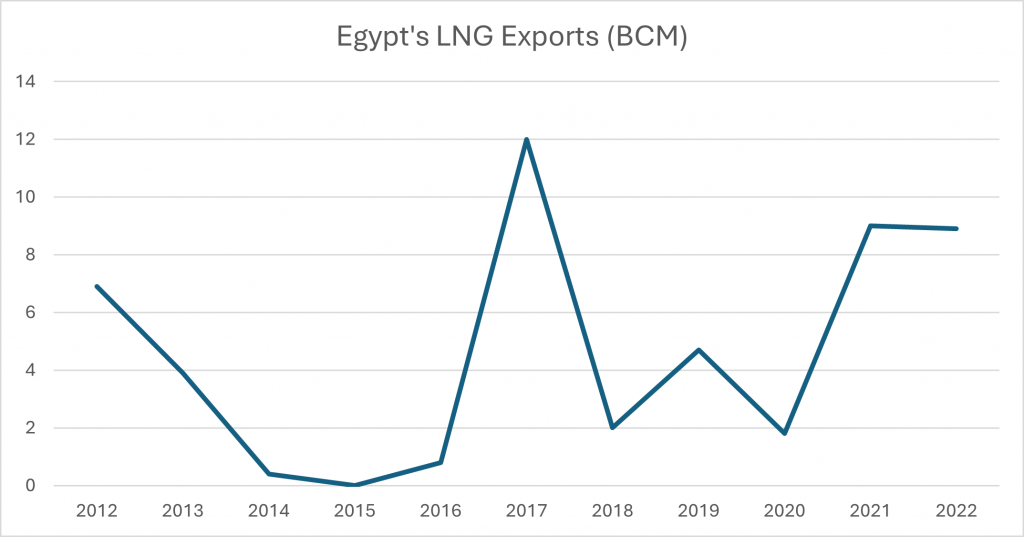

However, Egypt’s dreams of becoming not only a stalwart natural gas producer in the Middle East, but an LNG export hub as well, could be in jeopardy. Egypt has run into supply shortages that resulted in being unable to meet contracted export volumes in 2015-2016. Production nosedived and the gas that was going to be used for export had to be re-routed for domestic consumption. Egypt will need to ensure the reliability of its production and supply sources to convince potential buyers that if they sign a contract with Egypt for LNG, it will be honored.

Egypt currently imports Israeli gas from the Tamar field for its own domestic consumption and for re-export as LNG. This field suspended production[1] as a result of conflict in the region which has greatly affected Egypt’s supply of natural gas. The Tamar gas field resumed production approximately 1 month after the shutdown and was able to reach full capacity within a few days of resuming. Had the conflict between Israel and Hamas not taken place, Israel was planning to increase its gas exports to Egypt to further strengthen longstanding diplomatic ties between the two countries.

Gaza’s Natural Gas

Egypt also had plans to assist in the development of the offshore Gaza Marine gas field (approved by Israel in June 2023) which was going to begin late 2024 to secure another potential gas supply source. Development of this field containing an estimated 1 tcf of natural gas stalled due to political disputes. With the current ongoing conflict the future development potential of this field is up in the air.

But if it were developed, this field would also be able to help Gaza achieve energy independence as it currently has limited power generation capacity of its own. Even that generation is powered by fuel imported from Israel, and it imports electricity from Israel as well. Unlocking the gas reserves within the Gaza Marine field would not only provide energy for its people but could also help improve its economy through exports. Gaza has a limited amount of consumption that the 1 tcf would more than enough cover.

If we look at the conflict between Israel and Hamas from the standpoint of its potential effects on the global natural gas and LNG market, we see that the longer the conflict continues, the further the risk of supply disruptions and price fluctuations take place. Israel’s gas production took a hit from the shutdown of the Tamar gas field, but its other fields such as Leviathan and Karish were able to pick up the slack.

However, Israel faces conflict with Hezbollah on its Northern border with Lebanon. If this were to escalate further and more of Israel’s gas production capacity were to be come suspended, not only would it imperil Egypt’s supply, but the entire region of Israel, Palestine, Jordan, and even parts of the EU would be affected as they receive Israeli gas via pipeline or LNG re-exported from Egypt.

Only time will tell if all parties can reach an agreement and cooperatively develop the region’s large natural gas resources to provide energy for all.

Egypt’s Energy and Finance Challenges

As to Egypt, it is still in the midst of its own problems on several fronts and needs to find new sources of energy. Egypt’s credit has been downgraded and international players are hesitant to invest, citing lack of currency reform. Gas supply shortages have resulted in power cuts during the sweltering heat of the summer months.

With a combination of rising demand from residential and industrial sectors, falling imports, and plunging production from one of its top producing gas fields contributing to, “Total gas output [falling] to a three-year low in the second quarter of 2023,” this is a recipe for disaster.

Being able to export LNG would be of great benefit to Egypt by bringing much needed foreign currency into the country to help pay-down skyrocketing foreign debt, increasing investor confidence and even perhaps enticing the large capital investments needed for long-term economic stability and energy security. And it does appear that the government has made serious efforts in this direction in 2023.

Egypt briefly saw a spike in its LNG exports as a result of the war in Ukraine. Its exports to Europe generated $8.4 billion USD. more than double the previous year’s revenues from LNG exports. However, in time, the high natural gas prices came down and Europe diversified its sources and found long-term suppliers, and this impacted Egypt greatly. “In April, Egypt’s trade deficit increased by almost 24 percent year-on-year, driven by a decline in the value of gas exports.” Egypt saw its LNG exports decline both in value and volume and finally vanish for a short period of time due to its own gas shortages. It could happen again if new sources of supply are not secured or current sources of supply not properly developed.

With uncertainty surrounding Egypt’s future gas supply, market analysts and policy makers must have the tools and knowledge necessary to explore all options available. This could involve ramping up domestic production for consumption and LNG exports or increasing imports through new pipelines and/or LNG import terminals.

Using Market Simulation to Assess Egypt’s Natural Gas Future

RBAC’s G2M2® Market Simulator for Global Gas and LNG™ can be used to assess the viability and effects that any project or change in policy would have on supply, demand, prices, and gas flows.

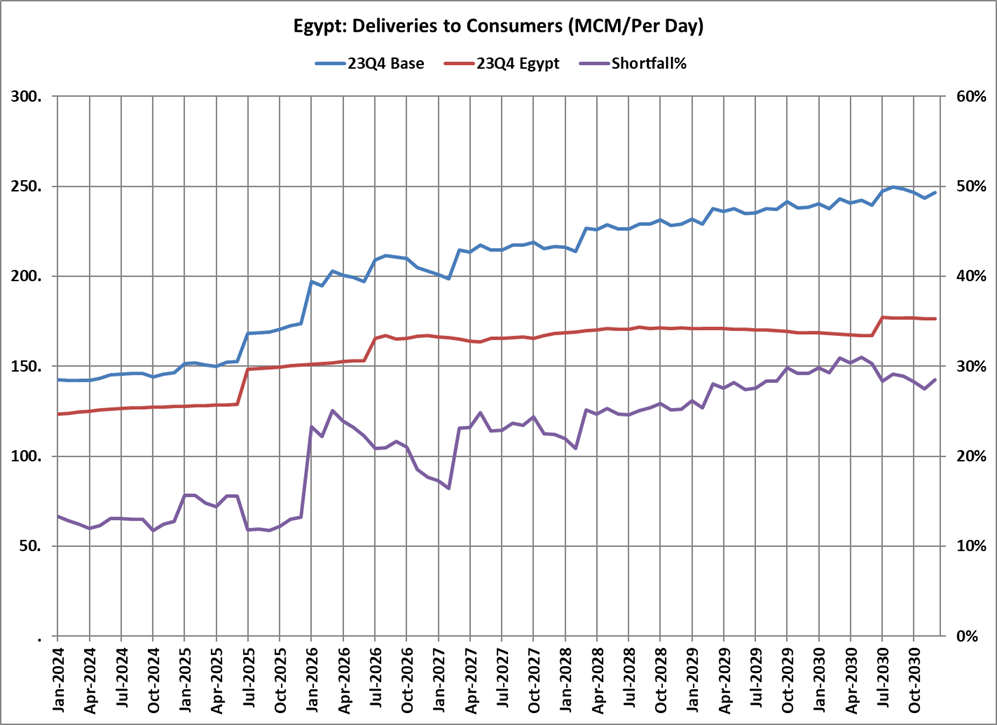

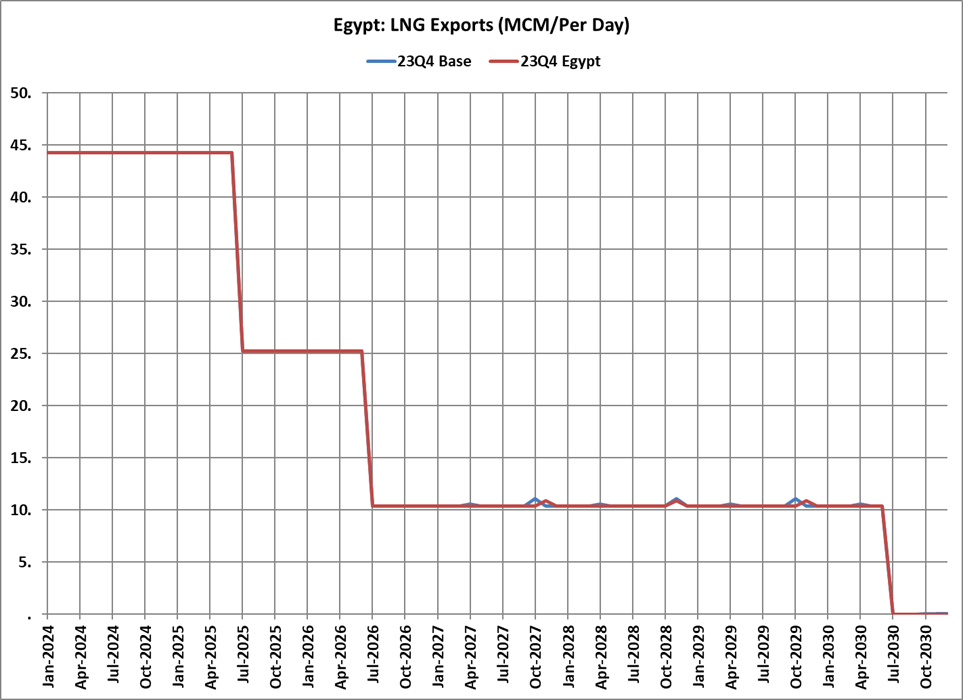

RBAC recently conducted such an analysis to investigate what might happen to the Egyptian gas market if pipeline imports from Israel were cut-off for the rest of this decade. As discussed earlier, the Arish-Ashkelon pipeline is the only source of gas imports for Egypt.

In the scenario where Egypt is not able to obtain a new charter for an FSRU to provide LNG imports, it would be dependent totally on domestic production for its natural gas supply. How would this affect the availability of gas for local consumption and for LNG exports?

Using G2M2, analysts at RBAC prepared two scenarios: 24Q3 Base (business as usual) and 24Q3 Egypt (cut-off Israeli pipeline imports 2024-2030). The charts below show the results.

Deliveries to consumers fail to meet demand. The initial shortfall is about 12% but domestic production cannot keep up with rising demand resulting in a 30% shortfall by 2030. LNG export contracts are satisfied but decline over the forecast period.

There is no additional gas available for new contracts or spot LNG exports. As they have done before, Egypt’s government would likely abrogate these contracts to try to satisfy local demand. However, LNG export terminal owners have shown that they are willing to go to court to force Egypt to make good when it violates contracts for supply.

In Summary

With geopolitical uncertainty in the region, it would well behoove Egypt to strengthen their supply sources whether through domestic production or finding another source of LNG imports, including new FSRUs. Recent efforts by the government and industry have shown a high willingness toward greater investment and productivity. It is with tools like G2M2 that both industry and government can find the best ways to achieve energy security, both in supply and production, through robust market analysis and better strategic decisions.

Thanks to RBAC’s G2M2 Team for assistance in the technical analysis.

RBAC, Inc. has been the leading provider of market fundamental analysis tools used by the energy industry and related government agencies for over two decades. The GPCM® Market Simulator for North American Gas and LNG™ is the most widely used natural gas market modeling system in North America. RBAC’s G2M2® Market Simulator for Global Gas and LNG™ has been instrumental in understanding evolving global gas and LNG dynamics and is vital in fully understanding the interrelationship between the North American and global gas markets.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack