In an era where energy demands are skyrocketing and climate change is reshaping weather patterns, Norway stands as a prime example of the vulnerabilities inherent in over-reliance on a single energy source. As Europe’s hydropower giant, Norway has long exported its abundant clean electricity to neighbors like the UK and other EU countries. However, a persistent drought in 2025 has exposed cracks in this system, raising alarms about domestic energy security and skyrocketing prices for Norwegian consumers. With reservoir levels plummeting to near 20-year lows, the country faces the grim prospect of rationing power while fulfilling export contracts. This situation underscores a critical lesson: energy security must begin at home.

Norway’s Energy Mix: A Hydro-Dominated Landscape

Norway’s electricity generation is overwhelmingly reliant on hydropower, which accounted for about 90% of its power mix in 2024, with wind contributing 9% and natural gas a mere 1%.

Are you Paying High Taxes in New Jersey, New York, or California?

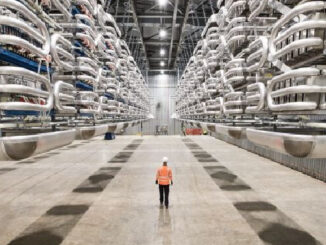

This renewable-heavy profile has positioned Norway as a net exporter, producing surplus energy from its vast network of over 1,240 hydropower reservoirs with a total capacity of 87 TWh.

In 2021, for instance, Norway exported a record 25.8 TWh while importing only 8.2 TWh, resulting in a net surplus of 17.6 TWh.

Low-carbon sources generated 98% of the country’s electricity in 2024, far exceeding the global average.

Yet, this dominance of hydropower comes with risks. Unlike diversified energy systems, Norway’s setup is highly sensitive to hydrological conditions. Climate change is exacerbating this, with forecasts predicting larger flood peaks, longer dry spells, and the need for greater flexibility in power production.

In 2025, warmer-than-average conditions and low rainfall from January to March depleted soil and water reserves across Europe, hitting Norway hard.

The Drought Dilemma: Low Reservoirs and Looming Shortages

The ongoing drought in 2025 has pushed southern Norway’s reservoir levels well below the 20-year average, trending toward historic lows.

Droughts reduce water availability, directly slashing hydropower output and causing economic ripple effects.

Without significant rainfall or snowmelt, there’s limited ability to replenish reservoirs, and experts doubt late-season precipitation will suffice this year.

In extreme cases, this could trigger rationing under recent amendments to the Energy Act, a scenario last narrowly avoided in 2003.

Potential environmental constraints, such as new regulations on 285 hydropower sites, could further limit production and flexibility in the Northern European power system.

Meteorological droughts, intensified by climate change, are already impacting hydroelectric efficiency across Central Europe, including Norway.

If the drought persists, Norway may lack sufficient backup power, forcing tough choices between domestic needs and export obligations.

Export Contracts: A Double-Edged Sword

Norway’s interconnectors with the UK (via the North Sea Link), Germany (NordLink), and Denmark (Skagerrak links) facilitate near-constant exports, supplying up to 1,400 MW to Britain and Germany—equivalent to two large gas plants.

These contracts have made Norway Europe’s third-largest electricity exporter in recent years, with the EU and UK as primary markets for its energy surplus.

In 2025, partnerships like the UK-Norway Green Industrial Partnership aim to boost renewables and grid infrastructure, but they’ve also sparked domestic backlash.

High exports correlate with volatile domestic prices. Norwegian consumers, in a highly electrified society, have seen electricity costs spike as power flows abroad, especially during low-production periods.

In 2024, prices surged due to slumped wind energy in Europe, pulling Norwegian hydropower southward and leaving locals paying “market prices” far above production costs.

This paradox—cheap hydropower production but high consumer bills—stems from market dynamics where exports drive up local rates.

Political opposition is mounting; Norway’s government has considered not renewing Skagerrak links and imposing export restrictions or tariffs to prioritize home use.

In February 2025, the governing coalition even collapsed over energy cooperation disputes with Europe.

The Human Cost: Higher Bills and Hardship for NorwegiansNorwegian households and businesses have borne the brunt of this export-driven model. Per capita electricity consumption in Norway is quadruple that of Germany, making price hikes particularly painful and threatening industry.

During the 2021-2022 energy crisis, consumers faced unprecedented volatility, with exports exacerbating shortages.

Proposals like taxing exports or state-run hedging (“Norgespris”) aim to shield locals, but they could reduce overall activity and still raise prices indirectly.

In a winter-dependent nation, rationing could cause severe hardship, highlighting the need for Norway to safeguard its resources first.

Lessons for the UK: Diversify and Reduce Reliance on Interconnectors

The UK’s heavy dependence on Norwegian imports—via the 450-mile North Sea Link—poses risks, especially if Norway curtails exports amid drought or political shifts.

Britain’s energy security could suffer, as interconnectors like these are vital for trading renewables but vulnerable to foreign disruptions.

To mitigate this, the UK should accelerate domestic development: expanding offshore wind, solar, and nuclear capacity to build resilience.

Recent approvals for five new undersea links harness North Sea wind potential, but true security lies in self-sufficiency.

Diversifying away from over-reliance on interconnectors—currently totaling 9.8 GW with the EU and Norway—will ensure a stable, clean energy future.

Norway’s predicament serves as a wake-up call for all nations: exporting energy is beneficial, but not at the expense of domestic stability. By prioritizing homegrown security, countries can weather the storms—literal and figurative—of the energy transition.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack