By Sagarika Jaisinghani, Bloomberg Markets Live reporter and strategist

The strong stock gains that have marked the early months of 2023 are likely to fizzle out if Russia’s war in Ukraine escalates.

While the region’s equities have recovered from declines seen in the immediate aftermath of Russia’s invasion that began a year ago, they are now more vulnerable to shocks after this year’s almost 8% bounce. Any escalation in the crisis will not only stoke geopolitical uncertainty, but also amp up pressure on energy and food prices and weigh on corporate profits.

“It’s clear the market views the risks as lower compared to the beginning of the war, and while elements of the rally are understandable, the margin of safety in European stocks has now been eroded,” says Hargreaves Lansdown lead equity analyst Sophie Lund-Yates. “That means any unexpected escalations or volatility is likely to result in a sharp market reaction.”

Although the optimism this year has been driven by cooling inflation and better-than-expected earnings, the war isn’t far from investors’ minds. Fund managers in a Bank of America Corp. survey see worsening geopolitical concerns as the second-biggest threat to markets, after sticky inflation. Most don’t expect a peace treaty this year.

The polarization between stock winners and losers, coupled with a weaker euro, suggest not all risks have been priced out, says Barclays Plc strategist Emmanuel Cau. The difference between the best and worst-performing groups in the Stoxx 600 is stark: energy shares have soared 20% in the past year, while rate-sensitive real estate companies have slumped 29%.

Among the big risks from here on is a potential energy crunch. While a mild winter helped Europe avert a crisis this time around, stockpiles could dwindle again if the war drags on into the colder months. “The need to replace a historically cheap energy source will remain a challenge,” says Charlotte Ryland, co-head of investments at CCLA.

With the war forcing a shift in governments’ long-term investments, spending on renewables and defense firms may get a boost. UBS Global Wealth Management strategists see opportunities in areas including commodities, green tech, energy efficiency and cybersecurity.

Another sector likely to be disproportionately affected is food and drinks, where supplies of some items have been disrupted in the past year. Bloomberg Intelligence strategists Tim Craighead and Laurent Douillet say profitability of the food industry “faces a potentially long-term test” as restricted supplies of key Ukrainian sunflower, oil, corn and wheat add to a rise in prices.

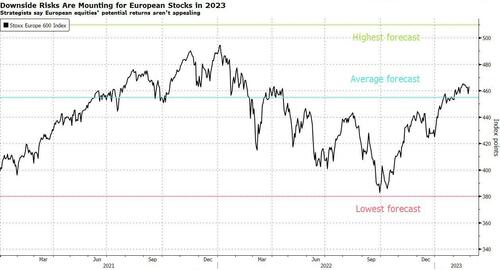

Economically sensitive sectors are also at risk of reversing an outperformance against so-called defensive peers if the war escalates. All in all, the outlook for European stocks is getting dimmer, with strategists in a Bloomberg poll expecting the Stoxx 600 to end the year below current levels on deteriorating economic momentum.

Citigroup strategist Beata Manthey expects geopolitical risks to keep a lid on European equity valuations as the boost from lower gas prices, a weaker dollar and China’s reopening is now priced in. “As for the rally, we wouldn’t be chasing it from here,” she says.

Loading…