HONG KONG—Chinese electric-vehicle makers that enjoyed years of explosive growth now face a slowdown in domestic demand, spurring them to push overseas and challenge global auto giants already struggling with a transition to battery-powered cars.

A subsidies-driven boom in past years helped China sell more electric cars than Europe and the U.S. combined. The sales surge created a wave of investment into homegrown automakers that have become the envy of the global industry.

A deceleration in the China market, after subsidies were reduced and consumers cut back spending, means the growth rate there has fallen behind those two regions.

The slowdown has fueled a fierce price war in China embroiling dozens of EV startups and foreign players such as Tesla

. Many Chinese EV makers burned through cash to chase a share of the growing market. Many are yet to turn a profit despite rising sales, leaving some at risk of going bust or needing injections of capital.

Slower growth also leaves an industry geared up to make millions more cars than it can sell domestically in the next few years. China’s government has acknowledged overcapacity and underused factories, and is pushing automakers to expand overseas. Analysts say that trend could lead to oversupply at home and abroad.

Automakers in China are projected to add capacity for five million cars between 2023 and 2025, most of which are EVs, according to an estimate by Bernstein Research. EV sales in China are expected to grow by around 3.7 million during this period, it said.

BYD, the crown jewel among Chinese carmakers that is backed by Warren Buffett, added enough factory capacity in China alone by December to churn out four million cars a year, Bernstein said. That figure is a million more than it sold in 2023.

Global ambitions

BYD, which has ousted Tesla as the top global EV seller, has ambitious plans to increase sales overseas in the coming years, including buying ships to transport cars to Europe.

Its first foreign factory making passenger EVs began delivering cars this year, from Uzbekistan, and a second in Thailand starts deliveries in July. It plans to open two more factories—in Brazil and Hungary—in the coming years, and is weighing setting up a plant in Mexico from which it would consider exporting to the U.S. BYD’s cheapest car sells for around $11,000 in China.

China’s commerce ministry this month encouraged its EV makers to expand overseas, such as by tying up with foreign partners for research, logistics and supply chains. Chinese auto suppliers will get credit from banks to support the push.

“There is clear overcapacity in China, and this overcapacity will be exported. Especially if overcapacity is driven by direct and indirect subsidies,” the head of the European Commission, Ursula von der Leyen, said late last year.

The commission launched an antisubsidies probe against Chinese carmakers in September, amid concerns Europe’s auto powerhouses could be hurt by China’s emerging rivals.

Rapid growth created price a war

Global auto giants that previously counted on sizable sales from China are now struggling to make gains there against dominant local upstarts, as overall appetite for electric vehicles wanes in other major markets.

Last year, more than one million domestically made electric vehicles were shipped from China as it became the world’s biggest auto exporter, to countries such as Australia and Thailand. That total included vehicles from Tesla and Polestar as well as Chinese-owned brands including BYD, MG and NIO .

Chinese automakers have so far had limited success in developed markets such as Europe, and they are largely shut out of the U.S. by tariffs and an inability to tap green-transition subsidies.

Whether China can prevent oversupply depends on whether policymakers can control the electric-car revolution as well as they juiced it.

Favorable consumption policies—including tax waivers, cash subsidies and incentives such as priority for rationed car licenses and parking—led to a three-year streak during which consumer demand for EVs soared and often outran supply.

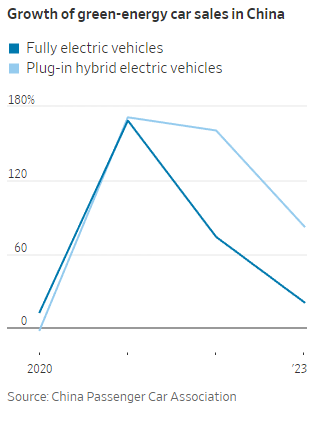

The central government withdrew EV-purchase subsidies for consumers at the start of last year, sending growth down to 21% for 2023 from 74% a year earlier. In comparison, EV sales in 2023 grew 47% in the U.S. and 37% in Europe, according to industry analysts.

The demand downshift sparked a fierce price war in China, with discount rates for electric passenger cars in the country climbing steadily last year to a historic high of around 8% by year-end, according to the China Passenger Car Association.

“Right now in China we already see overcapacity. This is because in the past few years many auto brands believe in the immense demand and that they will remain strong,” said Ming Hsun Lee, auto analyst at Bank of America.

A senior Chinese official last month indicated Beijing was concerned about disorderly competition, saying some local governments and companies had gone ahead blindly with electric-car construction projects or projects that are redundant.