In a significant development for the global energy sector, ExxonMobil is reportedly in advanced talks to re-enter Iraq’s oil industry after a nearly two-year absence. The U.S. energy giant is eyeing the massive Majnoon oil field in southern Iraq as its primary target for exploration and development.

This move could signal renewed confidence in Iraq’s oil prospects amid ongoing geopolitical challenges in the Middle East.

Background on Exxon’s History in Iraq

ExxonMobil has had a tumultuous relationship with Iraq’s energy landscape. The company previously held a stake in the West Qurna-1 oil field but exited in early 2024, citing operational and security concerns.

This departure left a void in one of Iraq’s key production areas, but recent improvements in security and infrastructure have apparently paved the way for a potential comeback. Iraq, home to some of the world’s largest untapped oil reserves, has been actively courting international oil companies to boost output and modernize its aging fields. The proposed deal involves non-binding agreements with Iraq’s Basra Oil Company and the State Organization for Marketing of Oil (SOMO). These partnerships would focus on exploring Majnoon—one of the richest oil fields globally, with estimated reserves exceeding 12 billion barrels—and include collaborations on export and marketing initiatives.

Sources indicate that a formal agreement for the management, development, and operation of Majnoon could be signed as early as today, October 8, 2025.

|

Year/Period

|

Production Level (bpd)

|

Key Notes

|

|---|---|---|

|

Pre-1980

|

4,000

|

Initial development by Braspetro.

en.wikipedia.org

|

|

1980-2003

|

Halted to 50,000

|

War halt; restart to pre-war levels by 2003.

cambridgeforecast.wordpress.com

|

|

2003

|

46,000

|

Drop due to Iraq War.

en.wikipedia.org

|

|

2010

|

45,000

|

Baseline before Shell consortium.

ir.halliburton.com

|

|

2013

|

175,000 (target)

|

Phase I startup under Shell.

iraqiembassy.us

|

|

2016

|

215,000

|

Actual output post-development.

gem.wiki

|

|

2018-Present

|

245,000

|

Under BOC; targets 400,000 by 2025.

|

Key Fields in Focus

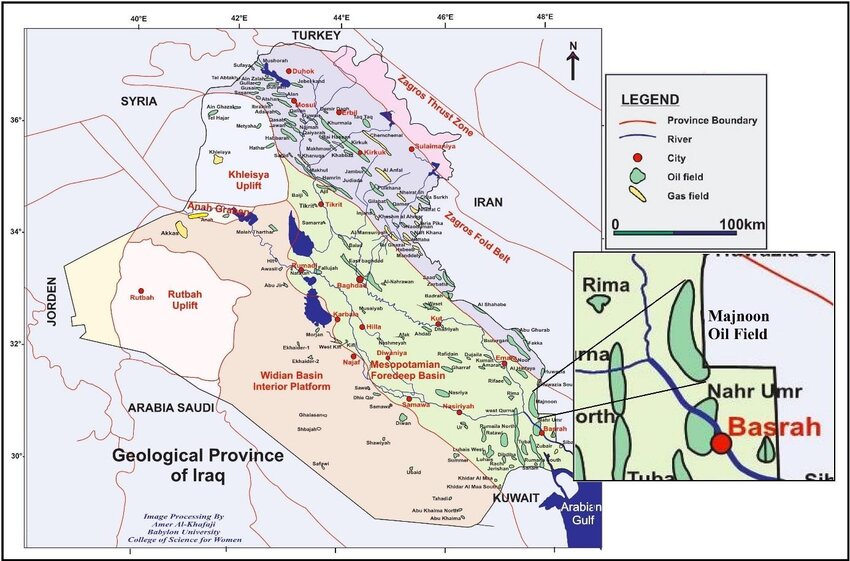

The spotlight is firmly on the Majnoon oil field, located in Basra Governorate in southern Iraq. Discovered in 1975, Majnoon is a supergiant field capable of producing up to 600,000 barrels per day at peak capacity, though current output hovers around 240,000 barrels due to underinvestment and technical challenges.

Do you have a Tax Burden in 2025?

Exxon’s involvement could bring advanced technology and expertise to enhance recovery rates and expand production. While Majnoon is the centerpiece, the agreements may also lay groundwork for broader export and marketing projects, potentially integrating with Iraq’s southern export terminals. This aligns with Iraq’s ambitions to increase its oil output to 6 million barrels per day by 2030, up from the current 4.5 million.

Discussions and Industry Reactions

The news has sparked lively discussions across energy circles, with analysts viewing it as a “game changer” for investors in the oil sector.

On platforms like X (formerly Twitter), experts note that this could represent “Big Oil creeping back to Basra,” highlighting a shift toward renewed Western investment in Iraq’s southern fields.

Geopolitical risks remain a hot topic, including regional instability from conflicts in neighboring areas, but improved security measures and Iraq’s oil ministry assurances have mitigated some concerns. Investors are buzzing about potential upsides for ExxonMobil’s stock ($XOM), as the deal could diversify its portfolio amid volatile global oil prices.

However, full production at Majnoon would depend on further studies and a production-sharing agreement with Iraq’s Oil Ministry, adding layers of uncertainty.

Critics point out environmental and local community impacts, urging sustainable development practices.

Potential Openings to Other Countries

While the focus is on Iraq, Exxon’s potential return could have ripple effects across the region and beyond. Success in Majnoon might encourage Exxon and other majors to revisit opportunities in similarly challenging markets, such as Libya, Venezuela, or even Yemen, where vast reserves await amid political hurdles.

Analysts suggest this move reflects a broader trend of energy companies seeking high-reward assets in OPEC nations to counterbalance declining production elsewhere.For instance, if Exxon navigates Iraq’s regulatory and security landscape effectively, it could embolden investments in neighboring countries like Iran (pending sanctions relief) or Syria, though these remain speculative.

Globally, this aligns with Exxon’s strategy to expand in low-cost, high-volume basins, potentially opening doors in Africa or South America where similar supergiant fields exist.

In summary, Exxon’s contemplated return to Iraq via the Majnoon field represents a bold step in revitalizing ties with one of the world’s top oil producers. As discussions evolve, the energy world will watch closely for implications on global supply, investor sentiment, and regional stability. Stay tuned to Energy News Beat for updates on this unfolding story.

Do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack